Advertisement

How are you planning to manage/finance your insurance premium cost after retirement? Esp for health related insurance?

Saw a straits times article today. It's rather informative. Mentioned that the insurance premium for retired person is 10% of retiree's monthly expenses.

Share.

5

Discussion (5)

Learn how to style your text

Reply

Save

Elijah Lee

17 Sep 2022

Senior Financial Services Manager at Phillip Securities (Jurong East)

Hi Sharon,

Good sharing.

The reality is that health care (shield plan) premiums escalate exponentially as one ages.

Many people do not have any concrete idea how much cash outlay they will need for their shield plans after they retire.

If they're on private coverage with rider, it's definitely 6 figures in total from age 65 to 85.

Even government A ward is also 6 figures.

Early planning is crucial to ensure that retirement finances can support the desired level of coverage.

Reply

Save

Lee Gek Lan

06 Sep 2022

Financial Consultant at Income

This article is a informative article and food for thought. Good to plan for retirement early to hav...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

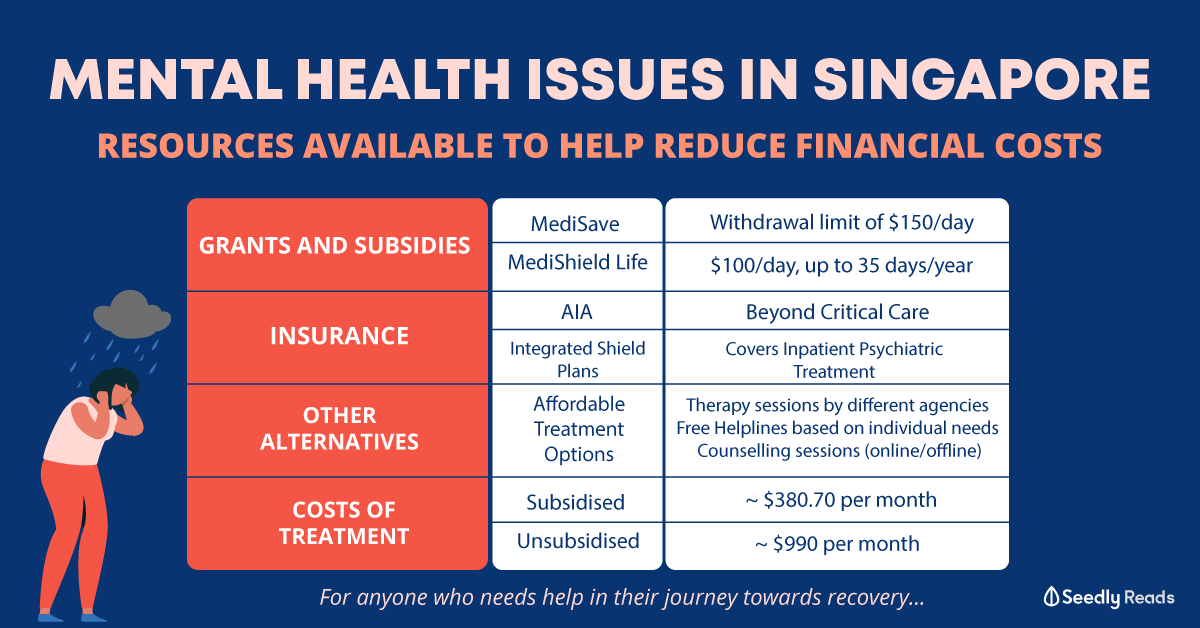

Some people are planning for their annuities and/or CPF life payouts to pay for insurance premiums during retirement. It can go out to $10K per year when we're in our 80s. Hopefully this article is helpful: https://plannerbee.co/learn-personal-finance/ho...