Advertisement

OPINIONS

Portfolio Review - January 2023

New chart update; I talk Tesla; my DCA plans; how I could have earned 32k extra in crypto

Full article on Substack (including my life journey!) can be found here. My substack profile here. My Twitter profile here. Previous month's Seedly opinion article can be found here (equities and crypto).

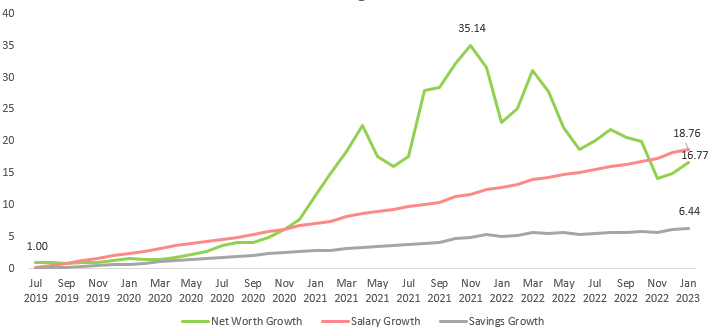

Equity Portfolio Breakdown

% Value: Value as % of my portfolio % Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

===

Equity Portfolio Performance

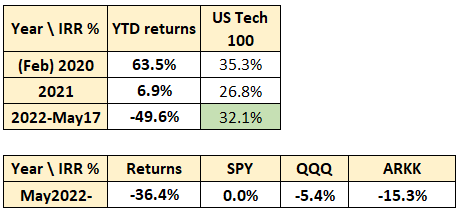

Historical Portfolio Returns (top)

Cumulative Portfolio Returns (bottom) - Since new brokerage

Monthly Portfolio Returns

CAGR Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. The CAGR returns are compared in the above table instead.

===

Crypto Portfolio Performance

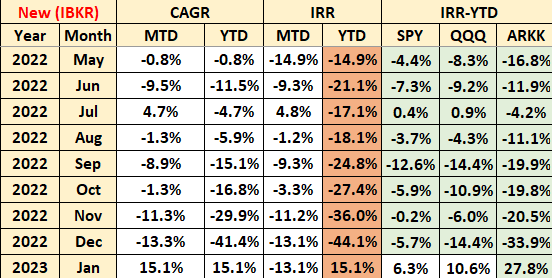

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio 2021 performance: 5.5x-ed my 2020 portfolio Lifetime performance: 6.3x my cost

Lifetime result:

- Achieved 2.00x of BTC performance (6.27/3.13)

- Achieved 0.54x of ETH performance (6.27/11.55)

Goal is to try and outperform BTC and ETH from here on out. Bring on 2023.

===

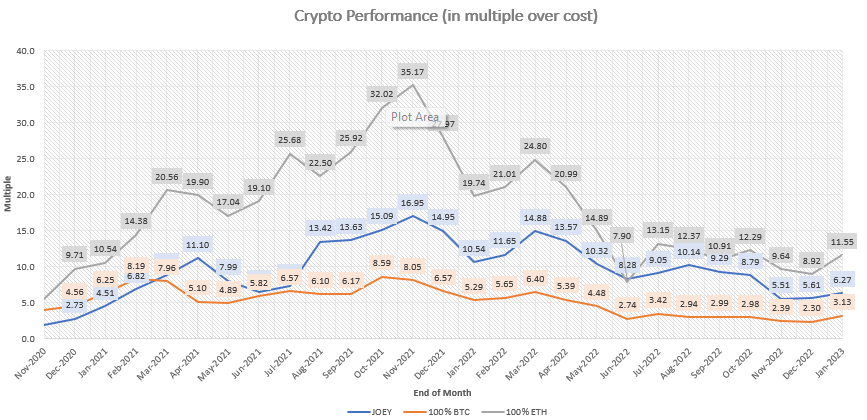

Net worth growth

New chart alert!

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

These are all indexed to when I first started work (Jul 2019), and is another barometer to gauge my investment prowess (or lack thereof). My job is to make my money work overtime, with the aim of growing my net worth faster than my savings (i.e. opportunity cost) and the total income received (an extreme benchmark, as it doesn’t consider my spending). They are all indexed to my net worth as of Jul 2019, thus the other lines show up as being lower than my net worth (which is indexed to 1).

The chart shows very clearly where the top of the market (as well as my net worth) was. I’d suggest everybody to start tracking their net worth internally - there’d be no accountability for your performances otherwise. How else would you prove that you’ve made your money work for you?

===

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.

Equities portfolio review

I made two buys this month in TSLA ($118) and NET ($47) as a minor DCA, in light of the recent bear market rally, driven by sentiments that the Fed will somehow stop hiking and pivot. I’m not quite convinced of this argument, which explains why I only made 2 purchases.

It’s quite clear that growth is waning, and recession fears may have a whiplash effect on reducing IT spend, and the ability for sales & marketing departments to get the revenue like they used to. Companies that purchase SaaS products are also affected by the economy, hence if these companies close shop, it’ll disproportionately affect the SaaS companies as well.

Thus, my Q1 outlook remains in kind of a wait-and-see mode, where I hope the upcoming earnings results (for the quarter of Q4 2022) will lead to further downward shifts in valuation and prices, which I’ll hopefully be able to capitalise on.

Tesla was the first to release their quarterly results and Q1 2023 outlook. Overall, metrics are still growing in the right direction, though I think that the broader environment weakness is getting to Tesla. Just as I type this (31 Jan), the stock has also made an impressive run up from $100 from the lows to $165, or about 65% appreciation. Just by price dynamics, this leaves little room for further appreciation, especially as the stock nears its 200DMA. If Tesla does rocket up to $200, I’ll be even happier and trim a little bit. If it doesn’t then I’ll hopefully be able to buy at lower prices in the near future. Eventually, I think the company will go on to be one of the biggest companies in the world. For now, I’m more than happy with 37% revenue growth and a positive cash flow margin.

===

Autopilot investments

Besides managing my equities and crypto portfolio, I’ve had a long-standing URA DCA plan. URA is an ETF tracking the uranium sector, and I’ve been buying it since June 2021, owing to my bullish view regarding the global adoption of uranium. I’ve already accumulated quite the position and it’s just above 10% of my equities portfolio. I don’t think URA will see 8% annualized gains for the next 30 years, but the underlying commodity is cyclical in nature which has potential to outperform.

Related to this, I wanted to review my broader investment strategy, especially around the longer-term DCA strategy, with the end goal of this being a hedge for my potential underperformance in investing. This goal was borne out of my subpar investing performance since 2020. While most retail (including me) performed poorly during that time, I am prepared for the day when even my highest conviction investments turned out to be the wrong idea.

None of us can predict the future; no matter how much promise Nvidia shows, it could trip up and lose market share to AMD; Tesla could just lose its shine as the ‘most desirable car’, and its market share to the rest of the auto market. There’s _a lot _of ways the future could pan out.

That’s tough.

Realistically, the probability is higher, closer to 0% than it is to 100%. This DCA strategy can hopefully make up for many my investment mistakes (past and future).

My platform of choice for this longer-term hedge is Endowus (my referral link embedded) as it allows me to invest both cash, as well as monies in my pension fund (CPF OA, currently earning 2.5% interest) if I wanted to. I’m currently deploying cash; and will include pension funds as a source of funds when my mortgage repayment become stable.

Given the choice of investment (S&P 500), I’m quite comfortable buying-and-holding this for the next 10-30 years, since the top 500 companies of the US market will only get bigger, and I’m exposed to the upside from all sectors instead of just tech, which is the core focus of my own equities portfolio.

I’ll begin to publish the CAGR performance of all 3 strategies that I currently employ (Equities, Endowus, and URA) for transparency, as well as accountability.

===

Crypto portfolio review

Another month has passed, which means another month which I bemoan selling my Solana NFTs at the bottom.

Let’s recap for those that didn’t keep score:

I sold 3 Degods for a combined 495 SOL at a price of $19, totaling $9,405. I sold 2 Y00ts for a combined 95 SOL at a price of $19, totaling $1,805.

Total gain: $11,210

Referencing today’s price (31 Jan 2022), the floor price of Degods was 484 SOL, and 119 SOL for Y00ts.

Total SOL if I’ve sold everything now: (516_3 + 119_2) = 1,786SOL. SOL price = $24.15

Total gain: $43,431

Because I panicked and sold at the bottom, I made about 32k less in USD.

Such is life.

This was an important lesson for me, and a constant reminder to myself that I’ll not paper hand future 5-fig NFTs that I own.

===

ETH NFTs

In other news, I caught wind of a nascent NFT bull market happening on Ethereum and decided to position accordingly. I already had 3 NFTs, and I decided to increase exposure, this time adding a second Kanpai Pandas at 1.48 ETH.

I don’t have a clear reason for buying a second one, but I wouldn’t want to have only one NFT if it indeed moons. Buying 2 NFTs from each project allows you to take half of your profits off the table, while still allowing you to profit from further gains.

It also helps that the community shows good vibes; the project team is consistently putting in effort (the artwork has been refreshed for all NFTs, to positive reception by the holders); the efforts lead to real world utility which will naturally lift the intrinsic value of this jpeg above 0. That’s all that matters - even as speculative value swings wildly; you can be rest assured that the value of your jpeg is not $0.

For transparency, as of end-Jan, here are my P/L figures for the ETH NFT portfolio.

Let’s see how many multiples I can get out of these cute Penguins and Pandas.

I don’t have an active strategy to accumulate more crypto, since my NFTs are already a leverage bet (without which I would already have 10-100 ETH which was my target for 2023). This year, I’ll focus my capital on facility hosting fees for mining rigs, as well as the occasional buys in Ethereum / Solana.

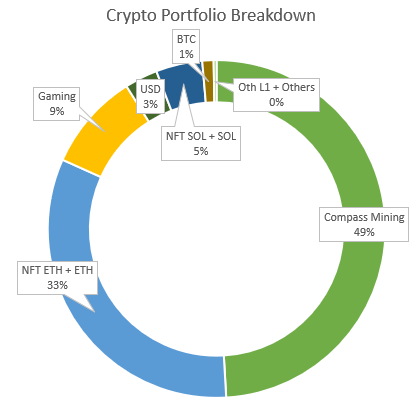

My portfolio holdings below:

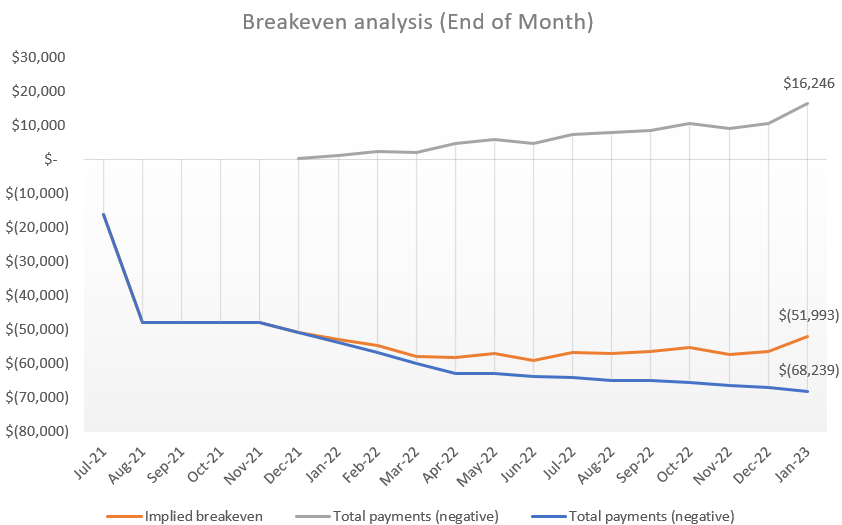

Mining

I have been regularly converting portions of my mined bitcoin into USDC (or ETH/SOL). While it’s not very profit maximising (selling 0.1 BTC at $65k is wildly different than selling 0.1 BTC at $16k), sometimes a miner does what he has to do to pay the bills. At about $160 per rig, the facility costs for 8 rigs will be pretty high.

I don’t have much in terms of spare capital, so I’ll adjust my strategy as we go along the next few months. I have about 2+ months of runway, and with a monthly revenue of about ~0.06 BTC ($1200 at $20k), the mined bitcoin can just about sufficient to pay the bills. Let’s see how it pans out. Chart below.

My long-term goal remains the same: mine enough BTC to join the 1BTC - 10BTC club. Nonetheless, it’ll be a liquid account which I can swap between altcoins / cash as the market ebbs and flows.

===

Life

The full section can be found on SubStack here.

===

Conclusion

Thank you all for reading thus far. 2023 is shaping up to be the most eventful (for better or worse) year I’ve ever had - 11 months to go!

See you next month!

Cheers, Joey

Comments

224

3

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

224

3

Advertisement

No comments yet.

Be the first to share your thoughts!