Advertisement

OPINIONS

When To Sell A Stock? 6 Reasons To Do So

When it comes to buying a stock, it’s easy. Isn’t it? But what about selling a stock?

Lin Yun Heng

21 Nov 2020

Senior Analyst at Delphi

Join My Tele Channel Here

After watching thousands of videos on which stocks to buy, evaluating its fundamentals and growth prospects, you click the BUY button and Voilà! You just bought your first stock.

So what do you do now?

No, you do not just sit back, relax and shake your leg. In fact, you need to put even more time and effort now that you own the stock. Stocks are not lottery tickets as there is a company behind every stock and by owning a stock you are essentially a shareholder of the company. You need to take note of news, keep track of its earnings and making sure growth prospects remain the same.

It is after you purchased the stock where the work becomes tedious, as you have to watch over your portfolio like a hawk and make sure you make sound investment choices which are in line with your risk profile, personality and time horizon.

Although many finance blogs educate beginners on the importance of “Buy and Hold” and “Not timing the market,”these are fundamental principles that you should already ingrain in yourself the moment you chose to be a long term investor and not a speculator.

“Know what you own, and why you own it.”

-Peter Lynch

If you understand the stocks you own and done your due diligence, you should have no reason to panic sell when the market crashes. In fact, you should be even happier because now you can buy more of the stocks at a cheaper price.

If you know that a pen is worth $1 right now and suddenly it drops to $0.50, do you panic sell your pen? Nothing fundamentally changed with the pen, so instead of making irrational decisions that the news and market tell you, you should be happy to purchase more pens since its 50% cheaper now! That is the same for stocks.

News headwinds drive stock prices up and down based on sentiments. News and market noises drives up market volatility which traders and speculators both adore because they thrive and make profits from price fluctuations. This is why you should never confuse trading with investing, because trading is short-term and relies on technical analysis whereas investing is long-term and relies on fundamental analysis.

Without further ado, let’s talk about the 6 reasons you can adopt when it comes to selling a stock.

1. Why did you buy it- Did it change?

The first reason why it is time to sell your stock is if the growth story or fundamentals are no longer great and what you anticipated. There may be fraud accounting, dividend cuts, acquisition, takeovers or it no longer can fend off the competition. Whatever the reason, when the fundamentals are no longer the same, it may be time to sell the stock.

For example, Singapore Press Holdings (SPH) used to be a blue-chip dividend stock before the age of digitisation. It was a favourite among Moms and Pops investors in the early 2000s due to their dividend growth and consistent dividend payouts and stable share prices. However, as the internet proliferated, coupled with the rise of free news media and not needing to pay any money to read a newspaper, the company and the industry quickly dwindled and it is now a sunset, old world industry stock.

SPH Share Price for the past 5 years

SPH Share Price for the past 5 years

If you did not sell the stock in the early 2010s when the internet and news were slowly replacing newspapers, you will be sitting at a -75% loss today. What’s worse is you continuing to believe it is a recovery play and you held on to it stubbornly, because you read online that the only way in investing is “Buy and Hold.”

Sometimes, it is far better to “cut the weeds and water the flowers” (sell the losers and hold the winners) but most people are “watering the weeds and cutting the flowers” (sell the winners and holding the losers) which is why most retail investor never ever beat the market.

So lesson 1: Sell if the story no longer remains or the fundamentals are not the same anymore.

Stocks I would consider to be this category and would avoid at all cost: SPH, SIA, Comfort Delgro, Singtel, Sembcorp

2. Check Risk-Reward

At what price did you buy? Did you buy at all-time highs or did you buy at all-time lows? If you are the former, good luck, you might not have any margin of safety because the higher the stock prices go, it means the higher the risk of it falling. Stock prices go up in the short run because of sentiments. Since the anticipation and expectation of a stock is high, therefore such stocks goes up quickly. However, if you do not understand and buy into the hottest stock at all time highs, you are spelling for trouble.

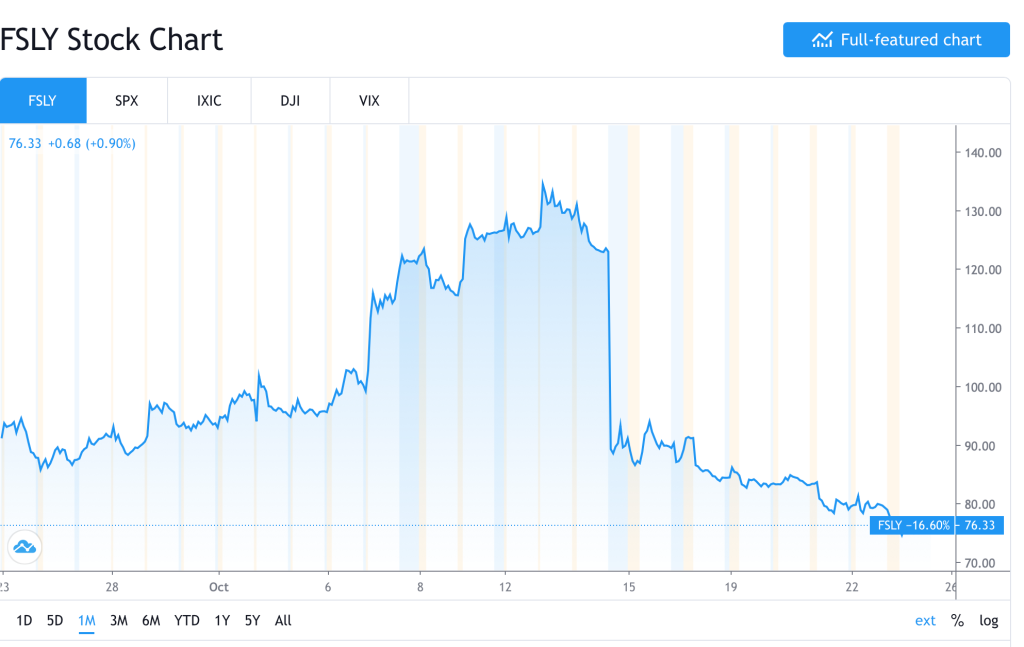

The moment earnings do not meet expectations, stocks prices will go down, and it will go down hard. An example of this would be Fastly.

What goes up fast, goes down fast as well. This is why stocks driven by sentiments can go up tenfold in 2 months, but can also crash tenfolds in 2 weeks. Always remember to weigh your risk-reward, your margin of safety and make sure your upside is greater than your downside. To do this you need to determine the intrinsic value of the stock through fundamental analysis.

There are many different ways you can determine intrinsic value, for myself, I usually evaluate stocks using DCF valuation (Discounted Cashflow), ROE valuation model or Sum of Parts Analysis for conglomerates such as Berkshire Hathaway or Tencent.

Lesson 2:____ Check Risk-Reward and sell when your upside is no longer attractive. The higher the stock prices go, the riskier it gets for a potential pullback.

3. Opportunity Cost

Now the 3rd reason why you should sell your holding is when there are better opportunity cost. I will give you my own experience: I was holding on to STI ETF for the longest time as I have been investing into it since 2019, and sitting at a loss, I did not bear to take the losses as it was pretty significant. However, I knew that by holding on to the loser (STI ETF) with many of the companies within the index losing its allure day after day, I decided I have to do something about it due to opportunity cost.

I researched into US stocks such as Salesforce, Tesla and Alibaba ADR which had better growth prospects than STI ETF. I eventually sold off my stakes in STI ETF in tranches and redeployed them into better counters and ETFs. There are far better ETFs which offers superior returns than STI ETF which were counters like ARKK, ARKW and ARKF (I own all 3 ETFs) and all 3 are sitting at a +10% to +16% unrealised gains.

So opportunity cost plays a part in your decision to sell your stock holding. Of course, some may disagree with me here as before even thinking about selling, we should just hold on since we believe in what we bought.

But sometimes growth stories changes and we have to evaluate it critically. Changing a “dying horse to a younger stronger horse” is far better than holding on to a dying horse thinking it will be like its glory days. Life just don’t work that way.

Lesson 3: Understand the opportunity cost by constantly looking out for growth opportunities and knowing which of your holding no longer has the growth prospect it once had, and by substituting it for something better might be better for your overall portfolio in the long run.

4. Stop Losses

This applies mostly to traders and not investors. As a trader, it is important to set stop losses to limit your irrational brain from activating. Being disciplined about taking profits or losses can boost overall net positive trades if you are able to adopt stop-losses.

For investors, stop-losses may be bad because you will be forced to sell a holding due to short-term market sentiments. If you sold Apple during March due to Stop-Loss parameters, you will be crying now because the stock recovered and is even higher than it was.

Hence, stop-losses while beneficial for traders, does not have the same effect if you are an investor so understand which strategy you are adopting. Traders adopt a short-term view (days/weeks/months) while investors adopt a long-term view. (years)

Lesson 4: Setting Stop-Losses allows you to minimise your losses and to be disciplined when it comes to trading. It prevents our irrational brain from making dumb decisions and ruin a disciplined trading strategy.

5. When you hit your goal

The 5th reason you should sell your stock is when you attain your goal. For example, I planned to retire by age 50 with at least 2 million invested yielding 5% annually which should give me $100,000 ($8333/month) in passive income every year.

I would set milestones in my life to hit this final target of 2 million by 50 and along the way would sell away my growth stocks positions in the later stages of my life as I want stability and take an overall more defensive stance to investing. When I reach my mini goals/milestones, (eg. 200k portfolio by 32) I will start to take profits and transit to allocating dividend yielding stocks but again this depends on the situation in the future.

So once you hit your own specific goal, it may be time to sell some of your stocks to take profits and recycle the capital into defensive stock counters where you collect dividends and start to take in more passive income.

Lesson 5: Sell and take your profits on aggressive counters and recycle them into defensive counters which provides passive income in the form of dividends. You may or may not decide to do this and this is evaluated at an individual level and specified based on your own goals and situation.

6. Never Sell -Be like Warren Buffett

Another school of thought is to never sell your stock if you are extremely patient and extremely confident in your holdings. This has historically been the most effective since dividends reinvested coupled with holding on to to solid companies will allow you to compound your capital slowly but surely.

But nowadays, this is the hardest thing to do since we humans fall trap to “Instant Gratification” and the effects of FOMO which cause us to make irrational decisions. I am also a victim of this and part of it is inevitable since it is human nature to want to enjoy the pleasures immediately instead of waiting for it later. An example of this would be the question of _whether to get 1 million now or to receive 20 million 10 years later. _Most people would choose the first option.

If you decide to be like Warren Buffett and” hold-till-you-die,” then you will be duly rewarded. (provided you buy into the correct stocks) However, as none of us are actually Buffett and we do not have foresight and wisdom like he do, you can adopt any of the reason when it comes to selling but the important part is to know the reason for selling and why is it justified.

If you don’t even know what you are doing and panic sell, you are better off not touching the stock market at all and should avoid stock picking at all cost. Letting professionals help you and investing into a “Buy and Forget” fund through a mutual fund/unit trust may be way better, and just treat it as a form of forced saving for retirement.

Lesson 6: Never sell your stocks if you don’t have to, simply buy into companies you are extremely confident in with solid fundamentals, and stay convicted and not time the market.

Conclusion

It is easier said than done. Buying a stock is much easier as compared to the selling. If the stock you hold is doing extremely well and the growth stories continue, you may not find a reason to sell it. Likewise, if a stock you own is doing extremely badly, you may be fearful and hold on to it to avoid losses, but if there are better opportunities out there, it is better to let go of a loser (after evaluating it critically) than to hold on to it.

Take the 6 reasons as a guideline but also with a pinch of salt, because what I say may not be what you believing in. There is no right or wrong when it comes to investing as there are various ways and approach to grow your wealth. So at the end of the day, understand your risk profile, time horizon and personality so you can go about thinking of a game plan on your path towards financial freedom.

Everyone’s approach is different and even if similar, it may not be exactly the same as we all have our own circumstances and situations we are dealing with in life. If you are curious about how I invest, you can view my full portfolio on StocksCafe here.

If you have any questions, do let me know and if I missed out any more reasons on selling, do let me know in the comments section below! ^^

This article was originally posted my blog: Investing Beanstock, now updated on Seedly.

If you want to find similar posts and investing ideas, check out my blog here to find out more.

I use StocksCafe to keep track of all my investments (include Robo) + research on stocks. You can also view my portfolio as well as many others so you can compare your own performance with other investors. If you are interested in signing up, you can use my referral link to sign up and access premium features for 1 extra month for new users. (3 months)

Comments

4846

3

ABOUT ME

Lin Yun Heng

21 Nov 2020

Senior Analyst at Delphi

Crypto Educator

4846

3

Advertisement

No comments yet.

Be the first to share your thoughts!