Advertisement

OPINIONS

What is Impact Investing?

An introduction to an investment strategy that you can consider.

Sebastian Png

03 Jan 2021

Seedly Student Ambassador 2020/21 at Seedly

Back in September, I participated in the iFAST Global Markets (iGM) Impact Investing Case Challenge, which sparked my interest in learning more about impact investing.

I then proceeded to search for impact investing within the Seedly platform in hopes of learning from the community, but all I could find was this question posted back in 2019.

Having noticed that not a lot of attention is given to this topic, I have decided to write this Opinion to generate more buzz around it, as well as contribute to the Seedly community.

What is Impact Investing?

According to the Global Impact Investing Network (GIIN), impact investments are “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.”

Such investments can be directed towards themes such as clean energy, sustainable agriculture, affordable healthcare and housing, to name a few.

Characteristics of impact investing

1. Intentionality

When it comes to impact investing, investors must have a genuine intention to contribute towards investments that carry social and environmental benefits.

This can be demonstrated by establishing transparent impact goals and forming an investment thesis to attain the goals.

2. Investment with return expectations

Although Impact investors harbour the intention to address social and environmental causes, they still expect some form of return on their investments - minimally the return of capital.

3. Range of return expectations and asset classes

The financial return of impact investments typically ranges from below market to market rate and these investments can be done across a spectrum of asset classes, as shown in the image below.

Source: Global Impact Investing Network

4. Impact measurement

To ensure transparency and accountability in the field of impact investing, there is a need for investors to measure and report their portfolio’s progress and performance, in terms of its social and environmental impact.

To standardize this process, GIIN created the Impact Reporting and Investing Standards (IRIS), a catalog of metrics that is widely accepted in the industry.

Impact Investing vs ESG Investing vs SRI

Prior to reading this Opinion, you probably have heard of Environmental, Social and Governance (ESG) investing and Socially Responsible Investing (SRI), which are often used interchangeably with impact investing.

Despite their similarities, the three terms have their differences.

For ESG investing, while it has an aspect of social consciousness, its primary focus is still financial performance. This differs from impact investing, which seeks to maximize positive societal and environmental impact over returns.

SRI, on the other hand, can be perceived to be in between ESG and impact investing as it aims to balance financial returns with creating positive social impact. Investment decisions are based on a set of ethical guidelines, to exclude certain businesses that are involved in unethical activities such as child labour and animal testing.

Impact Investing and the United Nations SDGs

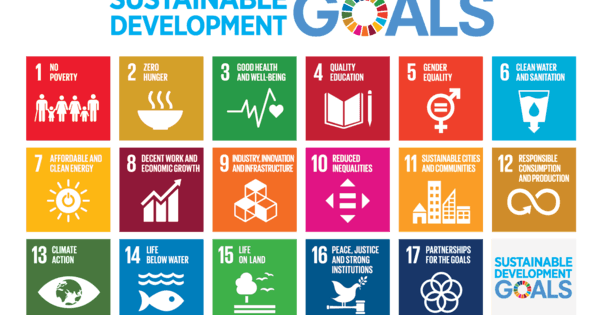

Source: United Nations

Impact investing serves an important role in directing capital towards achieving the 17 Sustainable Development Goals (SDGs), which were adopted by all United Nations members in 2015.

The goals are an urgent call to action towards global challenges, such as ending extreme poverty, addressing climate change, reducing inequality and generating economic growth.

Recognizing the significance of the SDGs, different parties have adopted impact investing as a means of contribution towards the goals. Banks such as Standard Chartered and UBS, and venture capital firms such as Quest Ventures, are examples of such parties.

GIIN has also released a report in 2016 that included various profiles of impact investors, their motivation behind tracking the SDGs and their investment strategies.

Tradeoff between impact and returns?

Since impact investing seeks to maximize positive impact, it must be at the expense of sacrificing financial returns, isn’t it?

Not necessarily so.

According to GIIN’s Annual Impact Investor Survey this year, the impact investing market is currently estimated to be worth USD 715 billion, an increase from USD 502 billion last year.

Additionally, 88% of the 294 respondents stated that their impact investments (collectively worth USD 404 billion) have met or exceeded their financial expectations.

This is quite a remarkable feat for impact investors, since 2020 was full of uncertainties which mainly resulted from the COVID-19 pandemic. Despite the headwinds, GIIN reports that investor outlook for the future remains positive.

Closing Thoughts

Impact investing provides a fresh perspective towards investing, by shifting our focus from purely financial returns to creating social and environmental impact, on top of returns.

Considering the growth and potential of the industry, I believe that impact investing is an area that all of us can explore and incorporate in our investment strategy.

Comments

231

0

ABOUT ME

Sebastian Png

03 Jan 2021

Seedly Student Ambassador 2020/21 at Seedly

231

0

Advertisement

No comments yet.

Be the first to share your thoughts!