Advertisement

30 Jun 2023

Hi, I am returning to the workforce soon. Basically I do not know how to save correctly. How should I allocate the savings, emergency fund and budgeting properly with the salary I receive?

9

Discussion (9)

Learn how to style your text

Reply

Save

Saving 30%

Emergency Fund 30%

Expenses 40%

YOLO so enjoy while we can

Reply

Save

TallRock Capital

11 Jul 2023

Financial Planner for Locals & Expats at TallRock Capital

Congratulations on returning to the workforce! Here are some steps to help you allocate your savings, build an emergency fund, and create a proper budget:

Determine your financial goals: Start by identifying your short-term and long-term financial goals. These could include building an emergency fund, paying off debts, saving for a down payment on a house, or planning for retirement. Prioritize your goals based on their importance and timeline.

Build an emergency fund: Allocate a portion of your salary towards building an emergency fund. Aim for 3 to 6 months' worth of essential expenses as a starting point. Set up an automatic transfer to a separate savings account each month to gradually build up this fund.

Create a budget: Track your income and expenses to develop a budget that aligns with your financial goals. Start by listing all your sources of income and categorize your expenses into fixed (rent/mortgage, utilities, insurance) and variable (groceries, dining out, entertainment). Use budgeting apps or spreadsheets to help you stay organized and monitor your spending.

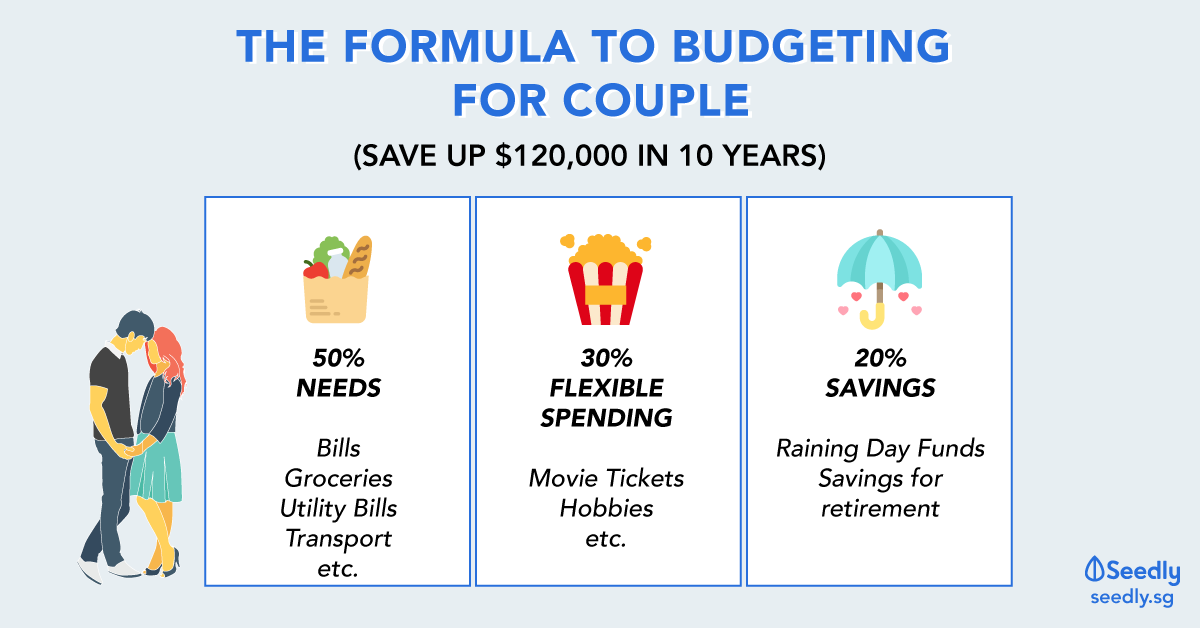

Allocate savings: Once you have established your emergency fund and budgeted for your essential expenses, allocate a portion of your salary towards savings. Aim to save at least 20% of your income, but adjust the percentage based on your financial goals and personal circumstances.

Prioritize debt repayment: If you have any outstanding debts, prioritize paying them off. Start with high-interest debts first, such as credit card balances or loans with high interest rates. Make consistent payments each month to reduce your debt and save on interest charges.

Review and adjust regularly: Review your budget periodically to ensure you're staying on track and making progress towards your goals. Make adjustments as needed, especially when there are changes in your income or expenses.

Seek professional guidance if needed: If you feel overwhelmed or unsure about managing your finances, consider consulting a financial advisor. They can provide personalized advice and help you create a comprehensive financial plan tailored to your specific needs and goals.

Remember, developing good saving habits takes time and discipline. Be patient with yourself and celebrate small milestones along the way. Consistency and commitment to your financial plan will help you build a solid foundation for your future financial well-being.

Reply

Save

Honestly when I first started working I was very excited to spend my money on nice weekend brunches, but it all really adds up. I would say to still keep withon a student mentality so that you don't overspend. You know how hard you work for your money so try to have an emergency fund, pay off all your debts and challenge yourself to save half of your salary 😊👍

Reply

Save

Track expenses. And mentally convert any potential expenditure into equivalents in daily spend (like...

Read 6 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

There is a % guideline, but it depends on your situation. i always think the first way is to track expenses so that you know where your money is going, then see if you can categorise them and if you are spending too much on wants or something and then monitor or budget to save. i would group emergency funds as savings.