Advertisement

Anonymous

How to know if paying tax using credit card through CardUp like service is worth it?

7

Discussion (7)

Learn how to style your text

Reply

Save

Yes it's worth it, since we have to pay income tax, why not using credit card to get some cashback?

You can sign up with my referral code: WEESHENT538

Reply

Save

I am a new user of Cardup. Below is my review.

Review: Have been contemplating whether to embark on...

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered Simply Cash Credit Card

4.1

176 Reviews

Standard Chartered Simply Cash Credit Card

Up to 1.5% on eligible spend

CASHBACK

Unlimited

CASHBACK CAP

$30,000

MINIMUM ANNUAL INCOME

UOB One Card

4.1

166 Reviews

POSB Everyday Cashback Credit Card

3.9

199 Reviews

Related Posts

Advertisement

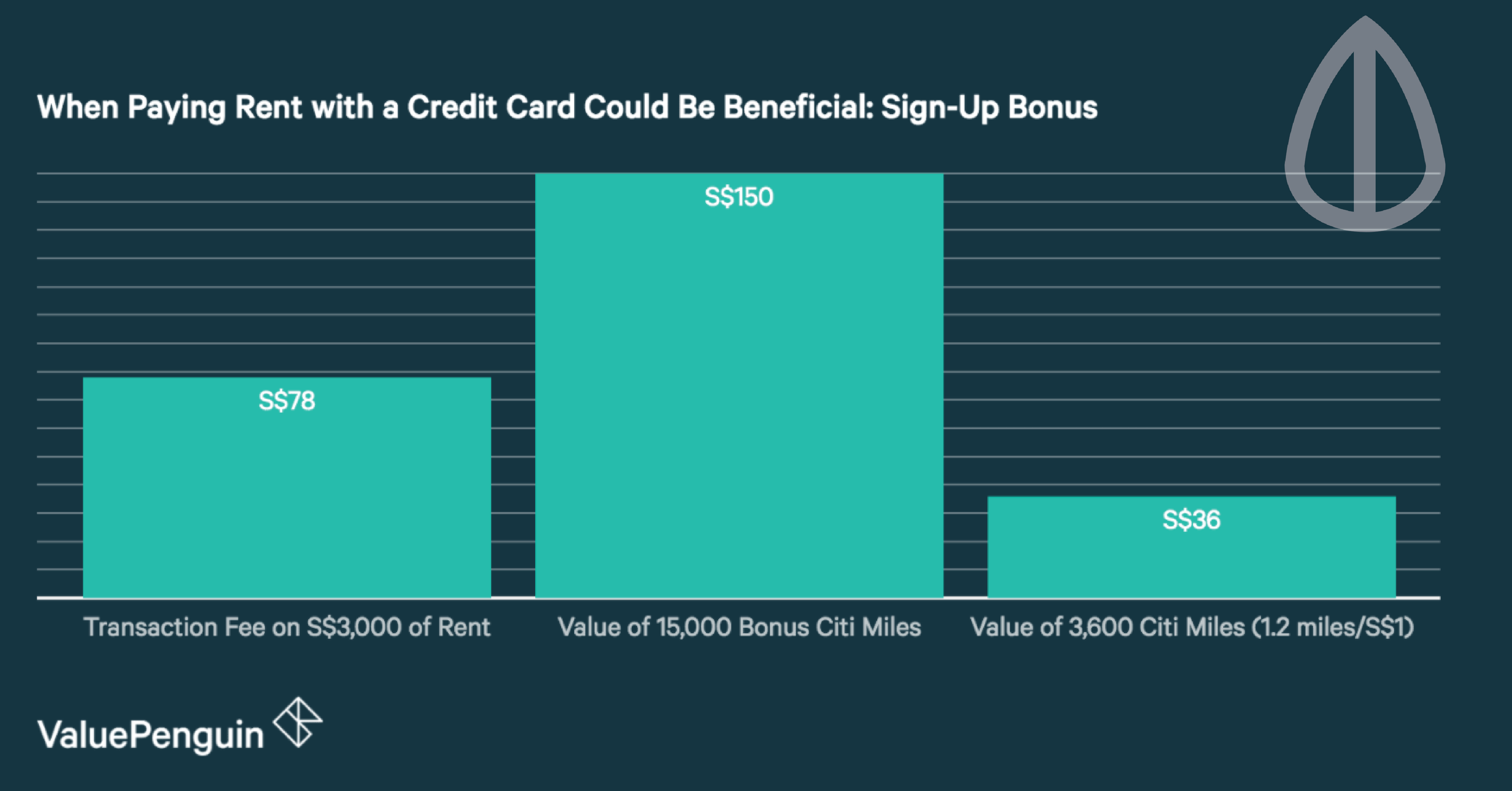

It’s worth it only if your card rewards like miles, cashback, points outweigh CardUp’s fee. Just compare the fee % with your reward value and ensure you can pay off the balance in full.