Advertisement

Anonymous

Am I spending too much on insurance? I am currently 25 going on 26 with an income of around 4,200 (inc CPF), I am not sure if the policies I have are too much?

Currently, I have:

- Hospitalisation (Paid by medisave, $500 per year)

- GREAT RETIRE INCOME 20, $2400 per year (endowment)

- GREAT LIFE ADVANTAGE III, S$2400 per year (CI + ECI (75k payout) + a bit of ILP)

Recently met up with a Prudential advisor. He told me that my CI coverage is too little and asked me to get

- PRUActive Life III, $1,570 per year (CI + ECI, 75K payout)

- ILP, $4,200 per year

This will bring my insurance to $3,970 per year and my wealth accumulation to $6,600 a year. Total will be $10,570 a year.

While I can afford it, I was wondering if I am spending too much? I also have a BTO coming up and planning to get married within the next 5 years.

10

Discussion (10)

Learn how to style your text

Elijah Lee

19 Feb 2022

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

I think your ILP is a bit off. Personally as a financial advisor i dislike selling ILP because of high fees and low-coverage. You are better off Investing yourself.

Create a brokerage account (tiger broker / Moomoo / Interactive broker), Buy SPY (S&P 500) at regular intervals. 1K investments per month into SPY can make you a million air in about 20-30years assuming 10% P.A return.

Happy to do a review with you with a promise not to sell you anymore product

Reply

Save

Tan Siak Lim

16 Feb 2022

CFP. Director, Financial Advisory Group at Financial Alliance

When asking whether you have enough insurance, it's probably more important to look at your coverage (that's what insurance is for), rather than just the premium. While you seem to have allocated a decent sum to insurance ($3970), you appear to be under insured, just by looking at what you shared. Of course, nobody is able to advise properly without understanding your circumstances more.

Reply

Save

Well, if you are getting advice from advisors from insurance companies, they are probably only going to give you solutions based on the products are they selling.

On wealth accumulation, try to explore more of other investment instruments, eg from robo advisors, etf..

Reply

Save

I'm not a financial advisor but would suggest you can seek a 2nd opinion from someone you trust ( ca...

Read 5 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Advertisement

Hi anon,

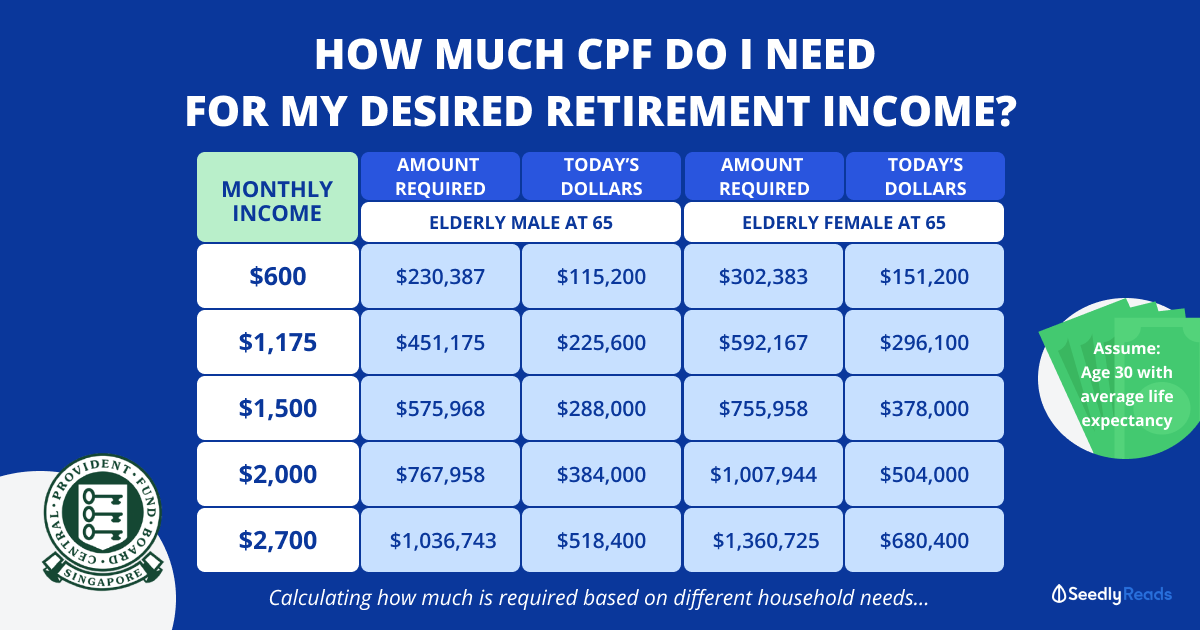

It is right to say that you don't have a lot of CI coverage, $75K is really not a lot of money if something were to strike. However, the most important thing is to first work out how much coverage you need. I wouldn't just take a suggestion of a PruActive Life III covering $75K if let's say, I really needed $300K of cover, my shortfall is $225K and I'll still be under insured even if I add on the PruActive Life.

Work out how much coverage you need first, there are some rules of thumb to help you (such as 5x annual income), although the actual amount is very much dependent on a few things such as your expenses. Also, since you have mentioned that you have a BTO coming up, it suggests that your expenses will rise in future (think bills, mortgage, etc) and it might be a good idea to 'pre-pone' your coverage and get a bit more pre emptively in order to ensure that you don't have to get more coverage again in 5 years.

With the amount of coverage you needed in mind, the next step is to address 1) the protection gap and 2) the ILP (the GE one) issue. Please have a read on my thoughts on protection based ILPs here and suffice to say, if you can avoid having an ILP in your portfolio for protection, it will be for the best. This may entail you finding a replacement for your Life Advantage III, but you should really speak with an independent financial advisor to get tailored advice. Personally, if I were in your situation, I'd replace the GE ILP with a non-ILP plan to cover myself for CI and ensure that this time round, the coverage is sufficient, once and for all.

Great Retire Income is an endowment and that is okay, it is a safe vehicle to grow your monies. I don't have any worries about such a plan.

As for the suggestion of the $4.2K ILP for investment, I'm a financial advisor myself and I don't use ILPs, or even mention them to my clients. I think that's quite telling. Personally, I invest on my own (shares, UTs, etc) and the same goes for my clients, whether I am managing for them or not.

The main issues (non-exhaustive) with investment based ILP tend to stem from high surrender penalties, a boat load of charges at the policy level, over and above those at the fund level, which really degrade performance, even when you factor 'bonus' allocations. Possibly the only good point is the chance to access funds that may not be available to the retail investor, but then the advisor has to be very good at picking these funds, and also managing the risk that comes with them.

You may just want to settle your protection needs first, as you already have wealth accumulation going strong, and save money for your BTO. As the owner of a resale flat myself, you will be surprised how much money you will need for a renovation (even a simple one) as well as fittings and appliances, and it might be better to be cautious first before commiting to another wealth accumulation plan. Lastly, please ensure that your wealth accumulation plan doesn't eat into too much cash flow, the last thing you need is to have a plan lapse because you could not keep up the commitment.

All the best!