Advertisement

OPINIONS

Portfolio Review - June 2023

Trying hard to correct my investment mistakes from 2021 / 2022... Up 58% YTD; Crypto 6x from Aug20

Full article on Substack (including my life journey!) can be found here. My substack profile here. My Twitter profile here. Previous month's Seedly opinion article can be found here (equities and crypto).

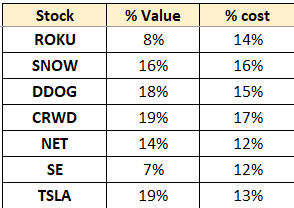

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

===

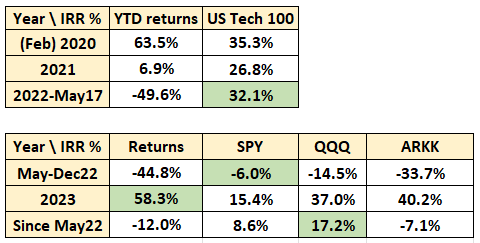

Equity Portfolio Performance

Historical Portfolio Returns (top); Cumulative Portfolio Returns (bottom) - Since new brokerage.

Monthly Portfolio Returns

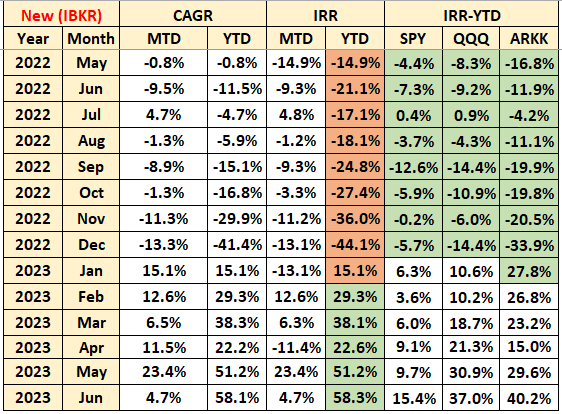

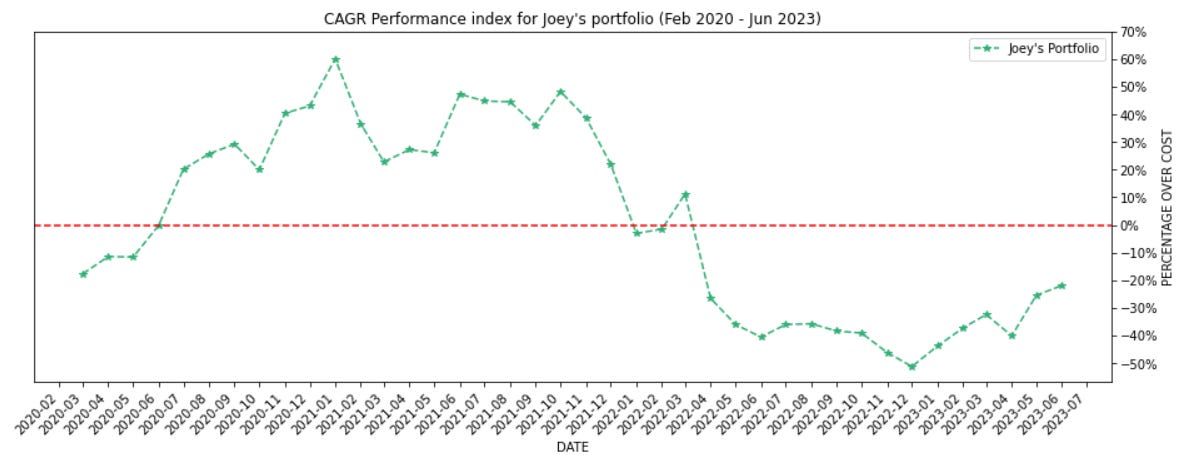

CAGR Performance

Note: CAGR for my portfolio is calculated as:

(market value of portfolio including cash / total cost) - 1

The CAGR returns are compared in the above table instead.

===

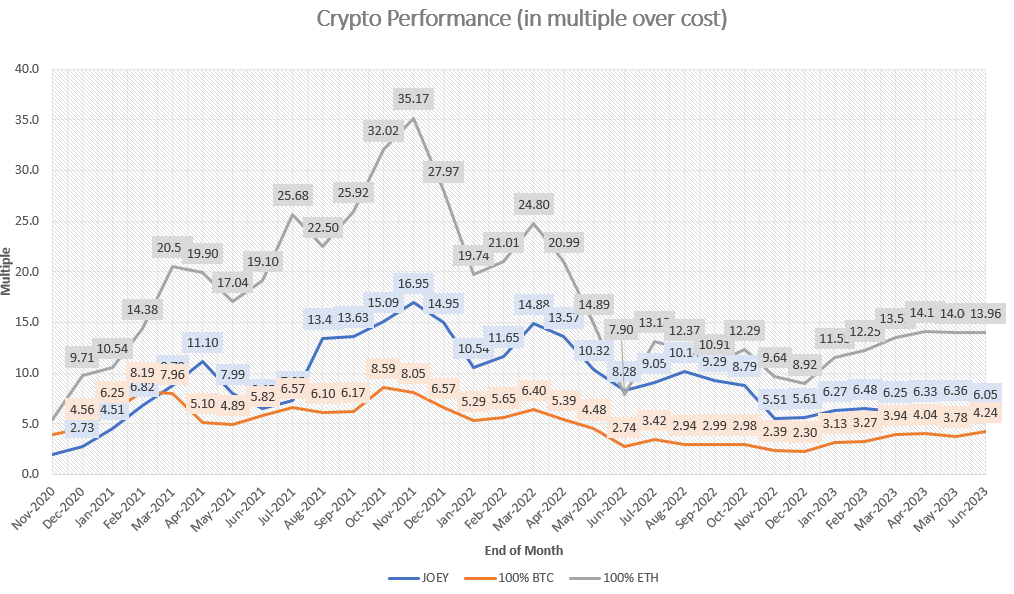

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 6.05x my cost

Lifetime result:

- Achieved 1.43x of BTC performance (6.05/4.24)

Achieved 0.43x of ETH performance (6.05/13.96)

When your NFTs aren’t worth what they used to before…

===

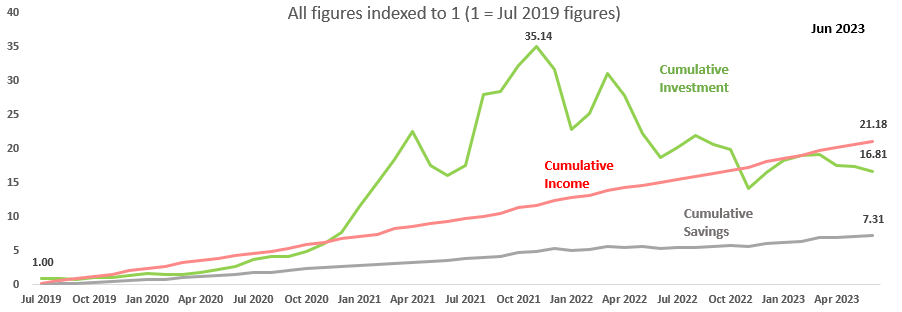

Net worth growth

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

To read this chart:

- I’ve received ~20x my Jul 2019 net worth, in terms of income / bonus.

- I’ve made my money work, and my net worth now is ~46.8x my Jul 2019 net worth.

- I’ve accumulated savings of 7x my Jul 2019 net worth.

Red line is an extreme example; Anywhere between grey and red is acceptable, since you’re supposed to compound your savings, and not your income (i.e. you don’t spend anything). Onwards and upwards!

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.

===

Equities Market Commentary

Another month, another month where markets are up. Thanks (Jensen / Elon)!

The current 6 months gave me 2020/21s vibe, where markets went unhinged on stimulus checks and were flushed with liquidity. Big players have no alternative (There Is No Alternative, or TINA) but to deploy these _phat _cash stacks into markets; Tesla went to $400, as did other more ‘pumpable’ names, like ROKU. Bitcoin, too, rocketed to $65,000, more than 3 times higher than its prior ATH set in 2017.

Good times.

The key difference now is that inflation is still way above 2%; bond yields are closer to 4%, while the Fed Funds rate is sitting comfortably at 5%. The commentary during the H1 2023 had commentary relating to runaway inflation / reining in inflation / potential recession, which makes for a good bingo game.

It appears that markets are very much focused on avoiding recession (the greater of the 2 evils). Any commentary on inflation is conveniently dismissed; truflation is now used as the ‘legit’ indicator of inflation, which aids the market in its forward-looking shenanigans. Mentions of “Recession” are a little more pronounced as Q1 cycle tapers out, with more companies mentioning curtailment in discretionary spending, especially in the consumer side of things.

I still like this odds, because the Fed has a dual mandate: 2% inflation, and low unemployment. Recession will lead to higher unemployment, as well as a host of other associated problems relating to the economy, so Fed will do its utmost best not to get to that situation. In Fed’s eyes, Recession high inflation, or at least that’s what I think.

In light of this new information, how should your view of the markets change, then? The broad market has already risen quite a bit, and what are the chances that it will go further? I do not know the answer to this question, but as my life section will detail, I don’t have a lot of spare capital to deploy into the markets as is.

My portfolio will simply be swayed by the winds of sentiment for H2 2023.

How about you?

Stonks

In _truly shocking _news, Nvidia remains up a bunch, despite the parabolic ascent from $200s, ever since they said “hold my beer” in their Q1 earnings, waxing lyrical about AI and how they are the ones to bring forth the next technological frontier to the world.

Having sold my last tranche at $280, the current price of $420 is painful for sure, but profits are profits; I managed to rotate them into other stonks, like Tesla, Snowflake, and Crowdstrike, which are up a bunch (but not as much as _Jensen’s _stock). Cool.

I also had a conversation with my friend (whom I’ve not met in awhile), who was also pleasantly surprised by his portfolio performance YTD. I’m sure most people would feel the same. But, I can’t help but feel a sense of doubt creeping in, because in 2020 everybody’s performance went bonkers; and most of them got properly humbled in 2021 and 2022. Would 2024 be the same?

Part of me leans yes, because market sentiments are a cycle (or pendulum, in Howard Mark’s own words), swinging from bullish to bearish. It doesn’t stay at peak bull / bear for very long. Of course, this isn’t me predicting an impending crash, but I have seen / experienced enough to manage my expectations on forward returns going forward.

I may even start raising cash by trimming some of my stocks, but we’ll see. It could be a start of the bull market, or it could be a bear market trap.

If it’s the former, I might even bet a little bit more on Tesla, who has recently onboarded their key competitors (e.g. Ford, General Motors) onto their charging network. Tesla owns about 60% of the fast chargers in US. That’s a pretty strong moat, if you ask me. There will be economies of scale as well, since people ‘pay’ to use Tesla’s fast chargers. Add to that the ever-inevitable Full Self Driving (FSD) which should come after nearly a decade (!), the Cybertruck, as well as a new mass-market car model, I think Tesla should be pretty ubiquitous with the concept of an EV, and we’ll see saturation in the US / Europe / China markets before SEA realizes just how ‘flex’ a Tesla can be.

I feel pretty good about Tesla’s long-term thesis, though I don’t have much capital to deploy, for now.

===

Crypto Portfolio Commentary

This month has been a roller coaster of a ride for crypto - SEC went on a suing rampage, bringing lawsuits to Coinbase, and Binance, for listing crypto tokens for trading, that should have been securities (i.e. like stocks).

SEC’s argument is that the entities should’ve thus be registered with SEC, thus allowing the federal agency oversight to the ‘wild’ west of crypto. Both Coinbase and Binance has retorted, saying that the SEC walked away from efforts to provide clarity on the law. Both these 2 players laid out arguments as to why they think these tokens aren’t securities. However, the SEC allegedly refused to give clarity on these, instead complaining that the players should have known better, and if they were confused they should have registered these tokens as security.

So it’s similar to the chicken-and-egg problem, where Coinbase and Binance is waiting for clarity, whilst the SEC waits for companies to register these tokens. Personally, my take on this is quite pessimistic - since regulation usually prevails over sound logic. Though, when all is said and done, I’m sure Coinbase would still be allowed to operate (it being a listed company and all), but it would be heavily regulated, in accordance to whatever rules that SEC deems fit for a securities company.

This was originally the bear market narrative that would likely take center stage for the rest of the year, putting a cap on prices, since the impending regulatory storm would dampen crypto trading activities, especially speculative ones, which can sometimes throttle the market.

Market was already weak from April 2023, after BTC reached a high of 30k, in sympathy with the equity markets (which also saw a strong rally). It floated down to 25k which if you were to see the charts, was right at support.

Then came the BlackRock spring, which sounded had a headline like this:

BlackRock files for bitcoin ETF in push into crypto.

Imagine, one of the biggest companies (in AUM), filing for a Bitcoin ETF. After multiple big players (e.g. Greyscale) have had their ETF be rejected for… reasons. Blackrock may be aggressively pushing into the crypto space, but it certainly isn’t ignorant to the graveyard of prior Bitcoin ETF failures.

Market read the headline to mean that there is a greater chance that Blackrock’s application with the SEC could be approved (though greater than just above 0%, is still closer to 0% than it is to 100%). I have no clue how the ETF will turn out, but I for one, am pleasantly surprised by the 180 degree turn in market sentiments.

Bitcoin breached 31k briefly, sending a strong signal that the crypto markets are here to stay. Don’t trust me though, that’s what Fed’s Jay Powell said here.

If you ask me, I know crypto is here to stay, and I’ll make sure to consistently increase exposure to the crypto space, and reap the fruits of worldwide adoption in terms of rising prices.

My portfolio holdings here:

Not much in terms of movements in crypto holdings, it’s been largely on autopilot, same as prior months. That said, I’ve done a small rotation, which is to convert the remaining of my gaming token play (PYR) into (PEPE), for about a thousand dollars’ worth. Why’d you do that, you may ask?

My thesis hinges on the staying power of the ‘pepe’ memes, which felt quite enduring already to me, having been in this space since 2017. When we talk about memes, or cultural icons specific to the crypto community, there is the Wojak, the Doge, as well as the Pepe. As I was writing this, I realised that I believed in PEPE more than I do DOGE, and promptly converted my tokens to PEPE.

Doge is more like Elon’s plaything. What if he doesn’t want to play with it anymore?

That’s a pretty risky play, if you ask me.

I’ve also added another NFT to my NFT collection on Solana, trying to capture the upside of the nascent bull market by way of NFTs (which is leveraged), not just through the spot token. We’ll see how it goes!

Anyway, that’s all for my portfolio movements - catch y’all next week!

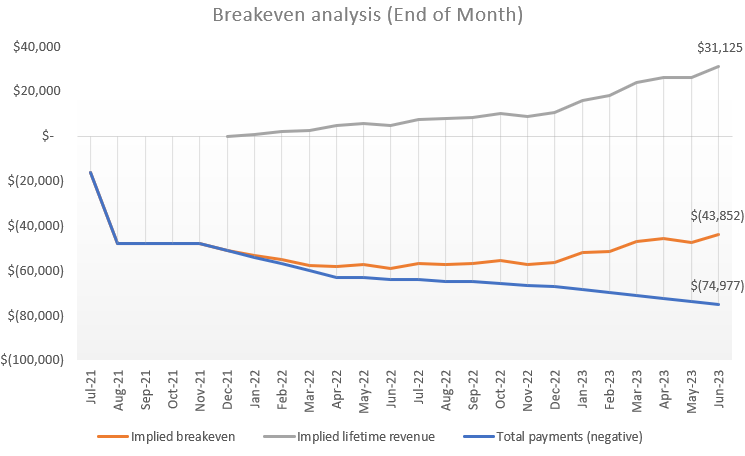

Mining

My mining operation saw a jump, thankfully due to the appreciation in BTC, which stemmed from a flurry of BTC ETF applications submitted by Blackrock and co (have explained more above).

Good news, but I still gotta bring in my outside capital to fully fund my mining operations, and boy it is expensive!

Profit charts below: slowly marching onto breakeven…

Life

See here.

===

Conclusion

Life’s busy this month (hence the shorter article), and it’ll get even busier for July. Here’s to hoping it’s all downhill after August (in terms of workload), so I’ve more time to focus on the blossoming bull market (if it exists), and other parts of my life that is non-work related.

Thanks for reading thus far; appreciate every one of you readers. Stay along with me, on this journey of growth and learning (and hopefully riches).

Cheers,

Joey

Comments

96

0

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

96

0

Advertisement

No comments yet.

Be the first to share your thoughts!