Hello, maybe these 'coronian times' are hard to bear for some of the community, particularly for those who recently invested first time into the stockmarkets.

But how much more important than money is our health and social wellbeing and that of our families (and animal friends). I hope that all of the Seedly community are well.

These are also times to contemplate on some very big problems or trends of capitalism or globalization (mass tourism, pollution, instant gratification, consumerism, egotism, waste, negligence of animal rights).

Don't panic, don't sell, just keep cool and wait, wait, wait ... With the U.S. only beginning to experience the spread of the virus I expect to see more market downside.

However all of us who are following an ultra-longterm buy & hold strategy, ideally predominantly with big & cheap diversified passive indexing ETFs and 0 (=zero) performance biting mutual funds also known as unit funds, possibly keep their equanimity and maybe even yawn (I hope) over the fact that currently the markets don't move up and up and up.

I also expect after several weeks or months, maybe 1/2 a year or end of 2020 the markets to recover, some sectors or countries will be hit hardly though, with longer consequences.

This 'corona crash' is a very good opportunity to learn about investing.

The new ones among us will ask whether investing into stocks/ETFs/unit trusts was really a good idea? But if they choose their investments wisely and diversified and anyway invested for longterm, nothing bad will happen, I think.

I wish You all well, GOOD LUCK.

I'll add two charts, the first one will update daily if this webpage is reloaded:

#1 the development of some large & cheap passive indexing ETFs (SP500, global stocks, U.S. tech, U.S. biotech, U.S. property, China Tech, China Golden Dragon, U.S. bonds, global bonds) since the recent stock market all time-high (= 19/02/2020, beginning of the current 'crisis' or non-crisis) to see what happens, interesting I find ...

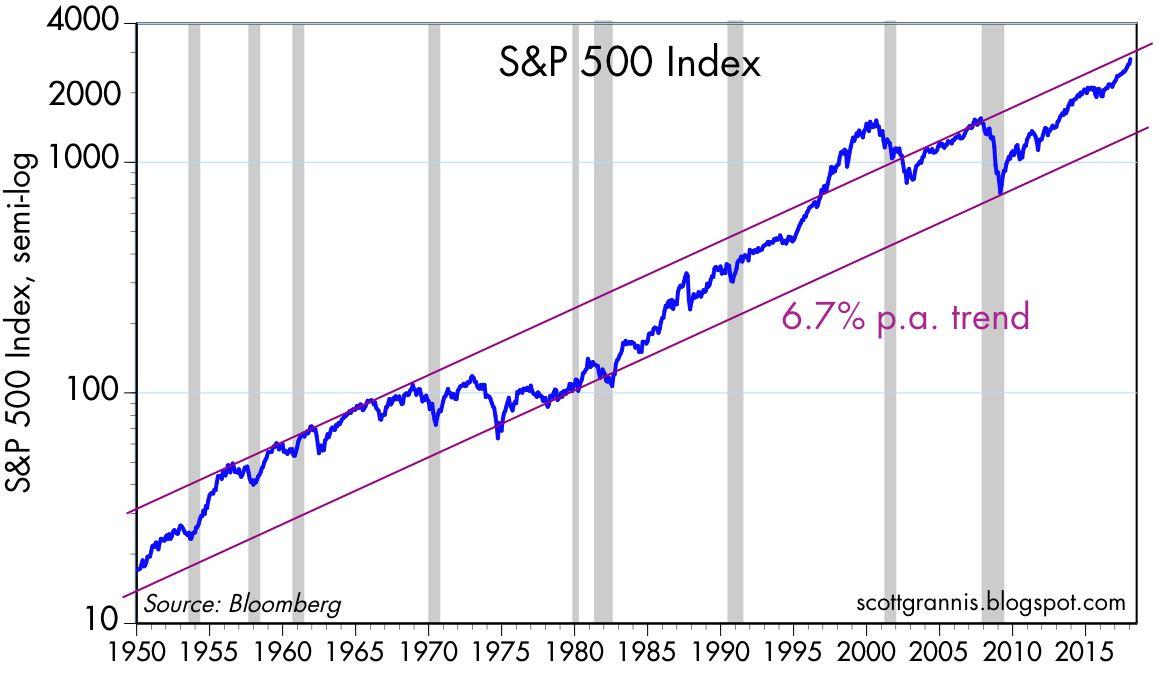

#2 for financial consolation and support of equanimity the very longterm chart of the one and only U.S. SP500, so many 'crashes', however they seem tiny over LONGTERM, true?

Hello, maybe these 'coronian times' are hard to bear for some of the community, particularly for those who recently invested first time into the stockmarkets.

But how much more important than money is our health and social wellbeing and that of our families (and animal friends). I hope that all of the Seedly community are well.

These are also times to contemplate on some very big problems or trends of capitalism or globalization (mass tourism, pollution, instant gratification, consumerism, egotism, waste, negligence of animal rights).

Don't panic, don't sell, just keep cool and wait, wait, wait ... With the U.S. only beginning to experience the spread of the virus I expect to see more market downside.

However all of us who are following an ultra-longterm buy & hold strategy, ideally predominantly with big & cheap diversified passive indexing ETFs and 0 (=zero) performance biting mutual funds also known as unit funds, possibly keep their equanimity and maybe even yawn (I hope) over the fact that currently the markets don't move up and up and up.

I also expect after several weeks or months, maybe 1/2 a year or end of 2020 the markets to recover, some sectors or countries will be hit hardly though, with longer consequences.

This 'corona crash' is a very good opportunity to learn about investing.

The new ones among us will ask whether investing into stocks/ETFs/unit trusts was really a good idea? But if they choose their investments wisely and diversified and anyway invested for longterm, nothing bad will happen, I think.

I wish You all well, GOOD LUCK.

I'll add two charts, the first one will update daily if this webpage is reloaded:

#1 the development of some large & cheap passive indexing ETFs (SP500, global stocks, U.S. tech, U.S. biotech, U.S. property, China Tech, China Golden Dragon, U.S. bonds, global bonds) since the recent stock market all time-high (= 19/02/2020, beginning of the current 'crisis' or non-crisis) to see what happens, interesting I find ...

#2 for financial consolation and support of equanimity the very longterm chart of the one and only U.S. SP500, so many 'crashes', however they seem tiny over LONGTERM, true?