Advertisement

Anonymous

Banks for dividends?

Currently, I invest in Syfe's offerings (REIT+ 100%, Equities). I am looking to diversify and invest in bank shares for the dividends. Thoughts on this? I did some research, and found that some people completely discourage buying bank shares, without giving much explanations

14

Discussion (14)

Learn how to style your text

Reply

Save

I like bank stocks - pretty stable, relatively high dividends.

Plus I don't really see the industry as sunset anytime soon.

Why not!

Reply

Save

Monitor market cycle and buy every time pe is low. sg banks generally safe to hold for divvies.

Reply

Save

Robin

01 Jul 2023

Administrator at SG

Local banks can consider but it will more meaningful to compare the 3 banks and know their business and country diversification to have a sensing of their potential future earning . I have a local bank + SReit ETF. Dividend about 5.4% per annum for now. Buying via brokerage will be cheaper than robo.

Reply

Save

I buy SG banks stocks so that I can sleep peacefully 😂 (background: im staying, working & building ...

Read 9 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

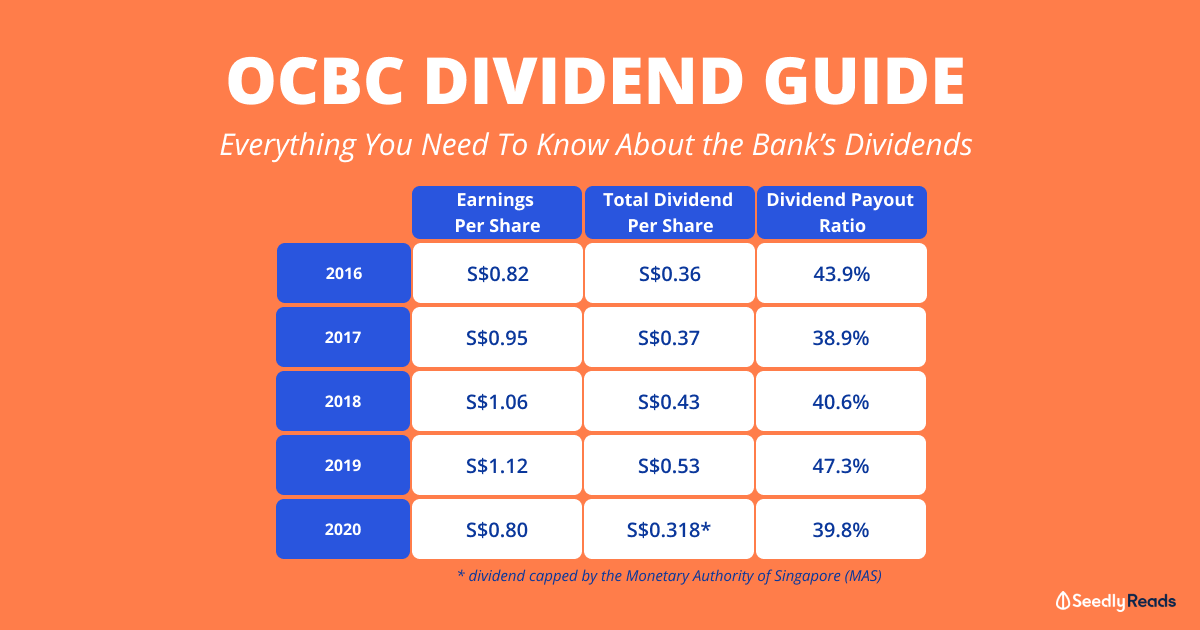

Investing in local banks to harvest sustainable dividends, is one option. Its weightage in the investment portfolio could be dependant on one's age. As local banks are rather "stable" (minimal business volatibility comparably), investors will not experience much "excitement" (roller-coaster ride). Hence, individuals with long investing journey whom could take abit more risk, may not enjoy the stability of this sector.