Advertisement

Anonymous

At what point should a couple who is still dating start saving for married life?

We have been dating for about 3 years now and we have never really discussed about marriage. But should we start saving now?

12

Discussion (12)

Learn how to style your text

Kenneth Fong

07 Jun 2019

Marketing Manager at Seedly

Reply

Save

I believe the perfect time to start planning and saving together is when you decide you are both comfortable enough to have the conversation of saving for common goals.

When you are comfortable enough to discuss these topics, it means you both share a vision of sharing the next phases of your lives together. Hence I believe once you have gotten to this point, you should both consider saving together.

For a lot of couples I've helped, this conversation sometimes happened at the start of their relationship and for some, never (at least, not until I've spoken to them about it as some may not even be aware about working towards common financial goals).

When you and your partner are both comfortable talking about:

a) Shared finances and sharing finances

b) Working together on a strategy towards common financial goals

Then you should seek out a financial planner who is able to handle this conversation together with your partner and yourself, and together, work on a strategy and actionable to-do's.

I can help you here :) Please contact me via https://cherietan.typeform.com/to/wdlOfuhttps://cherietan.typeform.com/to/wdlOfu

Reply

Save

Personally, I would say as soon as you guys see a future together. Of course, you’ll need your own personal savings.

I started a combined s account with my Boyfriend 6 months in when I was still an undergrad and he was serving his NS. We saved any amount we could each month and we made sure we kept each other in check. We’re hitting our third year soon and we’ve reached a five figure mark in our account to be used for our future expenses such as getting a house. We set a date and a fixed amount to put in each month. We both have learnt so much more about each other’s spending habits which I think is essential when you start living together.

We do talk about the subject of a break up and agreed to split the amount based on what we have each put in. I mean, this couple savings is essentially part of your savings too. So personally I would say start as early as you can.

Reply

Save

Huang Yixuan

29 May 2019

Person at Seedly Community

My personal POV is that logically, if you’re dating someone seriously it probably means this is a potential marriage partner. So once y’all can establish that comfortably, you can talk about your individual future goals and that’s when y’all will have an idea of what you want and what you would have to potentially save for. Keep this in mind and save individually, when the time comes when you guys are more serious and are pretty sure the other person is the one already, then it’ll be time to talk about financial planning to achieve your future goals. in the end, plans might change, but at least planning and saving makes sure you don’t end up in a situation where you have to put your dreams on hold (:

Reply

Save

For me, we started when we decide that we wanted to get married. So, the point where we decide that ...

Read 7 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

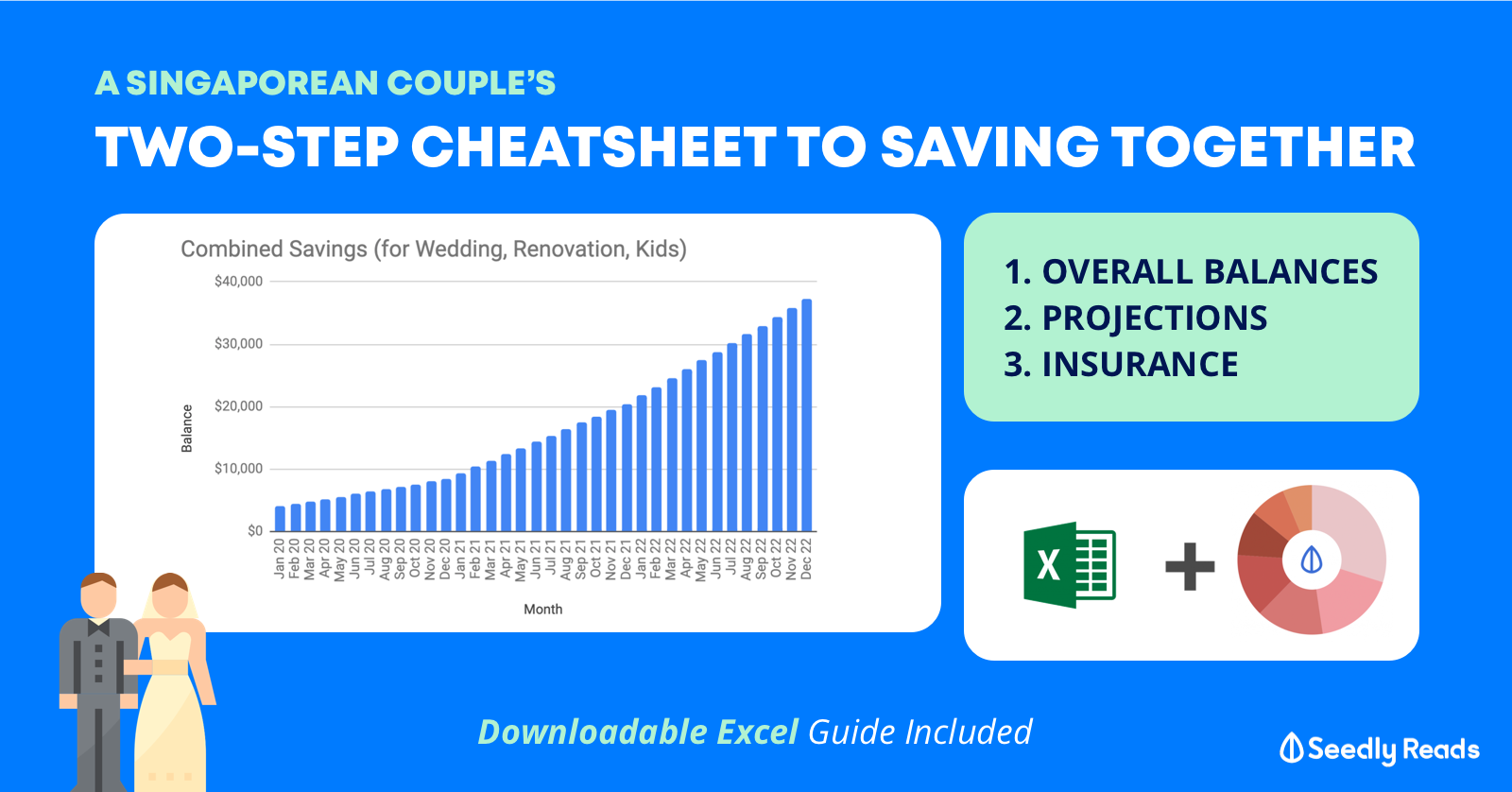

Even when both of you are still dating, it's never too early to start thinking about your life together.

Or... a life without each other for the matter.

Here's why.

When Should You Talk To Your Partner About Money

It's going to be a little creepy talking to your partner about saving for a wedding and a life together, especially if you've ONLY just met.

Case in point:

Source: knowyourmeme

Don't do that. Unless he or she is totally into that, then... Erm. Congrats you two...?

Instead, give it a couple of weeks, or months, or years in fact. Get to really know each other before deciding if you would really see yourself growing old with the person.

And usually, this would entail finding out pertinent stuff like money habits and your individual views about money.

THIS is when you know that it's time to get serious about saving for a life together.

If you're curious about how you can broach this topic with your significant other, Seedly has a great post about how to talk to someone about money without dying.

Should I Still Be Saving In The Meantime?

Yes.

Whether you see a life together with your partner or not. Both of you should still be saving regularly.

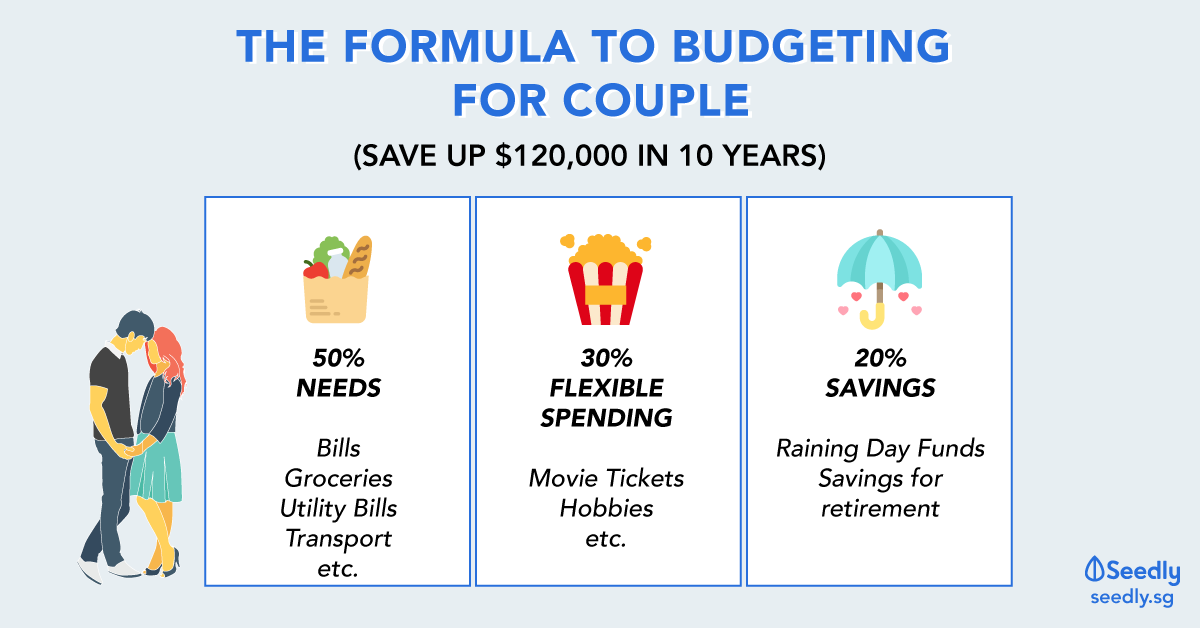

In the worse case scenario where you both don't work out, your savings will still allow you to wallow at home, while you watch reruns of Friends, and stuff your face with ice cream till you feel like you can socialise with people again. Or to pay for important stuff in your life like:

And in the best case scenario where you both decide that "Yeah, I'm totally cool living with this weirdo for the rest of my life," you'll have a solid base of savings to begin with and can continue to build your life upon it.