Advertisement

OPINIONS

Portfolio Review - September 2022

Free Fallin' - Tom Petty. I write about Q4 outlook, my equity / crypto movements + educational post on DeFi mechanics!

Full article on Substack (including my life journey!) can be found here. My substack profile here. My Twitter profile here. Previous month's Seedly opinion article can be found here (equities and crypto).

Equity Portfolio Breakdown

% Value: Value as % of my portfolio % Cost: Cost as a % of my total cost invested into equities Cost allocation: Based on my set target in USD. 100% means over-allocated…

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

===

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky.

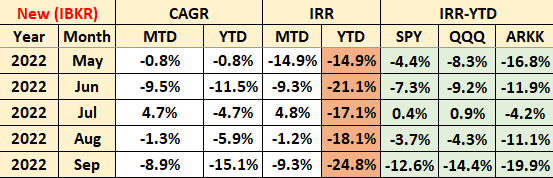

Time-weighted returns (IRR) & CAGR (top); Historical returns (middle); Cumulative returns (bottom) - Since new brokerage.

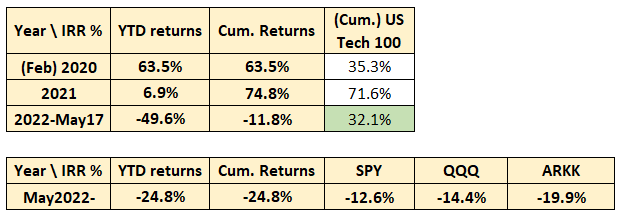

CAGR* Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. The CAGR returns are compared in the above table instead.

Crypto Portfolio Performance

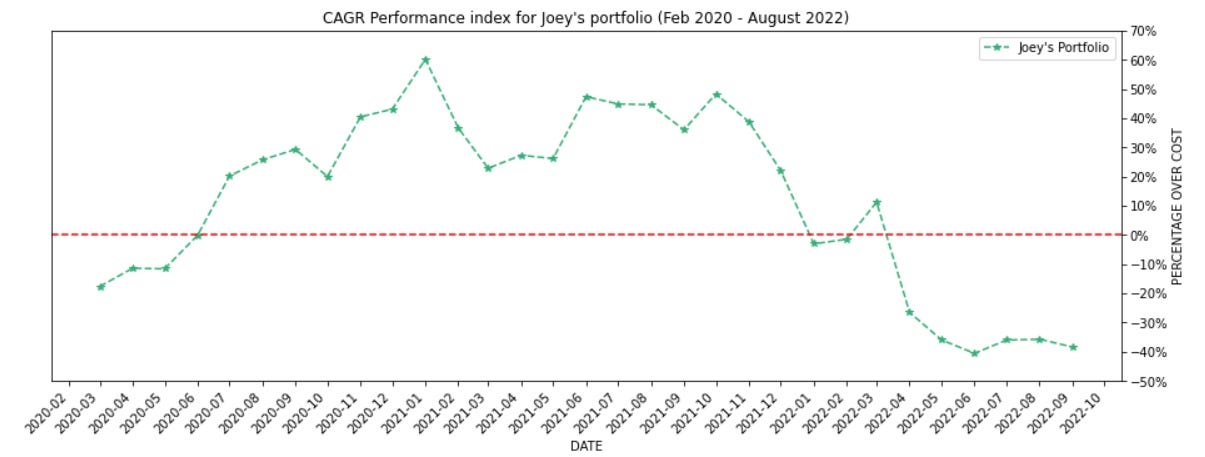

Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio 2021 performance: 5.5x-ed my 2020 portfolio Lifetime performance: 9.29x my cost

Lifetime result:

- Achieved 3.11x of BTC performance (9.29/2.94)

- Achieved 0.85x of ETH performance (9.29/10.91)

Goal is to try and outperform BTC and ETH from here on out. 👍🏻

===

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it. Catch the monthly update of my personal and investing life by subscribing here.

===

Overall commentary

Q4 2022 outlook

Whereas for the second half of 2020 and throughout 2021 I found myself rushing to allocate capital into both crypto and equity markets, in 2022 I finally appreciated the peace and calm that cash can bring. Not being able to back up the truck while many others are running for the exits will ensure your place in the hall of averages. By definition, outperformance happens when you do something that few are doing. You really want to be buying when everybody is selling, especially if you hold the same long-term view on investing as I am.

I wasn’t as disciplined in terms of raising cash from my equity account as I felt that selling at such prices will essentially mean you selling at the bottom. Instead, where possible, if you truly believe that your portfolio companies will be very successful over the long-term, then you should add to those positions. Thankfully, for crypto I was able to raise cash following some NFT hype, which were dutifully cashed out and routed into the stock market. I still have a healthy amount of cash to at least last me and my DCA buys into November during such time I believe the market would have found its bottom. Obviously, it won’t start trending higher, but the markets may look beyond inflation and interest rate hikes. No bad news = good news right?

I could be absolutely wrong and the markets may reel from worse-than-feared inflation (especially in depths of winter) which may prompt even more rate hikes for longer. If that materializes, I look forward to buying panic and fear with what little cash amounts that I possess.

The content above briefly summarizes my Q4 outlook and I think is one shared by many on FinTwit as well. It could be a byproduct of confirmation bias since its quite easy to find data to prove my point. Though, if you measure your investing performance over longer timeframes (e.g. 3, 5, 10 years), then why are you worried about the next 3 months? Do what you’re supposed to do, allocate capital, review and validate current thesis, and have a plan for the next year.

It’s easy to write something that sounds smart, like writing about a doom-filled Q4, but its hard to spit the truth - that we might all be wrong. It’s even harder to stay invested (both $ and mentally) in the markets and sit on your hands. It’s extremely difficult to allocate 100% of cash at the bottom. Then again, we do things, not because they are easy, but because they are hard.

Trading vs Investing

In July’s article In July’s article I wrote about purchasing a AAPL put ($155 strike) as a ‘hedge’ as the chart showed a rising wedge which I felt was too delicious not to take advantage of. During August as the markets went away from me and my strike price I had written down the option ($680) to $0 just to prove to myself how bad of a trader I am. As luck would have it, in Sept the price of the stock came close to my breakeven but eventually went away on 09Sept2022 back above $160). I took advantage and market sold the option at market open ($238) as I felt some sort of momentum driving up the markets. Recall that the option expiry was on 16Sept2022, and after the CPI reading the stock crashed together with the market and ended up closing at $150, which would’ve made me slightly profitable on my put option. Welp, that’s a $400 I could have gotten if I had just sat on my hands.

On the crypto side I had a stack of SOL which was originally earmarked as my longer-term bag. Sensing (or should I say influenced by Crypto Twitter) that the ETH merge may result in higher ETH prices relative to SOL (aka higher ETH/SOL and lower SOL/ETH), I sold 80% of my SOL bags into ETH on 06Sept2022. On 07Sept2022 I sold the remaining SOL ($31) and all ETH ($1509) to ‘raise cash’. As I write this (26Sept2022), SOL is $32.6 and ETH is $1309. Good trade for ETH it seems.

I mention these 2 trades to prove a point (to both my readers and I) that just because we trade doesn’t mean we should be traders. There are many factors involved in trading and the very best view trading like an actual job (as all traders should); I treated this as an afterthought (since I don’t have time nor am I in the right time zone to monitor constantly) and my trading performance confirms that. We always overestimate our ability and sometimes a little wake-me-up is necessary to get us back on track. Edit: I had another wake up call when I allocated quite a decent sum in my equities on 12Sep2022, the day before CPI readings smacked the markets back down.

Welp.

Investing is orders of magnitude less stressful, and I’m an investor, not a trader.

===

Equities movements

Another month, another session where we get smacked by a + 0.1 % (CPI). The start of September turned out pretty great, but went sour pretty quickly with the release of CPI. There’s not much we can pontificate about the markets since it was all I talked about over the past few sessions. What we can do is think about how to react when the market turns against us, and how best to position for the upcoming bull market.

Let’s face it, there’s only 3 possible states of the market - Bull, Bear, Ranging. I define ranging as post-bear market, but equities not having a sustained bid, which results in stocks just being in stage 4 without any sort of uptrend. We are currently in a bear market, but since the June lows, it can be argued that we are in a ranging market, but certainly not a bull market. In this situation, how shall we proceed?

The general wisdom prevails. Be a net buyer of stocks, and set your sights beyond the next 1-2 years. I bought on a few occasions this months and my buys are below.

=== Portfolio Changes ===

Added: CRWD (x2), NVDA, TSLA, NET (x2), SE, TWLO, SNOW

=======================

As (bad) luck would have it, I bought (some) right before the CPI reading, half-expecting a in-line with expectation or even below expectation (i.e. lower inflation). I was wrong; the market proceeded to tank below my buys. Fast forward the next 2-3 days, and prices are now higher than when I bought them at. Fast forward to the next week (26Sep-30Sep), and prices are now lower again. It’s an intriguing market, for sure.

Maybe I’m just a bad timer of markets. We shall see.

Regardless, if my thesis pans out for the few of my companies, it’s hard to argue against buying now. I mean, what more do you want? Markets are forward looking and with every inflation surprise markets are pricing even more hawkish environments. But, does that mean when the environment truly gets hawkish, the markets will continue to go down with it? I don’t think so, since this event had already been priced in at the point of inflation surprise.

I’ll just concentrate on beefing up my core holdings - companies whose 1) products are highly sought after, 2) can weather the macroeconomic downturn and high interest rates, and 3) have some sense of moat or being best-in-breed. For my portfolio, not all companies hit that sweet spot, and I can somewhat group my companies into a 3 groups:

- Large cap anchors with growing and slightly monopolistic traits in certain industries: TSLA NVDA

- Small-Mid cap high-performers that constantly exceed expectations: SNOW DDOG CRWD NET

- Small-Mid cap companies whose results are more dependent on discretionary spending or business activity: ROKU SE TWLO

Large cap anchors are self-explanatory. I think Tesla will be the Apple of EVs by the next 10 years. Nvidia will power the world’s AI. Any other companies I should consider? Namely, these 2 companies, in my opinion, have still a long runway with which to grow their profits. The rest of FAANG can be a worthwhile investment, but they have shown signs of saturation implying an upper limit to revenue growth. That said, by virtue of their size, it will be harder to still generate substantial investor returns, which is why this group should anchor my equity portfolio (i.e. heavy in size).

The second group is basically my mid-cap tech bucket. It’s good to point out that all 4 companies have products that still benefit from secular trends or are mission critical. For example, Snowflake benefits from migration to the cloud; Crowdstrike benefits from focus on cybersecurity. All 4 companies are best-in-breed in their core offerings, as shown by various high-level reports released (e.g. IDC, Forrester, Gartner). It stands to reason that during times when purse strings are tightened and companies are looking to consolidate vendors, they should (hopefully) be the vendor of choice and thus will weather the recessionary storm better than others. It also helps that they have a strong top and bottom line, whilst innovate quickly on product development as well. This group is one where I think will drive the most returns in the next 5-10 years (that is, if I don’t paper hands and sell them).

The last group contains companies that, like most of my portfolio companies, have seen outsized growth since covid, but owing to various factors relating to the business and economic cycles, fared badly according to expectations. For example, Roku has trouble selling their hardware and TVs profitably due to inventory bloat by retail stores; their ad business (high margin) has seen a sharp drop as advertisers who market discretionarily pulled their ad dollars. Sea Limited’s 3 heads of Garena, Shopee, and SeaMoney is now reduced to 1.5, with Garena bleeding users and being blocked in India (huge user base), Shopee having to cut headcount and exit from several markets, and SeaMoney being the only pillar still experiencing higher-than-modest growth. I could go on but my point is pretty clear. These companies are not doing so well, but if they are able to weather the storm, they should be back in action once markets turn bullish again.

It’s a long way to go in terms of building out the large $ needed for my large cap anchors, but it’ll likely be a longer-term DCA. I’m currently aggressively buying stocks in my second group; the third group still requires monitoring for another quarter or two before we ascertain that they’ve successfully survived the storm.

During the month Howard Markets dropped another great memo on the illusion of knowledge (i.e. forecasts) and why we shouldn’t use them. Have a read.

===

Crypto thoughts

ETH did a little merge, and price sold off a tiny bit after. Confounding the price drop was the hawkish sentiment overhang in the equity markets; there’s no added liquidity to fuel any sort of meaningful buys. Though, the fact that ETH successfully merged brings it 1 step closer to a boundless ecosystem that has real-world use cases that value-add to society.

Ignore the previous sentence, which is code for number go up. For my data-driven investors, the website here gives a real-time update on the supply change since the merge. No need to focus on it day and night, but over the longer-term it should trend up (higher number = lower supply). Tetranode, a well-known ETH whale, tells us what’s next for ETH after the merge.

Essentially, there’s still a ton of staked ETH locked and currently there are no functions to enable withdrawals. Once the function is implemented, staked Ether can be withdrawn and sold into the market. It’s kind of like unlocked supply, and while people might not sell, that’s yet another catalyst to look out for in 2023.

In terms of my positioning, I thankfully (or luckily) sold my spot ETH in Metamask to cash before the merge at $1740. I did that partly because I don’t want to deal with the ETHPOW forked tokens. It can be quite complicated and with the latter being valued at < 5% of ETH, the opportunity of profits is not that high to begin with. You also run the risk of encountering scam links or interacting with malicious code since ETHPOW is sort of a no man’s land. In any case, it was only a small amount (2 ETH), but that bumped up my cash reserves which gave me a peace of mind. I may become a net buyer in the near future, but no hurry. :)

There’s not much to opine in crypto too as well since the merge is kind of the last big event for crypto in 2022. It’s time to slowly hunker down and prepare for any downside surprises the equities market may have, which will surely impact the crypto markets. My investing stance has not changed much; am still a net buyer of tokens which I think will reward me with profits during the peak of the next bull market.

My portfolio below:

I have _levered _bets in ETH and SOL via NFTs, but am trying to weigh my allocation more towards the SOL ecosystem (again I’m biased but the metrics speak for itself). ETH is a large cap and is affected by the law of large numbers; SOL is smaller in market cap and it takes lesser amount of $ to move the same % in price. The higher beta is why I’ve recently started a DCA plan in SOL and plan to continue it for the next few months.

Here’s to hoping for a better Q4 - one where it crashes to June lows and we get a chance to load up again.

===

T00bs/Degods/DUST + Dust labs raise (7m)

In early September the team behind DeGods released a new mysterious NFTs (t00bs) which revealed an innovative way of accepting applicants into allowlists - via scholarships (_also called _y00tlists). Instead of the usual First Come First Serve (FCFS), y00ts scholarships are given to applicants based on merit. In this context, merit refers to engagements with DeGods team and the entire band too. Basically, the people that can hype up the DeGods brand and ecosystem will get into the list. By doing so, the team didn’t have to spend a dime in marketing efforts, which I thought was a pretty good example of guerilla marketing (aka unconventional).

I don’t have the marketing metrics (aka impressions), but you can be sure that the intended results were achieved. Here’s a good article summarizing the entire event (only described as pandemonium). The article also talks about Dust Labs, which is a tech startup related to DeGods, raising 7 million from VC funds such as FTX ventures, Solana Ventures, and Magic Eden, which tells me that what Dust Labs is building has potential. With private equity valuations, these numbers can shoot up quite drastically, and bodes well for my NFT portfolio. :)

In my April article I showed my NFT breakdown which contained its fair share of now-worthless-NFTs. The success of Degods has shown that we only need 1 winner from this to compensate for all the other losers. My SOL NFT portfolio has thankfully returned 1.61x on a value-over-cost basis. I think for a bear market where everything was down-bad, this return is kind of nice.

Can’t wait for when the bull market hits.

In any case, as I owned 2 Degods, I was entitled to mint 2 t00bs (which I did). The current floor price is about 100 SOL (10Sept2022), which is about 3.5k USD. Adding these 4 NFTs together (+ DUST, a useless token that can be bought and sold at market prices) gives me a rough SOL NFT portfolio net worth in about low-mid 5 digits. At the same time, I continue to accumulate DUST with the right price to offload it again at the high of the next cycle. Do note that I’m not bragging about the returns at all, but it’s important to understand why I talk about this ecosystem so often in my articles.

In my opinion, the NFTs are no longer a ‘trade’ for me but perhaps longer term plays, as long as the team behind this ecosystem proves their worth in the long run and continue to generate sustainable utility around this brand. If this is their worth in the bear market, I’d be excited to see its worth in the bull market.

For readers who are looking into the NFT space, it’s important to understand the core driver of value behind the underlying NFT. It’s not that the picture themselves look beautiful or dope; it’s the continued effort by the team to manufacture utility/value-add and demand for its NFT (+ ecosystem). Vibes and community matter, to a certain degree, but without continued work by the team to drive demand, NFTs usually trend to $0.

Here’s to hoping I don’t sell NFTs too early (things you say at the top before it crashes to $0). A fuller FAQ about the team and ecosystem written by the founder here.

Staking / Lending / Yield

I had a reader ask me to explain the principles behind staking, lending and generating yield for users. Given that some people only read about crypto either when BTC was at $65k or at $18k, can be hard for them to understand the mechanics of anything other than BTC, unless they actively seek out content relating to e.g. DeFi. It’s also a good way for me to brush up my knowledge of DeFi and do a little Feynman.

Staking

An action only applicable to tokens that rely on the Proof-of-Stake (PoS) algorithm to achieve consensus. Proof-of-X verifies transaction by showing proof that you have X. In Proof-of-Work (i.e. BTC), miners need to show that they’ve done the work, which for BTC is to find the right number (from 0 to infinity) corresponding to a hash (64 character alphanumeric). In Proof-of-Stake, you (as a validator) verify transactions by showing you have a stake in the protocol (e.g. ETH), which implies skin-in-the-game (can’t ‘hack’ the blockchain as you too would lose money). It’s analogous to a country only allowing its residents to vote. The resident has a ‘stake’ in the country!

The broad meaning of _staking _has since diverged post DeFi summer. Whereas it used to refer to the method by which validators verify transaction, it now merely refers to a function that allow holders to stake tokens (aka locking them) for either i) staking rewards, or ii) a voice in managing the protocol.

You need $0 and only a few lines of code to create a token. Thus, teams can bootstrap their product by creating a token and ‘inject’ market value into it. This is done via offerings, previously known as Initial Coin Offering (ICO), but better known as Initial DEX offering (IDO), and in some cases Initial Exchange Offering (IEO). The 2nd and 3rd term just means that the offering takes places either in another protocol or a centralized exchange. In all 3 methods, they are analogous to Initial Price Offering (IPO) for stocks, where you exchange money for a stake in the company. With the amount that they raise from I X O, teams can bootstrap the growth of their products by subsidizing user adoption via staking rewards (aka emitting free ‘tokens’ to those who stake). This incentivizes all holders to stake so that they can receive the free tokens. Otherwise, your stake would get diluted.

Staked tokens are not part of circulating supply, which lowers the amount of tokens left in wallets that can be sold. Less selling power in bull markets = price go up.

Lending

The mechanics for lending in DeFi protocols are very much similar to how banks work now, except with crypto’s pseudo-anonymity its hard to do background checks to validate a borrower’s ability to repay his/her debt. When you lend $ X to user Y, you would naturally expect $X+$Y in return to compensate for your opportunity cost, as well as the risk associated with lending money (in DeFi, this usually means tokens that have a $ value and are liquid) to an unknown user.

The interest rates are determined by supply and demand. If there is smaller supply of token X to loan than there is demand to borrow them, economics 101 would dictate that the interest rate would float up (aka the price of borrowing or the price of money).

For DeFi protocols, it is determined usually by code and logic rather than at the discretion of the protocol themselves. This is true for liquidation of loans as well, since these can be precisely calculated 24/7. Similar to staking, a DeFi protocol whose sole purpose is to act as a bank (where people can loan/borrow) could create a token and incentivize users to deposit money onto the protocol for loans to be written. Again, it sounds ridiculous to be doing this now, but there was insane demand for USD stablecoins at the peak of DeFi summer 2021, and the yields (interest rate) had to adjust by a large margin just to accommodate the gargantuan increase in demand.

Yield

Yield is what you get when you harvest crops. Yield is what you earn by doing DeFi actions in DeFi protocols. Yield = rewards. There’s no much to explain here, but all mention of rewards in the above 2 sections are what crypto users like to call DeFi yields. They are generally displayed as percentages and are designed (especially if the DeFi protocol is new) to entice users to stake, deposit, or borrow $ (you sometimes earn interest for borrowing).

Imagine the excitement from retail when they know protocols often provided 100% - 1000% (reward in tokens) in the bull market. He thinks: “Wow even if the token drops 50% in price I’ll still have a decent profit. This is a no brainer.”

Down 85%.

Yields = rewards = interest rates go up in the bull market but crash into oblivion in the bear market, which is exactly how the dynamics of supply and demand play out. In staking, if everybody stakes their token for the reward which is finite and known, you’d have lesser rewards for everybody (same pie divided by more slices). Yields will naturally go down, and users may jump to other avenues for yields. The rewards are distributed back to those who still stake, and thus the yields go back up.

===

Now that I’ve explained in length on DeFi, I’m more convinced that there are indeed elements of DeFi that are similar to a ponzi scheme. Having done my fair share of the staking and lending, I can safely say that unless you’re supremely savvy (or a whale), it’s unlikely you’ll be rich off of DeFi. You’re better off buying crypto tokens and taking profits along the way. With BTC going from 20k to 65k and ETH from 1k+ to 4.2k, why would you need any sort of yield that comes along with added risk?

There’s plenty of money to be made just buying BTC and ETH and DeFi is not something I will recommend to any investor starting out in crypto, though I must admit that it was interesting and fun to learn and play. That said, the game of yields was absolutely unplayable during bear markets.

===

Compass Mining

Marching towards a third of September and 3 of my miners (all in same Ontario facility) died on me. In summary, what was communicated to me was that the facility is shutting down due to a rise in their variable power rates (i.e. variable cost) on their part to host thousands of miners on their hydro/solar/natgas/nuclear powered facility. A dry season in Ontario led to less abundant hydro (likely their largest power source), making them reliant on oh-so-expensive natural gas.

The company believes that once these rates trend down, the facility can restart its operations and my miners can get back to work. It eventually turned the 3 miners back on, on the 29th Sept. Oh well. To be honest, I did not think this far when I bought these miners in 2021, neither was I very savvy an investor. The energy crisis has put a lot of industries on the backfoot, and Bitcoin miners are not spared (unless you have cheap electricity). Hopefully I’ve learnt my lesson regarding bitcoin mining and will put the mined Bitcoin to better use. My profit chart below.

One day of ‘scheduled’ downtime means one extra day this miner can last into the future! #selfconsolation

===

Life

Check out my life section on Substack: here.

Conclusion

Thank you all again for reading thus far. Just ~4 more articles to my actual renovation, 12 more articles to my wedding, and at least 24 more articles to my future child??

I hope you continue to join me along in this journey of life as I experience the ups and downs that come my way. See you next month.

Cheers,

Joey

Comments

302

10

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

302

10

Advertisement

No comments yet.

Be the first to share your thoughts!