Advertisement

OPINIONS

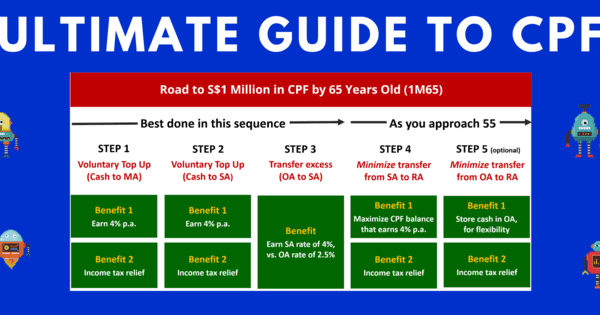

The Ultimate Guide to CPF: 5 Ways to Optimize & Become a CPF Millionaire (1M65)

A compilation of all the CPF hacks you need to meet your CPF millionaire aspirations.

This article originated from The InvestQuest.

For real-time updates, do join their:

Telegram Group: The InvestQuest

Whatsapp Broadcast: Just send “Hello IQ” to 8840 2520

Summary

Introduction to CPF

Step 1: Voluntary Medisave Account Cash Top Up

Step 2: Voluntary Special Account Cash Top Up

Step 3: Transfer excess OA balance into SA

Step 4: Minimize transfer from SA to RA

Step 5: Minimize transfer from OA to RA (Optional)

Introduction to CPF

What is CPF?

I used to think that CPF was a no brainer. Simply contribute to it as per the rules and I’d be assured of a retirement nest egg.

CPF can be pretty simple. After all, I managed to fit most of the important information of the CPF scheme in the image below.

However, when I read up on 4M65 (the goal of achieving S$4m in total CPF balances by age 65, as a married couple), I knew that sticking to the rules blindly was not going me there.

When you turn 55, you’ll have four CPF accounts:

The Retirement Account will be funded first by what’s in your Special Account, and subsequently by what’s in your Ordinary Account. This is until the pre-determined “Full Retirement Sum (FRS)” has been hit.

Importance of Optimizing Your CPF

Here’s a simple example on the importance of optimizing. Let’s say you and your spouse are keen to reach S$1m in your CPF by 65 years of age (1M65). Both of you have stopped working (so no more CPF contributions). You’re 30 and so have 35 years to go. To reach 1M65 on 2.5% yearly compounded interest, you’d need to have S$421K right now. But if you can get a 4% yearly compounded interest, you’d need a much more manageable S$253K. (Just an example! Not asking you to stop work!)

In short, it’s key to earn the highest interest rate possible.

5 Ways to Optimize Your CPF

This article details 5 ways to optimize your CPF and help with your journey to 1M65 (or 4M65 for some). These five steps are summarized in the below image, with the accompanying rationale.

It’s best to follow the below sequence (Step 1 to Step 5) because of various rules and limits of the different accounts.

Step 1: Voluntary MediSave Account (MA) Top Up

What is CPF MediSave Account (MA)?

MediSave is a national savings scheme which can be used for medical-related expenses such as:

Hospitalisations, surgeries and maternity expenses

Outpatient treatments like dialysis, chemotherapy, radiotherapy, diabetes and hypertension.

Premiums of approved medical insurance schemes like MediShield Life, Integrated Shield Plan and Eldershield.

For the full list of what MediSave can be used for and corresponding withdrawal limits, see this Ministry of Health website.

MediSave Account Key Terms

Base Interest Rate: 4% p.a.

Maximum Account Limit: Prevailing year’s Basic Healthcare Sum (BHS), which is S$60k for 2020. The BHS is adjusted higher on a yearly basis to account for increasing life expectancy and healthcare costs. The BHS remains fixed for the rest of your life, once you turn 65 (click here to see the BHS for the various years).

What happens if your CPF MA reaches the BHS? Further contributions to your MA and interest earned in your MA will then be redirected to:

Special Account (if you are below 55 years old) / Retirement Account (if you are 55 years and over), if you have not hit the prevailing FRS

Ordinary Account, if you have hit the prevailing FRS

Click here to see the FRS for the various calendar years.

Benefits of MediSave Account Top Up

If you have not yet hit the BHS, doing a voluntary cash top up to your MediSave Account provides two benefits:

Benefit 1: Enjoy a risk-free 4% p.a. interest rate on your MA savings

Benefit 2: Income tax relief at your marginal tax rate (see below table)

Do note that for the income tax relief, your chargeable income is reduced by the amount you topped up. For instance, if you earned S$60K a year and you topped up S$5K, your tax savings will be equal S$5K x 7%.

Maximum Limit for MediSave Account Top Up

The maximum top up you can make into your MA (in a calendar year) is the lower of the following two:

Buffer to maximum size of MA. Calculate using the prevailing year’s Basic Healthcare Sum (BHS), minus the MediSave Account balance before the top up

Buffer to the CPF Annual Contribution Limit of S$37,740. Calculate this using S$37,740 minus mandatory CPF contributions made during the calendar year. See this link for the CPF Annual Limit.

Calculating the above can be a chore, so it’s great that CPF already does this for you automatically (see the 4th and 5th screenshots below). Do note that the “Allowable Contribution” figure provided by CPF does not factor in further CPF contributions received before year end, and any subsequent breach of the BHS cap (point 1 above) or CPF Annual Contribution Limit (point 2 above) will result in a refund of the excess without interest.

Steps & Screenshots for MediSave Top Up

For readers keen to execute voluntary MA cash top ups, we have made screenshots of the process:

When you log into the CPF website, click “My Requests” on the left side of the CPF homepage

Click “Building Up My / My Recipient’s CPF savings”, which expands the page

Click “Contribute to my Medisave Account via PayNow QR or eNETs” (red box in 1st image below)

The process is pretty much self-explanatory after that

The InvestQuest View: As a young adult, voluntary cash top ups to the MA are what I would prioritize, as the MA balance can be used more flexibly as compared to SA.

Step 2: Voluntary Special Account (SA) Top Up

What is the CPF Special Account (SA)?

The CPF SA is an account that is meant for retirement-related savings and investments. Apart from the first S$40k balance, the remaining SA balance can be used for eligible investment products under the CPF Investment Scheme (CPFIS). Click this link for the full list of eligible products.

When an individual reaches 55 years old, the SA cash balance (followed by the OA cash balance, if the SA cash balance is insufficient) will be used to fund the Retirement Account (RA), up to the FRS amount.

Special Account Key Terms

Base Interest Rate: 4% p.a.

No Maximum Account Limit. However, there is a cap on how much you can transfer to your SA via “voluntary cash top-ups” and “OA-to-SA transfers”.

Maximum Limit for Special Account Top Up

Again, SA does not have an account limit.

But there is a limit to:

voluntary cash top-ups to SA

transfers from OA to SA

The cap on SA top-up/transfers is up to the point where:

your total SA balance reaches the prevailing Full Retirement Sum (FRS)

net of any SA balance withdrawals made to invest through the CPF Investment Scheme (CPFIS).

Full Retirement Sum (FRS)

- The FRS is S$181k for 2020. The FRS is adjusted higher on a yearly basis to account for long-term inflation and improvements in standard of living (click here to see the FRS for the various calendar years)

Benefits of Special Account Top Up

If you are under 55 years old and have not yet hit the FRS, doing a voluntary cash top up to your CPF SA provides two benefits:

Benefit 1: Enjoy a risk-free 4% p.a. interest rate on SA savings

Benefit 2: Income tax relief at your marginal tax rate (see below table), capped at S$7k per calendar year

Steps & Screenshots of Special Account Top Up

We have made screenshots of the first two steps of the voluntary SA cash top up process below for your reference.

Click “My Requests” on the left side of your CPF homepage

Click “Building Up My / My Recipient’s CPF savings”, which expands the page

Click “Contribute to my / my recipient’s Special Account via PayNow QR or eNETS”

The process is pretty much self-explanatory after that

The InvestQuest View: It is best to execute CPF cash top ups to your SA/MA accounts at the start of the year, to fully benefit from the entire year’s compounded interest.

Step 3: Transfer excess balance from Ordinary Account (OA) into Special Account (SA)

What is the CPF Ordinary Account (OA)?

CPF Ordinary Account (OA) is meant for Housing, Insurance and Investment purposes.

Cash balance in the OA yields 2.5% p.a. interest rate (versus 4% p.a. for SA, MA and RA accounts), so it can make sense to transfer your OA cash balance over to your SA account to earn the additional 1.5% p.a. interest rate.

Do note that you may transfer OA savings to SA, if you are under 55 years old and have less than the prevailing FRS in your SA balance (net of any SA savings withdrawn for CPFIS-SA investments). See this link for details.

What to Consider before you transfer from Ordinary Account to Special Account

Transfers from your OA to SA are irreversible, so before you go ahead transferring your entire OA balance, do have a think about the below two considerations first.

Firstly, do you have plans to utilize your OA balance?

CPF OA is relatively flexible in terms of what it can be used for. Many Singaporeans use it to finance their home purchase.

In our view, leaving some cash in your OA is prudent, as it can be used as a last resort to service a mortgage if you happen to be retrenched or face a situation where you are cash-strapped.

Secondly, is your SA balance nearing the FRS?

If it is, you might want to avoid transferring more OA funds into SA.

In Step 2 of this Article, we mentioned that voluntary cash top ups to your SA allows you to benefit from income tax reliefs, if your SA balance is below the FRS. If you execute an OA to SA transfer, you may have less headroom in your SA to benefit from this tax saving.

Steps & Screenshots for transferring from Ordinary Account to Special Account

We have made a screenshot of how to execute a OA to SA transfer below for your reference.

Click “My Requests” on the left side of your CPF homepage

Click “Building Up My / My Recipient’s CPF savings”, which expands the page

Click “Transfer from my Ordinary Account to my Special Account” (red box in 1st image below)

The process is pretty much self-explanatory after that

The InvestQuest View: We see the transfer of excess OA savings to SA most appropriate for individuals who have already settled their housing commitments and whose SA balance is still significantly below the 2021 FRS amount of $186k.

Step 4: Special Account (SA) Shielding

What happens when you reach 55?

When you reach 55 years old, your CPF SA cash balance (followed by the OA cash balance, if the SA cash balance is insufficient) will be used to fund your newly created Retirement Account (RA), up to the FRS amount.

Recall the base interest rates of the four different CPF accounts:

OA: 2.5% p.a.

SA: 4% p.a.

MA: 4% p.a.

RA: 4% p.a

What should you aim for?

As much as possible, you will want to have the highest possible cumulative balance in your SA, MA and RA to earn the higher 4% interest rate.

What’s the issue?

The issue is that the RA account is funded by your SA cash balance first, before your lower yielding OA cash balance is touched.

Special Account Shielding (taking steps to minimize transfer from SA to RA)

Here, we will share with you what some savvy individuals have done, such that a significant balance is retained in their SA, even after the RA is created. This concept is known as SA shielding.

For your SA, apart from the first S$40k balance, the remaining balance can be used for eligible investment products under the CPF Investment Scheme (CPFIS). So what happens if you invested in an investment product using your SA just before you turned 55, leaving just S$40k cash balance in the SA account?

Assuming that the FRS is S$186k (for 2021), S$40k from your SA and S$146k from your OA will be channeled to your RA when you reach 55 years old.

You can then sell the investment product purchased using your SA, and the sales proceeds will land back into your SA account, earning you a cool 4% p.a. interest.

As the intention is to find a short-term place to park your SA balance, many have suggested using a low-risk investment vehicle for SA shielding purposes.

Lowest Risk Mutual Funds offered by CPFIS

There are 15 unit trusts that are classified as low-to-medium risk on CPFIS that are eligible for purchase using SA savings (see full list here). We have included the investment details of these funds in the table below, sorted in ascending order of its NAV volatility over the past 1 year.

The InvestQuest View: In our view, Nikko AM Shenton Short Term Bond Fund seems to be an appropriate vehicle with a combination of high credit quality (A- average credit rating) with low portfolio duration (1.3 years).

Source: Bloomberg, retrieved 16 December 2020. Fund portfolio details are as of Oct/Nov 2020 factsheets.

Income Tax Relief for voluntary cash top-ups to RA

Similar to voluntary SA cash top-ups (mentioned earlier in Step 2), you can also enjoy up to S$7k of annual income tax relief for voluntary cash top-ups to your RA, as long as your RA is below the Full Retirement Sum (FRS). See this CPF link for details on the Retirement Sum Topping-Up Scheme (RSTU).

The main difference between SA and RA voluntary cash top-ups is that the former can be done only if you are below 55 years old, while the latter can be done only if you are 55 years or above.

Income tax relief for voluntary RA cash top-up is not exclusive for individuals who have executed SA shielding. However, there is a higher probability that the RA balance for these individuals will be below the prevailing FRS, as a portion of the SA balance had been shielded from being transferred to the RA earlier.

Step 5: Ordinary Account (OA) Shielding

Why would you want to shield your OA?

In Step 4, we explained that SA shielding is meant to maximize the CPF balance held within your SA / RA / MA (i.e. transferring as much as possible from your OA to your RA when it is first created).

So, it might seem counterintuitive why someone might want to shield the lower-yielding OA from automatically funding the RA account when he/she turns 55 years old.

There are two main reasons for this:

OA can be used more flexibly than your RA, such as for property purchases.

Income Tax Relief. If your RA account has not hit the FRS amount, voluntary cash top ups to your RA will let you enjoy an income tax relief for the cash top up amount (capped at S$7k per calendar year).

Steps for Ordinary Account Shielding

To execute OA shielding, you must already have done the SA shielding (mentioned in Step 4).

For your OA, apart from the first S$20k balance, the remaining balance can be used to purchase a low-risk unit trust, similar to what was done using your SA cash balance

Assuming that the FRS is S$186k (for 2021), S$40k from your SA and S$20k from your OA will be channeled to your RA when you reach 55 years old.

You can then sell the low-risk unit trust purchased using your OA, and the sales proceeds will land back into your OA account.

If you decide that you want to earn the higher interest rate from RA subsequently, you still have the flexibility to transfer OA balances into your RA (see link for details). This is so long as you are above 55 years old and have less than the Enhanced Retirement Sum (ERS) in your RA.

The InvestQuest View: OA shielding is most appropriate for individuals who are keen to execute voluntary cash top ups to their RA for tax relief purposes, and who prefer to have more flexibility in using their CPF balances.

Comments

10806

15

ABOUT ME

Level up your investment knowledge with us!

10806

15

Advertisement

No comments yet.

Be the first to share your thoughts!