Advertisement

OPINIONS

Portfolio Review - July 2023

Stocks up 72% YTD; I talk Equities, Tesla Earnings, DCA investments, and Crypto.

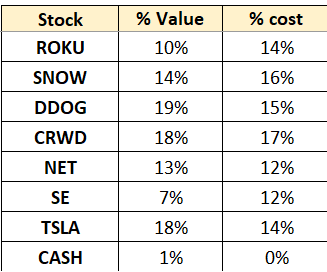

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

===

Equity Portfolio Performance

Historical Portfolio Returns (top); Cumulative Portfolio Returns (bottom) - Since new brokerage.

Monthly Portfolio Returns

CAGR Performance

Note: CAGR for my portfolio is calculated as:

(market value of portfolio including cash / total cost) - 1

The CAGR returns are compared in the above table instead.

===

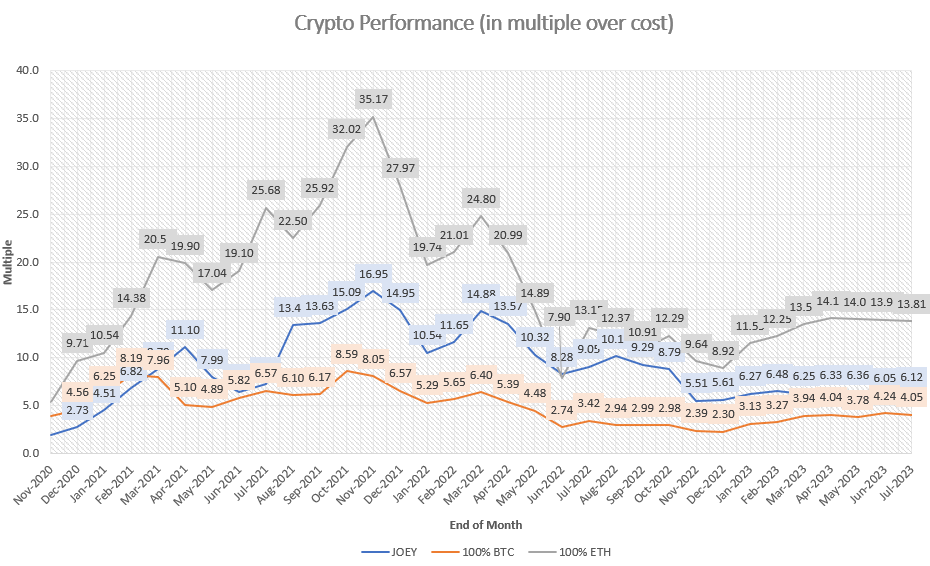

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 6.12x my cost

Lifetime result:

- Achieved 1.51x of BTC performance (6.12/4.05)

Achieved 0.44x of ETH performance (6.12/1381)

===

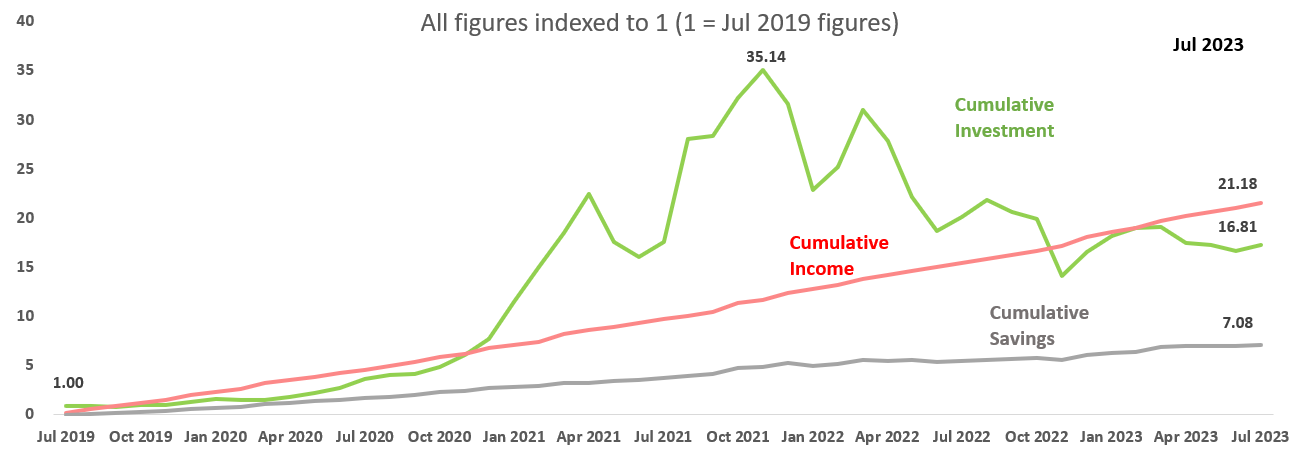

Net worth growth

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

To read this chart:

- I’ve received ~21x my Jul 2019 net worth, in terms of income / bonus.

- I’ve made my money work, and my net worth now is ~16.8x my Jul 2019 net worth.

- I’ve accumulated savings of 7.1x my Jul 2019 net worth.

Red line is an extreme example; Anywhere between grey and red is acceptable, since you’re supposed to compound your savings, and not your income (i.e. you don’t spend anything). Onwards and upwards!

===

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

===

Equities Portfolio Commentary

2023 is shaping up to be an excellent year, with my performance being much better than I had expected (see my earlier posts on my ‘doomposting’ vibes). With any luck, the YTD performance should just be enough to sport a gain (%) since the IBKR account was created (02 May 2022).

That’s really a sign of relief, because if you were not getting 20% while every mega-cap got at least 30% or more in YTD gains, then you are really either a very cautious investor, or you’re someone who should stick to index funds (as most investors, sometimes including me, should).

With every new high in my account value, I get increasingly cautious, having not done anything to prepare for the top in Nov 2021, which led to just a long slide down to the valley of losses, until the mid of last year. It feels like I should do something to protect my account value, but I have neither the money (i.e. spare capital) or framework to act on this hunch. Even now, I’m not very sure when the ‘top’ will be, or if this is the beginning of another bull cycle. One can surely bullieve.

Of my portfolio, it seems like only Tesla is showing decent gains, with the other stocks (mostly SaaS / discretionary) still languishing somewhat away from the bottom, having benefit from the rise of the mega-caps this past year. I’d really love to deploy more cash for this year, but I think the situation is between “the rock and a hard place”, what with my housing (rock) and wedding situation (hard place), which makes it difficult to deploy any amount of capital in the markets.

Alongside witnessing these gains, I sometimes wondered if I’m able to ‘take’ more from Mr Market, such as via call options, or option strategies designed to profit from volatility. Earnings seasons are round the corner, and we generally see a +/- 5% move after the companies released their earnings. What better way to maintain your portfolio exposure, than earning money in either direction?

Of course, it is not as easy as it sounds. First off, any option price you see on your brokerage account requires a payment of a 100x, since they are sold in batches of 100. Thus, a LEAP option (i.e. call option expiring in a few years) could cost $65 * 100 which is close to 6.5k USD. That is quite the amount, and I don’t have the funds.

Sigh

Tesla Earnings

The results were decent; surprisingly their production volumes grew a shocking 88% YoY, off of a low base obviously, but still sporting a meaningful acceleration from the prior quarter (+39k), and the quarter before (+1k). Management has shared that they will see a dip in production volumes in Q3, where the factories will be stopped for upgrades, presumably to improve long-term production volumes. Production volumes have been consistently above deliveries for the past 4 quarters, and I think inventory levels will be depleted by quite a fair bit. Hence, I don’t think this impacts anything.

Elon has shared quite a few times in past earnings calls, that the value of Tesla is the cumulative sum of the realised value of all its lines of products (Robotaxi, Cybertruck, Energy, FSD), amongst others. Some of them will come sooner, rather than later, and some of them will come with a vengeance. For example, Cybertruck demand is ‘so far off the hook’ Elon doesn’t even see the hook, while Megapack / Energy business is currently making a meaningful contribution to profitability, allowing margins to stay depressed (or even decreasing due to further potential price cuts), while Tesla fulfils its vision getting as many cars ‘on the ground’ as possible.

Separately, Tesla also re-started the referral program, which I guess offers some form of rebate (cash) to folks who successfully convinced non-Tesla owners to buy a Tesla. This should bring a less-than-decent-but-not-small pump to the number of deliveries, which should drive topline numbers. I’m also optimistic about the energy business which looks to be near terminal velocity. While revenue for these projects is often recognised YoY, these project usually span 20 years, and as long as contracts are bein bid and won regularly, I expect the contribution margin to increase consistently, morphing energy into a cash generating business, increasing cash flow that Tesla can deploy for other higher-value ‘call options’.

Good quarter overall, and I look to consistently increase my exposure to the stock, despite my rock / hard place situation.

===

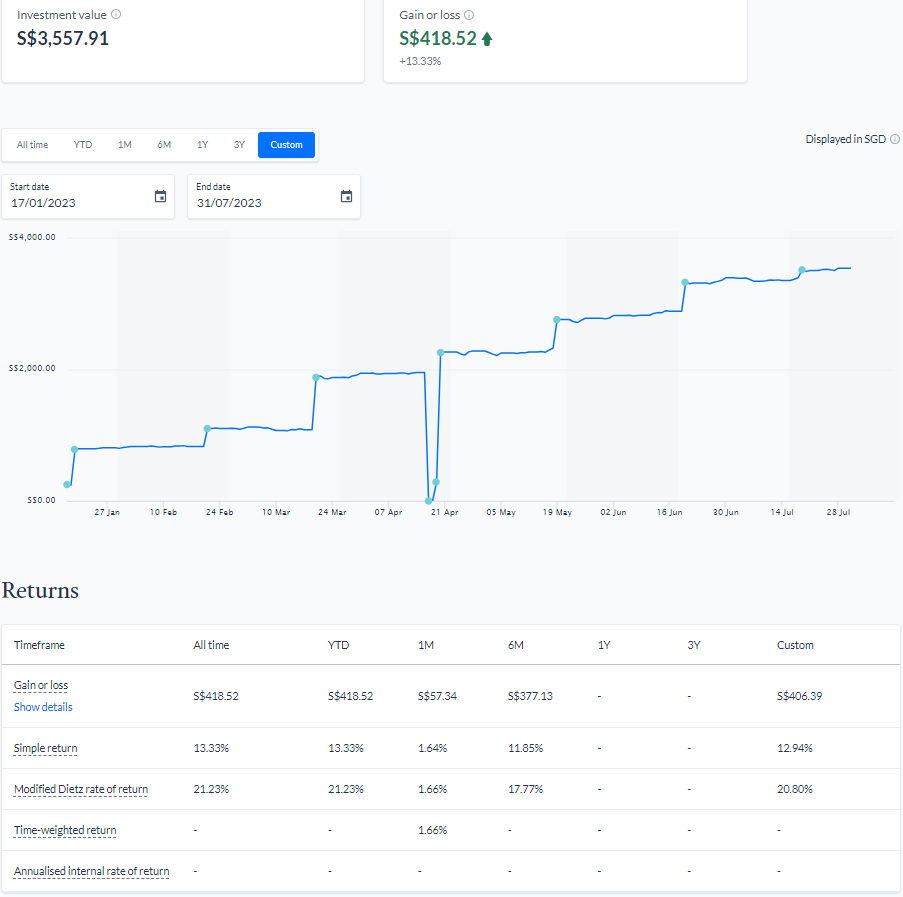

DCA investments

URA (Uranium ETF)

As mentioned in my previous article, I made the decision to reroute the DCA for this, into my Endowus (which helps to invest in S&P500). I felt that it was enough of a position for me (~5k USD) to see some gains in the near future, but at the same time, small enough for me to make a bet in something I don’t fully understand. This account is auto-pilot from now own, and let’s hope it gives S&P500 a run for its money.

Endowus (S&P500)

Owing to how high the markets are right now, I’m a little hesitant to continue the size of DCA for this bit, because markets don’t stay very high for very long. Even if markets continue to go higher from here, my guess is that more money can be made in e.g. individual stocks, rather than from a broad index. I’ll still continue to put in money for this, but albeit at a slower pace. After all, I’m intending to hold this for 30 years!

Crypto Portfolio Commentary

While crypto prices in general were buoyant following Blackrock’s filing of a Bitcoin ETF, as well as a landmark ruling for Ripple (which declared that XRP on exchanges isn’t a security, setting tons of legal precedence), crypto cannot push through the next barrier, having appreciated for the better half of June/July up till ~30k/2k BTC/ETH.

I don’t know the full details behind the ruling, but it has to be somewhat positive, right? I do know the space as a whole was getting skinned alive by SEC’s Gary in June, up until BlackRock swooped in with its Bitcoin ETF application. With the ruling, perhaps there could be leeway for other tokens to make the same argument, increasing the chances (even just marginally) that other tokens get eventually classified as a token, and not a security.

Anyway, markets saw that as a sign of continuation (as did I), but with every attempt at breaching 31k, Bitcoin was getting weaker in terms of buying momentum, and dropped back into the high 20s range soon after (29k as of 25 Jul). I didn’t position myself at all for these moves, because it’s hard to do so without being emotionally involved, which clouds your judgement in the first place. It’s not like anybody has a crystal ball that can predict how price will move in the future, right?

I’ve only manage to convert a small % of my spot portfolio into cash, whilst leaving my current investments largely on autopilot. This is because I often exit things too early (DeGods), or too low (i.e. panic-driven), and in doing so miss out of most gains (that usually comes to those who wait). It’s surely something that I need to work on.

Though, I would be better off locking my wallet and checking back after 2 years.

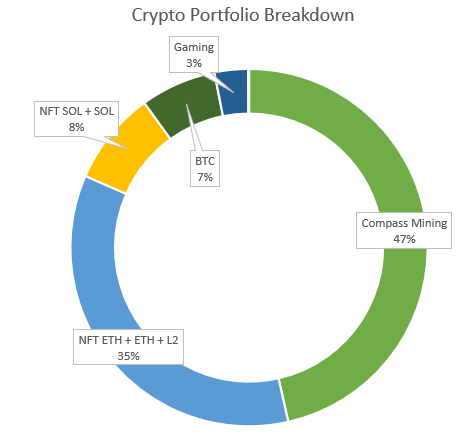

My portfolio holdings as below:

I’ve decided to stick with some core positions as a long-term strategy, since I no longer have the time and effort to stay up-to-date on every ‘coin’ that has the potential to 100x. Of course, in doing so, I’ve limited myself to just the major coins and certain coins / internet JPEGs I feel would have a bullish narrative around them, in perhaps 2 to 3 years (if I ever held until then, which would be an achievement in itself).

I own ETH BTC and SOL in that order ($ terms), and I feel a little under-allocated to the latter 2. BTC has its own appeal, and that is distinct from ETH, and SOL has room to play catch-up, especially if retail money finds their footing in the L1 ecosystem, now largely free from the shackles of FTX. In other words, in relative terms, BTC and SOL feel like they have more room to appreciate, than ETH, which is why I would like to increase my exposure to these coins. I currently do that by way of mining BTC (and routinely converting it into SOL), but perhaps I should also re-allocate some of my ETH stack to SOL when the price is right.

In terms of altcoins and internet pictures specifically, I own these few coins (JPEG, PEPE, RLB; Pudgy Penguins, Kanpai Pandas, Madlads) in no particular order. JPEG is the governance token of the protocol where I deposited my Penguins at, to secure a loan in PETH which is used to provide liquidity for PETH/ETH, which in turn generates a token as a reward (yield/ponzi). Edit: on the 31st Jul, the pETH/ETH pool saw an attack; though no funds were harmed, the value of its governance token dropped by 25%. Ouch. PEPE is the meme-coin behind PEPE the frog, and my thesis is unchanged (link last months article): meme coins generally have the highest volatility (goes both ways), and hopefully this meme culture doesn’t die down with the Twitter rebranding to “X”, which would otherwise spell trouble for my position.

Lastly, Rollbit is a online 24/7 casino that degens can participate anonymously through crypto, offering multiple types of betting such as for casino games, betting on crypto price movements, or even for key sports matches (e.g. boxing). Their token is the run-of-the-mill token which is rewarded to users through daily and weekly jackpots (for which RLB has to be staked, a % of which would be burned thereafter).

Anyway, these are the tokens that I’ll be holding for the foreseeable future.

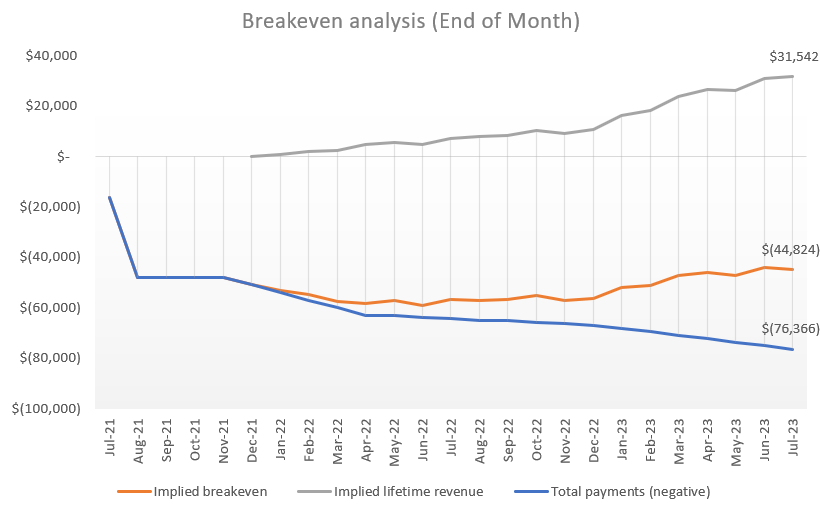

Mining

Mining has become a mixed bag, namely because the value it’s depreciating at every month is more than what I mined (in terms of BTC). Mostly this is due to bad timing, so as the saying goes, suck it up. I’ll still have to pump in money into crypto to pay the hosting fees for my miners, hence it’s more important for me to build up an increased spot position while I’m at it, as this will hopefully appreciate in the near future.

Life

Take a look a the article here.

Conclusion

Thank you for reading thus far. This is an abrupt article, I feel, because I was in the midst of moving house, and I had absolutely no time to finish up this article.

Apologies!

Next month would be another headache, and it’ll likely be barebones (i.e. simply showing charts); I’ll be away for the last 2 weeks of the month, and thus have no access to a laptop which I can pen my thoughts. Perhaps it’s for the better, if nobody likes to hear my thoughts? Hm.

Anyway, appreciate all you readers out there. See you next month!

Cheers,

Joey

Comments

78

0

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

78

0

Advertisement

No comments yet.

Be the first to share your thoughts!