Advertisement

Anonymous

For US stocks, should I go for dividend or growth stocks since there are 30% taxes for dividends? I intend to go for at least 3 months to 2 years. Any advice?

11

Discussion (11)

Learn how to style your text

Chris Susanto

21 Jul 2020

Founder at Re-ThinkWealth.com

Reply

Save

Billy

21 Jul 2020

Development & Acquisitions Manager at Real Estate Private Equity

You need to consider (aside from the 30% dividend tax), how much handling fees do brokerage firms charge.

Take for e.g. a company that offers 5% dividend yield. Post tax = 3.5%. FSM charges a $2 handling fee.

So if you were to work backwards, your dividends would minimally have to be $2 / 3.5%. Therefore it really depends on how much capital you put in for dividend yielding stocks.

But personally, US growth stocks has not disappointed me.

Reply

Save

Marcus

21 Jul 2020

Founder at manualmode

Generally, I go for growth stocks for the US market and dividend stocks for Singapore market (and if...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Moomoo Singapore

4.7

487 Reviews

From $0

MINIMUM FEE

0.03%

TRADING FEES

Custodian

STOCK HOLDING TYPE

Saxo Markets

4.5

961 Reviews

Plus500

4.7

144 Reviews

Related Posts

Advertisement

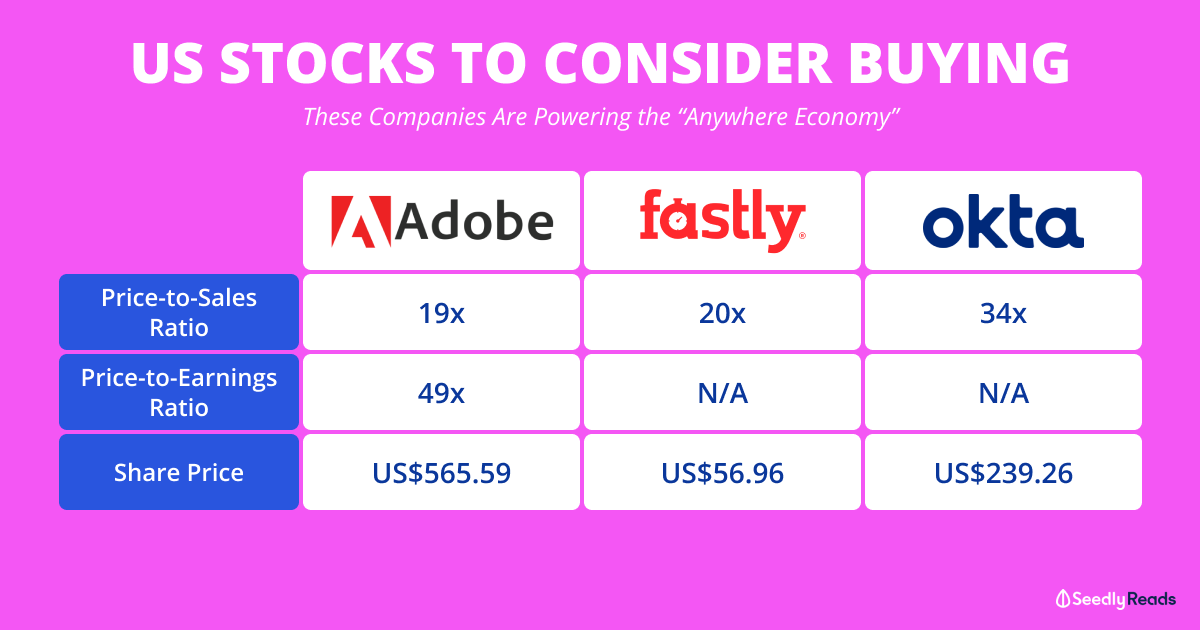

For US stocks, you should go for growth via capital appreciation. That is exactly what I am doing.

The majority of my portfolio is in US stocks.

Sg stocks are generally great for dividend-paying stocks or REITs - given one bought it at the right price. Due to no tax for dividends paid.

Most of the monthly stock case studies I did for my members are also US stocks. It's a pretty exciting market, to be honest as there are more global companies in the US stock exchanges.

In terms of your time horizon, 3 months to 2 years, I think that could be dangerously short. Read about the basics of investments here in my intelligent investor summary.

Hope this helps!