Advertisement

OPINIONS

Portfolio Review - Nov 2023

No sell November/December/12months of 2024

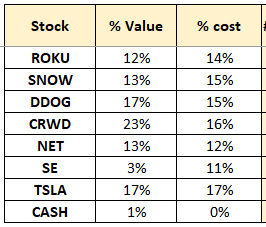

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

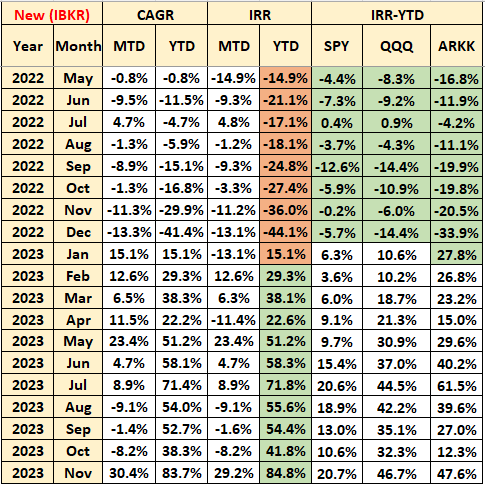

Equity Portfolio Performance

Historical Portfolio Returns (top); Cumulative Portfolio Returns (bottom) - Since new brokerage.

Monthly Portfolio Returns

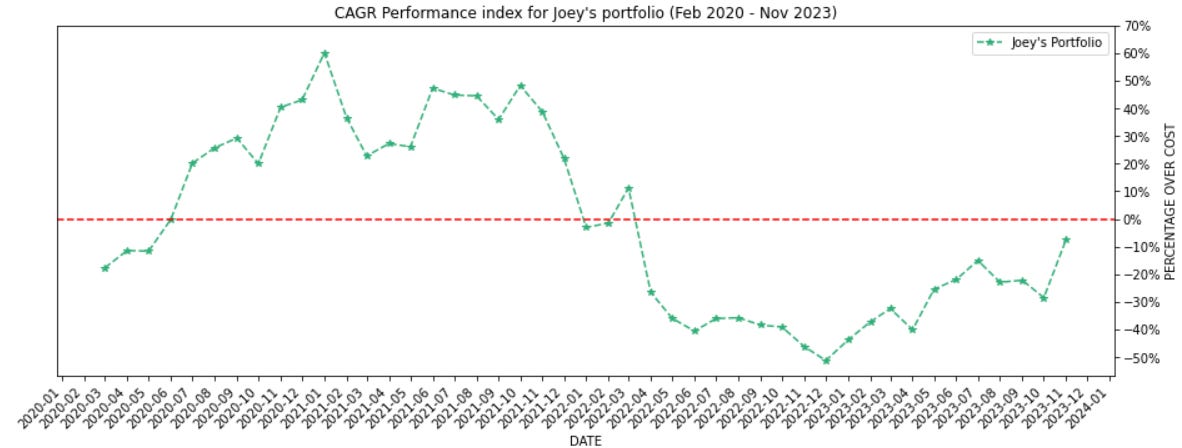

CAGR Performance

0Note: CAGR for my portfolio is calculated as:

(market value of portfolio including cash / total cost) - 1

The CAGR returns are compared in the above table instead.

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 9.71x my cost

Lifetime result:

- Achieved 1.83x of BTC performance (9.71/5.30)

Achieved 0.63x of ETH performance (9.71/15.37)

Thank you Solana.

Net worth growth

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

To read this chart:

- I’ve received ~23.44x my Jul 2019 net worth, in terms of income / bonus.

- I’ve made my money work, and my net worth now is ~25x my Jul 2019 net worth.

- I’ve accumulated savings of 7.4x my Jul 2019 net worth.

Red line is an extreme example; Anywhere between grey and red is acceptable, since you’re supposed to compound your savings, and not your income (i.e. you don’t spend anything). Onwards and upwards!

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.

Portfolio Commentary (Stocks)

It’s been super busy for me, what with an overseas trip in Aug, my wedding in Sep, Japan trip in Oct, and just heavy workload in November. I think it’ll be another short article for this and subsequent months, since commentaries are largely just blabbering. Importantly, as long as you’ve got results to show for, that’s good enough.

I don’t have a read of the market, but I do know patience and long-termism is well rewarded, now and into the future. No real use worrying about whether inflation will pick up, given that markets are usually forward looking. By that I mean, the market would have already anticipated that inflation would die down (thus lesser need for rate hikes) and position accordingly.

Given my limited attention on the markets, just a simple quarterly check-in with your portfolio companies will do wonders to your CAGR, assuming you’re continuously verifying the theses of these companies. I’ve been doing for over a year now for most of my companies, and will continue to do so in as and when I can.

I’ll continue to share them here, but it’s important that you (if you’re interested in stock-picking) form your own opinion on companies first, before corroborating your view with other investors (who may or may not be smarter than you). This is VERY important when your company craters 15% or more on a somewhat decent quarter, and the reason for that drop was the not-so-decent forward guidance.

Anyway, I’ll try to add exposure slowly into markets, and I remain hopeful that the worst is mostly behind us - greener pastures are coming, if we just bullieve~

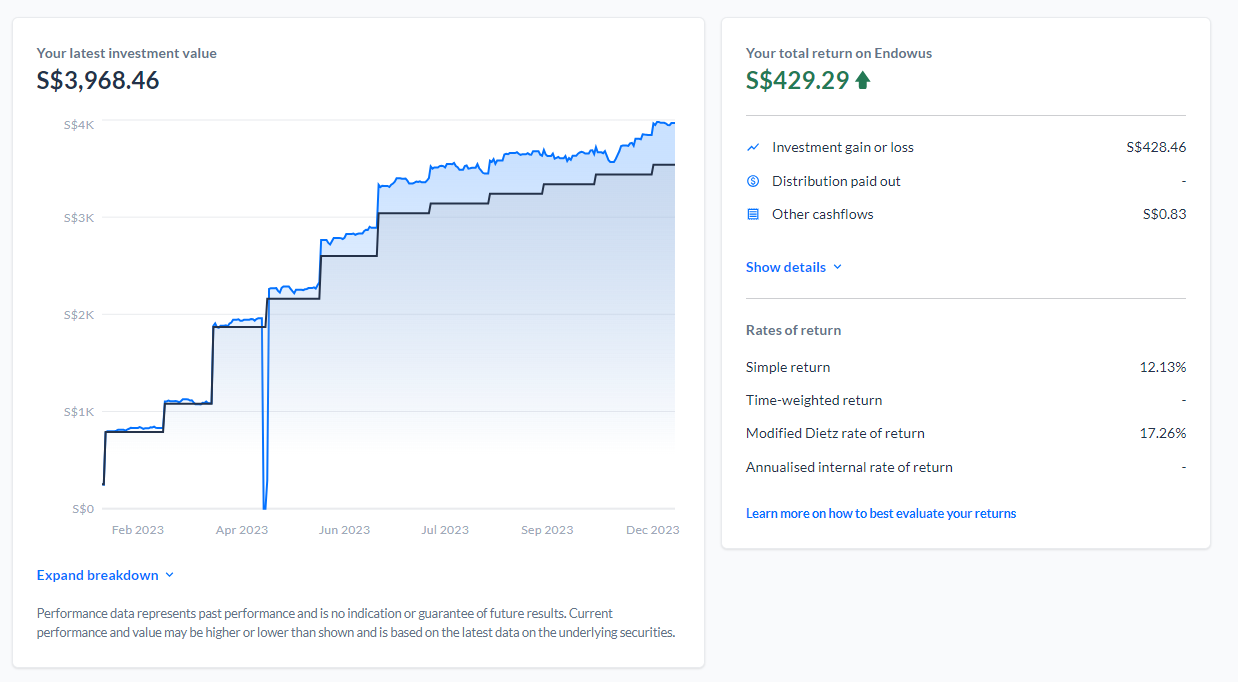

DCA Strategy

Endowus

Tiger (Uranium ETF)

Mining

Crypto Portfolio Holdings

Solana fever hit this month, with prices ballooning to $60+ before taking a pitstop at $50+. In all honesty, I have pretty high conviction that Solana will experience outsized gains relative to Bitcoin and Ethereum, likely due to law of large numbers limiting the % gains to be had on the majors, but also due to the appeal of Solana as a performant monolithic blockchain.

Bitcoin has its own use case (i.e. Money which transcends nation and state), whereas Ethereum is competing with not just Solana, but all its other supporting L2 chains. Recall that Ethereum has scaling limitations, and right now it’s throughput is somewhere below 50 transactions / second. Users who wish to transact either pay fees in the form of gas (which can spike to $50 in times of high demand), or do so through L2 ecosystems instead. Hence, the total value of Ethereum as a mega ecosystem is the cumulative value of Ethereum and all its L2 tokens combined.

Suppose that Ethereum wins the scaling war with the help of L2 tokens - where would the value accrue to? To Ethereum, or the L2 supporting chains? For me, I had a tough time figuring this out, thus the narrative that it’s “Only Possible On Solana” greatly appeals to me, given that developer activity + real-world projects are already gaining traction. Happy to take on that risk and denominate my portfolio in SOL until I’m able to reap most of its gain after the upcoming bull market.

Solana

Well well well, how the turntables… Surprising (at least to me) to see Solana attention hitting ‘critical mass’ - this despite Sam Bankman-Fried largely treating Solana as his ‘pump-and-dump’ playground. It appears that the overhang of SOL supply (embroiled in the FTX bankruptcy) is over us, and what appears ahead are blue skies that are only possible on Solana.

Being a not-so-active, but active-than-most user of the crypto space, I found Solana’s UI and ecosystem particularly refreshing, even while many OG protocols strive to be the next uniswap _or _aave. For the most part, the technical trade-offs made for magic to happen on the Solana blockchain has enabled truly innovative (_some might say scammy) _products to come alive, complete with real-world use cases, such as Helium network, Hivemapper, Render Network, as well as P2E games such as Star Atlas (i.e. the next Eve Online).

I’m glad that my investment / interest in the Solana space has borne fruit, and I hope my readers do too, though there’s still so much up for grabs, and its still so early. I have a bunch of friends more acquainted in the tech space, and until they mention Solana, it’s still quite early in terms of mainstream adoption (ever heard of ETH?).

Because of my conviction (borrowed or otherwise), I’ve decided to primarily denominate in SOL for my investment portfolio, and am looking to continue accumulating more coins until my _golden number _is reached. Denominating in SOL means that every other investment is weighted against the opportunity cost of not investing in SOL. For example, if I own BTC, would I earn more USD profits being in the orange coin, or in the purple coin? The answer is pretty clear to me.

While BTC and ETH does have proper institutional flows by way of ETF applications, I see the eventual approval of these ETFs as lowering the flood gates for retail participants to get exposed to the crypto markets. Bear in mind, the retail mania of 2020 will buy your BTC / ETH for sure, but everybody’s searching for more yield (returns), and in an environment where rates are likely headed downward in the next 1-3 years, the time of easy money should be upon us.

What happens then?

Conclusion

Once again, thank you, to each and everyone of you, that bothered to read / skim / scroll through the entire article. The flow for the article was quite abrupt but that was because I didn’t have time to frame my thoughts into meaningful prose.

See you next month!

Cheers,

Joey

Comments

477

0

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

477

0

Advertisement

No comments yet.

Be the first to share your thoughts!