Advertisement

OPINIONS

What to Consider before Start Investing

What to Consider before Start Investing

Vince

19 Mar 2021

Blog Owner at REIT-TIREMENT

One would not go skydiving without training and parachute. Similarly in the wealth-building process, one should not jump straight into "investment" without reviewing their current financial situation and plan beforehand.

Opps, there are peoples skydiving without parachute ? OK, bad analogy, but you get my point.Before you start your investment journey, it is important to understand and prepare for the following:

Oops, there are peoples skydiving without parachutes? OK, bad analogy, but you get my point. Before you start your investment journey, it is important to understand and prepare for the following:

1) Cash Flow

You would have to track your monthly income & expenses and record it down. With this, you are able to know where your money is going. A positive net cash flow is the key to wealth building. If your net cash flow is negative, then you would need to cut down on your expenses. There are lots of free apps for this purpose, or you could DIY yourself with a spreadsheet.

2) Networth

Similar to the above, only this time is to check on your assets & liabilities. If your net worth is positive, congratulation. If it is negative, you would have to find ways to reduce your liabilities. How to reduce liabilities? Save and reduces expenses to pay off debts.

3) Emergency Fund

Save up emergency fund for min. 3 months worth of your expense. Some would advise to save up 6 - 12 months expenses, it all depends on individual preferences and circumstances. Do not invest all your money, as the market can be volatile and you may be required to cash out at loss during an emergency.

4) Insurance

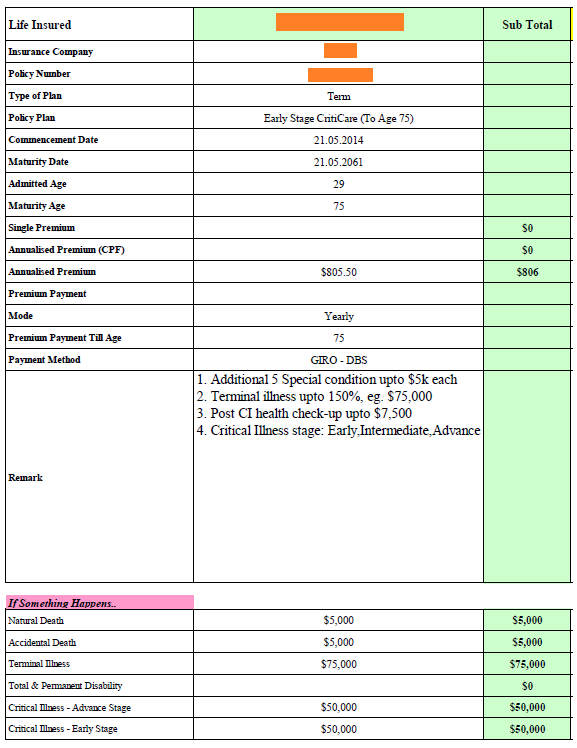

Purchase insurances to protect assets and your loved one, especially when you have a dependent. There are various types of insurance: health, accident, term life, whole life, critical illness, mortgage, home, and others.

Health insurance is a must as the cost of medical is expensive and it could easily wipe up the nest egg that you built for years. If you have dependents, then it is important for you to have term life or whole life insurance which payout upon your death or permanent disabilities. The same goes for mortgage insurance if you have dependents and outstanding housing loans to service.

It would be good to have a list of insurance policies that you and your family having and keep them all in one place. Some insurance agents would do an insurance summary free for you, all you have to do is ask them. If you are paying your premium yearly through GIRO, then it is even more important to have the list with the payment date so that you could prepare sufficient funds in your account. You do not want to miss out on any payment and lost your coverage, do you?

Sample of what my insurance agent done

Sample of what my insurance agent done

5) Debt

After saving enough emergency funds and have sufficient insurances for protection, the next step would be clearing off high-interest debt. Some high-interest debt examples are credit card debt, personal loan, renovation loan, with credit card interest rate, ranked the highest.

Logically speaking, you should start paying down the highest interest debt to maximize the reduction in interest expenses. However, this may not always the case; for example, the car loan interest is computed based on the initial loan amount, paying down a car loan won't help to reduce any interest expenses. Do not solely look at the advertised interest rate, ask for the effective interest rate (EIR) before getting any loan.

6) Goal

Set a S.M.A.R.T. goal and plan for how you want to achieve it.

Your goal should be concise on what you want and could accomplish with your available resources in a certain time frame. It should be measurable so that you could track your progress. Be honest to yourself, do not set an easy goal for the sake of goal setting.

Investment is not a grow rich quick scheme and every investment comes with risk, that is why it is very important to set your financial foundation solid before you start investing. I hope the above information is useful to you, feel free to leave a comment.

Comments

894

3

ABOUT ME

Vince

19 Mar 2021

Blog Owner at REIT-TIREMENT

Blog owner of REIT-TIREMENT, a blog that focuses on how to invest in REITs and managing personal finance

894

3

Advertisement

No comments yet.

Be the first to share your thoughts!