Advertisement

Anonymous

As a young millennial (23years old) who earns <$4k income, is it advisable to venture commercial/industrial/overseas residential first before getting local residential?

2

Discussion (2)

Learn how to style your text

Reply

Save

Personally, I would prefer to have a safety net before venturing outside and I would not go into property (probably excluding REITs). WHY? Prices of properties are determined by various factors including demand and supply. With falling birth rates, the shift from brick-and-motar stores to virtual platforms, the advent of disruptive startups like Airbnb and more, it is very unlikely for us to see the tremendous appreciation as we did before. It might not be impossible, but the competition is stiff.

Seeing that your income isn't particularly high, in the off chance you made a loss, the damage will be quite severe.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

I once considered looking into overseas properties - for eg. You can get many properties in South-east Asia at a comparatively lower price at a price per square foot basis, but it makes sense to be aware of the risks investing in a property which you don't have access to, and need to rely on an agent to manage for you.

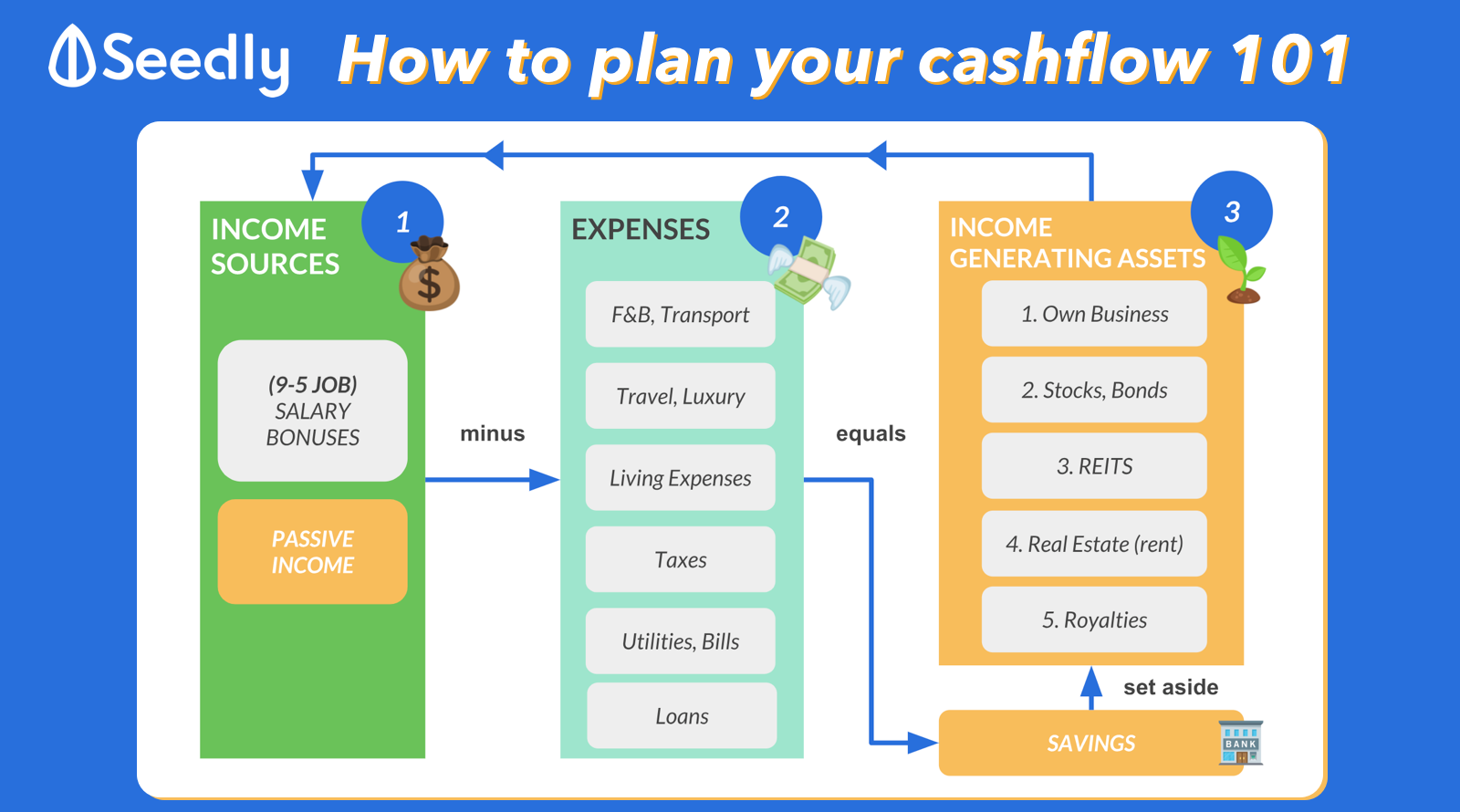

With regards to getting a local residential unit, what is your current investment capital size? Given that it makes sense to diversify, ensure that not majority of your investable capital is going into property. Look at other investment asset classes as well.