Advertisement

OPINIONS

Should You Diversify into Crypto? (Strategies included)

Are you simply investing in stocks? Or worse, just saving them in a bank and letting inflation eat away your money?

Lin Yun Heng

08 Mar 2021

Senior Analyst at Delphi

Join My Tele Channel Here

I am not going to lie, but I have been putting more time and energy researching deeply into the cryptocurrency space and why I feel everyone should too.

Crypto has been the buzzword of 2021 so far with Bitcoin and Ethereum breaking all-time-highs almost on a daily basis.

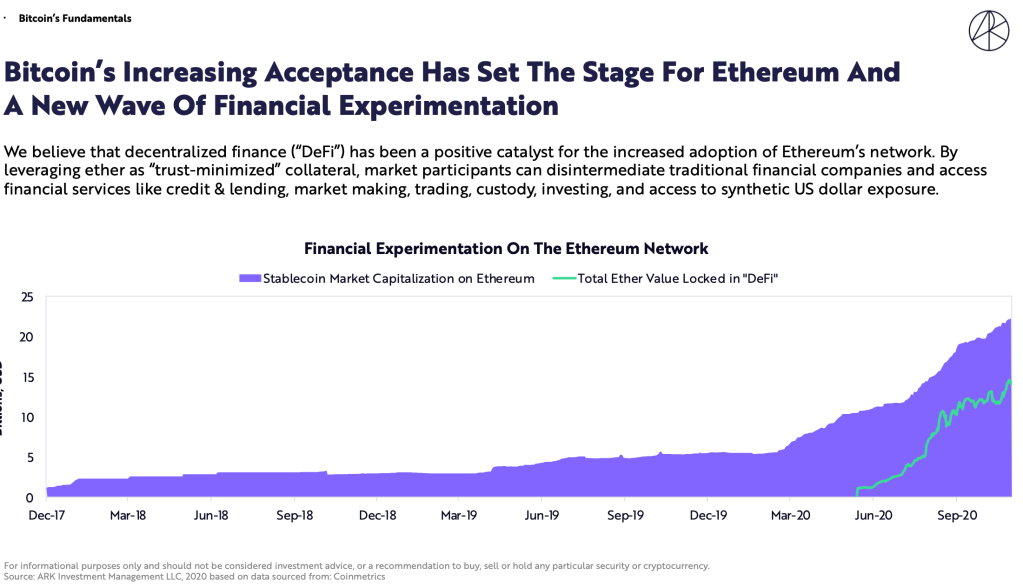

Adapted from Ark’s Big Idea 2021

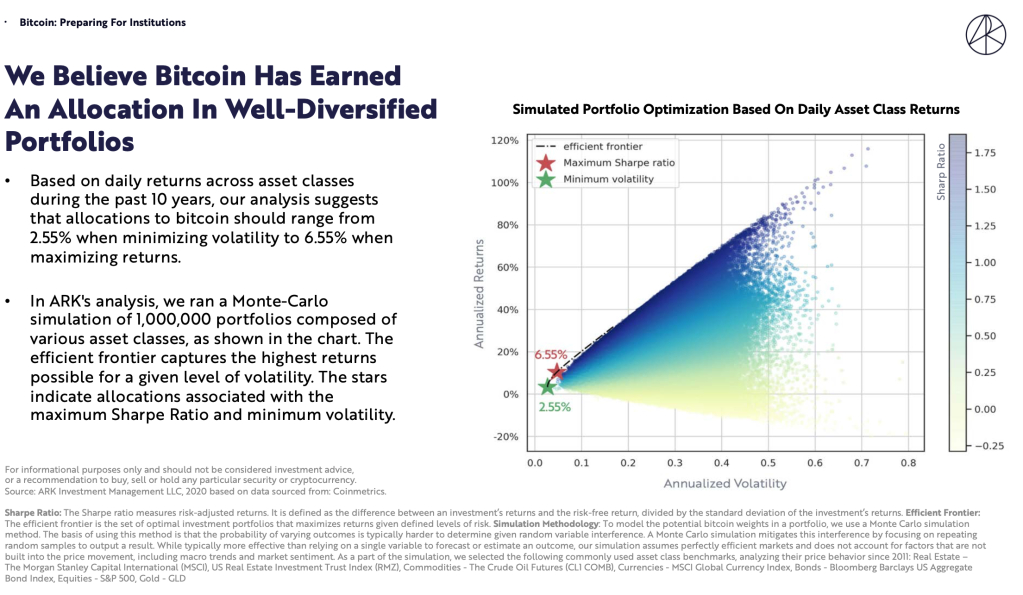

Adapted from Ark’s Big Idea 2021

Bitcoin is not the only thing there is when it comes to crypto, you have your alt coins such as Ethereum, Cardano, Polkadot, Binance Coin and also your Stablecoins such as USDT (Tether), USDC (USD Coin), Dai (Decentralised Stablecoin).

In short, stablecoins are usually pegged to a currency (such as USD) and aims to be “stable” and act as cash but in crypto form.

Every crypto asset has their own value propositions and own fundamentals as to why people would want to invest or trade in them. The Bitcoin thesis is probably one of the most popular, due to its popularity and insane run up since the 2017 price reset.

For those interested to invest into crypto, I highly recommend you checking out my exchange of choice and my review of it here: Gemini

Gemini Referral Code

Click on this referral link here and receive US$10 in Bitcoin after you top up at least US$100 on Gemini!

Is crypto really a speculation bubble waiting to be popped? Personally, I beg to differ. Here’s why:

Crypto Savings Account and Yield Farming

Do you know you can earn interest on your idle crypto assets such as Bitcoin, Ether, Litecoin and more? You can also earn crazy high yields on your Stablecoins with potential up to 100% interest rate per annum! How much interest is your bank giving you?

Personally, I am still researching more into yield farming but due to the complex nature of the DeFi space, I have yet to dabble in yield farming so I am sticking to crypto savings account for now.

The ones I am personally using are Nexo Wallet (for my Bitcoin and Ethereum) and Celsius Network (for my stablecoin, Dai)

Nexo Wallet

Nexo Wallet

Once I purchased the crypto, I will transfer the assets over to Nexo and Celsius respectively to earn interest on my assets and the best thing about it is that it compounds, even when I am doing nothing.

I will not dive into details on how the 2 platforms work but essentially, how they generate such high interest rates is the same as how a bank works: They lend your assets out to institutions and charge them a higher fee for lending the crypto asset, and in return give you interest as reward for putting your assets on their platform. (essentially how a traditional bank works)

Celsius Interest Rates (Aug 2020)

Celsius Interest Rates (Aug 2020)

Why am I confident in the 2 platforms? Even though they are not MAS regulated, Nexo is a regulated entity in the EU while Celsius is also a highly established player in the field.

Both feature high levels of security with Nexo having around the same security sophistication of Gemini and bank grade security for our crypto assets. Hopefully 1 day I will elaborate further on them.

To sum up though, I am earning 5.5% APY on my Bitcoin and Ethereum through Nexo (by holding <10% in NEXO Tokens) and 12.5% APY on my Dai stablecoin through Celsius.

If you are interested to deposit into the savings accounts, I have a referral code for Celsius below.

Celsius Referral Code: 199285483c

Earn $30 USD in Bitcoins when you join Celsius Network and make a first transfer of $200 USD or more using the referral code at the time of signup!

(Bitcoin reward will be unlocked 30 days after the initial transfer)

Risk Reward Ratio is Huge

Crypto’s upside is really unlimited when you think about it. At the time of writing, Bitcoin’s return year to date is 90.23% while Ethereum’s return year to date is 170.69%, that’s insane. That is some crazy returns in the matter of less than 2 months.

My crypto gains thus far amounts to 140+% gain since my first investment into the asset class back in late 2020. I am still dollar cost averaging every month into the asset class as well.

As of now, I am still holding on to just Bitcoin and Ethereum, but a few alt coins are showing extremely compelling value propositions and I just can’t ignore it anymore.

My crypto returns has already far surpassed my equities (stocks) and I will be focusing on this asset class in the near future. I am thinking of taking profit from my Equity100 portfolio and redeploying the profits into crypto too.

Ark’s Research on Bitcoin

Ark’s Research on Bitcoin

Shown above, it is clear that by diversifying into crypto or Bitcoin in particular, you essentially reduce your risk but increase your returns potential due to how Bitcoin has basically zero correlations to the stock market.

The more uncorrelated the asset classes the better, that is what diversification is supposed to be.

The thesis for Bitcoin has never been stronger. As more traditional investments dabble into Bitcoin, we will see even greater adoption and soon acceptance of Bitcoin as a legitimate asset class. Only time will tell.

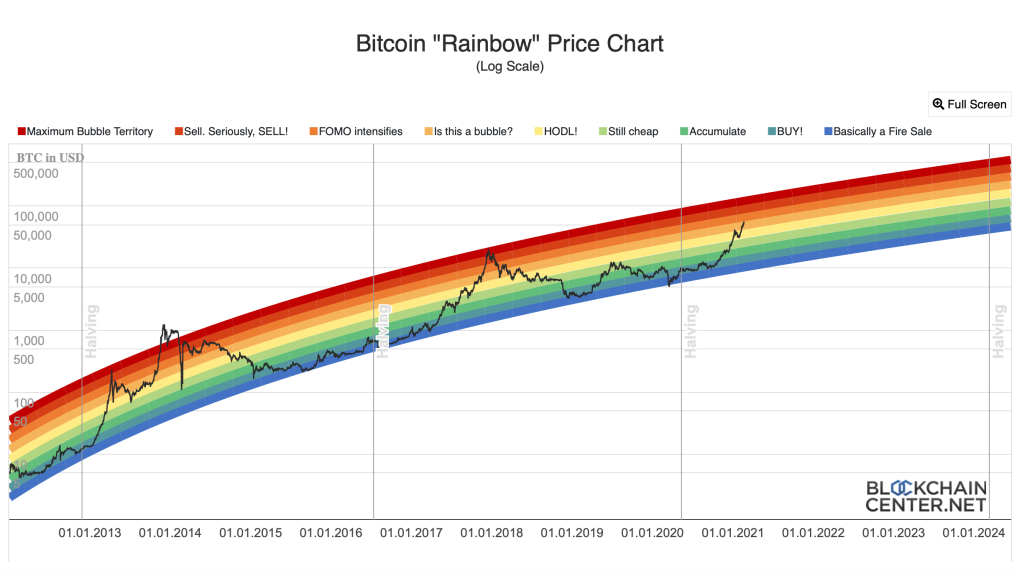

Bitcoin has been on a rising trend over the years and the diagram above gives a visual representation of what might happen to Bitcoin’s price going forward. Don’t just blindly trust it though, as due diligence is still needed and every person’s risk tolerance is different.

Strategy Going Forward

At the point of writing, crypto takes up roughly 13% of my entire portfolio (consisting DIY Portfolio, Syfe Equity100 and Crypto holdings).

I will be recycling a portion of my funds from Equity100 and redeploying it back into crypto. The reason being is simple: My Equity100 saw a huge run up in overall returns. I am overweight on equities currently and I hope to rebalance the allocation towards 25% crypto and 75% into equities.

Going forward I may be diversifying into other alt coins, and on my watchlist are the following:

Cardano (ADA)

Polka Dot (DOT)

Binance Coin (BNB)

These 3 picks are all part of the top 10 cryptos by market cap so you can sort of call them the “blue chips” of the crypto world. While these alt coins may not overtake Bitcoin, their value proposition is incredibly compelling especially the case of Polka Dot. I leave it up to you to do up your own due diligence and to further understand the asset class before dabbling in it.

Word of Caution!

Also, I urge all readers with less than 1 year of investment experience to stay away from crypto first, because the volatility of the asset class is insane and may not be suitable for beginners. A daily upswing or downswing of 30%-60% is possible, thus, I urge readers to take note of the risk involved with such an asset class as well even though the upside and returns may seem unlimited.

As of now, I will be deploying into crypto on a monthly, dollar cost basis and buy into them slowly but surely. While my cash lie around not invested, I will covert them into Dai to earn interest in Celsius first. When I want to deploy them, I will transfer them back to Nexo and exchange Dai for Bitcoin or whichever coin I wish to invest into.

Also, for those not informed, Bitcoin has hit US$57,000+ while Ethereum officially broke the US$2000 mark! I do expect to see a pullback soon but the dip will probably be bought back just as quickly. I will focus on accumulating them slowly over time and won’t be planning to sell them any time soon.

As always, I use StocksCafe to keep track of all my investments (include Robo) + research on stocks. You can also view my portfolio as well as many others so you can compare your own performance with other investors. If you are interested in signing up, you can use my referral link to sign up and access premium features for 1 extra month for new users. (3 months)

Have a great weekend and good luck investing! Stay safe and healthy always!

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. In fact, the content is not directed to any investor or potential investor and may not be used to evaluate or make any investment.

Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stock broker or financial advisor. (Or contact me!)

Comments

1503

4

ABOUT ME

Lin Yun Heng

08 Mar 2021

Senior Analyst at Delphi

Crypto Educator

1503

4

Advertisement

No comments yet.

Be the first to share your thoughts!