Advertisement

OPINIONS

Syfe VS Autowealth: Which Robo Is Better?

Just which one to choose? Returns? Capital? Ease of use? Here's a deep dive comparison between 2 popular Robo Advisors.

Lin Yun Heng

02 Jan 2021

Senior Analyst at Delphi

This article originated from my blog: Investing Beanstock

Join My Tele Channel Here For Updates!

With the rising popularity of Robo-Advisors due to their efficient approach and simplifying the barriers to entry for a retail investor. Gone are the days where you have to research on your own stocks or ETFs, the painstaking process of opening a brokerage account, and to try and “time” the market and disappoint yourself.

With Robo-Advisors, you no longer need to worry about having to time the perfect market entry (to go in at a good price), but instead let the Robo-Advisor automate this process for you, allowing even the most clueless and lazy individuals to become invested.

Their purpose is very similar to that of a human financial advisor but each Robo Advisor have their own specialties and approach for different investment needs in the market.

Without sounding too naggy, let us get to it and analyse these 2 Robo Advisors and which one may be best for your long term investing needs. Oh, and for those looking for a comparison between Syfe vs Stashaway, you can read this post here!

Background

Between the 2 Robos compared today, Autowealth has been around since 2017 while Syfe is a newcomer who launched their first portfolio in 2019. Despite being a newcomer, Syfe has been rolling out popular portfolios such as the REIT+ and the Equity100 for investors who want an SG-based Income Portfolio which is currently a first in the market as well as a 100% equities portfolio for investors seeking aggressive growth looking for the highest risk-adjusted return in the long run. Also new is a cash management portfolio with 1.75% yield coming our way in 2021.

Syfe has a total of 4 portfolios to date and are as follows:

Syfe Global ARI (Automated Risk Management)

Syfe REIT+ (100% S-REITs/S-REITs with Bonds)

Syfe Equity100 (100% equities) -My Pick

Syfe Cash+ (Cash Management 1.75% Yield)

Autowealth has a total of 4 different portfolios which ranges from Risk Level 1-4.

Risk Level 1 : Preservation (20% equities / 80% bonds)

Risk Level 2 : Conservative (40% equities / 60% bonds)

Risk Level 3 : Balanced (60% equities / 40% bonds)

Risk Level 4 : Long-term Growth (80% equities / 20% bonds)

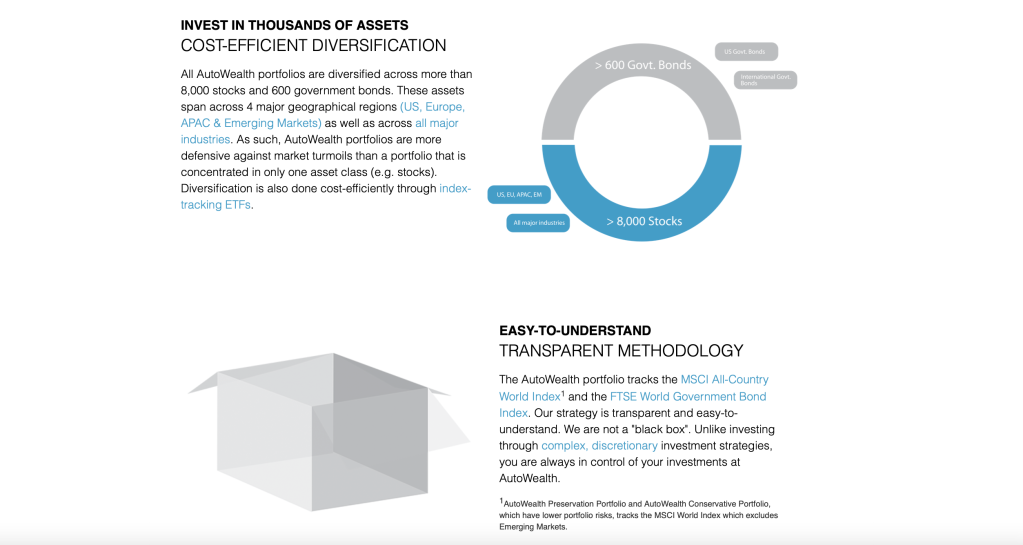

In each Autowealth portfolio, the ETFs used are:

Equities track : MSCI All-Country World Index ETF

Bonds track : FTSE World Government Bond Index ETF

Take note: Preservation and Conservative Profiles have lower portfolio risks, hence they track the MSCI World Index instead which excludes Emerging Markets.

TL;DR

Syfe Promo Code

For people who are interested to invest into Syfe and wants to open an account, you can use the promo code below as a bonus 🙂

Promo Code: SRPTH8LK3

$10 bonus for the first deposit of $500 (or more)!

$50 bonus for the first deposit of $10,000 (or more)!

$100 bonus for the first deposit to $20,000 (or more)!

Note: Bonus is applicable on the first deposit made only. The bonus will be automatically credited to your portfolio and invested along with your existing investments.

We will be comparing the Robos based on 2 factors:

Fees

Performance

1. Fees

When it comes to investing, the amount of fees you pay as a percentage of your investment is really substantial in the long run. 2% of 100k is $2000 and 0.5% of 100k is $500. Are fees significant? Yes. They play a huge role when it comes to overall returns of a portfolio in the long run. Since the fees are recurring, as your capital compounds, so does fees. Therefore, the lower the fees, the better!

So what are the fees structure when it comes to Syfe and Autowealth?

Autowealth

Autowealth has a simple fee structure where you basically pay 0.5% of whatever amount you invested and an additional 18 USD (24 SGD) for platform fees every year.

AutoWealth has a personal financial advisor or wealth manager that is assigned to each client. They call this the hybrid approach where you will meet the financial advisor before you open your account and start investing.

To put things into perspective, if you invest a total of $5000, you will be paying a total of $25 (0.05% fees) + 24 SGD (18 USD fee) making it a total of $49 paid to Autowealth in Fees.

If you put it in % terms, you are paying 0.98% in fees for your $5000 investment even before talking about any potential gain or loss on your investments.

We will get to this later and see how much invested capital will make this a better choice.

Syfe

When it comes to Syfe, it is obvious that they are more beginner friendly with a straightforward pricing structure: Anything from $1 to $19,999 will be 0.65% and above 20k will be 0.5% and 0.4% for 100k and above investments.

Autowealth and Syfe Fees Head to Head

Compare Syfe’s fees directly to Autowealth, if you invest a total of $5000, you will be paying a total of $32.50 in fees (vs $49 for Autowealth), or 0.65% of your total $5000 investment (vs 0.98% for Autowealth)

If you were to hit 20k investments, you will be paying 0.5% + 18 USD for Autowealth and 0.5% for Syfe, which makes Syfe a more superior option if your capital is between $0 to $20,000+.

The additional 18USD fee from Autowealth is a huge barrier for most investors as it takes up a significant amount in fees. Unless you have 100k or more in capital to invest into Robos, I think the clear winner here is Syfe because you are paying lesser fees on a recurring basis which will become really significant in the long run.

Fees Concluding Statements

In conclusion: If you are an investor in their early 20s with less than 100k capital, you are paying lesser fees yearly if you opt for Syfe since you will be incurring 0.4%-0.65% fees (excluding ETF expense ratio) compared to Autowealth’s 0.5% + 18 USD if you have a small capital.

If you are an investor in their 30s or 40s and beyond and looking for somewhere to invest spare monies of 100k or more, Autowealth may make sense to you since fees will be constant at 0.5% + 18 USD depending on how much capital you have.

Winner: Syfe (Lower fees = Higher Returns)

2. Performance

One of the key reasons why we choose an investment is due to its performance: Is the investment able to generate you the highest risk adjusted returns based on your own risk profile and time horizon? If yes, you found your right fit and can start to decide on what to invest. We shall now dive into the performance of the 2 Robo Advisors and see which one makes more sense based on your own individual risk profile and time horizon.

AutoWealth

As a general rule of thumb, the more equities (stocks) you hold in your portfolio, the more volatile (price fluctuations) your portfolio return is going to be. But do note volatility does not equate to risk.

A common misconception beginner investors make is to think that a volatile instrument is a risky investment, risk can be defined by many different things but the biggest risk to investing is not knowing what you are doing.

Even putting your money in the bank has risk, such as credit risk and inflation risk. So everything in life comes with risks. It’s sad that the only thing certain in life are taxes and death…

Autowealth’s portfolios generally follows a Boglehead Passive Indexing approach by diversifying into asset classes such as Stocks and Bonds and in general these types of portfolio tend to do decently well in any condition.

The only caveat here is that returns will neither be the best nor the worst. You will just enjoy a decent risk-adjusted return with downside risk protection from bonds but when markets go up bonds will be weighing down on your potential gains. (such as the current bull run we are in).

In conclusion, Autowealth’s myriad of portfolios offer a decent risk-adjusted return with downside protection and is matching the returns of the World Stock Market Index.

Your portfolio will not outperform the market, but it will most likely match market returns ranging between 5%-7% annualised. (Personally I feel its too little returns and I’m not amazed by the returns.)

Autowealth’s portfolio is designed for busy professionals wanting a lower cost collective investment scheme as compared to higher fees Unit Trusts. The portfolios itself consist of ETFs only though, so returns generally depend on overall market conditions.

This Robo is recommended for investors with Low/Balanced/Medium-High Risk Profile with a bigger capital (100k recommended), since the targeted group will be investing into the different portfolios with a short, medium and medium-long term time horizon with significant capital amassed already.

Syfe

When it comes to Syfe, Syfe offers 3 different portfolios targeting different types of investors with different risk profile and time horizon. For one, Syfe’s Global ARI is extremely similar to Autowealth’s portfolio with a focus on downside risk management and tilt towards international ETFs. It can be seen in the above backtest done by Syfe which shows that they have the ability to outperform the index they are tracking.

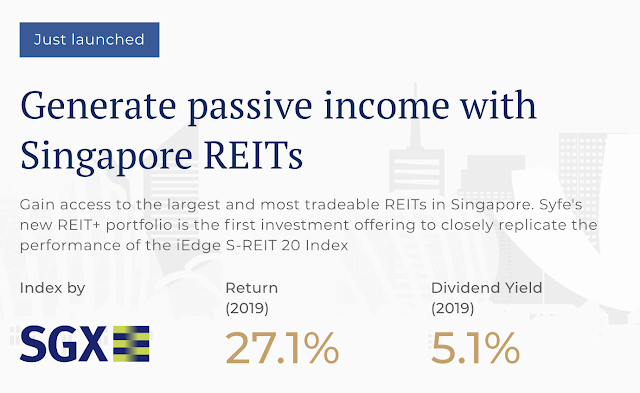

Syfe offers the industry’s first and only SG REIT based portfolio REIT+which was extremely popular among Singaporean investors when it first released. It gave an opportunity to Singaporean retail investors to own the top 20 REITs in Singapore without incurring hefty trading fees and upfront capital if they were to do it themselves.

However, it is still a good way to diversify into the S-REIT market and a good starting Income Portfolio. It generated a return of 27.1% with a dividend yield of 5.1% in 2019. However do note that past return is not a guarantee of future performance so it is still up to you if you choose to invest in this portfolio.

As for Syfe’s newest portfolio Equity100, it changed the entire ball game when it comes to Robo advisory investing: They have opt for a 100% equities (stocks) portfolio targeting investors seeking the most aggressive growth with a long time horizon. This portfolio will outperform any other portfolio offered by Autowealth if you as an investor hold it long enough because equities trend upwards in the long run and absolutely destroy any other asset class over a long time period.

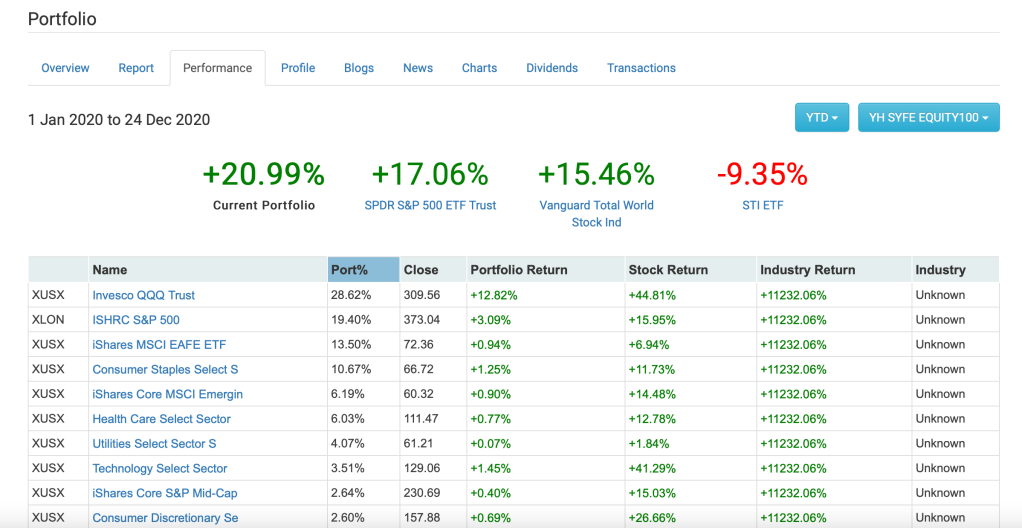

From my StocksCafe Portfolio (Syfe Equity100 Outperforming 3 Indexes)

From my StocksCafe Portfolio (Syfe Equity100 Outperforming 3 Indexes)

Based on my own computation of my Equity100 portfolio, it is significantly outperforming the S&P 500 ETF, VT (World) ETF, and absolutely crushing our local STI ETF Year-To-Date.

Syfe also has a cash management offering called Cash+ coming up which I presume should be competing for a share of the capital protection market, for yield hungry individuals looking for a place to park their funds now that banks are slashing their interest rates. I do foresee many people using this after they max out their 10k in Singlife. With no lock up and withdrawal fees, this offering is extremely competitve and should be popular among fixed deposit holders or people wanting to preserve their capital.

In conclusion: Syfe offers 4 strategic portfolios which caters to different investors or for an investor to craft a powerful Core-Satellite Portfolio to capture higher gains using Equity100 and hedging against downside risk using the Global ARI portfolio as a Core holding. The REIT+ can also compliment the growth segments by providing passive income in the form of dividends while Cash+ can be double as an investing warchest and for capital preservation purposes.

Based on individual risk profile and time horizon, you can then determine which portfolio to choose. As a general rule of thumb, the younger you are the more risk you should be willing to take due to the long time horizon you have ahead. Hence, Equity100 will become part of my long-term portfolio since it will give me the highest risk-adjusted returns in the long run compared to diversified portfolios holding bonds and gold which may weigh down my potential gains in the long run.

Winner: Depends (Syfe if you are able to stay long term with them/Autowealth if you are a busy professional wanting downside risk and average 5%-7% risk-adjusted returns with a medium term time horizon.)

Overall Thoughts

So at the end of the day, which Robo advisor you choose really depends on how much capital you have and what kind of investor you are. If you are currently schooling and only have a couple hundred bucks, or less than $20,000 to invest, Syfe makes the most sense given its lower fees (0.5%-0.65%) compared to Autowealth (0.5% + 18 USD)

Autowealth really only makes sense if you have higher capital to make the 18 USD less significant and even so, if you are happy with 5%-7% and do not wish to find out more on how you can achieve 15% or more return, then go ahead with Autowealth.

Other than fees, an investor can opt for Syfe if you are looking for a 100% equities portfolio through the Equity100 or a 100% S-REITs portfolio through the REIT+. Both of these are unique and the industry’s first, so if you are a young investor that wants to go full equities like me or simply wants to invest in Singapore’s top 20 REITs, Syfe will make the most sense to you.

Likewise, if you are busy professional with little time to care about your finances and investments, wants to have the flexibility in choosing different risk profile while protecting your downside risk, you can opt for Autowealth’s portfolio and customise it whichever way you like and call it a day. Or you can also use a Core-Satellite strategy using Syfe’s Global ARI as a core holding, and then Equity100 and REIT+ as a satellite holding.

This will make sure you have your downsides covered while at the same time enjoying some of the gains from the satellites holding that the Core is not able to attain.

At the end of the day, investing should not be binary and you can opt for both Robos if you want to. You can even use Autowealth’s portfolio as a core holding while Syfe as a satellite holding, it is totally up to you!

All of these comes back to the same questions:

How much capital do you have?

How long is your time horizon?

How much risk are you willing to take?

Are you in a profession whereby there’s simply no time to care about investments?

Once you are able to answer these questions, the right Robo will naturally make sense to you. But the most important thing is to start now and stop procrastinating!

Autowealth Beanstock Rating:

Rating: 3.5 out of 5.⭐⭐⭐⭐

Syfe Beanstock Rating:

Rating: 4.5 out of 5.⭐⭐⭐⭐⭐

Both Robos have an extremely clean UI and easy to understand platform with great customer support. One thing to note though, is that Autowealth only works on the web platform and no mobile apps, in contrast to Syfe which have both web and mobile platform.

You will get a dedicated financial advisor when you first begin with Autowealth, and likewise 1 month access to financial advisors for Blue tier members of Syfe after signing up.

Both are able to bring back decent returns for their investors. The reason Syfe got a higher Beanstock rating is because it ticks more of my personal checklist of investing but that is because my needs and your needs may be different. (And also because Equity100 can deliver returns which I am satisfied with)

Choose the Robo which can offer you the highest risk-adjusted returnsbased on your own risk profile, time horizon and capital available. With the capital you have, choose the one that will incur the least fees because fees will really eat into your returns and will be compounded just like your capital. Hence, the Robo you choose should be in line with all the above criteria and you should always stay invested, so remember to pump in spare cash every now and then.

Thank you for reading! I hope you have more clarity on the similarities and differences between Autowealth and Syfe. Both are excellent Robos which allow investors to diversify into Global ETFs without incurring hefty trading fees and to start. So which one did you choose? Leave your comment down below! Stay safe and stay invested!

Oh and, Syfe Promo Code for those who wanted to scroll back and find it, here it is for your convenience 🙂

Promo Code: SRPTH8LK3

$10 bonus for the first deposit of $500 (or more)!

$50 bonus for the first deposit of $10,000 (or more)!

$100 bonus for the first deposit to $20,000 (or more)!

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. In fact, the content is not directed to any investor or potential investor and may not be used to evaluate or make any investment.

Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stock broker or financial advisor.

If you have made it this far into this post and found it helpful or informative, consider joining my Tele Channel!

Hitting the Like button will help my content to reach out to more people who would benefit from it just like you did!

Comments

1994

0

ABOUT ME

Lin Yun Heng

02 Jan 2021

Senior Analyst at Delphi

Crypto Educator

1994

0

Advertisement

No comments yet.

Be the first to share your thoughts!