Advertisement

OPINIONS

Portfolio Review - February 2023

Finally outperformed indices*! Talked abtSaaS earnings + NVDA, crypto AI coins & longer-term positions I currently hold.

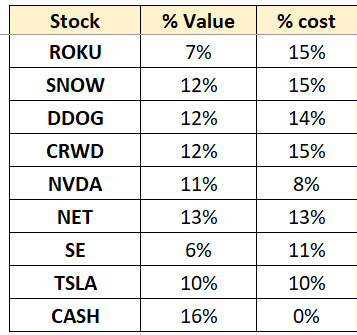

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

===

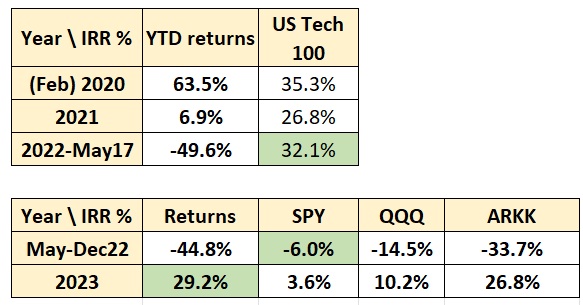

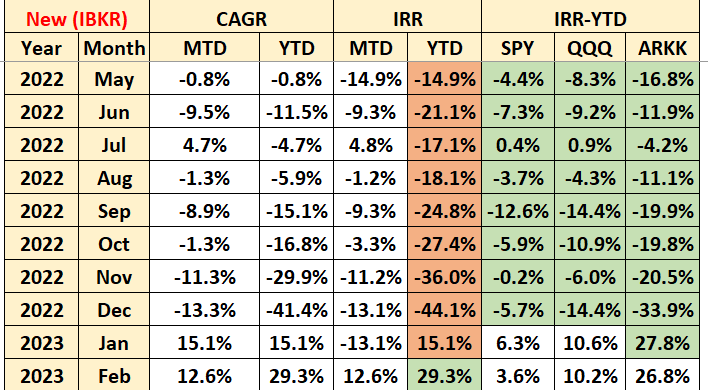

Equity Portfolio Performance

Historical Portfolio Returns (top); Cumulative Portfolio Returns (bottom) - Since new brokerage.

Monthly Portfolio Returns

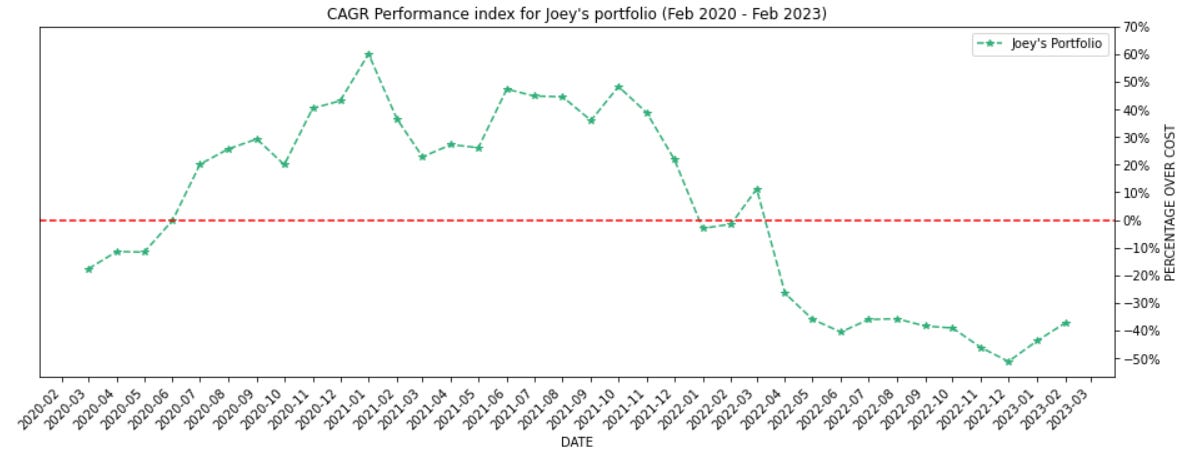

CAGR Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. The CAGR returns are compared in the above table instead.

===

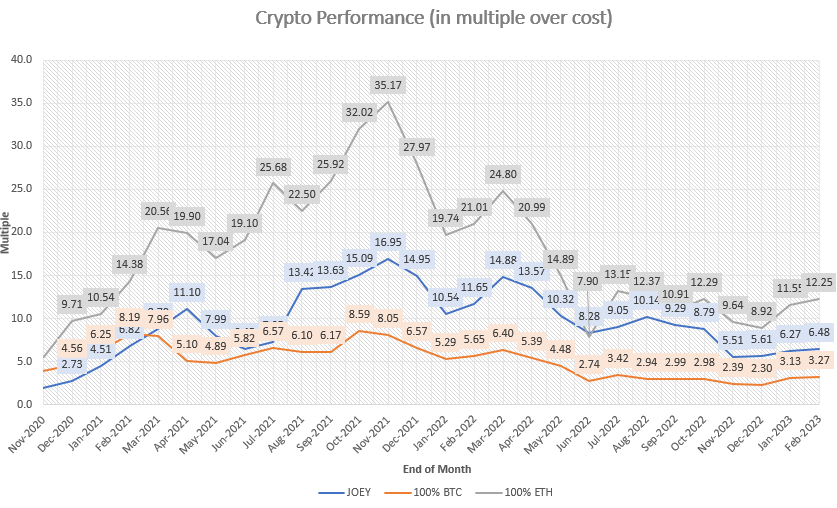

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 6.48x my cost

Lifetime result:

- Achieved 1.98x of BTC performance (6.48/3.23)

- Achieved 0.53x of ETH performance (6.48/12.25)

Goal is to try and outperform BTC and ETH from here on out. Bring on 2023.

===

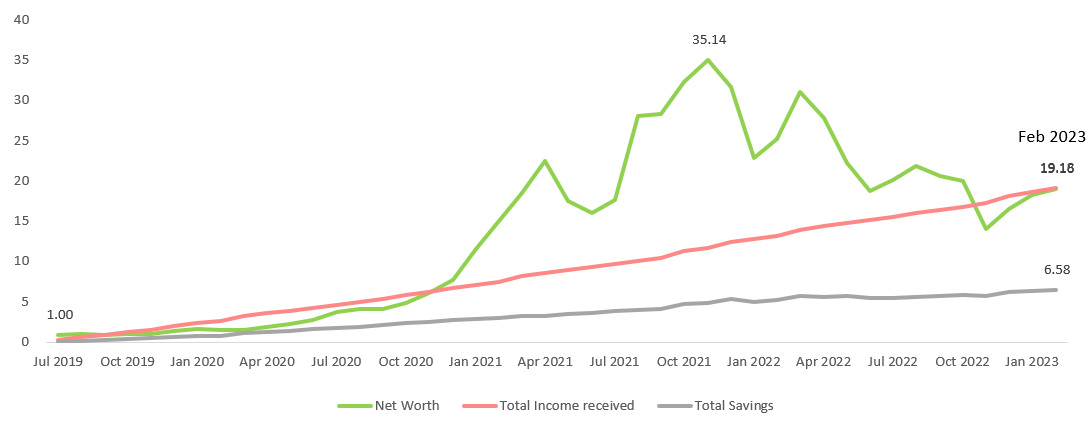

Net worth growth (new chart alert!)

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

To read this chart:

- I’ve received ~19x my Jul 2019 net worth, in terms of income / bonus.

- I’ve made my money work, and my net worth now is 19x my Jul 2019 net worth.

- I’ve accumulated savings of 6.58x my Jul 2019 net worth.

Red line is an extreme example; Anywhere between grey and red is acceptable, since you’re supposed to compound your savings, and not your income (i.e. you don’t spend anything). Onwards and upwards!

===

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.

===

Equities portfolio review

Portfolio movements

In early Feb I made the decision to trim a decent chunk of my Nvidia and Tesla position. I felt that they had run up quite strongly since the lows, and were due for a pullback. I wasn’t 100% sure so I sold some of it.

I sold Tesla at $203, and Nvidia at $215, and $232. Currently both companies are higher than when I sold it, but that’s fine since I still profit (from my reduced position. Moving on :)

Regular readers (& friends) will know that 2023 is a year of big life events for me, thus having the opportunity to capture some gains is something I wouldn’t shy away at - especially since I’m planning a shift in contribution between equities and crypto (I haven’t added money into crypto since Jul 20!).

In any case, with interest rates staying higher for longer, I still prefer to have cash to buy these 2 companies (or others) back at a lower price. Time will tell if this is the right choice, and whether price will ever return to that "bargain" basement. If no, I’m quite content in deploying the cash to SaaS companies that need to ‘brace for impact’.

My review of companies that have released earnings in Feb below.

Cloudflare

Topline slowed further from the highs of 54% in 2021 to 47% in Q3 2022 and to 42% in Q4 2023. Unlike Datadog (which guided abysmally), it guided for steady-but-slower revenue growth of about 37-38%, which I think management will beat-and-raise till 42%. This doesn’t incorporate plans to improve sales productivity and focusing on top-down sales (i.e. CIOs). Expenses have also tightened, leading to a positive free cash flow this quarter; it has also guided for positive FCF for FY23 as well.

Customer wins are aplenty, implying market share is at least constant and/or improving. Usage metrics are declining, alongside the deteriorating environment and and headwinds around optimisation, and so there could be opportunistic periods this year where one can accumulate more shares for the longer term. The growth story still seems intact - that the current stacked S-curves will materialize itself one after another, ahead of investor expectations.

Datadog

The observability company still managed to grow customer base, albeit its lower-end customers (SMEs) more affected thus showing muted growth in customer counts. Enterprise customers grew at the same rate in the prior quarter, alongside 1m ARR customers (albeit slightly slower than Q4 2021 vs Q4 2022). Topline dropped hard from 61% to 44%, showing its vulnerability as a semi-usage-based company, and having to deal with tough comps (highest sequential revenue growth).

That said, bottom line still pretty healthy, with negative single-digit operating margins and positive free cash flow margins. The abysmal guide of 20%+ for the financial year felt like sandbagging to me, and the current expectation (& sentiment) would be for them to beat-and-raise. Growth story still feels intact to me given the numerous customer wins and their world-class DBNER (130% for 22nd quarters straight). Looking forward to accumulate more shares.

Nvidia

On balance, Nvidia did pretty well with ~6B in Q4 2022 revenue, given that they’ve hit a record peak of 8.3b in quarterly revenue just 3 quarters ago. It’s not the drop that that Nvidia did well in, but rather that the decline has somewhat stopped. Management has even guided to sequential revenue growth for next quarter, which implies the growth story seems to be in play again.

AI was the focal point of the call, and Jensen (CEO) sold the promise of AI and how Nvidia had spent years preparing for this (which they did). The quarter went pretty well, and all eyes are on the company surpassing their quarterly guide. Though, in a high interest-rate environment like the one we have today, it’s hard to justify owning such a richly valued stock (PS of ~20 and PE of 100). Is the promise of AI priced in already - and when will we actually see revenues from the software side?

In acknowledging the sky-high valuation, I’ve sold another tranche of my Nvidia portfolio to buy lower, or to hedge (by starting a position in AMD). In my opinion, both companies have incremental market share to gain from the exponential increase in computing needs, and both will stand to win (not to mention it’s quite cheap too).

===

DCA Investments

Endowus chart

Nothing much going on here, just good ‘ol DCA. Though, it’s a little weird that the value doesn’t change for days (even during the working week), which doesn’t quite align with my understanding of how a fund (I’ve allocated into a S&P500 fund) works. Other than that, it’s a really fuss free experience for me so no complaints there.

URA

Almost as large as my current Nvidia position…

===

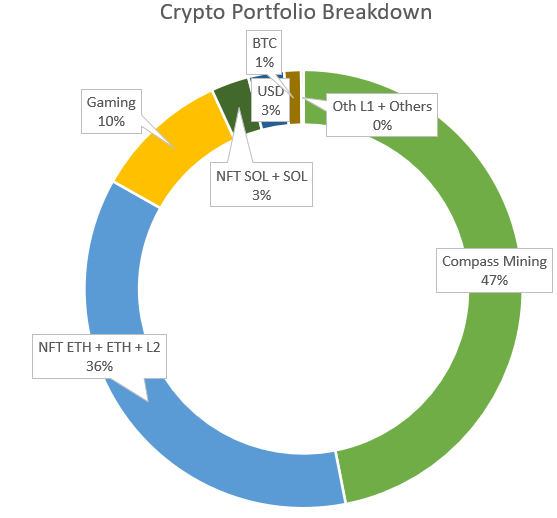

Crypto Portfolio Review

I wrote earlier in the month that the market seems to have stalled in terms of price performance and narratives, but with various narratives now popping out of the blue since then, I think this section deserves a rewrite. From a crash to a higher low (hopefully) of 22k, the orange coin recovered to near 25k, setting off narrative-fueled rallies in generative-AI, L2 ETH ecosystem tokens, and most recently (as of 20 Feb) China tokens (which died as quickly as they were reborn).

Holdings below:

The new tokens I’ve taken a medium-term position in (vs past 1-2 months) are:

- GMX

- RLB

- MATIC (Sold to buy lower)

- JPEG

During the end of January and early Feb, I dabbled in AI coins briefly and burned myself, like the retail that I am, and promptly exited with about 40% loss. Thankfully, my risk was calibrated, and thus I remained relatively unscathed. My experience:

AI coins

Over the later half of January I noticed the trend of AI taking off, probably due to the virality of Chat-GPT and how Microsoft’s Bing could potentially usurp Google as the dominant search tool. As Satya proclaimed, he (Microsoft) wanted to make Google dance and he wanted people to know that it was Microsoft that started that dance.

Pretty bold move, and the buzz likely spilled over into the generative-AI space, where I noticed 2 coins that could potentially float higher (in price) due to this short-term narrative taking flight. I won’t mention the names here because they are quite illiquid, and the slippage was quite high. For savvy traders, you’d know that you need to set a slippage tolerance for swaps that have low liquidity, since swapping e.g. 0.1 ETH could move the price by quite a few % points.

In both projects, I had to set a slippage tolerance of 5% (!), which means that if I bought it at $1, due to slippage, I would’ve bought it at 1.05. It didn’t help that the inefficiency was further stacked against you with savvy algorithms constantly arbitraging your trade, leaving you with even less than what you’d hoped for.

In any case, my ride on the narrative train was short lived; I thought I was smart to have ‘spotted’ the trend before anybody else, but it turns out that ‘anybody else’ was retail which was never going to come, and the trend had already shown signs of reversal (hindsight of course). It must’ve been barely a week, but having bought the top, I sold at a 50% loss.

It was quite a small sum relative to my portfolio, thus I escaped relatively unscathed, but I still wanted to increase exposure in altcoins, this time into longer-term plays that has an already established product, and is leading in terms of market share.

Well, nothing much I can do about it anyways, time to move on and look forward. I’ll elaborate on a short thesis on the other coins below.

GMX

Having explored Polygon in January with some discretionary trading (“fees” worth 150 USD), I wanted to increase exposure on projects that will still be here (& growing) in the next 1-3 years (a little hard for the crypto space but Curve has already been around for much longer). GMX strikes me as a very capable decentralised exchange that offers perpetuals (for trading), whilst also providing utility for GMX holders in terms of fee-sharing, as well as staking rewards (in terms of native tokens, no less).

There’s a very illustrating dashboard showing details on their token, as well as how the exchange has been performing, in terms of volume traded, and number of users. Their native dashboard can also be found here.

People need to trade, and more so on an exchange that doesn’t gamble with their user’s deposits (ahem… cough ftx cough). The fact that their base of operations is on Arbitrum (Ethereum L2) and Avalanche will further attract trading dollars (given that fees are a very small percentage of what it would’ve cost on Ethereum) as crypto becomes the global 24/7 casino.

RLB

Speaking of 24/7 casino, Roll bit is trying to fulfill that market itch by allowing participants to gamble (away) their money in a decentralized fashion on Solana. Casino stocks are often referred to as ‘sin stocks’, but it doesn’t take away the attractiveness of the casino model. The user base appears to be pretty strong (with a crypto OG being an absolute whale (relative) on the platform, no less), and the allure of a ‘jackpot’ win brings all the gamblers to the yard.

I think it’s a good proxy / index for a casino play, and I intend to stay long this coin for awhile, at least until retail mania (that feeds so rabidly on gambles or ‘bets’) gushes back into the crypto space (who knows how that long will take).

JPEG

I’ve been participating in this protocol since early Dec 2022; using NFTs as collateral to mint liquidity, and providing said liquidity to the protocol (for users who want to swap to more established tokens e.g. ETH, USDC), whilst depositing the receipt into an auto-compounding vault (where the protocol team employs a mix of options strategies to earn yield), and depositing that _receipt into the ‘citadel’, which allows the holder to earn JPEG, the governance token. _That’s a mouthful.

Basically, it’s similar to a ponzi scheme where value is seemingly created out of thin air; except in this case, there is value from providing liquidity for those who need it, and to be rewarded as loyal users of this protocol with a governance token. As mentioned in previous articles, I’ve only loaned a small amount (with decently high margin of safety), and thus I’m comfortable utilizing this protocol as it’s unlikely I’ll get liquidated (am monitoring almost everyday).

Another characteristic of this token is that it behaves in quite a volatile fashion, going up 1x before dropping 50% in just a matter of 1-2 weeks! It’s quite the inefficient market, and I’ll hopefully be able to capitalise on some of this mispricing to accumulate more bags for the next bull market…

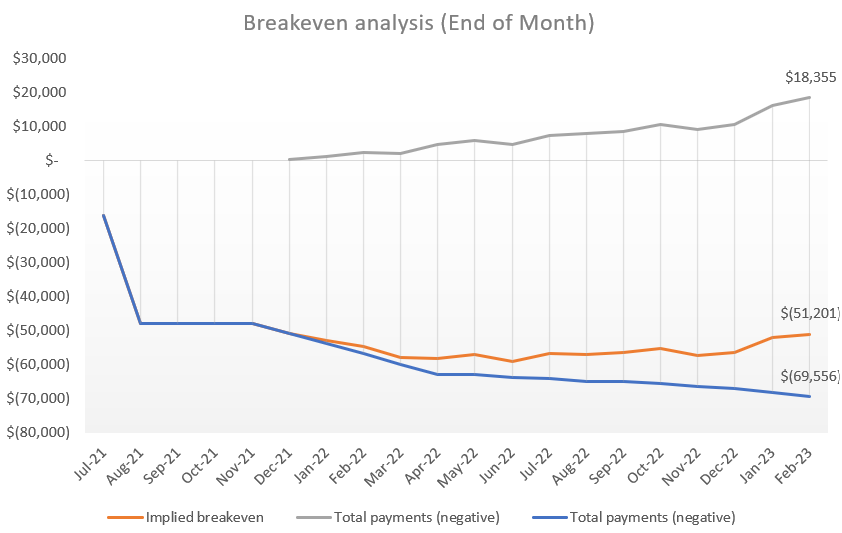

Mining

Slow and steady wins the race…

===

Life

See here.

===

Conclusion

Thank you for reading thus far and joining me on my investment journey.

As always, appreciate any comments or suggestions you may have, but otherwise, see you next month!

Cheers,

Joey

Comments

144

0

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

144

0

Advertisement

No comments yet.

Be the first to share your thoughts!