Advertisement

Hi, have built an ok CPF amt after working for many years. I am 50 now and retiring in 10 years time. have some spare about 50 -100k cash on hand. What can I do with 10 years to go?

I have $50k to $100k spare cash, retiring in 10 years, any investment advice appreciated.

4

Discussion (4)

What are your thoughts?

Learn how to style your text

Reply

Save

I think it will be best to invest in dividend income Products!

Reply

Save

PolicyWoke

26 Dec 2020

Turbo-charge Your Savings with REPs at PolicyWoke

Hi Petela,

For the spare cash you have, it depends on your risk appetite.

For low-risk options wit...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

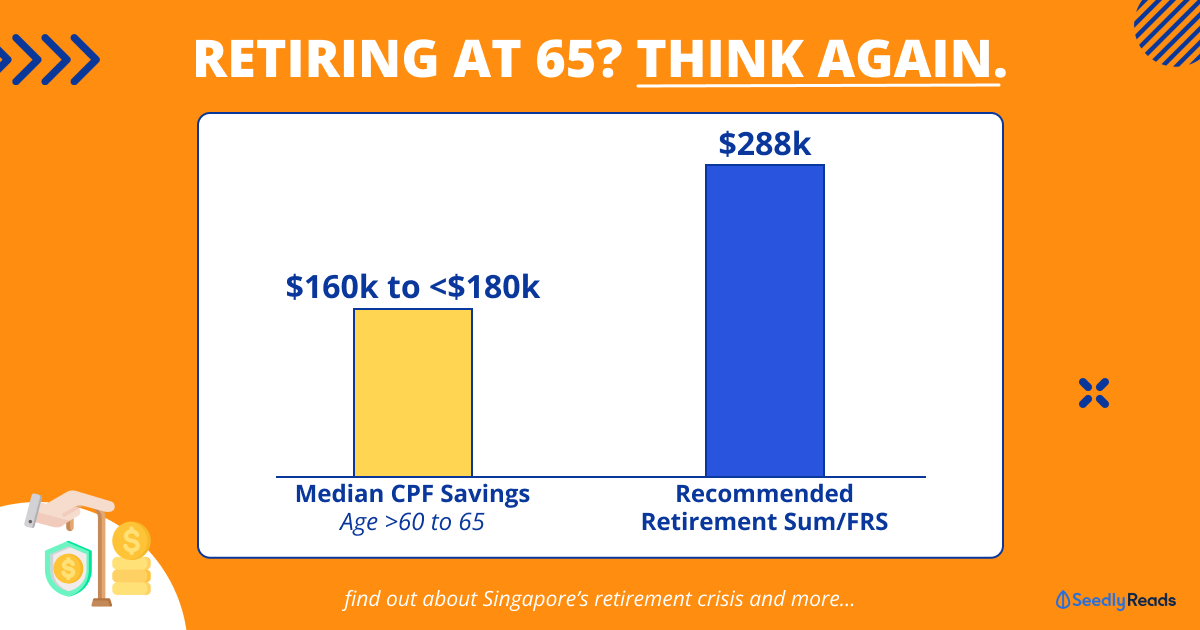

1st: Your current target is to pump your CPF to $271500 by 55.

2nd: depend on your comfort level. You may choose to invest in (a) dividend paying stocks, or (b) growth stocks, or (c) unit trust that give monthly payout (Similar to bond, but dont buy fixed income or individual bond)

But with 10years to compound you may need to pump more monthly to see significant impact. Below shows the calculation, assume you pump $2k monthly into your investment for 10 years With 6% growth.

Leave the link below, u can play with the caculator to see your target sum & your monthly contribution required.

http://www.moneychimp.com/calculator/compound_i...

https://www.cpf.gov.sg/Members/Schemes/schemes/...