Advertisement

Anonymous

Hi guys, I currently have around 1.5K of funds available for investment. I am comparing between Syfe Equity 100, Endowus Equity and DIY into ETF. What is your recommendations/advice?

I am in my mid-20s so there is a long timeframe for my investment to grow and I am able to stomach the higher volatility along the way. I am looking to capture the highest growth/returns. Been robo-investing for a year, picked up investing knowledge but not enough conviction to DIY into individual stock yet. Would love to hear your advice and opinion!

3

Discussion (3)

Learn how to style your text

Reply

Save

Choose the companies with great moat. So that it will be still around 100 of years and you can sleep well at night.

Choose the companies that have great cashflow. With good cashflow company can pay dividend, acquire new buisness, expansion or buy back shares (making EPS higher)

Dont chase gain, super high gain may not be substainable.

Reply

Save

The differences wouldn't change much since there are a lot of overlaps. Maybe some savings DIY inste...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

StashAway

4.7

1295 Reviews

StashAway Simple Guaranteed 3.55% p.a. (Guaranteed rate)

Cash Management

INSTRUMENTS

None

ANNUAL MANAGEMENT FEE

None

MINIMUM INVESTMENT

3.5%

EXPECTED ANNUAL RETURN

Mobile App

PLATFORMS

Endowus

4.7

658 Reviews

Syfe

4.6

934 Reviews

Related Posts

Advertisement

It really depends on your investment philosophy.

Equity100 supposedly employs a "Smart Beta" strategy that considers factors such as volatility and size to construct their portfolio.

Endowus 100% equities also employ a similar (not the same) approach with their allocation in Dimensional funds.

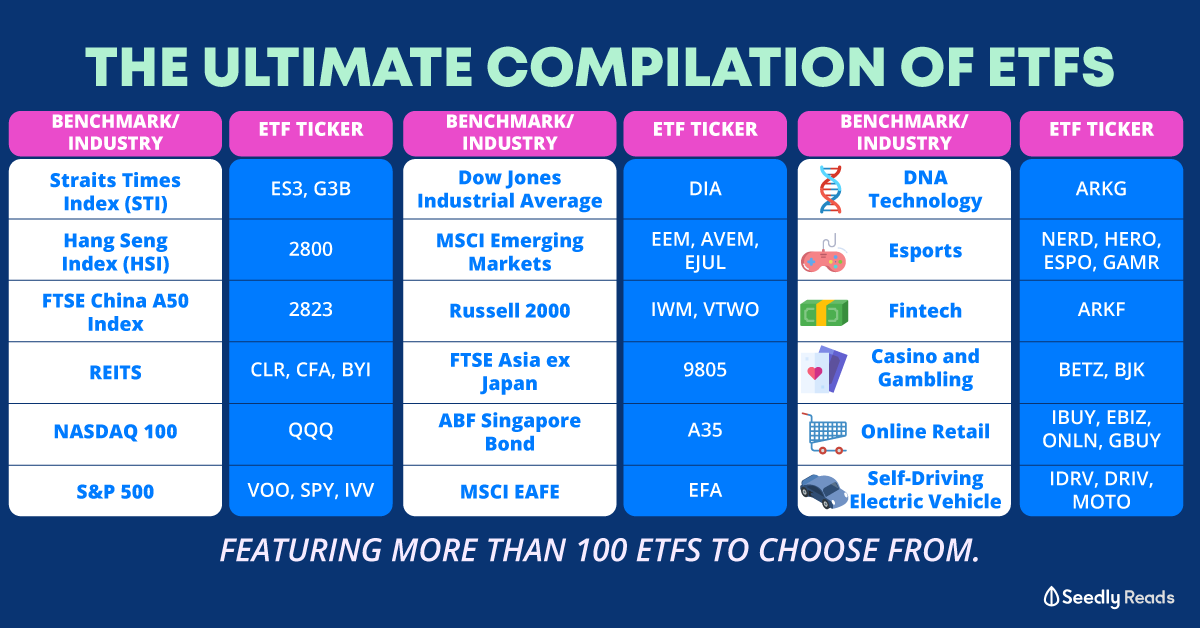

If you disagree with their investment methodology, then perhaps you can consider DIY.