Advertisement

How should I start to plan for my retirement? Please share where can I start with? CPF retirement account?

18

Discussion (18)

Learn how to style your text

Reply

Save

For me, CPF is considered a backup for basic retirement. Might have to do more if you want more.

Reply

Save

Start by estimating how you need in retirement (based on ur expenses) and see how long u think you need it for.

Reply

Save

There are a million and one different approaches to retirement planning. I follow this five-step plan to retirement planning:

- Define your retirement goals

Family and inheritance

Paying off your house mortgage

Financing your ideal retirement lifestyle

Having an emergency reserve

Travel

Charitable giving

Hobbies such as landscaping

Realising a new business

Pursuing a different career path

Anticipate your retirement spending needs.

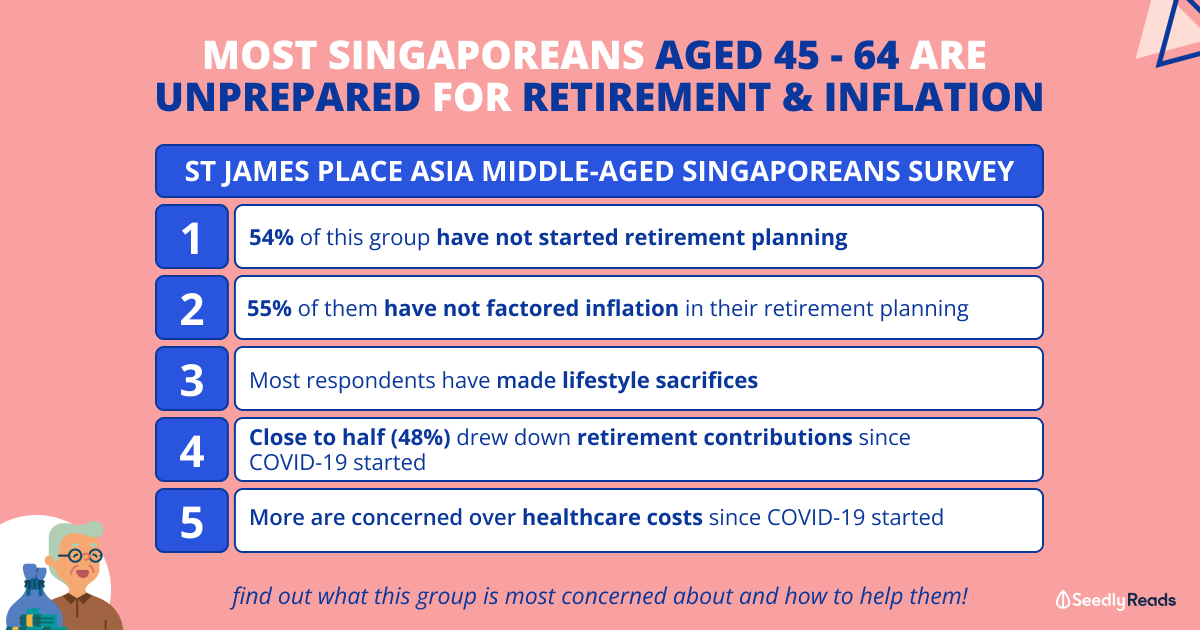

Knowing your retirement age and goals, you can then do some guesswork to quantify the required savings involved. Since we’re thinking decades ahead, you will also need to adjust for inflation. I used this retirement calculator which already accounts for inflation.

Start saving smart and investing early

Central Provident Fund (CPF)

Supplementary Retirement Scheme (SRS)

- Insurance policies and private annuities

Diversify your investment portfolio

Consider your decumulation strategy

CPF Life is a national annuity scheme that provides you with monthly payout for as long as you live, starting from age 65. The monthly payouts are withdrawn from your CPF RA (Retirement Account) balance, while the exact amount depends on which plan you choose – Basic, Standard, or Escalating. CPF Life alone however, often isn’t enough for most Singaporeans’ retirement lifestyles. You can however, also opt for private annuity plans to help bolster your retirement income.

Reply

Save

If your taxes are in the xx% bracket, definitely consider topping up your CPF SA and even SRS, since...

Read 12 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Know how much u need during retirement by estimating the amt based on ur lifestyle