Advertisement

OPINIONS

Portfolio review - July 2022 (Crypto & Equities)

Monkey see monkey do

Full article on Substack (including my life journey!) can be found here. My substack profile here. My Twitter profile here. Jun's Seedly opinion article can be found here (equities and crypto).

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

Cost allocation: Based on my set target in USD. 100% means over-allocated…

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

===

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky. July seemed like an euphoric month.

Time-weighted returns (IRR) & CAGR - Past 12 months (right), New brokerage (top left), and cumulative (bottom left).

CAGR* Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. The CAGR returns are compared in the above table instead.

Equity Portfolio Changes

Added: DDOG

Started: nil

Trimmed: nil

Sold: U

===

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 9.05 my cost

Lifetime result:

- Achieved 2.64x of BTC performance (9.05/3.42)

Achieved 0.69x of ETH performance (9.05/13.15)

Goal is to try and outperform BTC and ETH from here on out. 👍🏻

===

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it. Catch the monthly update of my personal and investing life here.

===

Overall Market Commentary

This month felt slightly different in that there seemed to be quite the rally in both crypto and equities, and it appears as though the market ran out of things to be bearish about. In absence of bad news, markets = up (don’t ask me why).

Could it be that the _doom _has ended, and it’s now clear skies from here?

The sky always look darkest before dawn. (or something like that)

Thankfully (or not), my work consumed most of my time and attention for this month; hence I simply observed the markets instead of letting my emotions / decision making be clouded by the mire of stock market news flow. Howard marks summed it up pretty well (heavily paraphrased) in a past memo in this (also great) book (The Most Important Thing: Uncommon Sense for the Thoughtful Investor):

When markets are good, people buy in hopes of selling higher; optimism sets in and the insert flashy new thing is going to change the world. Buyers keep buying, optimism amplifies until the last buyer, buys.

Just as the pendulum in old clocks stop for a brief moment at extremes, so too does price, which quickly turns another way. Sensing further declines, the thoughtful investor sells which exacerbates the feedback loop, sending prices crashing. The masses catch on and do the same, with prices in free-fall until the last seller, sells.

Human nature has always been optimistic as we’ve seen in the rally here (doesn’t matter if its short covering or real buying activity). Importantly, what will you do?

Markets (especially the bear) impart humility in all of us because after 50-70-90% drawdowns we realise we’re infallible. 100% + IRR returns from 2020 no longer exist and you’re essentially bag holding your portfolio just praying for breakeven.

13Jul2022 (mid-week) - 22Jul2022 (Friday)

The reason why I’ve created another section just for this time period is because my portfolio (across equities and crypto) benefitted from a decent rally during this time. Is it a new market trend, or just a bear market rally? Let’s examine the evidence (my portfolio holdings as of 22Jul2022 (before market open).

A range of 8% gain to 25% gain in just 1.5 weeks shows how wild this market is. With every inch of our brain telling us to ‘think long-term’, our heart whispers to us: “Buy The F*cking Dip”.

Just like the monkey, we often respond to things _after _they happened. It takes knowledge and experience to be able to buy when others are fearful, to then sell when others are euphoria. Though, let’s set the record straight and clarify: We are not traders and we don’t have unlimited capital to deploy (don’t know how people on FinTwit do it).

What’s the best course of action in this situation then? The first step is to recognise and acknowledge any emotions that may cloud your decision making; in this case it is euphoria (or FOMO). The next step would be to step back and objectively assess the situation. Has Fed pivoted (aka engaged in QE) or provided more liquidity? The third and final step is to identify what lies ahead: Earnings season, which brings about more volatility.

Markets have a way of defying expectations. Just when you expect a 20% bear market rally, you’re met with 45% gain from ETH (~25% gains from NET, no less) within this time period. Just when you think ETH will hit another 50% from here, that’s when you buy at the top again.

If you don’t already know what to do, then the best course of action is to do nothing. Your investing decisions should be rational, but they should also be reasonable. If not being exposed to the market makes you an insufferable person during the day, and keeps you anxious all night (930pm local time is when US markets open) trying to find a bottom to start your position, then the best course of action would be to buy, no?

A part of this comes from the regret minimization framework made popular by Jeff Bezos. Basically, optimise your decisions to ensure that you regret it the least. Buy now, even though it may seem like the rally is ending (so that you won’t regret it if it goes up even further), but don’t buy in all at once (so that you won’t regret it if it drops by another 15-20%; you’d still have cash to deploy).

Makes sense right? What I’ve just described = Dollar-cost averaging. (Thanks for coming to my Ted Talk). On a more serious note, if you’ve made it this far into the bear market, you should at least have more control over your emotions and biases that impact your investing judgements.

For me personally, I feel less FOMO than I do before (per my previous article), and I try to time my purchases (from what little capital I have remaining) after the company’s earnings call just to avoid the whipsaw volatility (we’ve just seen SNAP drop another 23% after their earnings, in which they missed the guidance that had already been lowered earlier in the quarter). It’s ever more important to ensure your company still has momentum and a reliable runway for growth before buying more shares.

A case in point would be Sea Limited (SE) which would be impacted (more so than others) by any weaknesses in the consumer economy brought about by potential recessions. On the other hand, SaaS companies like CrowdStrike that sells an indispensable product (cybersecurity) has stayed resilient even with economy slowdown, since their products are must-haves regardless of whatever situation the world finds itself in. Of course, from time to time, the company may drop the ball citing weakness in discretionary spending, and fall short of analyst expectations or worst still, lower their forward guidance. Stocks generally drop off a cliff following that.

Markets can crash, or they can go back to new highs from here. Disregarding your priors about the macro-economy for now: Are you prepared for both scenarios?

I am, given that I’m still largely invested (in both crypto/equities). What used to be ‘bullets’ to deploy on the way up is now a call option on the way down, waiting to be exercised onto exciting opportunities.

To end of this section, here’s a tweet I found meaningful (applies to both crypto and stocks).

Howard Marks also did a fantastic Q&A at Goldman Sachs, speaking about the investing psyche and dishing out investing wisdom. Would recommend a listen.

For the savvy investors, this read on bullsh*t in investing is a good wake up call.

===

Equity portfolio commentary

I’ve made 2 changes: Rotating out of Unity (~$33.5) into cash, and buying Sept 16 puts for AAPL on 28th July. Let’s break it down.

Basically, Unity and Ironsource are merging, but not in a 50-50 kind of way. This merger is more like an acquisition and existing Ironsource shareholders will own about 26.5% of the combined entity. Since it’s not a sale of existing shares, the current shareholders will be diluted, which will only take place when the shares are trading above the conversion price of ~$48.

The purpose of this merger (as per Unity) is to bolster the Operate side of business (which is Ad monetization), as well as to put a floor on its bottom line (Ironsource is currently driving an operating profit). I wrote about the last earnings (Q1 2022) here that led to the 20-30% markdown post-earnings, which basically says that their Ad monetization is shit and won’t get better anytime soon.

Price dumped a further 15-20% the day following the announcement (presumably due to them reducing their full-year guidance yet again), and with the gloomy macro background there’s no real rush to add to my existing position (which is already at its limits).

Funny how I was able to convince myself that buying at $157 was a good choice. Even by writing this I subconsciously reflect on the decisions I made regarding Unity, which was filled with knee-jerk emotive reactions and a blatant disrespect for valuation.

Despite that, it doesn’t really make sense to sell the company now (unless there are better places for your money), or does it? The next 2 paragraphs (optimistic view, pessimistic view) show how easy it is to justify whatever investment decisions we want to make.

We should at least wait till the dust settles (aka Q2 earnings) to reassess the outlook of the company. Given that it’s sharing a duopoly with Epic Games in this industry, it just needs to get its acquisition in line for synergy to actualize and value to accrue.

Unity with growth at ~20% YoY is ridiculously low for an industry (gaming) which is supposedly benefiting from tailwinds and resilient changes in user behavior (people are playing more games, everything is digital and going into real-time 3D content).

What’s more, they are a duopoly with Epic Games, and whilst the merger of Ironsource will inject profitability into Unity’s bottom line, it remains to be seen whether this company (who said that it’ll take 2 years just to merge the offerings of Weta Digital) have got what it takes to accelerate growth & restart the growth flywheel again.

It’s very easy to self-justify your decisions, which makes it even more important to read the opinions and viewpoints of others (hopefully smarter than us) to come to an informed decision. Don’t listen to me though, I’m no expert. Look at both sides of the coin before making your decision: Bearish case here, and Bullish case here.

I’ve also purchased my first option which is a put option (expiring 16 Sept 2022) on Apple. I’m probably an idiot for thinking this but looking at the chart above, it was the classic run up to earnings pattern (see below); the chart was just glaring at me, taunting me to profit from the eventual break of the patten. Sorry but nothing good ever came out of a rising wedge. Happy to be proven wrong, though, since Apple is Apple for a reason (compared to Walmart customers who may feel the effects of discretionary spending from inflation even more).

Of course, the risk is all mine; it was about $680 notional, so if it expires worthless (i.e. AAPL 0.61%↑ $155 by mid-Sept), I’m cool with that (downside limited). This was written just an hour after markets opened on 28th; Apple is set to release earnings after hours, will update the charts after.

The markets can stay irrational longer than we can remain solvent.

Well, preliminarily speaking, I’ve been proven wrong (rare to see rising wedges breaking up, which to be honest feels a little parabolic to me). Let’s see how this option fares over the next month.

===

Crypto Portfolio Commentary

The majority of crypto ‘grey-swan’ events (my own term for events that come with systemic risk to the ecosystem, while being somewhat predictable) happened in May/June, leaving July absent of bad news. Bitcoin and ETH had already breached $19k and $900 respectively, revealing delicious opportunities from the perspective of a long-term hodler. Being a retail pleb, I failed to buy the bottom. All things considered, though, my portfolio is in a pretty good position.

Sensing (a little late) that the bottom may have been formed, I added more to my spot positions of SOL and stETH at $40 and $1529 respectively. I probably don’t have plans to sell them anytime soon, but will instead try and hedge (via perps or puts) when this rally gets too heated. Aside from these buys, my portfolio now is pretty much on autopilot, with the exception of grand opportunities that present itself (such as the 3AC fiasco).

I already have a sizeable amount of (heavy) bags that stand to benefit (but still well below breakeven) given the rally that we’ve seen. If this rally proves to be the usual bear-market rally, one can only hope that I’ve mustered the courage to deploy my capital into crypto tokens I call investments.

As I said in my previous article (crypto section), crypto is a 24/7 casino, which in finance speak translate to ‘extremely high beta’. If S&P goes up 10%, you can be sure that BTC goes up 10%, and that ETH gains is BTC, and altcoin gains are (generally) ETH.

This is analogous to Facebook sandbox (like Farmville or Mafia Wars) games where you ‘send’ your ‘cows’ out to ‘farm’ and they come back with bounties. Tis’ the same for investments. In times of optimism, you send your capital out to enjoy greater yield (haha, especially after the fall of TerraUSD / anchor). Once the cycle is over, you sing a hypnotic melody to get these ‘cows’ to come home, and harvest those sweet, sweet gains.

Over multiple cycles, you should ideally increase your portfolio by some multiple (i.e. 2x), not because you’re very skilled at flipping your portfolio, but because crypto is most inefficient at its greediest. Sharing the same sentiments as GCR, I’m also long humans being insert bad trait here. Hence, you could say that there’s ample supply of the greater fool with whom we can sell to at the top (if we ever become good enough to do that).

Back to the markets, while I’m sold on the near-term crypto bottom having formed (because they formed due to exogenous events that are hard to repeat), I’m not sold on there being a chance that we can test the bottom again. At the same time, to hedge on my gut feeling, I’m also regularly putting some money to work, especially with the ETH merge on the horizon (probably a sell the news event). Interesting thought experiment about the ETH merge here by Galois Capital.

To end off this section, check out Arthur Hayes’ new reads about why he thinks QE-redux will come soon, but not in the way people expect. Article 1, and Article 2.

Token holdings

Holdings not in order of size, degen plays (if any) excluded:

L1s: SOL AVAX (incl. JOE) Cosmos (ATOM JUNO OSMO)

Gaming: MC RAIN JEWEL (incl. CRYSTAL) PYR MMA

Infrastructure: SHDW POKT

Large caps: BTC ETH (all in stETH)

Others: BASIS FTT

Not financial advice. I may rebalance my portfolio at any point of time.

===

Lessons about jewel

After a meteoric rise in 2021 to $24 and a subsequently 99.375% drop to $0.15, I think it’s appropriate to call time on JEWEL which is the main token being used for DeFi Kingdoms, a crypto Play-2-Earn game.

Time of death: __April 2022

The writing on the Trading View wall is crystal clear. An absolute shame I wasn’t smart enough to take profits and just let the rest ride.

JEWEL has been priced like a dead fish gasping for its dying breaths on land. It’s such a sad sight to see, given that I was quite bullish on it and have invested quite a fair bit into this project. Other die-hard JEWEL bulls may celebrate this as a generational buying opportunity (and I would agree to a limited extent if the Fed tide of liquidity turns), but it’s hard to see the project slingshot back into the previous highs.

Since crypto tokens have no intrinsic value (same for blue-chips like BTC and ETH), tokens are priced at levels for which there exists an equilibrium of buyers and sellers.

At its current state, the market has decided that JEWEL be priced at $0.15. Even if retail comes back, why are we so sure that they will indeed ape their money into JEWEL and not a new enhanced version of P2E which has all the advantages of P2E without the flaws?

A best-of-breed comparison is Axie Infinity, which is the poster child of P2E gaming scene. Its token price shares a similar fate (albeit lower drawdown of 92%).

From DappRadar, the 30-day unique users for Axie Infinity stands at 536k vs DeFi Kingdoms at 59k. When retail flocks back to the P2E scene, which project will they bid?

DeFi kingdoms with 8-bit graphics and token prices that couldn’t even generate a decent income in 3rd world countries, or Axie Infinity which has recently overhauled their tokenomics (as well as suffered a hack)?

Even by just looking at blue-chips (BTC, ETH), there is substantial gains to be had, if you believe in the eventuality of market cycles. ETH (13th July 2022) sits just above 1k, with a all-time high of 4.8k.

It’s of course biased to anchor to past prices since they are not predictive of future prices. Though, I’d say this:

History doesn’t repeat itself, but it often rhymes. - Mark Twain

Why speculate in projects in which you have a lower probability of being right, when you can simply DCA into proven projects and ride the wave of optimism (not to be confused with the token) into market cycle tops again? (notable that the return to benchmark assets (in crypto) happens after investors like me suffer their first ‘real’ downtown)

I’ll leave it to you to ponder over what I’ve said, but the lesson here, summarized:

Risk management (don’t put all-in into 1 project)

Take profits (when to sell: when you think it’s going to the moon)

Don’t anchor yourself to past projects (bags)

===

Compass Mining

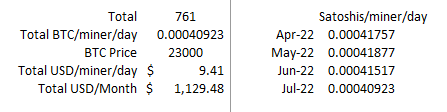

My 6th miner came online (2 remaining) and the rest of my miners are just chugging along. Due to the summer heat, it was normal to see periodic downtime from my miners and so that was simple a consequence of mining at US facilities. I am hoping this will only continue until late August at which point autumn will arrive and things become calm and cool. My mining stats below.

I’ve also paused converting my BTC into USD or ETH due to low prices. With what seems like a short / mid-term rally on our hands, I think I may put on some simple hedges at 25k BTC and 1.6-1.8k ETH to preserve the dollar value of my investments. The reasoning is quite simple: Macro conditions have not changed. Until they do, my investment decisions should be defensive in nature. My bottom line below.

Conclusion

This is a slightly shorter article then previous months, and the length of future reads will likely be moderated by my stressors at my work (see my life section on Substack). I honestly hope I shake off the newbie mentality and be proficient at my job; but to do that I must step out of our comfort zone.

Thanks again for reading thus far, appreciate each and every one of you. See you next month.

Cheers,

Joey

Comments

350

3

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

350

3

Advertisement

No comments yet.

Be the first to share your thoughts!