Advertisement

OPINIONS

The True Reason to Choose Term Life Insurance Over Whole Life

Focus on the main reason you buy insurance. Let that guide your decision making.

Ng Lip Hong Kyith

19 Feb 2021

Chief Editor at Investment Moats

The reason why we chose term life insurance over whole life insurance is to be adequately insured.

Many people chip in on the topic of why buying term life insurance is better than whole life insurance. Many explained that

Term life insurance is cheaper

You should separate investing from insurance

Investing via whole life insurance might not give an as good return compared to investing in specialized investment instruments

I think these are good points but I think it may confuse us, and lead us away from the main point why we should choose term life insurance over whole life insurance.

A Brief Summary of the Difference between Term Insurance and Whole Life Insurance

Before we go into our discussion, I need to briefly explain the difference between term and whole life insurance because I realize there are people new to this insurance stuff.

Term insurance is insurance protection that you purchase for a fixed term. This term could be 5-years, 10-years, 25-years or up to 99 years. The insurance companies allow you to specify the duration of the term within what they allow.

When you purchase term insurance, you are covering to hedge a specific health risk. For example, you purchase a $1 mil term life insurance that covers you until 70 years old. The health risk is that if you passed away prematurely, your dependents such as your wife and children can depend on the insurance money and faced less financial hardship due to your death.

Term insurance does not have a residual cash value. This means that if you surrender after X number of years, there will not be a sum of money you can take back.

There is term insurance that covers home, life, critical illness, early critical illness, disability.

The premium terms can be increasing over time, decreasing over time, flat throughout the duration (level term). Some policies have flat premium but the plan is renewable over x number of years, then after that the premium changes.

In contrast, whole life insurance, as the name suggests is an insurance that covers you for your whole life. Remember: The objective is to cover you for the whole life. While the name states whole life, certain whole life policies cover till an arbitrary 120 years old.

The main whole life plan covers as life insurance and you can attach riders that cover disability, critical illness, TPD, waivers to it.

You can choose to pay premiums for the whole life (e.g. from 25 to 99 years old), or you can choose a limited premium payment terms (pay for 10, 15,20, 25 years and then you do not have to pay anymore. The shorter the period, the heftier the premiums per year)

There is a cash value to whole life insurance.

When you pay the premiums, the premiums are contributed to an investment fund called a participating fund. The participating fund is managed by the insurance company, usually in a conservative way.

The value of your whole life depends on the performance of the participating fund.

Why Do You Buy Insurance?

The reason you buy insurance is to hedge a health risk. There are a lot of different kind of health risk such as risk of hospitalization, cancer risk, organ failure, banged your head against the wall, suffering from vertigo so that you are unable to work.

Your health may suffer in the short run or long run, or you may passed away immediately.

Usually, there is a monetary cost to this risk.

If you buy insurance, you hope the payout will alleviate potentially large financial costs.

The most prevalent health risk that you would want to alleviate is pre-mature death.

If a person passes away prematurely, his or her dependents would have to bear the financial burden of:

Making up the annual cash inflow so that they can still spend annually

Service outstanding loans that your family owe to others (mortgage, vehicle, personal loans)

We will usually buy life insurance to hedge this risk.

There are two options: Buy term life insurance or Buy whole life insurance.

Technically, there is a third option which is to buy a mixture of both (but we shall only go through this later)

How Much Insurance Should We Buy to Ensure We are Sufficiently Covered?

Let us illustrate this with a case study.

Suppose we have someone similar to Kyith.

Let us call him John. John is 41 years old on his next birthday. John is a non-smoker and he makes $40,000 a year. John has a wife and a nearly-born baby boy.

If John passes away pre-maturely, his wife and baby boy will suffer to some degree.

While his wife is working, she will lose his income, which goes towards paying for expenses and saving for their retirement.

This will also place additional stress on his wife. Without his income there will also be doubts in his wife’s head how she can manage life while working and taking care of an infant.

The sensible way to show love and responsibility is for John to purchase a life insurance that adequately covers his income and part of any outstanding debt.

Let us assume that the family do not have any outstanding debt. This means we do not need to set aside a sum of money in our insurance protection planning to pay off the debt.

A sensible amount of protection John needs to cover is an equivalent of 25 times his current income.

If John passes away at any point within these 25 years, his wife will have a sum equivalent to 25 years of income to cover his share of future household expenses. At least his son and wife do not have to be so stressed over this.

25 years is a good estimation untill his son becomes less dependent on his wife. By then, his son should be productive and be able to contribute income to the household.

In this way, we are balancing the cost of insurance with some rationality.

This means that John needs a life insurance coverage of 25 x $40,000 = $1 million.

If your income is higher, you will need higher coverage. If your dependents are estimated to be less dependent earlier, reduce the number 25.

This rule-of-thumb is not rocket science. If you use MoneyOwl’s Insurance Protection Guided Tour, the guided tour will give you roughly the same conclusion.

Note: If you wish to factor in the inflation of income, the coverage amount may be larger. Sticking with the same example, John will need $1.46 million based on 3% a year inflation rate.

Should John Cover the $1 million Insurance Protection Need with Term Life or Whole Life Insurance?

John has two main ways to obtain a $1 million coverage: buy a term life insurance that covers for at least 25 years or buy a whole life insurance.

For whole life insurance, John can buy a 10-year, 15-year, 20-year limited paying term. Once he finishes paying the premium, he will own the policy for life.

If John chooses the term option, he would try to cover his life till age 70. John chooses to be conservative, shooting past the age 66, where his son will become economically productive.

If John chooses the whole life, he can choose to pay a limited term and be covered for life.

The whole life option looks good because the plan covers $1 million for his whole life. However, the cost of insurance increases from 65 to 70 years old. After that period, the probability of death increases as we age. Since the probability is higher, the cost of insurance naturally factors in this higher probability.

The Difference in Premium Paid Between the Term and Whole Life Option

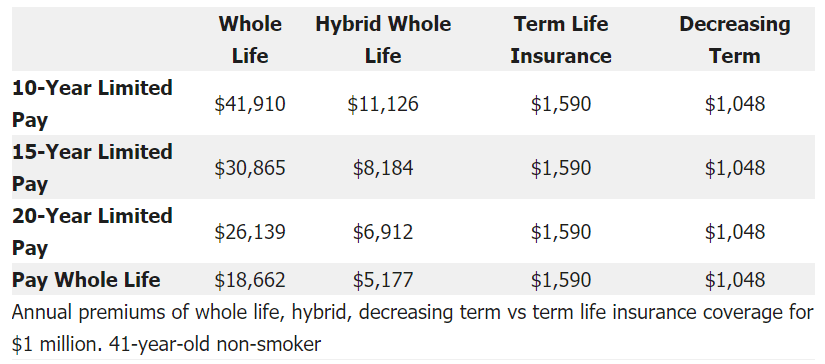

I manage to generate the premiums for a 41-year old non-smoker for both term and whole life of different duration with an insurer.

They have both whole life and term life insurance.

For clarity, I eliminated any riders such as critical illness, early critical illness but include only the TPD rider. I believe we should address each insurance risk independently, and not keep mixing up these stuff into one rojak.

I manage to generate the limited payment for the whole life policy in 10, 15, 20 and 99 years.

Here are the annual premium comparison for $1 million in coverage:

The annual premium difference looks horrendous for the whole life policy.

However, there is a reason. For the whole life, you are insuring from 41-years-old to 99-years-old. This is a longer duration of assurance than the term, which is limited to 70-years-old. The cost of insurance is far more expensive to assure the period after 70 years old.

John Will Spend A Large Proportion of His Pay On Insurance Protection

A part of John’s paycheck will be spent on paying the premiums so that he remains covered.

How much would John be spending on insurance with the two option?

To get an adequate amount of coverage, John has to spend almost half his salary on insurance coverage. The 10-year limited pay is totally not an option because it is more than his pay!

These are mandatory payments that John have to make. If John does not make it over time, he will lose the coverage.

John will wonder how he is going to spend on his family expenses and save for his other financial goals if 47% to 104% of his paycheck is spent on his insurance coverage.

The term option will cost John less than 4% of his annual paycheck. This will leave a lot of cash inflow to spend on his expenses and save for retirement.

And remember: John needs more than a life insurance coverage, he would still need to cover for disability income, critical illness.

If John opts for the same option as the life insurance, he may end up spending a large majority of his paycheck on insurance.

Focus! Your Priority is to Be Adequately Covered for a Specific Duration

Some may comment: Kyith this is an unfair comparison, we should respect the other virtues of the whole life insurance.

I think too many a times, we spend time arguing about other aspect of the term versus whole life comparison that it takes the reader’s attention away from what they are buying insurance for.

John’s primary focus is to ensure that should be passed away prematurely, his family have adequate coverage for the duration he needs.

He has to balance this with his current spending goals and future spending goals.

If he spends so much on insurance, then he has less for his current spending goals and future financial goals.

The rest of the considerations are less important.

If we are focused on this, let us compute the cost of insurance to get that coverage, at least till John is 66-years-old:

Whichever whole life option is chosen, John would have spent 12 times more on insurance coverage until his son is economically productive.

Would Hybrid Whole Life Insurance Address the Problem with Whole Life Insurance?

In recent years, a new kind of whole life insurance started to become more popular.

These hybrid policy are a cross between whole life and term life insurance.

Typically, these plan provide a multiplier of an original coverage at a cheaper premium.

For example, if John would like a $1 million coverage up to age 70 years old, he can opt for a base coverage of $200,000 with a 5 times multiplier.

With a 5 times multiplier, John can effectively cover the $1 million needed up till age 66.

How does the premium look?

The premiums rest between the whole life and term life insurance.

What about the percentage of paycheck spent on insurance coverage?

With the hybrid whole life, John could spend a smaller part of his paycheck on insurance.

In my opinion, the hybrid whole life policy is an admission by the insurance companies on the failure of whole life to provide adequate coverage.

If whole life is effective in addressing our coverage adequately, hybrid whole life policies should not exist at all!

If hybrid is cheaper, should you get this middle ground plan?

I would urge you to ask yourself what is the reason for getting the insurance coverage. If it is for protection… then why do you pay more when you have a perfect option to pay less?

How Much Does Term to 99-years-old Cost in Premium Terms?

The objective for insurance here is to hedge the risk of pre-mature death, during the period where you really need it.

I don’t think a lot of people need it till 99 years but some of you might be interested to know that there are term life insurance that covers until 99 years old.

The premiums are not cheap because the probability of death goes up as you age and so does the premiums.

But here are the comparison:

This term will cover John for about 60 years. Notice that the premiums are not too far off from the premiums for Hybrid Whole Life if you pay till age 99.

After 70 years old, your hybrid whole life will have $250,000 and more in cash value, but the coverage from 70 till potentially 99 years old will be less than the term till 99 plan.

If John passes away at age 75, he will get more money from the term till 99 plan than the hybrid.

So you really need to know what you want.

From what understand, currently NTUC, Prudential and AIA have term till 99 years old. I struggle to find any from the rest of the insurer.

What If Your Coverage Needs Increase?

John may start off needing $1 million in coverage but over time, his dependents increase, so does his salary.

If John choose the whole life option, and when his coverage needs approach $1.5 million, he will need to increase his hefty insurance premiums to be adequately covered.

The whole life option would mean he needs to increase the premiums by 23% to 50% of his old paycheck (since he needs to increase his coverage by $500,000).

With the term option, he would just need to increase the premiums on life insurance by 2%.

What if Your Coverage Needs are Reduced?

At some point, John may not need that $1 million coverage.

If he survives for 15 years, if he passes away pre-maturely, his dependents may only need 10 years x his annual salary.

It would be challenging with the whole life option to cancel some of the coverage when you do not need the coverage. The whole life insurance is meant to cover you… for the whole life.

Technically, it can be done. You could staggered your whole life insurance purchase just like term life insurance.

However, term life insurance has more flexibility in this kind of execution. You could purchase 5 x $200,000 in coverage. Your premiums might be slightly less optimized (the per dollar value of a $1 mil term plan is cheaper than a $500k term plan) but you could structure it in a way that you can cancel some of the term coverage when you do not need.

There is also a kind of term life insurance call decreasing-term life insurance or mortgage insurance that blends this decreasing coverage well.

John could purchase a $1 million decreasing term at age 41. As the years passed, the coverage is reduced as your needs get lesser.

Decreasing term is cheaper than the normal term but the gap has narrowed.

I have updated the table to reflect the annual premiums of a decreasing term:

What If We Treat the Cash-Value Build Up by the Whole Life Policy as an Investment?

I would like to remind you that we are getting to a less important consideration of the discussion.

The objective is always… get adequate coverage for the duration you need. The rest is less important.

Whole life insurance is often sold fo it’s flexibility both as a savings tool and protection tool.

My opinion: When you choose to purchase a whole life policy, your intention is to have adequate coverage for your entire life.

Strictly speaking, you cannot surrender that cash value or get income out of those whole life plan even though you have the option.

If you do that, you risk not having enough money for your dependents at any point of your life.

Why do you need to cover life insurance for your entire life, even when you do not have dependents after age 70?

I think you have to answer that question yourself. I have no answer for you because there are not a lot of reasons.

If you wish to have a standalone whole life plan that covers alternative treatment for critical illness after age 70, I can understand that. However, if it is to cover when there are no dependents? I have no idea.

Perhaps for estate tax planning if you have financial investments in places where your heir might need to pay high estate taxes. (read 4 Potential Ways to Estate Tax-Proof Your Investments)

For some, your plan is for the cash value to contribute to your retirement fund after age 70.

I think you have to ask yourself if you would be happy that your retirement fund grows at a less than optimized rate of return.

The typical participating fund behind these whole life policies are a 70/60% bonds, 30/40% equity portfolio.

The portfolio is lower in aggressiveness. For those with longer time horizon, and have higher ability and willingness to take the risk, a more well-optimized approach would be to invest independently in higher equity and lower bond allocation.

Your returns potential is higher due to the greater risk is taken and absence of exorbitant insurance commissions.

Lack of investing competency should not be used as an excuse to prefer investing in a whole life over a more optimized investment approach.

Why?

If you do not invest in independent unit trusts or ETF portfolios, your alternative is to buy a whole life policy from some adviser.

The adviser should be competent in advising you on the investment solutions suitable to you.

If the adviser is not competent enough to advise investment solutions for you, then why did you choose that less-than-competent adviser in the first place?

Many Singaporeans do not have Adequate Insurance Coverage

We have seen enough survey that keeps emphasizing that Singaporeans are not adequately covered.

What is the reason?

I think is a combination of the following:

Each of us has a limited surplus from our work income that we need to spend, save for financial goals

Product recommendation is carried out not based on what is the most valuable solution, but based on how much you have. If you let them know you have $25,000 a year for your financial goals, the economic bias will likely lead your adviser to recommend products that take up all of these $25,000.

#2 will lead to more recommendation of whole life or hybrid plans because they meet the sales target of the advisers.

If you only have $10,000 a year, the likely recommendation would be a 15-year or 20-year hybrid plan. Does this cover your needs? Yes.

However, is there a more cost-effective option that is closer to $1,590 a year? Yes.

Why isn’t this recommended? There can be a whole lot of reasons for that.

Last Words

If you do not know what you want well, you will be lead by consultants all over the shop.

I learn that during my IT hey days. When it comes to sales, sometimes there aren’t alot of difference between the two industry.

The difference is that my user may have more money to burn than me if I make the wrong decision.

You may often find it hard to make a decision between term and whole life for your insurance coverage needs.

I would suggest you start by thinking about what you wish to achieve and let that guide you.

If you are looking for adequate coverage at the lowest cost, let that drive your decision.

By day, Kyith works as Senior Solutions Specialist at Providend.com, Singapore's Fee-only Wealth Advisory Firm. By night, Kyith writes at Investmentmoats.com

Comments

4892

3

ABOUT ME

Ng Lip Hong Kyith

19 Feb 2021

Chief Editor at Investment Moats

Once an engineer. Once educated in Singapore. Currently Financially Independent. Now working in a Fee-only firm.

4892

3

Advertisement

No comments yet.

Be the first to share your thoughts!