Advertisement

OPINIONS

Portfolio Review - October 2022

It's an E-long only market now; Let that sink in. I talk 5 investing lessons I learn & Q4 outlook v2.0

Full article on Substack (including my life journey!) can be found here. My substack profile here. My Twitter profile here. Previous month's Seedly opinion article can be found here (equities and crypto).

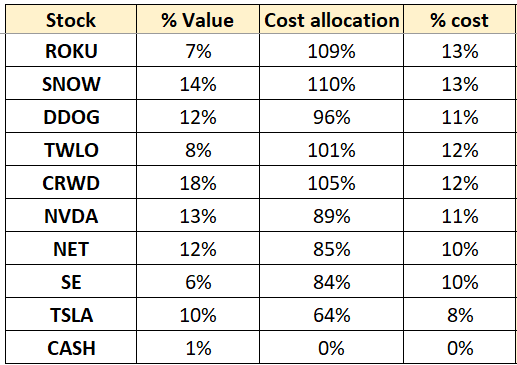

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

Cost allocation: Based on my set target in USD. 100% means over-allocated…

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

===

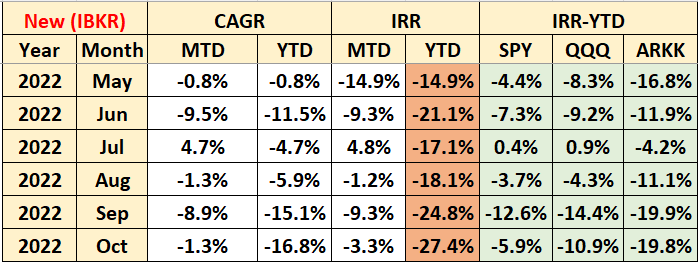

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky.

Time-weighted returns (IRR) & CAGR (top); Historical returns (middle); Cumulative returns (bottom) - Since new brokerage.

===

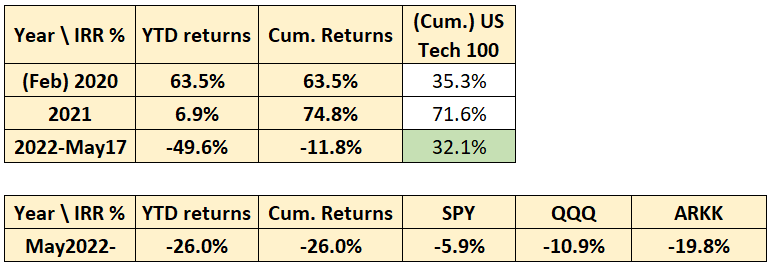

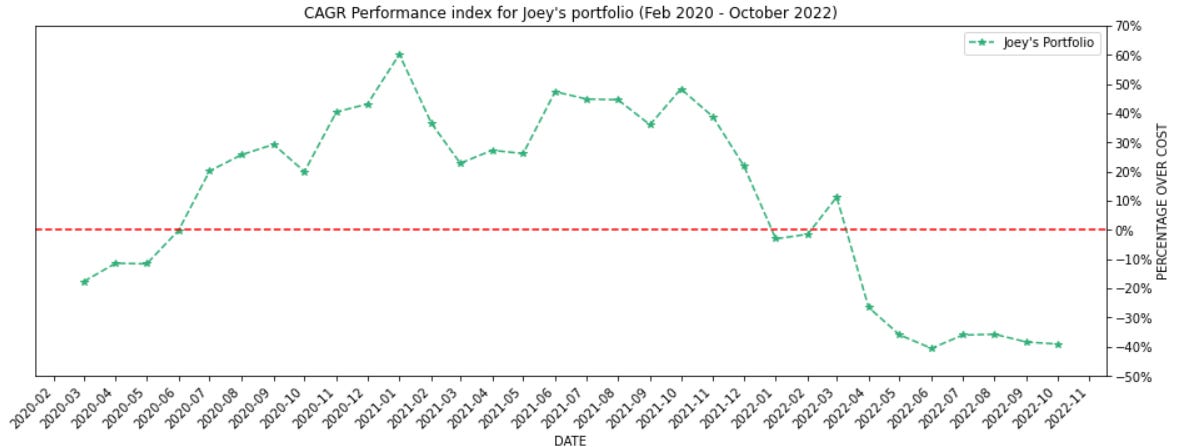

CAGR* Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. The CAGR returns are compared in the above table instead.

===

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 8.70x my cost

Lifetime result:

- Achieved 2.95x of BTC performance (8.70/2.95)

- Achieved 0.72x of ETH performance (8.70/12.16)

Goal is to try and outperform BTC and ETH from here on out (been losing past few months…) 👍🏻

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.

===

Overall commentary and thoughts

Relooking Q4 Outlook

I laid out my Q4 take in my previous article, which can be broadly summarized as:

I believe the worst is (almost) over. I have some money to buy the dip, but if the dip keep dipping, I’ll have to dip into my savings to buy the dip.

After what felt like a bloody first half and a somewhat euphoric second half, I guess we’ll never know until after the fact, whether October turned out to be the bottom. I still have cash that I can allocate to the markets, but that amount is dwindling.

Wearing the long-term investor hat certainly seems appealing right now, since most of what I want to buy is already on sale (read: too many % off all-time-highs). However, the past year has taught me that low prices can always go lower; SaaS can be pretty dirt cheap at 3x sales and yet nobody seems to want them (see: Twilio).

I think the above aptly describes how most amateur investors (me included) approach investing during times of panic. Wisdom tells us to buy when everybody’s selling, but our emotion tells us that “oh it’ll go way lower”. It doesn’t help that our mind gets constantly distracted with FinTwit talking heads (Jim Cramer, Thomas Lee, Cathie Wood). One has gotten the reputation as the anti-guy: when he buys, you sell (& even has institutional money behind the inverse play). One has faded into irrelevancy after relentlessly calling for a continued bull market even as we shed blood, sweat and tears since the start of 2022. Finally, the last person wrote an open letter to the Federal Reserve that said something along the lines of:

helpmyportfolioisdownbadyougottastophikingratesandturnonthemoneyprinterandsavemyetfs

People are still throwing money at Cathie, though.

Of course, there are also investors whom we all respect and admire, such as Howard Marks, Warren Buffet, and even legendary traders like Stan druckenmiller; the list goes on. While it’s important to learn and understand from them, what’s good about reading every investment memo if you can’t apply that knowledge into practice?

True growth starts and ends from within. Learning from others can only grow you show much; you’d have to do it yourself to really internalize and apply what you learnt. It’s rather easy to self-reflect, but not a lot of people do that.

I recently replied to this question (Was there any investment decision you made that you regretted till today?) on local personal finance platform (Seedly) and in doing so it forced me to reflect on, and take stock of my investing actions these past 2 years.

I listed down key lessons from the mistakes I could list off the top of my head (& there are many). Let’s go through each of them in turn:

- Don’t buy when everybody is buying (conversely, don’t sell when everybody is selling)

I met up with my friends and one of them casually asked how the stock market (& crypto) was doing. He had the opinion that the market was fading, which was exactly why I replied that it’s almost time to buy. As described above, I viewed the end of 2022 (or at least, towards the end of winter) as being the window where there exists maximum financial opportunity in the markets for the next 3-5 years.

More seriously, I am looking for the financial markets to ‘break’ and the Fed to step in and realise that they’ve hiked too fast and too far, enough for widespread systemic risk to tick up a notch. Fed still needs to ensure inflation is moderated and back at the 2% level, though, but between financial collapse and fear-gripping inflation, the former must be avoided. I could be wrong, but prices are already very depressed; the earnings season will likely lead to another slew of downgrades as analysts expect spending and budgets to tighten across the board. So in summary, I’m looking at a few things:

- Financial markets to break (like what UK had experienced, with the Truss budget).

- Earnings season for companies to signal that “ok everything is legit bad”.

The point of maximum financial opportunity is upon us; are your cash stacks ready to buy? Edit: We just went through big tech earnings, which saw Amazon, Google, Meta down after earnings, with the exception of Apple. Wonder what this means for the rest of the market?

- Understand what drives market movements in a cyclical fashion

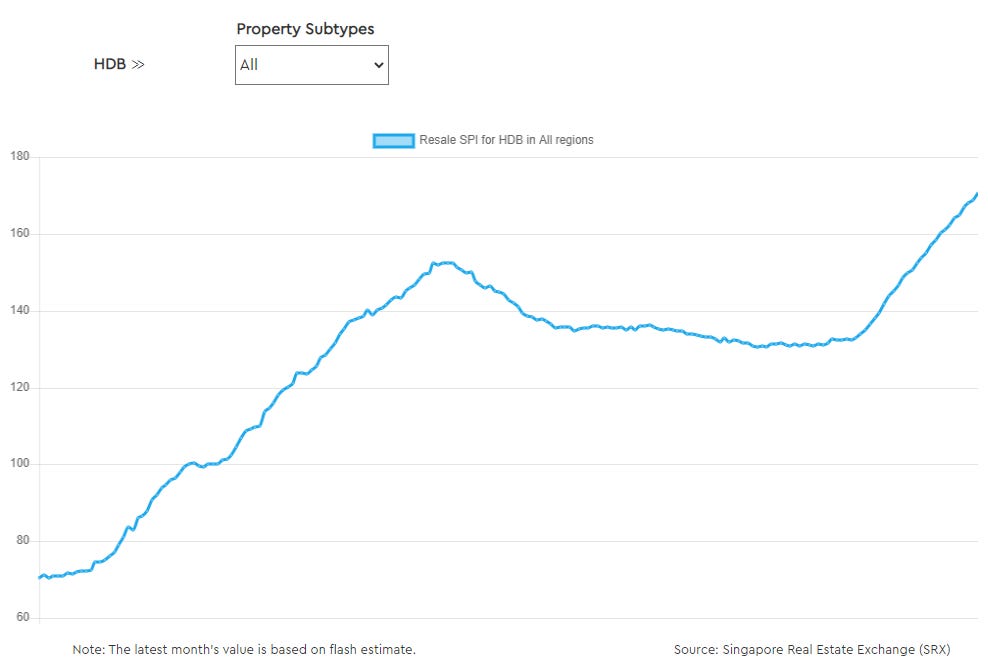

The markets moves up. And then it moves down. There are assets that behave similarly, but their gradient is positive (i.e. higher high, higher low, higher high … ). The public housing market in Singapore, for example, has seen growth for the past 16 years (chart starts from Jan 2006 with monthly data points).

This is cyclical; but you ask, “what does this have to do with the stock markets?” To which, I reply, “Rates!” Interest rates are central to investing (as I’ve come to understand in 2022), and markets swing violently on the fluctuations of basis points.

For companies, this is how higher interest rates affect them:

High interest rates = Tighter liquidity conditions = Less room to raise capital (cost of capital is high due to high costs of borrowing) = Can’t aggressively expand operations = slowing growth = undershooting guidance in earnings = stock crashing in price.

Note: Analysts provide price targets on companies based on the widely popular Discounted Cash Flow model (DCF) which uses the terminal interest rate to discount future cash flow into the current present value. If the interest rate increase, the present value decreases and so too will price targets (which people pay much attention to).

For individuals like you or me (aka consumers):

- High interest rates = harder to get loan (higher repayment too) = more incentive to earn yields in your savings account = lesser need to spend = lower consumer confidence = lower consumer spending = slower growth for retail-focused cos (e.g. Sea Limited) = undershooting guidance in earnings season = stock crashing in price.

Put simply, interest rates go up and down. Mostly, they stay down longer than they remain up. So, while there seems to be no end in sight for Fed’s hikes, it is important to pay attention to where the rates may eventually settle, how long they settle there for, and whether it will drift down in the subsequent months or quarters.

Nobody knows, but it is increasingly attractive to be a buyer than a seller right now.

- Don’t be afraid to sell and take losses or profits. (Cash is chicken soup for the investing soul).

This takes a page out of the chapter: Trading. We must always learn to pay ourselves. Investing is a pursuit that can last the next 20, 30, 40 and 50 years. It’s _rational _to want to emulate Warren Buffet, Phillip Fisher and co, and not have to sell for the next 3 decades, but we are not the two of them, and we have obviously different goals.

The companies of today exhibit very different characteristics than companies that the 2 extraordinary men invest in; the threat of technical disruption is now only a few years away (e.g. due to Moore’s law), industries are much more saturated, and go through the technological adoption cycle rather quickly. The stock markets hinges on what the Fed says or does, which doesn’t always align with the business growth trajectory. In short, many things are uncertain, and while we should strive to hold shares in companies for as long as possible, we must always continue to verify, but more importantly, take decisive action (including selling and taking profits).

There’s absolutely nothing wrong with selling a stock that has seen multiple expansion that has went too far, or a stock that appreciated 4x in just the last year. There’s also nothing wrong in selling a stock if you can’t sleep at night owning it, or if you think the company’s moat will shrink or even outright disappear.

In a year like 2022, isn’t cash the best investment to own and hold?

- Journal your investing decisions, and go back to it from time to time.

Our memory is imperfect, and we always remember ourselves and what we did in the best possible way. We owe it to ourselves (and future generations) to journal what had happened, what we did, and why we did that. This is essentially a single source of truth that can reveal insights into your previously strongly-held beliefs.

The same reasoning applies to our investment decisions, especially for our rationale behind buying and selling. Why did we buy Sea Limited at $360, or Roku at $400? Why we sell Unity at $30, and Teladoc at similar prices? At the very least, there should be some evidence detailing these thoughts.

This helps in reconciling your investment performance. It’s OK to have a negative return on your portfolio, but its not OK to sit by and do nothing about it. Again, the approach would be different if you classify yourself as a buy-and-hold investor in indices. You do you, but you should do the best of you.

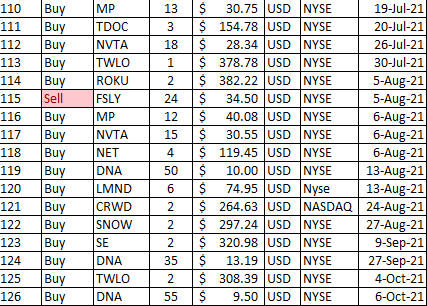

Anyway, it was a good mental exercise to reflect on my past decisions. The key to becoming an excellent investor lies in how much you reflect on your own actions, and how much you try and improve on your shortfalls. Here are my buys from the few months just before the Nov 2021 top, for transparency.

Oh how time flies, many mistakes and many lessons.

===

The overall commentary on the markets are that the Fed, close to the end of October, got cold feet on their plan to rein in inflation through continued rate hikes. I wonder if this was in any way related to the US midterms (i.e. re-election season). Politicians need to show that they have helped fought inflation (as can be seen by the already high interest rates), and that the financial markets show signs of bullishness (as stock market wealth is closely tied to household wealth and more generally, happiness). Notably, this is more conspiracy theory than mainstream consensus.

Given this uncertainty, the best strategy is simply to survive and outlast any prolonged bear market that comes our way.

Moving onto the markets, with Fed absolutely not ready to make any sort of pivot, it appears that the markets only have one way to move. I agree with market consensus that the Fed tap is closed tightly as fk right now, but the point of contention would be _when _the tap can be turned back again to resume the tide of liquidity into the dry markets again. Energy (key component of inflation basket) will likely be bid this winter as countries scramble to generate electricity while bypassing Russia’s ban. OPEC+ and their production cuts aren’t going to help prices either. Thus, one can reasonably expect them to stay elevated for longer.

In terms of my own movements, I’m probably looking to buy more after the upcoming earnings results (soon). My hypothesis is that if the stocks suffer from discretionary slowdown and undershoots its own guidance and market expectation, stock will crash, which will give me a better window to buy. If it doesn’t, it may still likely be dragged down by the market in absence of liquidity.

Essentially, I’m the smart-ass know-it-all investors who assures himself that the stock market will go lower and I’ll back up the truck when that happens. Being transparent every month about my buys/sells compels me to be more serious about investing, both as a passion project and as a means to attain financial freedom.

===

Equity movements

My portfolio is on auto-pilot, with monthly DCAs into the market and quarterly reviews of the companies that I own. It can go lower, but for me it’s too daunting to start hedging the portfolio now. Also, as mentioned last month, I intend to invest more dollars into tier 1 (anchor stocks) and 2 (high-growth SaaS) companies, while adopting a ‘wait-and-see’ approach in tier 3 (retail-focused companies).

I have already reduced the amount of capital for investment due to my current life stage, which limits my purchasing power. With the volatility surrounding company’s earnings, we should instead focus our ‘ammo’ for during the earnings season, and not the weeks before/after. It’ll be increasingly difficult to outperform expectations (as compared to 2020/2021 bull market). That’s my current approach, but it’ll take some time (4-6 years?) to increase my invested capital to my desired short-term target.

The wisdom of increasing your income (over your CAGR %) is quite true in this regard. Focusing on the former speeds up the compounding process because 10% at 100k is quite different than 10% at 50k. Sometimes I do reflect on my career choices and wonder if my salary would’ve been higher had I not accepted my first job.

What would you have done differently, for the first 3 years of your career?

A few months back I also outlined my wish list prices for my portfolio companies, with “now” prices indicating the price as of 31May2022 (which was quite some time ago), and “low” prices indicating the low of the stock at the time. Strikethroughs indicate whether the stock (as of end Oct) has breached passed the prices.

- now $187, low $155 NVDA: $175 / $150 $140

- now $252, low $208 TSLA: $300 (200DMA) / $250 (local low) $183

- now $128, low $112 SNOW: $155 / $140 (10-20% lower) $120 (IPO $)

- now $160, low $130 CRWD: $175 / $160 (local low) $120

- now $83, low $55 SE: $75 / $65 (my first buys in Q2 2020) $50

- now $95, low $76 ROKU: $85 / $75 (near Covid lows @ $56) $65

- now $56, low $50 NET: $75 / $65 $45

- now $105, low $88 TWLO: $110 / $100 $90

- now $95, low $82 DDOG: $100 / $90 $80

It has been 5 months since June; how the prices have changed were particularly illuminating, particularly so the prices for CrowdStrike and Snowflake still remain well above their lows. Prices can always fall further, but I’m still glad to have accumulated more shares in all my holdings bar Roku since June 2022. I am no longer concerned on waiting for the bottom, but instead I’m buying what I can over time, in hopes that the companies I own will grow larger over the next 3-5 years.

My October buys here: TSLA (x2), CRWD

There’s not much else to buy (yet) as I’m expecting earnings season (in November) to provide me with better opportunities. I’ve also pumped in a good amount of capital over the past 3 months, though I’m still trying to increase my allocation in Tesla as it’s underweight right now. They’ve just released their earnings, so let’s review.

Tesla

Tesla’s FCF surpassed 3 billion this quarter (just under 9b LTM); given the revenue of 21.5b that’s around ~14% FCF margins, which is very neat for an “auto-manufacturer”. The FCF allows them to invest in pretty much whatever projects that they have. Their AI day also has the worlds’ brightest AI minds wanting to score a role at Tesla. These speak volumes about talent pool within the company, and also the ability to take many shots on goal (with Cybertruck, Semi, FSD, Insurance, Optimus, and many more). It was a great quarter overall. My full 1-pager review and metrics I track here.

Earnings galore in the next 2 days after I hit “Publish”!

===

Cryptocurrency thoughts

It is concerning that the volatility in crypto markets were somewhat snuffed out like a candle on a cold winter night, yet the legacy markets (SPX, QQQ) are still roaring with it, ripping 5% up and down on the whims of the Fed, inflation, and yields. This speaks to a broader point about market beta, which was indicative of how Bitcoin went to 65k (twice) & ETH to 4.2k whereas legacy indices saw 40-80% appreciation.

The beta of asset X tells you how much X will move given a 1% move in Y. In this case, Y is SPX or QQQ, or a weighted average of both. This beta had helped shape (for better or worse) the cryptocurrency markets into the leveraged financial casino that everybody goes to satisfy their trading itch. Markets closed on weekends? Come to crypto. Markets closed for the Trading day? Come to crypto.

The lack of volatility and the reduced beta (+ lower than average volumes) speaks “volume” because it indicates how serious institutional funds take crypto as a legitimate trading venue. There’s no guarantee that they’re lost for good; if anything the beta/vol will come back during the next bull market, but I think their absence is concerning, especially since we’re still stuck in a range. Like a bouncing ball, it will keep bouncing until there’s no more kinetic energy with which to commit to the next bounce. After which, instead of stopping like a ball, price is more likely to sink?

In this regard, the price is behaving like 6k in 2018, which preceded the drop to 3k. I am not expecting a 50% drop but I don’t see any bullish momentum for the remainder of the year. Thus I’m taking action to at least hedge my current positions, including in the cosmos ecosystem, Solana, and a partial hedge in Ethereum. Hopefully, this allows me to protect my dollar value in the event that prices bleed through the range, while giving me the extra ammo I need to buy depressed prices. Edit: This was written during mid month, where I opened my hedge. There was indeed bullish momentum bubbling beneath closer to the end of month, starting with short squeezes in the market that sent everything near 10%. I closed my shorts for about 1k in losses.

I think I may have overestimated my abilities at trading and keeping my emotions in check. I overmanaged my position, and felt anxious when price moved against me. It wasn’t optimal for sure, but I think that’s enough of a reminder to keep me in long-only positions from now on. Thankfully, I limited my risk and didn’t risk every $ of cash I have. Starting a hedge at these prices was also, frankly speaking, too little too late, and I paid the price for it. Let’s see what Q4 brings, and whether there’s opportunity for me to continue allocating $ into longer-term spot positions.

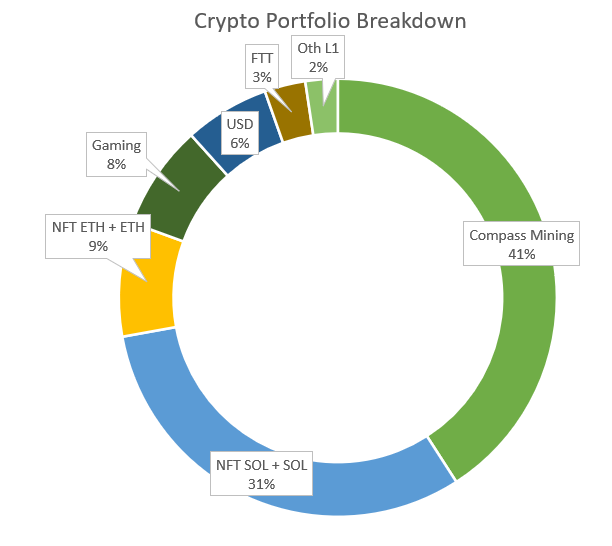

My holdings here:

I recently added another DeGods NFT as I felt the drop in floor price (normally 330 to now 260 SOL) is a good short-term discount that smells of opportunity. I’m also long-term bullish on this project and the associated DUST ecosystem (see my writeup last month). The purchase took a healthy chunk out of my cash levels. To restore balance in my mental state (and my cash position) I sold some positions that I felt will never see the light of ATHs again, namely these 3 coins: TraderJoe, Basis Markets, MMA Gaming. I intend to reposition into Merit Circle and Vulcan Forged (as a longer-term gaming play), and Ethereum as part of my core holding. ETH’s supply change has indeed decreased since the merge, which is a longer-term slow-and-bullish catalyst.

Come what may, I’ll just be DCA-ing into the markets as per usual, and hoping for the best when the bull markets come back around.

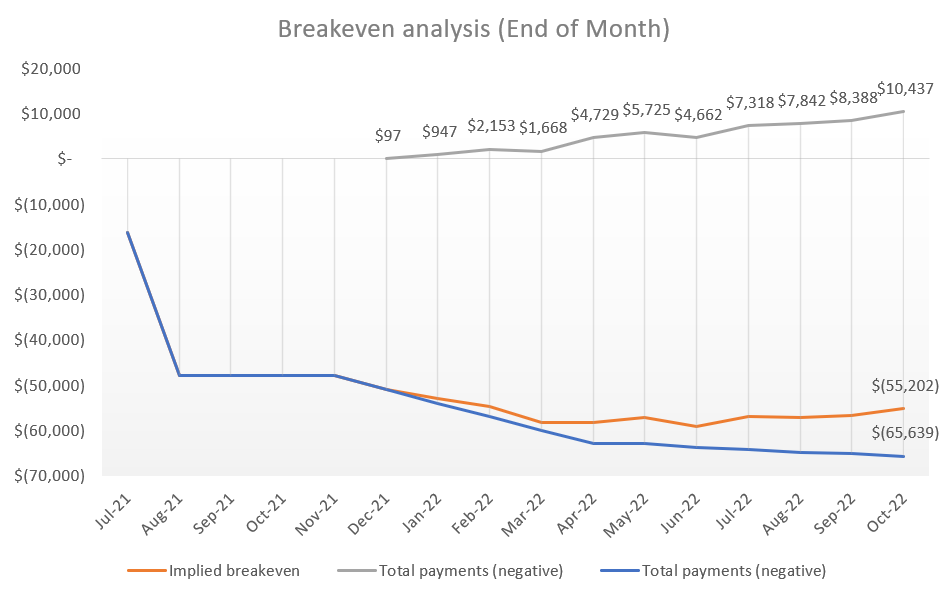

Bitcoin Mining

The last 2 out of my 8 miners are still not online, but glad to see the rest chugging along just fine and allowing me to DCA into Bitcoin. My profit chart below. At these low prices, it might take a little longer than 2 years to breakeven, and with my cash strategy, I’d hate to see these satoshis go to waste by me continuously selling my miner profits to cash. Then again, the volatility of bitcoin speaks for itself; the price could very well be $15k or $22k the next day - we just don’t know. I guess that’s why going to cash is such an alluring strategy. My profit chart here.

Slow but steady…

===

Life

Check out my life section here. I talk about what I bought for my upcoming home, and about whether my current job is indeed suitable for me or not.

Conclusion

Thank you all for reading thus far. It’s an exercise in itself to fill this article with words, and another to ensure that the words mean something to the reader. Both writing and investing are active pursuits that I’m attempting to improve in, and excel at in the near future. Let’s get that bread!

See you all next month.

Cheers,

Joey

Comments

216

5

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

216

5

Advertisement

No comments yet.

Be the first to share your thoughts!