Advertisement

Anonymous

How much should a fresh graduate allocate his/her salary (inclusive of repayment for student debt)?

There is a lot of guides out there about how one allocate their salary towards savings, investment and expenses. None of these guide factor in student debt which is what almost every student have when they graduate. I am curious what allocation would you recommend to repayment the student loan? Will it take over the investment portion (eg 20% for investment but use that 20% for loan repayment then investment only when the loan has been repaid)? On average, a student loan is $35K.

7

Discussion (7)

Learn how to style your text

Reply

Save

Hey Anon, I'm a class of 2019 graduate and before COVID-19 happened, I have been consistently paying about 30-40% of my salary (started out with 30% and slowly increased to 40% after a few months when I get a feel of my expenses. I keep track of my expenses down to the cent with the Seedly tracking app so that has definitely helped a lot!). For me, being debt-free is the most important thing and especially so now in a time of an interest-free environment. Of course, you should never forget holistic financial planning, which means getting yourself insured & your savings beefed up (& invest too). Just want to let you know that it is possible and due to COVID, my expenses have dropped a lot as there is no need to save for a holiday or going home (I'm not local so I take frequent flights home and that is an extra expense but seeing as it helps with my well-being, it is more a necessity than a want), and thus I saved up enough to pay off my interest-heavy loan! So now I'm just going to take my own sweet time to pay off the interest-free one (which will remain interest-free after 1 June 2021 still as it has always been interest-free). All the best!

Reply

Save

Personally, I'll be graduating this year and my allocation would be:

45% Expenses + Insurance

30% Investment

15% Loan Repayment

10% Savings

Like what Rachelle mentioned, student loans interest rates are ranging from 4-5%, however, I am a little more optimistic and would prefer repaying them over a longer duration of 6 years. Although, some might say market conditions may vary, but if I am investing long term, I am expecting my returns to exceed 8% yoy (annualised) which allows me to negate the rates for the student loans.

I think it might help if you have a bigger picture of your investment goals and strategy and situate yourself on how much risk you are comfortable with. Only then could you decide on the proportion you would like to invest/repay your debts. :)

Reply

Save

Rachelle Lye

08 Mar 2021

Digital Marketing at Fintech

Hey Anon,

I'm a Class of 2020 Graduate and I plan to pay off my student loan before the interest rates kick in on 1 June 2021.

What I've been doing is really prioritising paying off my student loan over any other savings or investments, because the interest rates on student loans are really quite high at 4.38% to 4.5% p.a.

The typical recommended allocation is

50% Expenses

30% Savings

20% Investments

Personally I would aim for:

40% Expenses - Including insurance

40% Loan

10% Savings

10% Investments

If you regularly give your parents say 10% to 20% of your salary, if they happen to still be working and do not need the money urgently, you could speak with them about focusing on paying off your student loan first.

I understand the temptation of investing is very real HAHHA so I would still allocate 10% to it, but personally being debt free would be a load off my mind, for me to fully focus on invesments and reogranising my finances afterwards.

Hope this helps for perspective! And all the best! :)

Reply

Save

Zac

06 Mar 2021

Noob at Idiots Invest

Agreed with lurkingham and bullythebear. High interest debt (or any kind of debt, for that matter) w...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi anon,

Congrats on entering adult life and starting off strong by joining a personal finance committee and inquiring about debt management!

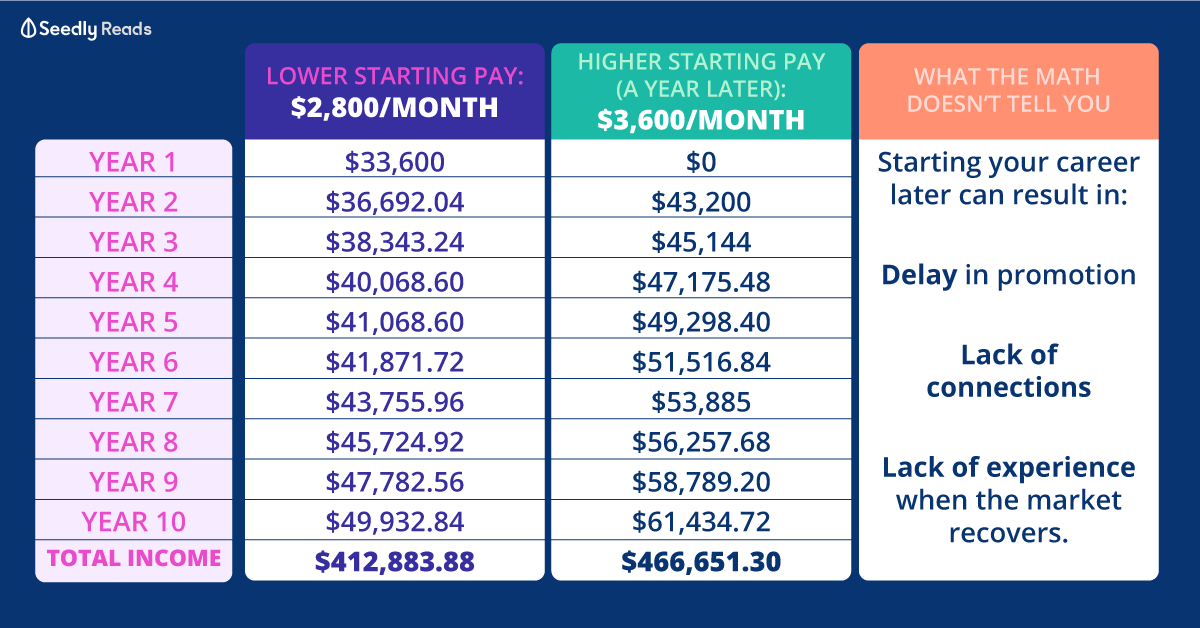

Aside from allocation being covered by the other members, I believe one important question is whether you're team rush or team stretch? if you'd like to rush the repayment by lowering interest rate, I suggest you allocate it heavier and hold off investment first. The benefit of rushing the repayment provides the advantage of less interest being paid. Tuition fee loan interests are not as high as personal or credit card loans, but they can take a kick out of your overall payment, so do consider.

if you're team stretch, I'd also recommend you to consider allocating more to either savings or investments in a structural manner. The advantage of being involved in savings earlier gives you the autonomy to utilise your savings in the event you need to, while being invested in the market earlier. However, this advantage adds on a challenge; of whether you can achieve a yearly return of more than 5% to cover the interest rate.

both approaches are neither entirely right nor wrong and it strongly depends on your financial situation which I believe is an important context which wasn't mentioned in your question. Once again, congrats on your convocation and I hope you make the call with full conviction! :-)