Advertisement

Anonymous

800k cash, frs reached, n a fully paid 4rm flat in mature estate with 51 years all these at 43 years old. do u think my friend is doing well? He hope to retire by 55.. don’t want to chg new house ok?

10

Discussion (10)

Learn how to style your text

Anonymous Poster

17 Jul 2023

Reply

Save

Ur fren is fine

Reply

Save

Anonymous Poster

16 Jul 2023

Oh by the way his hdb is left 51 years lease but at marine parade with mrt 3 mins walk away.... wld anyone recommend him to upgrade? Or wait for potential sers?

Reply

Save

Isaac Tan

15 Jul 2023

Assistant Director, Investment Advisory at iFAST Global Markets

Hello there,

His current situation working towards retirement in 12 years time is well within reach. Now lets take a closer look and break it down in terms of numbers and see if its something that he wants.

Home is not a worry, so thats something he dont have to worry about since he doesnt want to move.

It is important to know how much passive income will he be spending when he goes into retirement at 55 so we can work backwards and see if its realistic.

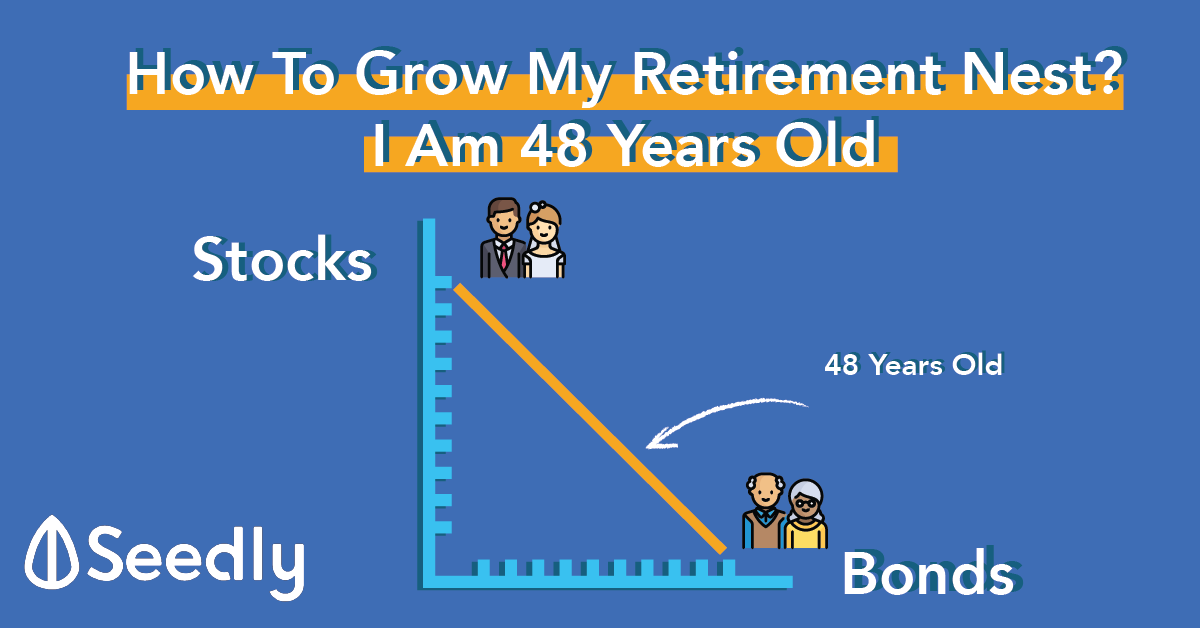

Assuming his 800k is fully invested in a balanced portfolio (50/50 stocks and bonds) and assuming a 5% pa return over the next 12 years.

His 800k will grow to approximately 1.3 - 1.4million.

1.4mil can generate approximately 5-6k per month when he is 55 years old. Very possible to live a comfortable life.

Next question would be, what is his current income?

what is his current expenses? and what is his net cashflow at the end of every month?

It might be good to explore how he is allocating his future cashflow from now to 55. If he is investing in all the right tools in the right ways, he can potentially reach 2mil-3mil by 55 years old very easily as i would guess that he is also having a strong earning capacity in order to achieve everything that he has today :)

With 2-3mil, That would translates to 8k~12k per month of monthly income!

Again, whether a person is doing well or not, that is very subjective to individual expectations. If 8-12k a month is able to sustain his total expenses, he is well on track to his comfortable golden years ! Many of my clients are PMEB/T and what i do is basically to help them get more clarity of their finance.

Knowing where they are today, and where they would like to be in future.

So the above questions on his cashflow and how he is allocating his money will be something he need to work out on, to have a clear finanical plan and investment strategy to get him there.

If anyone needs an unbias input, feel free to reach out :) happy to put things into perspective for anyone who might see value in that.

Cheers!

Isaac Tan

Reply

Save

To have a "feel" whether your friend is on track to retire at 55, suggest he conducts a budgeting ex...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Does friend who feel lease is running out when he is 93.25 years thinkinh too much unnecessarily?