Advertisement

Anonymous

How much should you spend monthly on insurance based on your income?

Hi, I would like to ask generally how much should you spend monthly on insurance based on your income?

7

Discussion (7)

Learn how to style your text

Jiayee

29 Dec 2020

Salaryman at some company

Reply

Save

Elijah Lee

28 Dec 2020

Senior Financial Services Manager at Phillip Securities (Jurong East)

Hi anon,

I have a 40-30-20-10 guideline which goes as follows:

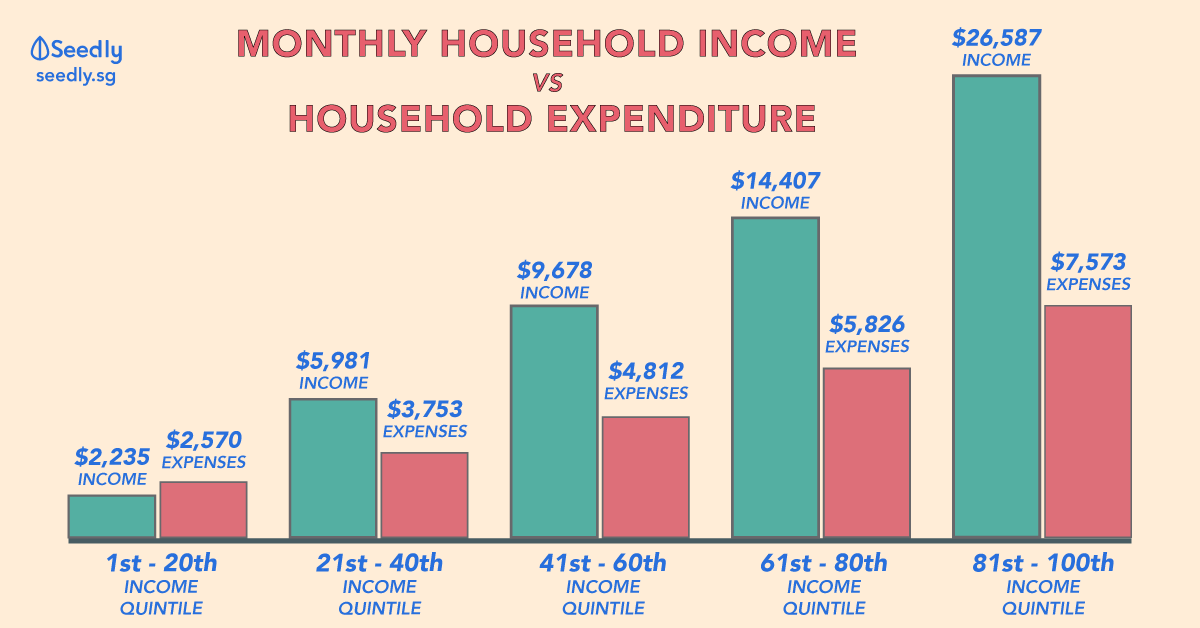

40% Expenses (maximum)

30% Mortgage/Rent (maximum)

20% Savings/Investments (minimum)

10% Insurance (maximum).

Thus, protecting yourself should generally not exceed 10% of your income unless 1) You are subjected to loading or 2) you are a sole breadwinner and need to cover multiple family members.

Plans such as retirement income plans would fall under the category of savings/investments. If you have no mortgage to pay, then you may redirect that 30% towards investments.

Ultimately it is still a guideline so the exact percentage will depend on your circumstances.

Reply

Save

Sebastian Png

27 Dec 2020

Seedly Student Ambassador 2020/21 at Seedly

Hi Anon! CPF advocates for at least 10% of your income to be allocated towards insurance, according ...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

I spend based on my needed coverage. Since I'm still young, I'm still spending less than 10% of my income on insurance.

Rather than as a percentage of income, it's more sensible to look at the coverage needed because sometimes, insurance policies that cover $2x can cost less than 2 times the cost of an insurance policy that covers $x.