Hi anon,

I can share how I manage mine with my wife. This would answer both 2) and 3) since some months we earn the same, and some money we have vastly different salaries. 1) is a bit tricky, but I have seen such families whereby the main breadwinner allocates a fixed amount of allowance for the other party to run the family. I'm afraid I can't comment too much on 1) at this point, but open discussion on what the hard earned money should be used on is a must to prevent quarrels and disagreements.

About my situation: We have a joint account (opened up after we got engaged) where we both contribute an equal amount each month. Since her income is fixed, and mine is variable, we both agree on a minimum fixed amount that we both won't have an issue to put in every month, and a maximum amount that she is comfortable to put in. Then, depending on my income, we both contribute the minimum fixed amount every month, and topup if my income is better on some months. If you both earn the same amount, then contributing an equal amount each is probably the best way.

I guess it does help that both of us have a common and very clear idea about what

we intend to do for our finances; we're both income investors and are willing to spend more money investing than on things like holidays or food (although we do take the occasional break). Thus a common understanding is very important so that we end up at the same destination of being financially independent with our passive income, even if we don't agree on the method used to get there.

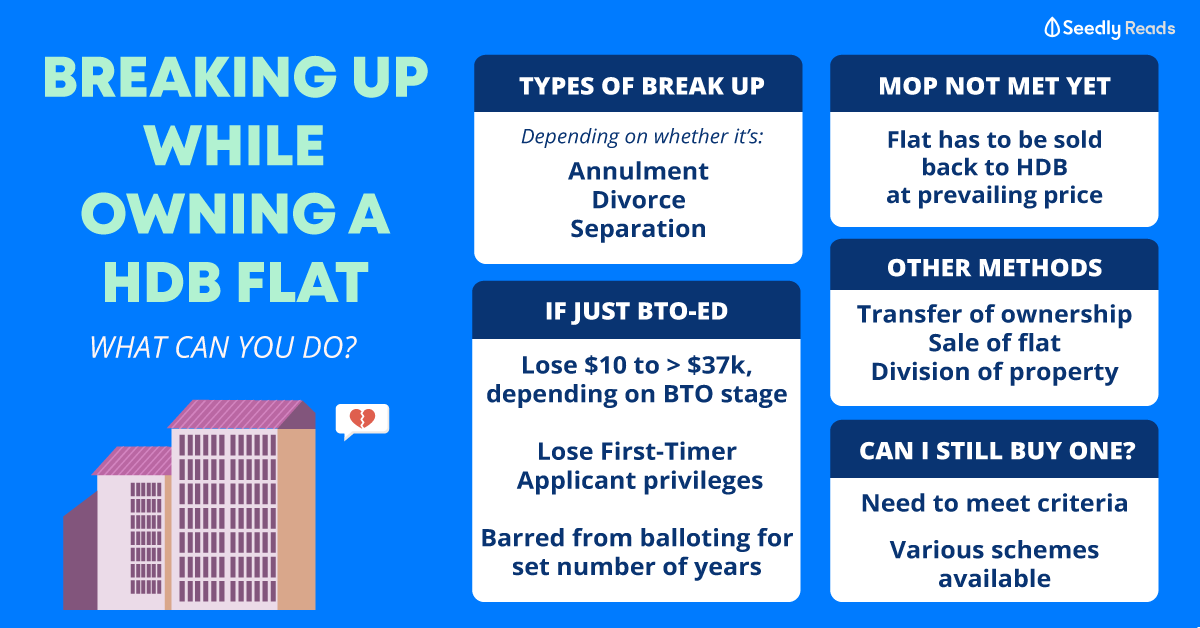

We both are looking for a HDB flat; that we have both discussed and agreed upon, including things like the maximum we'd be willing to pay, mortgage duration, etc.

The main difference is that our investments are currently separate, on top of the fact that we both have restrictions on investing due to the nature of her work (compliance issues). She doesn't question what I stocks or UTs that I buy, although she does give inputs. The same in reverse, I cannot force her not to buy or to buy a certain stock, but I will give her my analysis.

The money in the joint account is only to be spent when both parties agree upon it. So this will be for major joint expenses such as buying new furniture or such. If a kid comes along, we'll both have to agree on the spending as well, and I'd expect it will even boil down to the type of milk powder, or brand of diapers. But we'll manage.

Our personal expenses are kept separate, and we don't need to seek consent for that as long as it's not significant. I generally spend more money on my investments anyway, and that has to clear her compliance, so she knows what I'm spending a large part of my money on!

It's possible to do a contribution proportionate to your income each month, but if your incomes are within 10% to 20% of each other, then it's probably okay to just decide on a fixed amount.

One should have a good conversation with your other half and understand the differences in your viewpoints; find a common ground upon which both can agree on as both parties will likely have different views. Prepare to compromise and allow each other a certain level of space when it comes to personal discretionary spending.

Hi anon,

I can share how I manage mine with my wife. This would answer both 2) and 3) since some months we earn the same, and some money we have vastly different salaries. 1) is a bit tricky, but I have seen such families whereby the main breadwinner allocates a fixed amount of allowance for the other party to run the family. I'm afraid I can't comment too much on 1) at this point, but open discussion on what the hard earned money should be used on is a must to prevent quarrels and disagreements.

About my situation: We have a joint account (opened up after we got engaged) where we both contribute an equal amount each month. Since her income is fixed, and mine is variable, we both agree on a minimum fixed amount that we both won't have an issue to put in every month, and a maximum amount that she is comfortable to put in. Then, depending on my income, we both contribute the minimum fixed amount every month, and topup if my income is better on some months. If you both earn the same amount, then contributing an equal amount each is probably the best way.

I guess it does help that both of us have a common and very clear idea about what

we intend to do for our finances; we're both income investors and are willing to spend more money investing than on things like holidays or food (although we do take the occasional break). Thus a common understanding is very important so that we end up at the same destination of being financially independent with our passive income, even if we don't agree on the method used to get there.

We both are looking for a HDB flat; that we have both discussed and agreed upon, including things like the maximum we'd be willing to pay, mortgage duration, etc.

The main difference is that our investments are currently separate, on top of the fact that we both have restrictions on investing due to the nature of her work (compliance issues). She doesn't question what I stocks or UTs that I buy, although she does give inputs. The same in reverse, I cannot force her not to buy or to buy a certain stock, but I will give her my analysis.

The money in the joint account is only to be spent when both parties agree upon it. So this will be for major joint expenses such as buying new furniture or such. If a kid comes along, we'll both have to agree on the spending as well, and I'd expect it will even boil down to the type of milk powder, or brand of diapers. But we'll manage.

Our personal expenses are kept separate, and we don't need to seek consent for that as long as it's not significant. I generally spend more money on my investments anyway, and that has to clear her compliance, so she knows what I'm spending a large part of my money on!

It's possible to do a contribution proportionate to your income each month, but if your incomes are within 10% to 20% of each other, then it's probably okay to just decide on a fixed amount.

One should have a good conversation with your other half and understand the differences in your viewpoints; find a common ground upon which both can agree on as both parties will likely have different views. Prepare to compromise and allow each other a certain level of space when it comes to personal discretionary spending.