Hi there! I went to compare both products and this is what I've came up with:

TL;DR

The Great Eastern Prestige Life Rewards 2 (PLR2) is different from ETFs as it includes an insurance death benefit component, on top of wealth accumulation. It is also a more passive strategy than ETFs.

However, looking only at the investment returns, ETFs is a better strategy than the PLR2.

What is Great Eastern Prestige Life Rewards 2?

It is a life annuity that guarantees monthly lifetime payout with a single premium payment. This can allow you to enhance your retirement income and leave an inheritance for your loved ones.

The single standard premium is $500,000 and can be either in SGD or USD.

So what exactly is a life annuity?

An annuity is a type of insurance policy that usually guarantees fixed payouts at regular time intervals for life or for a fixed period. CPF Life is one such example of an annuity plan that all Singaporeans have.

Key Features

Here are some key features of the PLR2:

- ·Guaranteed monthly payout with a non-guaranteed cash bonus starting from the 5th policy year. This payout continues until death or diagnosis of terminal illness of life assured, or policy surrender.

- Guaranteed returns of 1.62% per year, or $8,112 in retirement income with single standard premium. (This is the risk-free way of getting passive returns that you are looking at)

- Life assured is insured for 105% of single standard premium paid plus any additional bonuses upon death or diagnosis of terminal illness.

- Policy surrender value of at least 80% of single standard premium from Day 1.

- Flexibility to choose to receive monthly payout or accumulate it at prevailing interest rate for higher returns.

- Guaranteed acceptance with no medical underwriting

What does it not cover?

With the above benefits, the PLR2 sounds good but it lacks coverage in the following areas:

- Critical illness, whether is it early, intermediate or terminal stage.

- Personal accident, whether is it permanent disability or death due to accident.

- Loss of income due to illness or injury.

Source: Great Eastern

How do you know if the PLR2 is suitable for yourself?

If the following is important to you:

- Lifetime monthly payouts.

- A one-time premium commitment with no further premiums.

- An insurance policy without medical underwriting.

- Do not require access to the funds until retirement.

- To generate potential higher returns than bank accounts.

Then the PLR2 maybe a good fit for you!

With that said, please also remember to do your own due diligence before buying into the product! Further areas to consider on the PLR2 are its investment returns based on historical performance and comparing it with annuity policies from other insurance companies.

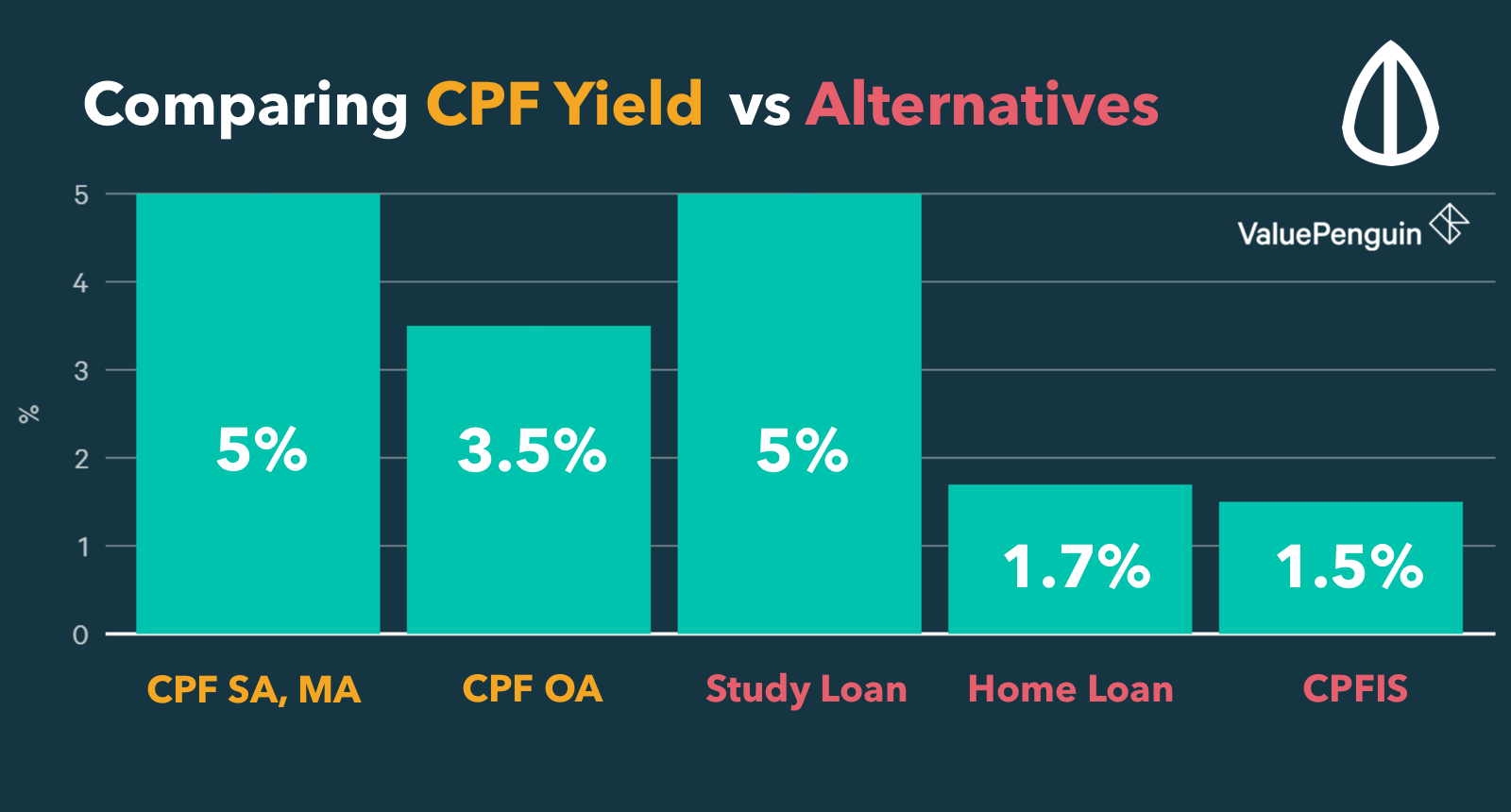

Source: Central Provident Fund Board

If you are looking at retirement planning, I would recommend maximizing your CPF Life first before supplementing it with a private life annuity plan. This is because the guaranteed returns of 4% or more per year is a lot higher! It is also a risk-free way of getting passive returns as it is backed by the government.

You can top-up your Special Account in cash if below age 55, and Retirement Account if above age 55. Additionally, this would entitle you to tax relief of up to $7,000 per year.

Is investing in Exchange-Traded Funds (ETFs) the next best option?

I’m sure many of us know what ETFs are so I’m not going to go into the details.

In the broad spectrum of investing, ETFs is considered a “passive” approach to investing in an equity portfolio for long-term investment. However, it is not exactly passive as you would still have to monitor the index the ETF is tracking from time to time to see if it is performing.

There are also various risks involved with ETFs:

- Subjected to market fluctuations caused by economic & political developments, interest rate changes and perceived trends in stock prices.

- Exposure to only a single market, e.g. STI ETF, unless the ETF has a globally diversified portfolio.

- Not actively managed, so the manager of the ETF would not sell a stock even if it was thought to be in financial trouble, unless that stock is removed from the index.

- Dividends are not guaranteed.

You are recommended to read the ETF’s prospectus before buying in!

Just to put things into context to compare with the PLR2, the SPDR STI ETF (ES3) has an annualized return of 3.49%, inclusive of dividends, for the past 5 years. This is much higher than the PLR2’s guaranteed returns of 1.62% per year.

You can read more on the STI ETFs here: https://blog.seedly.sg/spdr-sti-etf-vs-nikko-am...

My Personal Thoughts

The PLR2 is different from ETFs as it includes an insurance component, on top of the investments. Additional to wealth accumulation, if you would require the insurance death benefit component, then the PLR2 is for you. It is also a more passive strategy than ETFs.

However, if you are only looking at the investment returns, then ETFs is a better strategy than PLR2. Even though ETFs have higher risks (though still lower than investing in equities), it has historically shown to achieve higher returns.

Hi there! I went to compare both products and this is what I've came up with:

TL;DR

The Great Eastern Prestige Life Rewards 2 (PLR2) is different from ETFs as it includes an insurance death benefit component, on top of wealth accumulation. It is also a more passive strategy than ETFs.

However, looking only at the investment returns, ETFs is a better strategy than the PLR2.

What is Great Eastern Prestige Life Rewards 2?

It is a life annuity that guarantees monthly lifetime payout with a single premium payment. This can allow you to enhance your retirement income and leave an inheritance for your loved ones.

The single standard premium is $500,000 and can be either in SGD or USD.

So what exactly is a life annuity?

An annuity is a type of insurance policy that usually guarantees fixed payouts at regular time intervals for life or for a fixed period. CPF Life is one such example of an annuity plan that all Singaporeans have.

Key Features

Here are some key features of the PLR2:

What does it not cover?

With the above benefits, the PLR2 sounds good but it lacks coverage in the following areas:

Source: Great Eastern

How do you know if the PLR2 is suitable for yourself?

If the following is important to you:

Then the PLR2 maybe a good fit for you!

With that said, please also remember to do your own due diligence before buying into the product! Further areas to consider on the PLR2 are its investment returns based on historical performance and comparing it with annuity policies from other insurance companies.

Source: Central Provident Fund Board

If you are looking at retirement planning, I would recommend maximizing your CPF Life first before supplementing it with a private life annuity plan. This is because the guaranteed returns of 4% or more per year is a lot higher! It is also a risk-free way of getting passive returns as it is backed by the government.

You can top-up your Special Account in cash if below age 55, and Retirement Account if above age 55. Additionally, this would entitle you to tax relief of up to $7,000 per year.

Is investing in Exchange-Traded Funds (ETFs) the next best option?

I’m sure many of us know what ETFs are so I’m not going to go into the details.

In the broad spectrum of investing, ETFs is considered a “passive” approach to investing in an equity portfolio for long-term investment. However, it is not exactly passive as you would still have to monitor the index the ETF is tracking from time to time to see if it is performing.

There are also various risks involved with ETFs:

You are recommended to read the ETF’s prospectus before buying in!

Just to put things into context to compare with the PLR2, the SPDR STI ETF (ES3) has an annualized return of 3.49%, inclusive of dividends, for the past 5 years. This is much higher than the PLR2’s guaranteed returns of 1.62% per year.

You can read more on the STI ETFs here: https://blog.seedly.sg/spdr-sti-etf-vs-nikko-am...

My Personal Thoughts

The PLR2 is different from ETFs as it includes an insurance component, on top of the investments. Additional to wealth accumulation, if you would require the insurance death benefit component, then the PLR2 is for you. It is also a more passive strategy than ETFs.

However, if you are only looking at the investment returns, then ETFs is a better strategy than PLR2. Even though ETFs have higher risks (though still lower than investing in equities), it has historically shown to achieve higher returns.