Advertisement

OPINIONS

Portfolio review - May 2022 (Crypto)

Welcome to Goblin Town - Part Deux

Full article on Substack (including my life journey!) can be found here and here. My substack profile here. My Twitter profile here. April's Seedly opinion article (on Crypto and Equties) can be found here.

Regrettably, this newsletter about my portfolio has gotten a little long. Hence I’ll split it into 2 parts. Here is a handy table of contents (which might change from time to time) that you can navigate around to read the parts that interest you.

- Portfolio performance

Equity breakdown Equity performance Equity movements Crypto performance

Net worth changes

- Commentary - Crypto

Broad commentary

My portfolio holdings + movement

LUNA + UST: What happened and my actions

AVAX / SOL: My investment thesis

Compass Mining activity

- Life (in Substack link above)

===

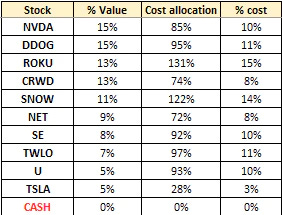

Equity Portfolio Breakdown

% Value: Value as % of my portfolio % Cost: Cost as a % of my total cost invested into equities Cost allocation: Based on my set target in USD. 100% means over-allocated…

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

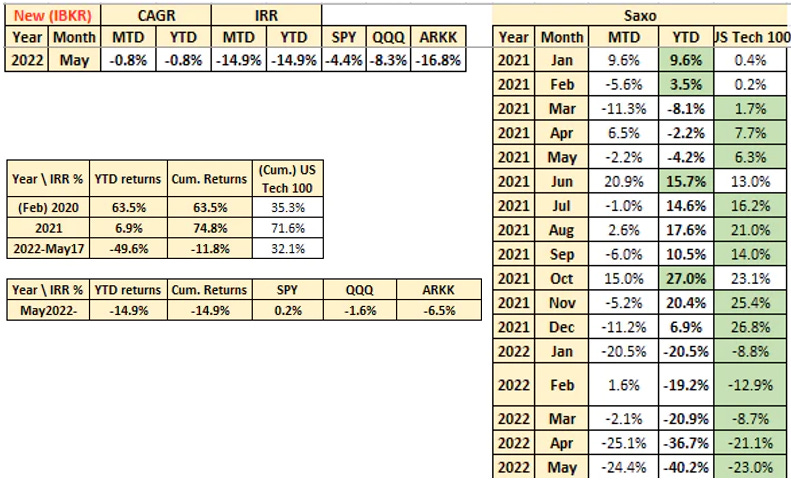

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky. It is clear as day though, that my portfolio was decimated in May (despite the end-of-month rally). Down, but not out. 💪🏻

Time-weighted returns (IRR) & CAGR - Past 12 months (right), New brokerage (top left), and cumulative (bottom left)

CAGR* Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. CAGR for NASDAQ & SP500 is calculated by retrieving the month’s performance (e.g., 5%), then extrapolating it over previous month’s market value + $ injections in the current month. This is also known as money-weighted returns.

It’s a good measure for non-investment savvy folks who wants to know how much money they take out vs what they put in; Value over cost. My chart is an attempt to simulate this by using MoM returns of classic benchmarks to compound my cumulative additions into stock markets. I’m doing this bc investment calculators for NASDAQ & SP500 isn’t as accurate I would like them to be.

===

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.😊

===

Equity Portfolio Changes

Added: DDOG, U, TWLO, SNOW, ROKU

Started: TSLA

Trimmed: nil

Sold: nil

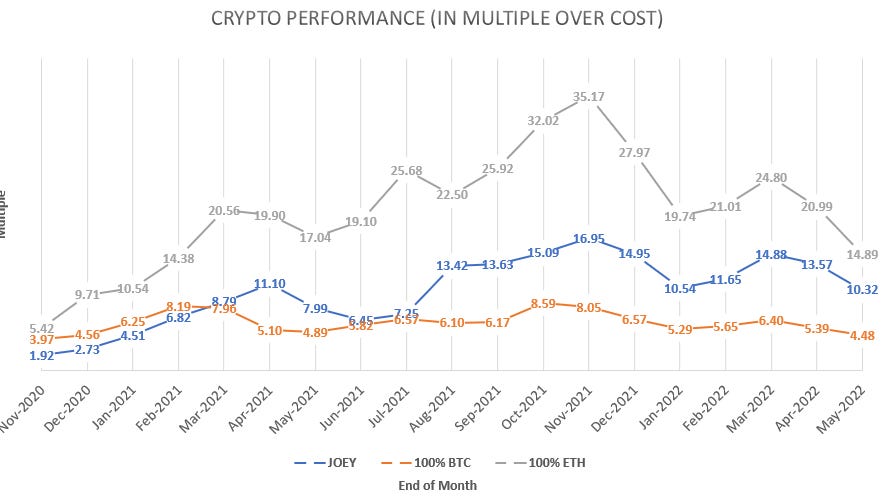

Crypto Portfolio Performance*

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio 2021 performance: 5.5x-ed my 2020 portfolio Lifetime performance: 10.32x my cost

Lifetime result:

- Achieved 2.30x of BTC performance (10.32/4.48)

- Achieved 0.69x of ETH performance (14.89/10.32)

Goal is to try and outperform BTC and ETH from here on out. 👍🏻

===

% of Net Worth (direction change from previous month) in:

Stocks: 15.1% (🔼🔼) Crypto: 75.2% (🔽🔽)

Net worth excludes fixed assets (e.g. house).

===

Crypto

Bitcoin started off at $38k, and ETH $2.7k. Everything was fine, but with the broader market sentiment then, it was practically begging for a 5-10% dip, which Mr. Market dutifully obliged. Then came the LUNA blowup, which I’m sure has unforeseen knock-on effects going into the summer because of the breadth and depth of VC money that was implicated in this. Inflation is still high, Fed is still tightening, and my stance on the crypto markets are largely similar to the stock market due to its high correlation (which happens during bear markets, though crypto has decoupled onto the downside).

Any investor looking at this asset class for a longer-term portfolio should focus on a few things:

- Value accrual

- Portfolio management

- Survival

I’ve discussed value accrual quite a few times by using certain examples such as Anchor Protocol (March article), TraderJOE (February article), Degods (April article). The core idea is that tokens (like stocks) are usually a way for VC or seed funds to manufacture exit liquidity, given that they bought it at prices practically near $0, and will want to sell as soon as their tokens are vested. Without a robust accrual mechanism in place, there will always be structural outflows weighing down the price of your favorite tokens (e.g. $MKR, $LDO).

While speculative premium is a thing, I find that narrative (& actual premium) generally works well only in bull markets. In bear markets investors are much, much more stringent in their portfolio holdings which leads to another 90% drop after a 90% drop in our favorite coins. Most of the coins that we hold are unlikely to survive to the next cycle, simple due to the pace of technology disruption in crypto and Web3. The main coins that have stood the test of time (aka Lindy effect) will continue to do so - those should represent a healthy proportion of your portfolio. Any altcoin we trade should be used to accumulate more of these coins for the long-term. For me, that is ETH BTC (main) and SOL (semi-main), and denominating in BTC and ETH for now, instead of vs USD.

The main difference lies in the former group taking a longer-term view on crypto as an asset class experiencing global adoption (which has been _prophesized _for many years now). When that happens, you should want to denominate in coins because then your dollar value should have appreciated even more more (by way of those coins appreciating in value and you accumulating more coins). Of course, crypto can just drift into irrelevance and slowly fade to $0. Who knows?

Which leads me to my next point: Survival.

If you truly want to invest in the crypto markets, you’ve got to understand that it’s like stock markets on hard mode. Why do I say that? Crypto as an asset class has yet to undergo widespread regulation, and it’s total market cap still dwarves that of the stock market. This means that any dedicated party can initiate market fluctuations by moving price beyond a certain % of Average True Range (ATR), which would trap a good amount of stops. We saw that very clearly with LUNA/UST (more below) that has wiped out billions of funds from investors who (for better or worse) believed UST to be equal to 1 USD, and parked their hard earned money (sometimes even family savings) all into this, which are now worth very near 0.

Survival is such an important point because of the positive reflexivity that has benefited crypto over the past few cycles. For us to get rich, we need to buy low and sell high. Can’t really do that if your portfolio is worth $0 and you don’t have any USD lying around to capitalize on depressed prices, right? There’s plenty of ways to survive in crypto. For me, I have my main altcoins that I’m looking to accumulate more of, as well as select alts that I feel have speculative premium going to the next bull cycle. Then I also have some cash to buy alts (one can always rotate from main coins alts for a play on higher beta).

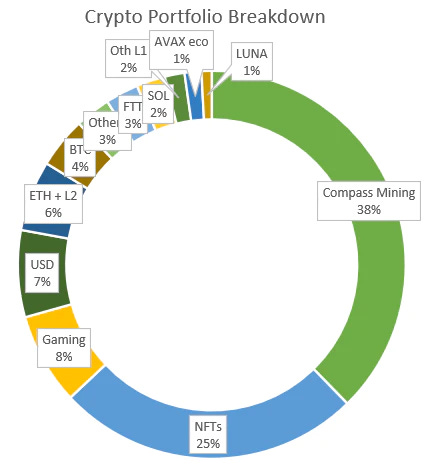

Anyway here are my portfolio holdings:

Token holdings

Holdings not in order of size, degen plays (if any) excluded:

L1s: LUNA (v2) SOL AVAX (incl. JOE) Cosmos (ATOM JUNO OSMO) Gaming: MC RAIN JEWEL (incl. CRYSTAL) PYR MMA Infrastructure: SHDW POKT Large caps: BTC ETH (half in stETH) Others: BASIS FTT

Not financial advice. I may rebalance my portfolio at any point of time.

I didn’t make many changes besides responding to the LUNA/UST saga below, which was very timely in hindsight; managed to get out of UST with only a small loss. (LUNA holding explained below) I’ve also been converting my mined bitcoin into either cash or ETH. Given the small cash amount I have in stables (now bigger % since my alts are crashing in value), I will need to be patient in deploying them, and will hopefully do so aggressively when true panic hits.

===

Terra-Luna + UST

The symbiotic relationship between LUNA (the token) and UST (the algorithmically backed stablecoin) took a turn for the worse (understatement) when it briefly de-pegged around 08 May 2022. Let’s recap for those who may not understand.

Stablecoins = crypto currencies that peg to a specific currency (USD, EUR). The USD supported & enforced by the US Government (USG) is backed by hard assets (gold), foreign reserves (EUR, JPY, GBP), as well as global faith & trust in the US dollar system (which is the world’s reserve currency). There are a bunch of stablecoins in crypto that try to do the same. The big ones (USDC, USDT) rely on central entities to back each token issuance with an actual asset, usually US paper like Treasuries, bonds. Essentially, you can be quite sure that the USDC minted is agreed upon by the majority of crypto that it is pegged to 1 USD. There are smaller ones such as DAI that tries to reduce risk of the reserves (aka the backing) being worth lesser than notional amount of issued coins. They do so via over-collateralizing, which requires a US value of $1 to mint a DAI (stablecoin) worth $1. This ensures that in the event of a large crash, DAI can still be redeemed for $1.

Then, there are algorithmic stablecoins, such as TerraUSD, which is not backed by any collateral (until recently) and relies on arbitrage to keep the peg of 1 UST : 1 USD. While recently they’ve added about 3 billion worth of BTC (1/6 of total UST market cap), it only made their stablecoin partially collateralized. The partial collateralization, in the right moment, can spell a perfect storm. Read here for a good explanation of how the issuance process worked.

Essentially, if people lose faith in UST, they will sell UST for USDC or USDT (in curve pools here). This happens until there is no USDC or USDT left in the pool that they can swap. Users can also burn UST to mint $1 of LUNA. This is the mechanism that led LUNA on a bull run just a mere 1-2 months back. You can burn $1 of LUNA for $1 UST. If LUNA = $100, you can mint $100 UST. Most if not all usage of UST is for anchor protocol, which provides an unsustainable 20% yield on UST which is the highest rate of stablecoin return in crypto until recently.

To dump UST, you can swap $1 UST for $1 worth of LUNA. If LUNA were at $50, you would be able to swap for 0.02 LUNA, instead of 0.01 LUNA (if it were $100). Since bank runs happen when people lose faith in the currency, due to it’s intertwined relationship, the faith refers to both UST as well as the LUNA ecosystem. Just as LUNAtics cheered the drastically reducing of circulating supply as hindsight justification of numba go up (it hit $120 briefly), market makers and whales mercilessly inflated the circulating supply of LUNA as UST is burned by the entirety of crypto. It shot up from 300+ million to a whopping 1.46 billion LUNA (check out the current supply of LUNA v1 here), and price is down 99% in a single day.

Recall that the company behind this ecosystem (Terraform labs + Luna Foundation Guard) had 3 billion USD worth of BTC. They could buy UST to soak up the selling pressure, but selling BTC will also lead to market wide liquidations, especially in high-beta names… like LUNA. Luna was hit particularly bad with liquidations and had its own cascade. With the example above, infinitely more LUNA is being minted to burn UST. Price went to 0.008 on 12May from 2.22 on 11May, to 0.00011 on 31 May. Talk about 99% down.

I have not seen a crash as wide reaching and as bad as this for the past 3 years. LUNA, at its height, was a top 10 crypto currency by market capitalization. A 99% loss wiped out multiple billions in wealth especially for die-hard LUNA fans, more so for those who irresponsibly put in more than they can lose.

If anything, this was as big for the crypto scene as perhaps the Greece default of 2014 was to the Euro (a more classic and familiar analog would be Lehman brothers but I think that’s perhaps 50% worse). The amount of capital that was blown up (at least 10 billion) is mind boggling, and will forever be etched in our minds as an uber tail risk that materialized. Though, funny thing we never had any real systemic fractures; Price just went down only.

For contrast, LUNA was trading at $82 just at the end of April. It is now practically $0 UST is trading at a 97% discount. This was beyond ridiculous, and instead of explaining on and on about the mechanism, here are some of the tweets that I felt was particularly noteworthy. edit: written this before Mid-May, updated tweets for LUNA V2

- Terra in the war room, then subsequently strategizing a LUNA v2

- Do Kwon being Do Kwon. See: tweet 1, tweet 2, tweet 3 Surprise! Kwon seemed to have failed launching a stablecoin which is called Basis Cash. Unconfirmed and unverified though.

Funny thing is - most in the real world who don’t read crypto won’t even know much about this. Crypto suffered a nasty round of liquidations due to this, and even Yellen who is the US Treasury Secretary (aka some big shot who carries influence) called this out. In doing so, another big risk of regulation may get realized which may result in a temporarily outflow of capital (especially by big, institutionalized entities as they have to comply to much more rules). That is a risk to worry about, for another day…

Now, where was I in the midst of all this?

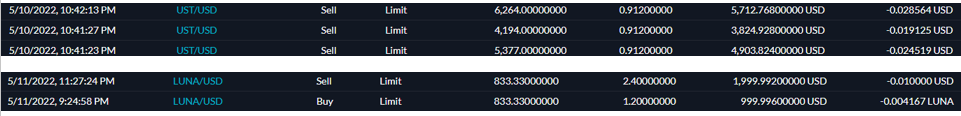

For all those wondering - these are the positions of LUNA and UST I had from the end of March and April.

I was lucky to have decided to offload my about 50% LUNA around 90s - 110s from March to April (thank Stader Labs for liquid staking). Though the conversion was to UST which was promptly chucked into anchor protocol, lol. I was at work (in office) for most of the fiasco, and managed to only assess the situation on the 10th May. Thankfully, there was a brief moment where the peg was close to 1, and I converted every UST I had for a small 8.8% loss. It appears, sadly, that the peg never went back this high and is now rolling in <0.05 range.

As LUNA cratered towards 0 (or pretty damn near), I felt that the risk was quite overblown relative to the fair value, as it’s not like the blockchain shut down. I punted a small 1K USD @ $1.2 LUNA the night after, and exited for a lucky 2x (as price dropped another 90% and then another 90%. Shit hits hard man.

So, in light of all these events, I am very lucky that my cash stack only suffered a small loss. It is a true shame that my remaining LUNA is staked (locked for 21 days). It is now worth 0 (or about $0.1 USD), which is a 11k drop from last April. Quite a big loss to my net worth, but as always, I will survive (thanks to that USD stack now).

As an update to what I wrote (now 26May2022), LUNA has decided to fork the LUNA blockchain, renaming the old one LUNA Classic and the new one, LUNA. The new LUNA will not have the UST stablecoin mechanism, which squarely puts it in the L1 basket w/o any catalyst deserving of additional allocation (already still worth 0). My advice for anybody who also have held LUNA through the entire thing: just treat the investment as $0, but more importantly, don’t sell it immediately. Given the forgetfulness _of crypto retail, I wouldn’t be surprised some sort of hype and marketing gimmick happened to LUNA which can pump it back to the double-digits, perhaps in the next bubble. Until then, it’s a $0 for me. [_edit: After checking, I received about 350 LUNA, with 120 LUNA being available immediately. Seeing as the price somehow hovered at $9, I sold it (proof below). The remaining LUNA are stuck in limbo, vested over 3 years. Hey turns out it wasn’t $0 after all.]

Thanks for playing…

Thanks for playing…

If you still don’t understand what the fiasco is about, you can always count on Lyn to provide a great read on the crash, as well as how you should think about crypto (from her lens). For a broader read on stablecoins in general, do check out Arthur’s related article.

The stablecoin contagion spread briefly to USDT which briefly lost its peg (now restored). Whilst USDC is likely now the top stablecoin of choice, one can never truly anticipate the seismic shifts happening to the world of crypto underneath, especially in the realm of regulation. Stablecoins will likely be the harbinger of death owing from the UST fallout which will likely prompt heavy investor protections (aka regulations). This will in turn restrict flow of capital and likely stablecoin usage too, and can be thought of as a pseudo-QT on the crypto world.

I am slowly waiting on limit orders for ETH and perhaps SOL too. My alt L1 conviction is at an all-time low, with the exception of Solana. ALT/ETH ratios will surely get decimated in times of bear markets (and ETH/BTC as well), so there’s no point in increasing speculation on L1 adoption, at least until the next retail wave comes along. My ETH is slowly being allocation to stETH, which is the liquid staking token for ETH provided by Lido Finance. Essentially you can stake ETH and receive rewards per day, at about 4% yield pre-merge (expect higher yields post). It’s a good dividend I guess if you’re already choosing to hold ETH for the long-term.

The next section details my general (not watertight) thoughts around why I feel Solana should be valued higher than Avalanche.

===

AVAX and Solana

In my opinion, the value accrual mechanism for ETH as of now (if you strip away the L2s and the underlying speculative premium) is 2-fold: 1) Demand for block space (which explains its ridiculous fees) and 2) Security (the fall of LUNA only exemplified how secure ETH is; the argument is making the rounds of CT from the mouths of ETH maxis *cough bankless cough*).

The mechanism for AVAX and Solana is somewhat similar, but slightly different. Let me explain. Since they’re an L1 (apps & protocols build on it), one way to measure how much value accrue to the network is by seeing the demand for block space increase (which in turn, drives fees). This applies to Avalanche but not Solana as the latter runs on a fixed fee system. The other way is security, which can be measured by available metrics that aren’t not mutually agreed upon in crypto. For example, the founder of Solana uses the Nakamoto coefficient while ETH maxis always point to the # of validators (& 3rd parties like you and me who do their part in staking crypto in say Lido Finance for stETH).

Solana strives (but has not succeeded) to be the Nasdaq on blockchain via their high TPS, whereas Avalanche aims to be the GameFi L1 via their subnets supporting application specific chain (called appchain, an example the DFK chain for DeFi Kingdoms). Take note that the native gas token used is JEWEL (not AVAX). The way it works is that since AVAX has a bunch of validators, a subset of that can be used to validate a separate chain. So these validators could be like those that are set up by the DFK team, which requires a minimum of 2000 AVAX (around 60k @ $30/AVAX). There are of course security concerns, but I think that can be resolved by specifying the type of validators that can validate the DFK chain. The game itself isn’t focused on censorship resistance too; more of gameplay and performance, as well as barriers for new users (aka gas fees).

In the ETH kind of framework, the gas fees can be correlated with activity on the blockchain, which roughly translate to broad price movements. If subnets are the key differentiating factor for Avalanche, and appchains can use their own tokens (JEWEL for DFK, TUS for Crabada), you would now have a reduced demand for the native gas token (AVAX). Where is the value accrual? While 2000 AVAX per validator may seem great enough, my swap fees on TraderJoe are often in the range of 0.01 to 0.02 (now 0.005). So 2000 AVAX roughly equals 200000 transactions. Transactions per day are about 2.5 times that (as of 14May2022 as I wrote this).

Assuming that each subnet requires n validators, which means 2000n AVAX, and using a worst case scenario (conservative estimates) of 0.005 AVAX / 400k transactions /day (seems like that is the trajectory), the lost revenue in fees amount to 2000 AVAX per day. Will there be 1 interested party becoming a validator every day?

If yes, then you are suggesting that value accrual is net gain after subnets. I am leaning towards no since the only notable subnets are only DFK and Swimmer’s Network (Crabada). Also, this will likely worsen since subnets is similar to sharding, which is the key improvement that ETH will make for ETH 2.0. Lastly, the AVAX paid to the AVAX foundation or core team will just get ruthlessly dumped to raise cash; unlikely to have any sort of vesting period. Hence there is no removal of supply, which is analogous to buying and selling AVAX on any DEX.

I don’t know, personally I don’t find that the ecosystem has any sort of defining factor besides being just a copy of an EVM. I do hope that there’s some underlying tech differences regarding the infrastructure, but that will unlikely matter to retail capital inflows, who would come for what’s popular (e.g. NFTs on Solana/Ethereum, DeFi on ETH).

If you’re thinking hard to justify putting in money into this, then you shouldn’t invest in any. Sometimes, we don’t need to think too hard.

For Solana, I think the backing of FTX and Jump (both big players in crypto), the decision of STEPN to launch on Solana, NFT users (MagicEden) eclipsing ETH users on (Opensea) and core technological differences between ETH and SOL (vs ETH and AVAX) says enough to me that I am willing to accumulate SOL as a blue-chip investment. It also helps that they are actively the top few in terms of number of developers (and have very happening hacker houses too globally).

Another point is that I have bags in SOL (DeGods, SHDW, MMA, BASIS, Friktion Finance); so of course there is a vested interest in me wanting to see this ecosystem succeed. 😂

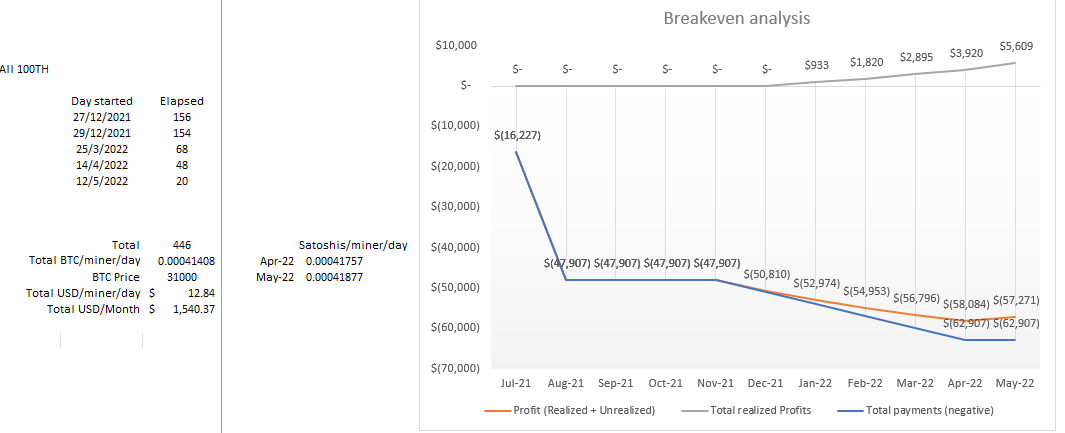

Compass Mining

My fifth miner came online just before mid-May; appears that the shipping delays have been fully resolved. I think the remaining 3 miners should come online every month (from June) just before the 15th, so fingers crossed. The mining rewards will come at an opportune time to allocate into other alts as well as to raise cash. Here are my mining stats:

The right middle column shows the performance of the mining pool in satoshis, but that excludes my take profits and rotation into other alts. Generally, the higher the figure, the more bang for your buck your miners are getting. If you have a constant amount of miners, you will earn lesser satoshis over time due to the % of hash rate (which increases quite steadily over longer-term). For info, I have all my miners working for Slush Pool for the sake of decentralisation.

The bottom line of my mining operations can be found on the right side, in a neater chart. The realized profits include the dollar value gained from the sale of BTC mined, either to cash or to some other token, as well as any BTC that I decide to keep.

I’ve also finished my my payments of my miners, which represent the full fixed costs for the 8 of them. The rest of the payments over my mining career would only be for the hosting payments, which is payable per month. Even at around $130 to $150 USD per month per miner, 8 of them will equal around $900 USD per month, which isn’t cheap to be honest. Although delays in my first 2 miners meant that there will be 12 months of facility hosting waiver, which is money well saved for me.

From my November 2021 article

From my November 2021 article

In a steady state basis though, I would need to raise cash every month to pay off the hosting fees, which would come from altcoin profits or from miner rewards. I am undecided how this arrangement will work, but am for sure looking forward to earning that sweet, sweet bitcoin. 😎

===

Life - can be found here.

===

Conclusion

Thank you for reading thus far; I hope you learn something from the things I write (be it about the markets or about me). Feel free to drop any comments or suggestions on how I should make my articles better! I fully acknowledge that the lengthiness of this article is quite a big problem, and making things concise will be something I hope to master in months to come.

Talk to you next month.

Cheers, Joey

Comments

243

0

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

243

0

Advertisement

No comments yet.

Be the first to share your thoughts!