Advertisement

Anonymous

How should I handle my finances(50-30-20 rule) esp when I would have school fees coming up when I start school next year?

I'm waiting for local Uni next year August(placing confirmed). Currently working part-time till August which pays quite well ~$2.1k/month. I have very little in savings e.g. <5k. What is the best way for me to budget my expenses?

13

Discussion (13)

Learn how to style your text

Reply

Save

I think that taking an interest free student loan would be a good option since you are going to a local uni.

The 50-30-20 rule is just a guide, it will be great to save more and below are some tips:

- set up another 2 bank accounts besides your salary crediting account. On receiving your salary set up a standing order (or you can manually transfer) the amount of savings and investment directly.

- For the savings account I recommend the SCB jumpstart

- For the investment account you can try DBS with the Posb invest saver program while reading up on investments

If you are unable to meet your savings target try to cut down your expenses by tracking them.

Reply

Save

Bjorn Ng

20 Dec 2019

Business Analyst at 10x Capital

Hello there! School fees definitely comes first when you start schooling. You say you have little savings, is there any particular reason why is that so? Any possibilities to cut down on some expenses to save up?

I actually don't follow the 50-30-20 rule per say, I just save as much as I can every month, and know myself that I am prudent and will not spend unnecessarily. As long as you can manage and control your spending, that is okay.

Reply

Save

Cedric Jamie Soh

20 Dec 2019

Director at Seniorcare.com.sg

Oooo all these finance rules or guidelines... are just.. guidelines.

you don't have to follow it because everyone's circumstances are different.

most importantly... you are not working full time. You have a large expense that is temporary and as a young student, you can ignore these financial guidelines for an easier life. (living is not to save money but to maximise happiness)

If its me

school fees most important

daily expense

some entertainment to relax and reduce stress from work AND school

save whatever i can save

faster graduate and then become a lot more financially stronger.

Reply

Save

To be honest, if you have very little savings now, it is quite difficult to do 50-30-20, because wha...

Read 8 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

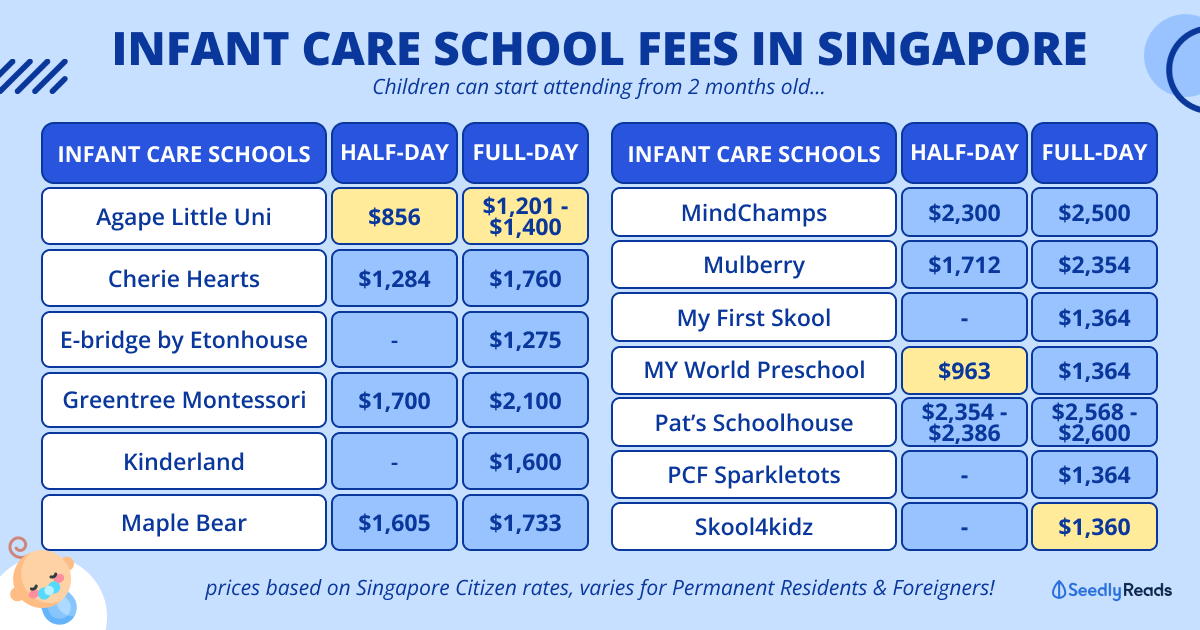

Hi, glad that you are thinking about saving money at your age. With the school fees, it's going to be difficult to really stick to the 50-30-20 rule, and you don't have to. For now, focus on saving up for the school fees. Calculate how much the fees would be, and whether you will still be working part time after you start school. Try to spend prudently and save the rest.