Advertisement

OPINIONS

Square: An Unstoppable Giant You Should Not Ignore

Learn more about Square and why you should not overlook this growing giant. It's eating bank's market share like lunch!

Lin Yun Heng

04 Jun 2021

Senior Analyst at Delphi

Growth stocks of all kinds have been pummelled in recent weeks. The media would probably leave you thinking it is due to interest rates, inflation worries, or whatever else is the flavour of the day.

I personally don’t know why growth stocks suddenly fell out of favour among Wall Street, but one thing I do know is that there are bargains to be had if you know where to look.

One such bargain is in payments leader Square.

Square Inc is the epitome of the fintech and crypto world. Square operates the merchant, SME (Small/Medium enterprise) space as well as comprehensive P2P payment, crypto and investing ecosystem integrated by Square’s Cash App.

Even with the expected growth for Cash App and recovery within the Seller side, valuation remains quite high with a fair amount of future earnings growth looking to be priced in by the market, even though revenues could serve as a key driver of share upside. Risks do remain however, regarding Cash App’s revenue generation and other business segments.

In short, Square is a monster growth stock which is seemingly overvalued by traditional metrics and for a very good reason. The stock price has been unstoppable ever since inception.

With a market cap of nearly 100 Billion, Square has grown rapidly into one of the largest companies in the United States, and competing with the largest banks in the world and they are doing very well at winning over customers which will be explained later.

Insane Growth Ahead

Square has grown immensely in recent years. The company has moved into creating a payments ecosystem that helps businesses, no matter the size as well as consumers, storing money, paying for goods and services, receiving payments for goods and services etc.

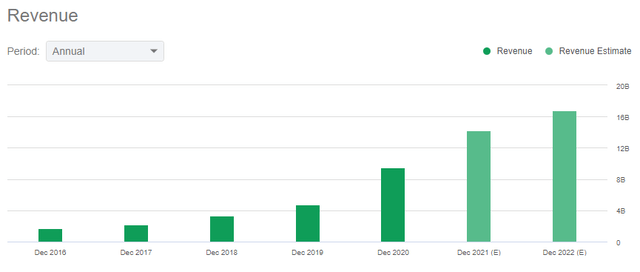

Square’s revenue more than doubled last year as the pandemic took hold and accelerated Square’s adoption among consumers and small businesses in particular. Square is expected to add more than $4 billion in revenue this year and another ~$2.5 billion next year.

Square has thrived because it offers small businesses a full ecosystem of business services such as hosting their website, point of sale software (POS), appointment keeping, and of course, a wide range of payments options.

In an economy where millions of people became unemployed, Square stepped into the void and helped people start a business online with ease.

The gig economy plays right into Square’s hands as people that would have traditionally worked for someone else are working for themselves instead. Square can handle just about anything a person in such a position would need on a turnkey basis, very quickly, and for a reasonable price.

Square’s Business Segments

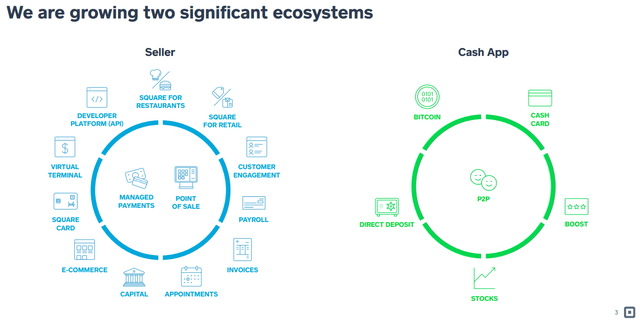

Square is essentially two different businesses operating under the same wing, with one segment which is more mature than the other.

Segment 1: Seller Ecosystem

Square Seller is essentially a one-stop solution for businesses of all sizes, with small businesses likely seeing the highest value proposition from utilising the Square ecosystem.

Square’s seller/merchant segment ended the fiscal year with small gains to revenues, +1.9% y/y, with gross profit +8.4% y/y on low double-digit increases in Q3/Q4 as re-opening measures expanded and restrictions lightened.

What once used to be the key segment, the seller ecosystem saw its contribution of 82% of gross profit generation in FY18 drop to just 55% in FY20 as Cash App grew tremendously on the flip side.

A large majority of Square’s merchants are located in the United States, although international operations are growing, including in Australia, Japan, the UK and Canada.

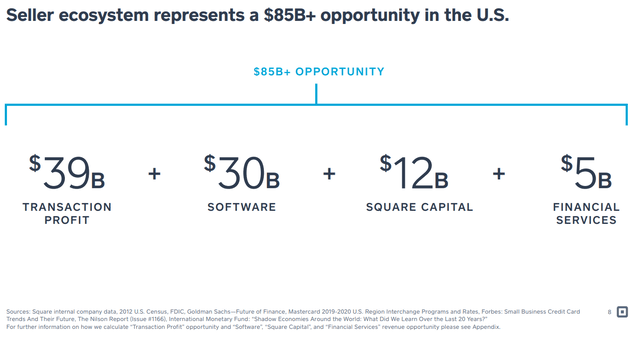

Square believes the Seller business has a total addressable market of $85 billion today, which should only grow over time. As the economy grows, this pot should get bigger and bigger, allowing not only Square to grow but also its competitors. This is the best kind of market to buy into for investors because everyone in the same market can win.

This is not a case of competitors fighting over leftover scraps of a dying market; there is plenty to go around, which greatly increases the chance of growth for individual stocks such as Square.

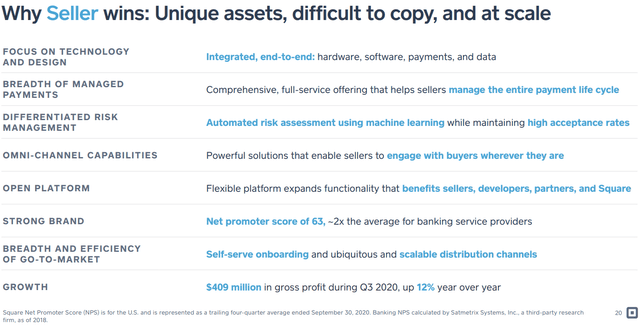

One thing to understand is that Square is not just an app that does one thing; it’s a full service business solutions provider, and as it scales, that will allow further investment in this ecosystem and strengthen its competitive position over time.

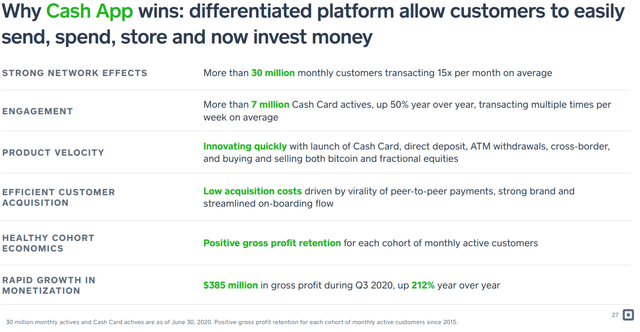

Another important element is the powerful moat of network effects. While competitors can wholesale copy Square’s ideas, they simply do not have the large extensive network of buyers and sellers which Square created to effectively turn the business into a network, and switching cost are extremely high for both merchants and consumers should they make a switch.

Segment 2: Cash App

The other business segment is Cash App, which is an all-in-one financial services solution for consumers. The app allows consumers to store money, pay for goods and services, and invest, all in one place, including Bitcoin, stocks and more.

Like the Seller business, Square didn’t have a novel new idea; rather, it is improving on what already existed and is building it out with scale.

Cash App offers consumers unparalleled convenience in terms of having one place that fits all (or at least most) of their needs and serving the role as a Super App which prevents the consumers from switching services.

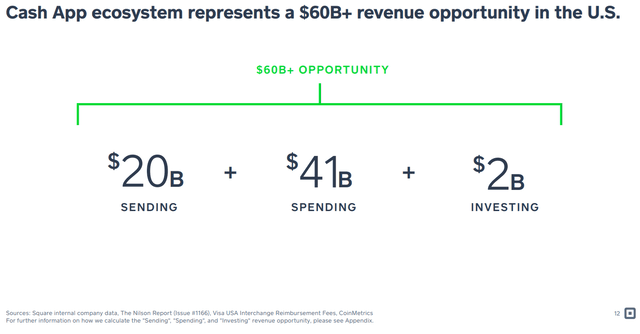

Total addressable market is smaller than the Seller business, which certainly makes sense, but keep in mind that Square is still in the early stages with Cash App. The runway for this business is potentially longer than Seller because it is still in its early stages, and adoption rate is still pretty low.

The good news is that adoption continues to grow at a rapid rate, particularly among younger consumers that are more willing to make digital peer-to-peer payments, or making investing decisions like buying cryptocurrencies.

Square’s profit potential from adding Bitcoin capabilities alone is huge, and with the run-up in the price of the Bitcoin since the start of the year, interest in buying it will only grow in the long term.

Cash App offers fractional shares as well, which is popular among Cash App’s target audience because it allows retail investors to invest smaller amounts of money at a time, lowering the barrier to investing and more masses will be incentivised to invest as a result.

More user growth and more user activity will translate to higher segment revenues (both including/excluding bitcoin). Key tailwinds stemming from strong historic and expected future user growth exist: increased monetisation abilities from multi-function services/increased engagement and Bitcoin-driven revenues.

Square is also slowly chipping off at traditional bank’s market share with more and more users preferring Cash App instead of large traditional banks in the United States.

Square as a ‘crypto exposure’ play

Due to Square’s allocation of its treasury into Bitcoin and generating 48.1% of total revenues to the company at $4.57 billion, Bitcoin has been a primary generator of revenue growth during FY20.

Square has effectively become a crypto ‘play’ for investors who do not wish to directly purchase crypto but have crypto exposure through crypto-related companies.

Shares are a bit more correlated to Bitcoin’s price during 2021. Rising Bitcoin prices can serve as a catalyst for shares due to some correlation of the two as well as revenue growth through Cash App. Likewise, falling Bitcoin prices can serve as a major headwind, again with correlation as well as with lesser revenues and possibly less engagement and multi-function engagement.

Valuation

With an incredible ecosystem of business and consumer solutions for all sorts of financial matters, even despite the competition from large banks and main competitor Venmo (Paypal owned), Square has an unique economic moat in the form of brand name recognition as a leader in the space, particularly for small businesses, and is rapidly gaining adoption among millennials and Generation Z consumers that want convenience for their finances, and don’t care too much about having a physical bank branch nearby. (which are slowly dying off)

The company has been profitable since 2017 on an annual basis, and despite a huge amount of revenue growth last year, profits didn’t grow noticeably. Square invested heavily in growth initiatives last year to take advantage of the economic situation that drove higher adoption rates of its services.

However, given Square is as a growth stock, I’m not bothered with whether it makes $2 per share next year or less, Square should still be valued on aprice to sales basis as they are in the growth stage of the business cycle.

Price/Sales Multiple

Square’s highest valuation was three years ago when it hit a staggering 22X forward sales. Today, shares are going for approximately 7X forward sales, which is well below its long-term average multiple of 10X.

It might be difficult to say a stock with a forward sales multiple of 7X is cheap, but in Square’s case, it seems to be. Investors have proven willing to pay much more for this stock.

Even if it takes some time to get back to a multiple of 10X or more, 7X forward sales is a fair valuation for Square.

For myself, I added more shares of Square during the sell-off and will be happy to add more if the stock price were to coincide with forward sales multiple of less than 7X.

Conclusion

Square’s growth trajectory has been rocketed higher on the backs of Cash App and Bitcoin, primarily, although the Seller ecosystem and PoS re-opening benefit has shone through the second half of 2020, with strong growth rates amid broader economic reopening lightening of restrictions.

Square has the right combination of fintech and crypto to pave the way for significant future revenue growth, and with that, earnings leverage, growing at ~20% and 48% CAGR through 2025 to $24.5 billion and $5.60 in EPS.

While competitive risks are significant for both segments, Square’s multi-faceted ecosystem for Cash App can keep customer retention high. Square has various different outlets for growth and success, although a growth into its current valuation could take some time to pan out, thus, I remain cautiously bullish on the long term potential of Square but will take any opportunity there is to buy the dip if valuations were favourable.

While a 7X forward sales multiple may seem extremely over-valued if you are using mature companies as benchmarks, the valuation in the case for Square is very reasonable given Square is highly sought after by Wall Street.

Square’s steep valuation since the early growth stage had been stable and expected of a growth stock. Don’t expect Square to ever trade at a PE multiple of less than 20 because monstrous growth requires a huge price tag to be rewarded with handsome returns.

What do you think of Square? Do you own SQ in your portfolio? Let me know in the comments below!

Join My Tele Channel Here For Blog Updates And More!

I use StocksCafe to keep track of all my investments + research on stocks. You can also view my portfolio as well as many others so you can compare your own performance with other investors. If you are interested in signing up, you can use my referral link to sign up and access premium features for 1 extra month for new users. (3 months)

The Power of Low Fees

One huge advantage I have as an investor is paying very minute fees which can really eat into returns in the long run because I am using Firstrade to buy US Stocks which has absolutely $0 fees and extremely fast wire transfers for deposits and lightning fast trade executions.

Ever since I switch to Firstrade last year as my main investment vehicle, I saved up on a ton of fees and hence able to achieve way better returns than before. I saved up more than 5 times the fee paid in 2018, 2019 and 2020 this year due to the switch and I am really happy thus far.

Of my entire investments in 2020, fees only take up 0.1% of my entire portfolio! (2018+2019+2020 combined across all brokers and Robo)

Alright that’s it! For now, think long term, tune out the noise and avoid the temptation of gambling meme stocks, think of the companies that will do well in the long run simply find bargains/dollar cost into your positions. If you need some inspiration for companies to research, you can check out my post on 5 stocks to buy if the market crashes here.

For those who are already into Crypto

Want to learn how you can earn high yielding interest rates on your idle crypto assets in a secure, safe and easy manner? You can read up more on my post here to learn more about Celsius and Nexo which give you interest on your crypto assets!

Or do your due diligence on Bitcoin in my post here and also my crypto exchange of choice Gemini here if you are looking to buy your first crypto!

Referral Links (Click and Sign Up)

Gemini Exchange: Deposits and buy US$100 or more crypto on Gemini and you will earn US$10 in BTC.

Coinhako Exchange: You can create an account by clicking the link and then enter promo code: COINGECKO when doing a buy/sell and enjoy 20% trading fees discount!

Binance Exchange: Create a Binance.com account here and trade the widest range of crypto pairings!

Celsius Network: Earn US$40 in BTC for free with your first transfer of US$400 or more in any crypto asset and wait for 1 month!

Nexo: No referral events at the moment 😦 Just sign up and enjoy this great product!

MooMoo Apple Stock Promotion

Just 3 days left before this free Apple Stock Promo ends! Have you gotten your free Apple stock?

Moomoo app is a MAS regulated stock broker gaining popularity and traction in Singapore as they offer 1 free Apple stock ($120+ USD) for new users!

Sign up here and simply deposit $2700 SGD on the Moo Moo App and see the free Apple stock when the stock market opens!

You can withdraw the entire deposit amount after you claim the free stock as well 🎉

This promo ends on 31 May, so get that free Apple stock while it last!

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. In fact, the content is not directed to any investor or potential investor and may not be used to evaluate or make any investment.

Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stock broker or financial advisor.

Comments

1082

5

ABOUT ME

Lin Yun Heng

04 Jun 2021

Senior Analyst at Delphi

Crypto Educator

1082

5

Advertisement

No comments yet.

Be the first to share your thoughts!