Advertisement

OPINIONS

Portfolio Review - November 2022

"Effective Altruism" - I talk earnings of ROKU DDOG NET TWLO (sold) SE NVDA, FTX implosion, my crypto rebalancing

Full article on Substack (including my life journey!) can be found here. My substack profile here. My Twitter profile here. Previous month's Seedly opinion article can be found here (equities and crypto).

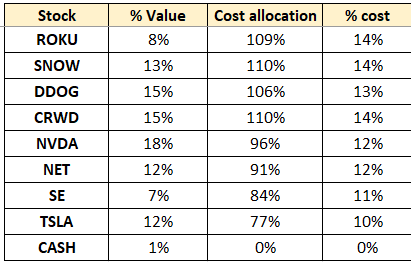

Equity Portfolio Breakdown

% Value: Value as % of my portfolio % Cost: Cost as a % of my total cost invested into equities Cost allocation: Based on my set target in USD. 100% means over-allocated…

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

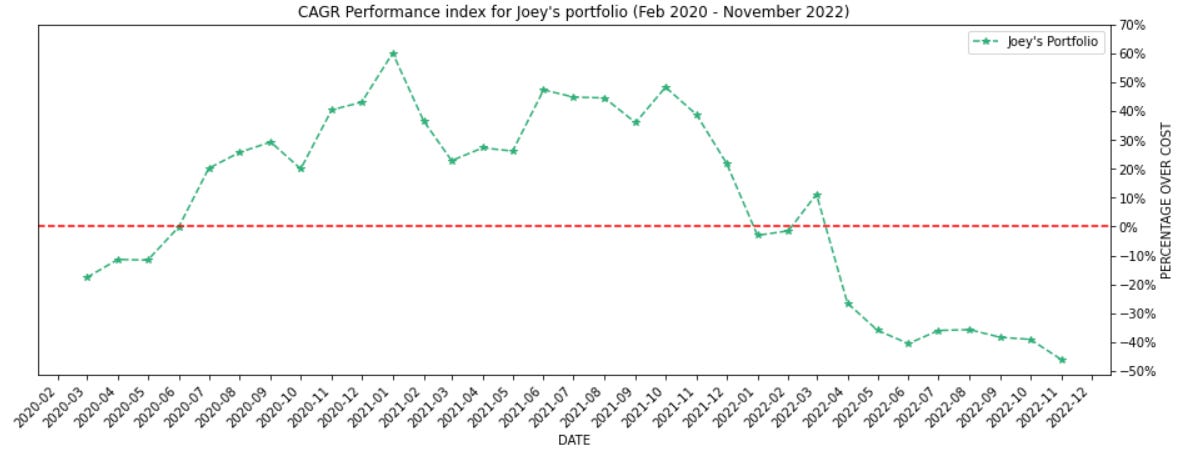

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky.

Time-weighted returns (IRR) & CAGR (top); Historical returns (middle); Cumulative returns (bottom) - Since new brokerage.

CAGR* Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. The CAGR returns are compared in the above table instead.

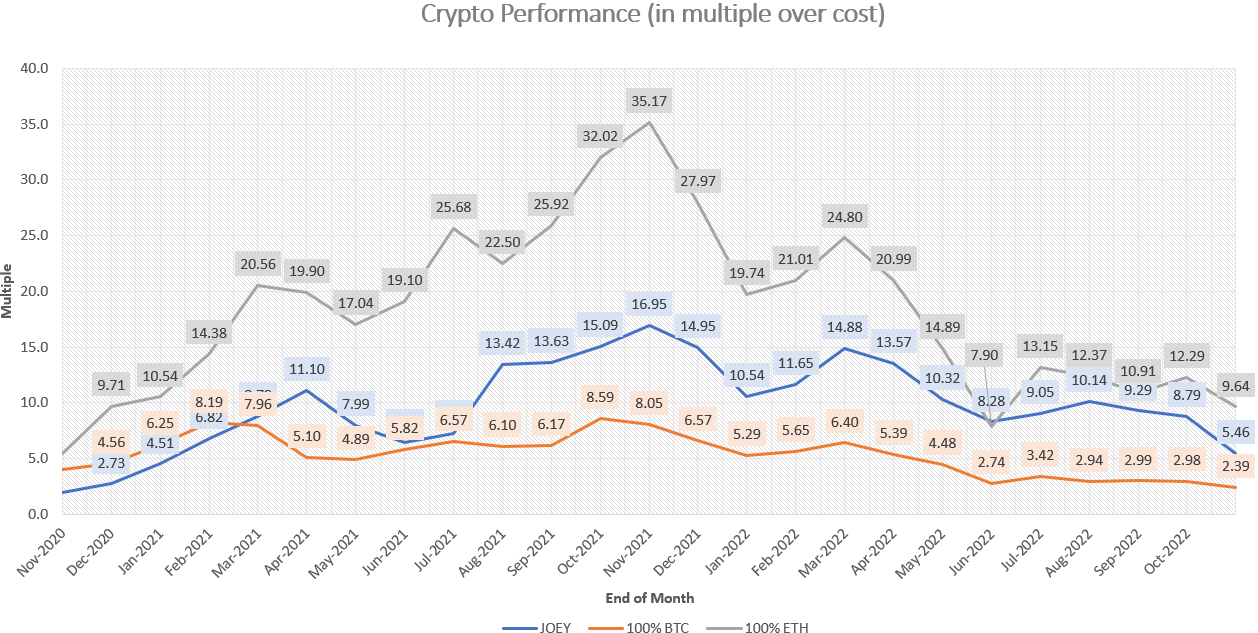

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio 2021 performance: 5.5x-ed my 2020 portfolio Lifetime performance: 5.5x my cost

Lifetime result:

- Achieved 2.28x of BTC performance (5.46/2.39)

Achieved 0.57x of ETH performance (5.46/9.64)

Goal is to try and outperform BTC and ETH from here on out (Tough luck beating BTC/ETH when you’re a victim of FTX…)

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.

===

Equity Portfolio

There’s not much to update since the previous article; I’m still a net buyer of stocks. Much of portfolio companies released their earnings and I’ll be providing a short commentary below. I’ve also rotated out of Twilio after looking at their earnings into Datadog, Cloudflare, and Tesla. What’s left for Q3 earnings would be Crowdstrike and Snowflake, set to release their earnings during the turn of the month.

I’ve previously spoke about my portfolio framework (i.e. Tier 1/2/3), and it still applies:

- Tier 1 (Anchor stocks): Tesla, Nvidia

- Tier 2 (High-growth SaaS): Crowdstrike, Snowflake, Datadog, Cloudflare

- Tier 3 (Discretionary / retail companies): Roku, Sea Limited, Twilio (sold)

It’s a little late to consider rotating out of these stocks into cash; Companies don’t grow into billions of market capitalization in a quarter, and so our patience with these companies shouldn’t be quarter long. Like a marathon, you would ideally place your bets on the steady runner vs someone who starts out fast on adrenaline only to succumb to fatigue halfway through and walk the rest.

5-10 years may seem like an awfully long time (after all, I’m only 28 years old), but it’s important to leave the power of compounding uninterrupted. A company growing their revenue every quarter by 5% can hit 7x in 10 years. Tesla grew at an average of 10% per quarter; they’ve almost 3x their revenue in just under 3 years (2019 Q4 to 2022 Q3). The bottom line is what matters of course; Tesla grew its operating profit 3x in the same period as well. That is nothing sort of impressive and it paints a compelling story about the power of compounding (& long-term shareholder value).

Anyway, here are my thoughts on the companies that have released their quarterly earnings in November:

Roku

Roku is still experiencing macro headwinds, evident from their worsening operating profit (had to sell Players below cost to attract new customers). Onboarding new customers is an inevitable race to zero margins due to the competitive nature of these products. In a recessionary environment, who wants to spend $ on stuff? This cuts across Roku’s platform revenue as well, with advertising budgets being slashed mercilessly, hurting both their revenue & margin profile. The weakness from the ad market will persist well into 2023, which is concerning. Should Roku be unable to ride out the storm, the company may get bought out by bigger players thus capping future upside. The silver lining though, is that engagement and reach of their in-house channel (The Roku Channel) still improved considerably, giving advertisers bang for their buck when these budgets do come back.

With the expectations of recession rising considerably, it may be a long while before fundamentals recover. Until then, this company is a HOLD.

Datadog

Datadog’s growth has slowed, as expected, but is still growing revenue and large customers at a healthy clip, whilst maintaining the best-in-class DBNER (Dollar-Based Net Expansion Rate) of over 130% for 21 consecutive quarters(!!). Its Free Cash Flow margins are sitting at 15%, though lower than 30%+ few quarters before, but still positive. Datadog is the clear leader in the observability space, with its culture of high-speed iteration and innovation boding well for its foray into the security space too. This opens up new sources of revenue, which also sees them gain further market share. The SaaS nature makes Datadog less vulnerable to budget cuts, as the platform brands itself as mission-critical; Datadog watches over all metrics, traces, and logs, monitoring the health of any tech stack / platform at any point in time.

It’s a company that I envision to be much larger than it is today, and it’s a stock that deserves my investment capital. This company is a BUY.

Cloudflare

The company is in a similar situation as Datadog, but with 2 key differences:

- Smaller scale (Datadog’s 440m vs Cloudflare’s 252m in quarterly revenue) and

- Not cash flow positive (~ -2% in current and previous quarter).

These 2 differences lowers Cloudflare’s valuation, though there are things to be optimistic about that could justify its current premium. Their CEO has recently stated that their product roadmaps consists of 4 acts: Content Delivery Network (CDN), Security, Zero-Trust, Workers. From what I can tell, from a revenue standpoint, Cloudflare has moved past Security and is currently marching towards Zero-Trust. Zero-Trust and Workers are bets on the bleeding edge of technology, which if materialized, can bring an inflection to revenue growth, supporting their longer-term guidance of a 50% CAGR in growth.

Zero-Trust is already validated by the cybersecurity space as the next step, which leaves Act 4 (Workers aka Edge Networks aka supercloud):

With their presence in almost everywhere and anywhere, they’re able to shoulder the pains of server-side configuration, allowing developers to simply write and deploy code while leaving everything else to Workers (i.e. VM provisioning, # of cores). They already have 1 million developers on it, and have recently announced a $2b launchpad program to entice more developers and startups to use Workers. The future is exciting, and I’m happy to be an investor in this company (BUY).

Twilio

Twilio was still able to grow revenues at a large scale (983m vs 943m prior quarter) is already impressive. However, it has been bleeding money since 2019, with an average of -30% in operating margins. Not only that, their DBNER has waned since the height of Covid (143%) to 122% in its most latest quarter. With the secular tailwind of every company wanting their own 1st party data (& hence would want to use Twilio’s customer data platform), there isn’t much traction to be seen. I became less impressed with the management, their growth and margin profile (unable to turn cash flow positive with margins deep in the red), as well as their SBC/dilution. Despite the valuation being near rock bottom, I am no longer confident that they will be able to meaningfully increase their EPS and break even in this environment. Turnaround stories are the hardest and that’s why I sold it for Cloudflare, Datadog, and Tesla.

Sea Limited

The markets definitely loved Sea Limited’s aggressive cost cutting, though the bleeding cash cow in Digital Entertainment is still a major cause for concern. While management has stated that they aim to hit Non-GAAP profitability for the whole of Shopee by the end of 2023, will it be fast enough to replace Digital Entertainment, assuming Free Fire loses its shine as well as its players (worst case scenario)? I don’t believe that will happen, but if it does, then the 2 heads of Sea Limited in 2021 just became only 1 (Digital Financial Services, or DFS is still far from being a material contributor in revenue). Like Roku, it is not immune to the recession, and as discretionary spending slows in developed regions, players in Asia should also spend less (in both Free Fire and Shopee, perhaps), leading to possibly lower revenues all around. It’s not a sell, but I’m going to pause adding into Sea Limited for now (HOLD).

Nvidia

The chip company continued to see softness in the gaming and visualization segment, while data center revenues managed to stay flat. Based on the CEO’s commentary, it’s likely that all 3 segments of gaming, data center, and automotive will see modest sequential growth. Assuming the softness in gaming segment can be resolved, the upgrade cycle in new GPU architectures (i.e. Ada Lovelace, Hopper for data center) will continue to grow revenues on the all accustomed upward trend. With broad-based AI adoption this decade, high-performance chips will forever be in demand and that says a lot about their eventual market share in 2030. I’m bullish.

===

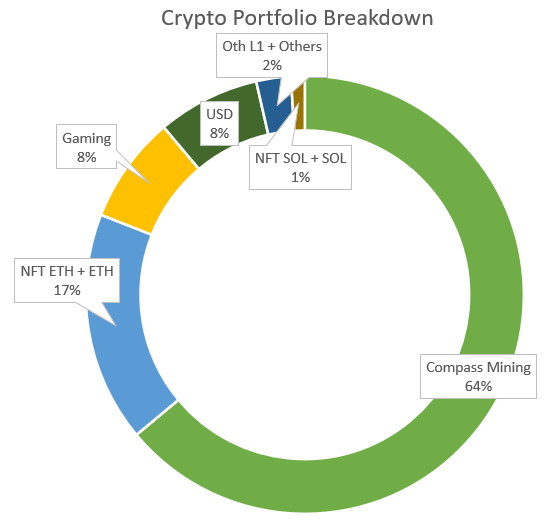

Crypto Portfolio

If there was ever a apocalyptic event in crypto - the LUNA saga was far and away the first, with FTX a close second, forcing me to drastically rebalance my positions as the saga unravels. Aside: FTX implosion was likely due to bad debts from LUNA implosion.

The FTX saga did numbers on my portfolio - forcing my hand to drastically rebalance my positions in light of this. If you hadn’t heard about FTX or don’t know how exactly it unfolded, you may wish to read these links below:

- Article from Investopedia here, 20-tweet thread from Delphi Digital here

- Sam’s confessions to reporter post bankruptcy here and his final thread here

- For the savvy crypto folks Adam’s mega tweetstorm here

- Unrelated Potential contagion for the rest of crypto here

- Unrelated Singapore’s sovereign wealth fund writing down its FTX investment, and is opening an internal review on its investment.

Of my crypto assets, the entirety of my cash position (what little it was) was on FTX, which includes the FTT token (bought in early 2021 to enjoy fee discounts & free blockchain transfers), as well as a longer-term small spot position in Solana. It was truly painful and shocking that this happened, but it was even more surprising as many in Crypto Twitter (CT) (including folks who have been in crypto since 2017 or even earlier) similarly placed their funds, and their trust, with Sam Bankman-Fried.

For me personally, Sam and his turbocharging of the Solana ecosystem helped me reached a low-mid six-figure portfolio for my crypto assets (though I stupidly HODL-ed most of it). I paid attention when Sam infamously put a $3 floor in the price of Solana. Imagine my euphoria when Solana topped out at reached ATHs of $240+ near the end of 2021; good for a near 100x return. Never sold it all though. Sigh.

Furthermore, FTX and Alameda Research were quite heavily involved in the Solana ecosystem, setting up Serum, which is a decentralized engine leveraging on legacy market’s Central Limit Order Book (CLOB) to speed up trading on Solana. Sam and co were also heavily investing as VCs in many of Solana ecosystem projects. I wasn’t as savvy as I thought, and was blindsided by FOMO as I diversified into “Sam Coins” (colloquially known as coins on Solana which have low circulating supply relative to total supply, grossly inflating the Fully Diluted Value (FDV)).

Financial markets were flushed with liquidity back then, and while the inflation driven crash took out most of my unrealized gains in crypto, it didn’t strike me that Sam would be the main perpetrator behind wiping out my gains; It was just me not being savvy of an investor to take profits while everybody was euphoric.

Fast forward to May/June 2022 and on the Luna ecosystem. Back then, this was the most important crisis of 2022; LUNA and UST essentially become worthless overnight. Read here for a good summary of what/how/why it happened, and the market-wide repercussions.

The fallout caused many large funds and players to capitulate alongside the Terra ecosystem. Infamously, 3 Arrows Capital (3AC), which was one of the largest funds (in AUM), had doubled down on their LUNA position as it was crashing. 3AC rode the liquidity tsunami of 2020/2021 and made _big _profits on coins, such as ETH (they famously described 100k ETH as “dust”).

With their famed reputation, 3AC was able to secure many lines of credit, and at an eye-watering interest rate. This fueled their massive trading operations up till the LUNA/Terra crash. Post-apocalypse, 3AC had no money to return funds who were willing to throw money at them, leaving a gaping hole in the crypto-capital markets.

As the contagion spread throughout crypto, other protocols/exchanges started freezing withdrawals and even filing for bankruptcy. With no Fed backstop, crypto was left to die a sad miserable death.

In came Sam, who claimed to come away from this crisis largely unscathed. With “loads of capital”, Sam began to buy distressed entities to further expand his already large crypto empire (his FTX exchange was the top 5 global trading venues for spot tokens). With his lobbying for crypto regulations in the US government, everybody thought Sam was the vegan-effective-altruism-dude who will shepherd crypto to new highs once again. Of course, the rest was history (see Investopedia article here).

I was a natural skeptic due to the number of times protocols get exploited (even I had been scammed in 2021). However, all of that was for naught, as I was biased to SBF, thinking that he could do no wrong, and that he’s still a good actor for the space. This was why (in hindsight) I didn’t withdraw my money out of FTX until it was too late.

I got catfished, basically, and because of this, crypto will likely be sent to the dark ages with full-on regulations that will stifle innovation in the blockchain space, pushing the entire industry back by at least another 5-10 years. Sigh.

Enough rambling, let’s talk about the rebalancing that I did for my portfolio:

Knowing that FTX and Alameda Research had it roots deep in the Solana ecosystem, as well as my soft spot for Solana and its attractiveness as a competing L1 to ETH, I liquidated all of my Solana portfolio, even my NFTs which I had intended to hold for the long-term.

- NFTs: 3 DeGods (sold @ 165 SOL each), 2 Y00ts (sold @ 47.5 SOL each)

- Tokens: 69 SOL in FTX exchange (can’t sell), sold 4310 DUST at $0.27

Solana was priced around $18.5 back then (around 11 Nov 2022), a huge discount from its pre-crash price of $33. The total value in NFTs and DUST sold were about 12k USD. The USDC was bridged to ETH, then used to buy some ETH, with the remaining being sent to my Trezor cold wallet. It was a hasty decision because I was worried about the contagion effect it had on the broader Solana ecosystem.

It’s now 1 week later, let’s review if that’s the right decision (from a PnL standpoint):

- DeGods (now 349 SOL), Y00ts (now 127 SOL), DUST (now $0.45)

Solana is now $13.58 (end of month), so the total value here would have been: $17668. My opportunity cost from my ‘hasty’ decision was 5.6k USD.

The above is simply a thought exercise to assess my decisions when push comes to shove. Had I not sold, would I have sold now? Would I have taken advantage of the mini euphoria in NFT land? Or would I have held for better or for worse? One thing’s for sure, the NFT project has been building throughout the bear market and I’ll surely keep a lookout for any potential discounts if it ever materializes.

In any case, without the covid-driven FED printer, it’s hard to see how crypto can hit ATHs again in 2023, especially with oncoming regulations stifling innovation. That said, I believe that DCA-ing in ETH (70%) and SOL (30%) will be profitable 5-10 years out. I’m also doing DCA into Bitcoin by way of my 8 miners too.

Given the velocity of events unfolding in crypto, I feel increasingly out of touch with the crypto space, with my work as well as personal events commanding more of my time/attention, leaving even lesser time to find another 10-100x coin like Solana.

I’m still a long-term believe in Crypto / Bitcoin, but will probably shift my focus back to the equity markets going forward. This is not goodbye for the crypto section of course, as I’ll continue to broadcast my portfolio changes & broad sectorial thoughts.

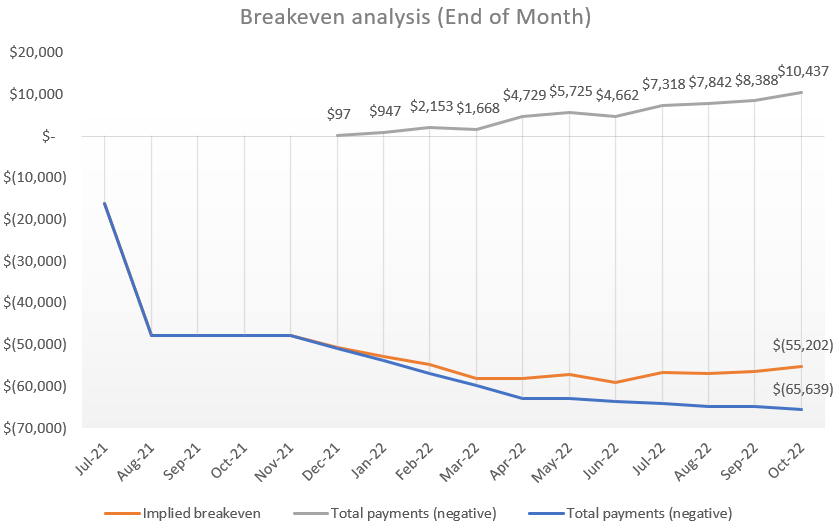

Bitcoin Mining

No change or updates, miners just keep mining. The only concerning thing about this is that I would need USD to pay for hosting fees, which was why I liquidated my NFT portfolio in the first place. It’s definitely way easier when Bitcoin was at 60k; I could sell 0.01BTC for $600 and pay half my hosting fees. Now it can only pay 1/6 of it. Tough life, but all these is for the expectation that price will eventually trend higher 3-5 years into the future, so I’m willing to wait for that. Profit chart here.

Life

Half-Marathon

Find the full section here on Substack.

Reservist / Eventual career path

Find the full section here on Substack.

Conclusion

Thank you all for reading thus far. Till now, I’ve gotten an average of 50 views per month, and I have no idea who’s reading this. I don’t have plans to improve the viewership; posting this just allows me to upload my thoughts online, available for all to see (including my future generations).

I encourage people to do the same, because it’s the fastest way to achieve growth (by honest self-reflection). We are stuck in this rat race for the rest of our lives too, so why not make plans to bring the finish line closer to you?

See you next month!

Joey

Comments

171

6

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

171

6

Advertisement

No comments yet.

Be the first to share your thoughts!