Advertisement

Dividend Income Enthusiast - What to buy other than SG REITs and Blue Chips?

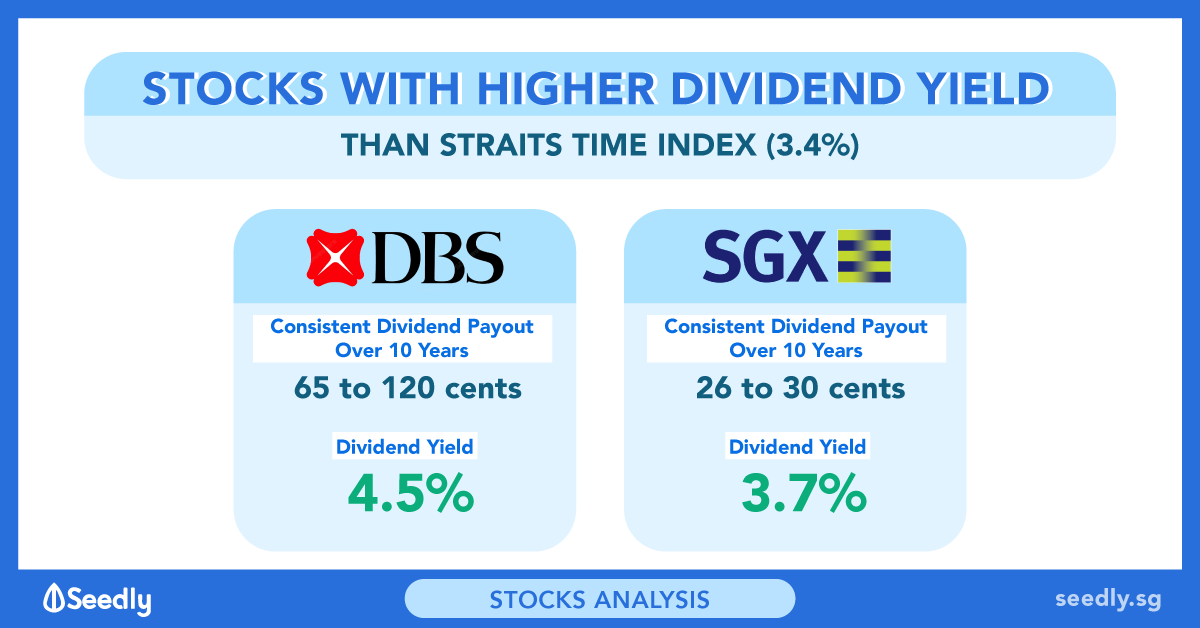

I am looking to build a passive income stream and am open to investing in stocks or other financial instruments so long it gives >4% annual yield.

I currently am sitting on a portfolio of SG REITS, blue chips and ETFs - Seeing that there may be diversification risk, what other stocks/instruments do you recommend I add to build on my dividend income? I have a small warchest to deploy and am adding into my current positions whenever i see an opening .

I did not invest in the following for the respective reasons:

US REITs - Unsure of how the market is like there, can't see it in person unlike SG REITs (don't invest in what you don't know/understand right?) Additionally, we will be subject to tax and estate taxes (in the unfortunate event that we pass).

SGS/SSB/TBills - Don't think it warrants over 4% yield as of now

Thank you all in advance!

19

Discussion (19)

Learn how to style your text

Reply

Save

US Office REITs listed in SGX, Keppel Pacific seems interesting

Reply

Save

Don't just focus on yield if you are investing in stock. Look at the company's past performance and it's likeliness to sustain or increase its dividend in the future.

Not a recommendation but these are the counters that I have which I invest for income - HRnetGroup, Micro-Mechanics, Sheng Siong, The Hour Glass and Venture. I talked about them in a video made 2 months ago. https://youtu.be/2_g7A27maPo?si=84vXg22sAH1cHxLL

For your reference. Remember to dyodd.

Reply

Save

Dividend stocks - u need to buy stocks at low price that pay out high but stable . If u buy stocks at high price , u need alot money . People like AK74 all have high dividend income because when they bought their stocks, it was at low low price so they slowly accumulate and get big dividend.

Reply

Save

My friend who loves investing said that uSMART SG is very good, regulated by the Monetary Authority ...

Read 10 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Whatever you do, don't buy us stocks for dividend. just not worth it. Explore hong kong. Similar tax haven