Advertisement

OPINIONS

Portfolio review - EOY 2022

Year-in-Review

Full article on Substack (including my life journey!) can be found here. My substack profile here. My Twitter profile here. Previous month's Seedly opinion article can be found here (equities and crypto).

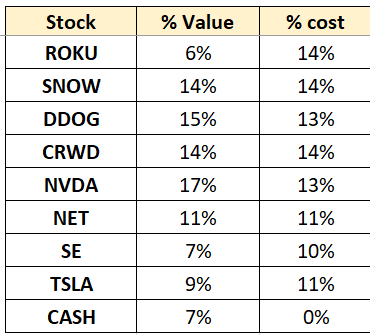

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

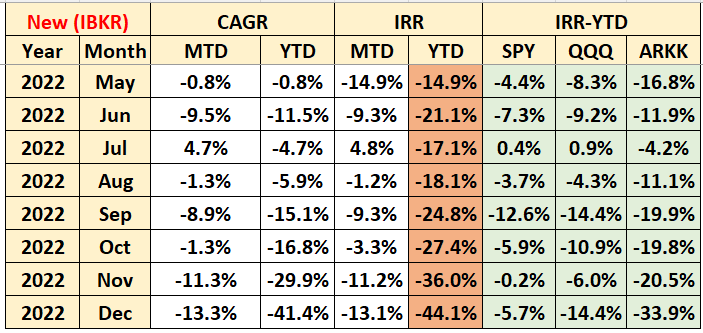

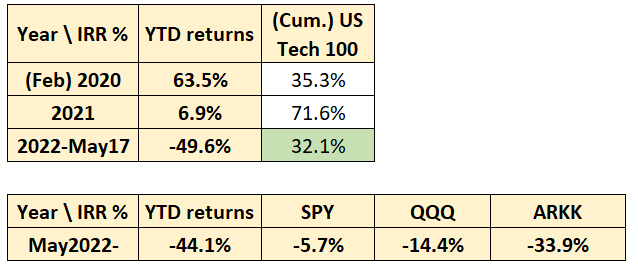

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky.

Time-weighted monthly returns (IRR) & CAGR (top); Historical returns (middle); Cumulative returns (bottom) - Since new brokerage.

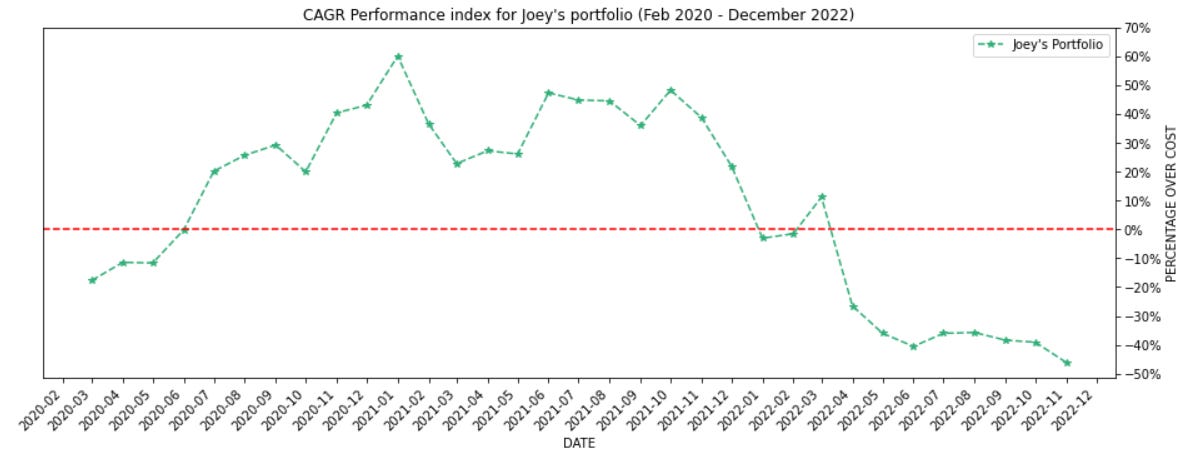

CAGR* Performance

Note: CAGR for my portfolio is calculated as (market value of portfolio including cash) as a % of cost - 1. The CAGR returns are compared in the above table instead.

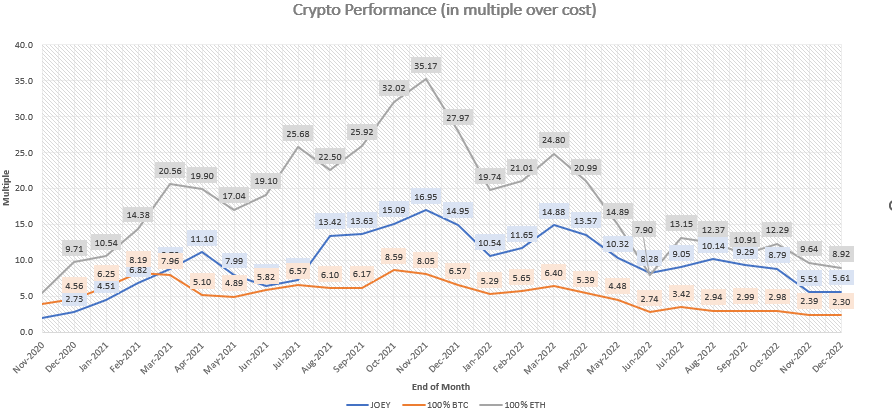

Crypto Portfolio Performance

- Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 5.6x my cost

Lifetime result:

- Achieved 2.44x of BTC performance (5.61/2.3)

Achieved 0.63x of ETH performance (5.61/8.92)

Goal is to try and outperform BTC and ETH from here on out. Bring on 2023.

===

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing here.

===

Equities portfolio review

There’s not much in stock-land to review, but since I’m an retrospective man, I thought it was appropriate to look back in time, from when I first started investing in Feb 2020, and visualize my buy points and how the longer-term charts for some of my companies look like.

Given my current performance, it goes without saying that I’ve had more than my fair share of mistakes (such as buying at the top). That said, perhaps the next 6 months can help me correct some of my mistakes, since I’ll have cash to deploy at the lows (relatively speaking).

I’m annotating all my buy points from Mar 2020 till now, including my current cost price to illustrate the fact that 1 mistake (or many) doesn’t kill your portfolio.

Sea Limited (Cost: $126.03 Current Price: $52.03 Drawdown: -58.7%)

Roku (Cost: $149.19 Current Price: $40.70 Drawdown: -72.7%)

Cloudflare (Cost: $68.80 Current Price: $43.78 Drawdown: -34.3%)

Twilio (exited in Nov 2022) (Cost: $171.90 Sold: $48.60 Drawdown: -71.7%)

Snowflake (Cost: $216.12 Current Price: $143.54 Drawdown: -33.6%)

Nvidia (Cost: $164.98 Current Price: $146.14 Drawdown: -11.4%)

Datadog (Cost: $96.06 Current Price: $73.50 Drawdown: -23.5%)

Crowdstrike (Cost: $157.13 Current Price: $105.29 Drawdown: -34.4%)

Tesla (Cost: $228.27 Current Price: $123.18 Drawdown: -46.1%)

There’s no time to dwell on the past and your mistakes, but you do need to learn from them and make better decisions next time. With inflation still being sticky and an upcoming earnings recession (i.e. companies not earning as much as they claim they can), the stock markets should yield attractive opportunities for the average retail.

Here’s to hoping that I can outperform indices even after 5 years…

===

Crypto portfolio review

Being active in the crypto space for some time (and making some money whilst losing most of it), I never could stay still and do a regular DCA (though I am on it now). Sometimes at night when I’m scrolling Crypto Twitter, I’m reminded of the DeFi scene and how the entire farming ponzu-scheme worked to bring ‘magic’ money in terms of free yield to us humble farmers.

I dived yet again into the cesspool that is DeFi and farming. Let’s face it: DeFi _is _risky, and it’s even risker if you attempt to integrate NFT elements into your entire DeFi strategy. Before I continue, let me explain in brief what I mean by DeFi, given that the class of 2022 has all but forgotten about it since the days of the Terra crash.

I wrote something similar in my Sep 2022 article, if you’re interested. Basically, the premise of DeFi is that you’re able to earn yield with whatever tokens you have. For example, everybody needs liquidity. A popular pair such as ETH/USDC has tons of retail + protocols interacting with it, each paying a trade fee of about 0.3% (in addition to ETH gas). We can deposit equal sums of ETH and USDC for which other participants can freely swap interchangeably. In turn, you earn 0.3% for each trade.

It would be insanely lucrative if you were the only contributor towards ETH/USDC, but that’s not the case. In other words, your yield is shared by the thousands and thousands of crypto folk. After depositing USDC & ETH, you get a receipt indicating that you’ve received LP tokens in return. These tokens are basically an IOU for what you deposited, though the final amount will be affected by Impermanent Loss (IL).

The next step of DeFi involves putting the ‘receipt’ (LP tokens) into another pool, which entitles you to farm xyz tokens. Why, you ask, would people let you farm tokens freely? These farming events are usually a way to attract liquidity to your protocol, thereby increasing user activity and bootstrapping the project. Recall that the tokens are farmed, but it costs essentially nothing to create it in the first place, hence why Trad-Fi folks view the practice as ‘scammy’.

Everybody is incentivised to deposit their LP tokens in that pool to receive rewards because of opportunity cost (your LP tokens would just be sitting there while others earn tokens which can be sold). Since there is also liquidity for the farmed token (xyz / USDC) which also earns from fees, the farmed token now has a price that can properly quantify the market cap of that entire project.

The protocol I’m current using is JPEG’d, which is a NFT protocol on Ethereum that allows users to use NFTs as collateral to then take out loans (in pETH or pUSD, which is their version of the same token). The NFTs are valued by their floor price, which the protocol fetches from various marketplaces (e.g. Opensea). Currently, only a few NFTs can qualify as collateral for their protocol, which I guess depends on the floor price, project, community, and a bunch of other factors.

Since I’ve 2 spare NFTs lying around, I’ve decided to make full use of them, taking out a small loan (~0.75 pETH each) to then farm in their pETH/ETH pool. pETH is a token that users can only mint from collaterizing their NFTs in the protocol, and is thus limited in circulating supply (aka no whale to dump). Users also have the option to mint pUSD, but the costs are much higher (as pUSD is pegged to USDC which is pegged to the actual USD).

The result was a 1.5 ETH loan, which when combined with my spare ETH (owing to my DCA), allows me to farm pETH/ETH for a decent yield (these tokens are managed by the protocol in Option Vaults like Dopex for yield generation). The receipt can then be deposited to farm JPEG (their governance token), which unlocks certain benefits such as allowing you to increase your LTV limits (currently at 35% of your floor price).

Of course, this comes with risk, but based on the protocol mechanics whereby any ‘free’ tokens (pETH and pUSD) must first be collaterized by the value of the NFT, it has in place a decently sustainable flywheel that does not lead to risk of ruin (barring tail risk events). Hence, I’m willing to put a bunch of my NFT portfolio in it.

Not investment advice.

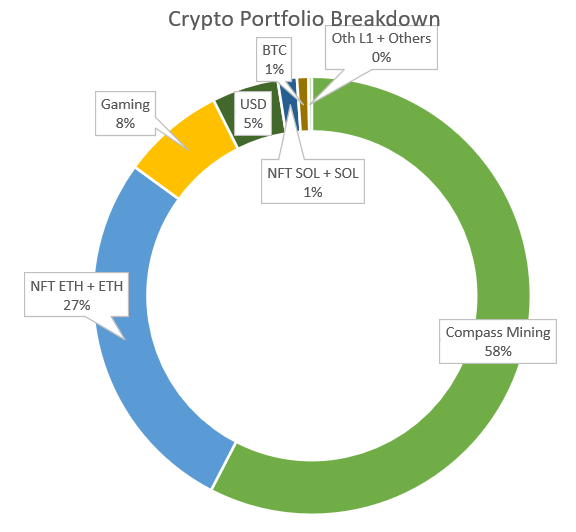

Elsewhere, I increased my exposure in Ethereum NFTs, this time with Kanpai Pandas, where I felt the community and the project team behind it have elements of durability (i.e. lasting however long this bear market will be, and thriving on the other side). My NFT portfolio now consists of:

- Pudgy Penguins x2

- Kanpai Pandas x1

My full crypto portfolio here for reference:

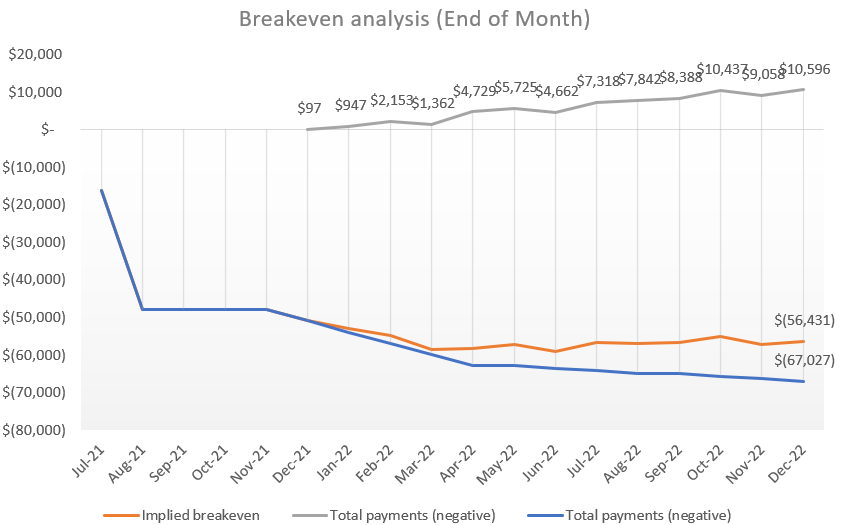

My bitcoin mining chart here for reference (7/8 miners (!) online):

My portfolio has been properly decimated by 2022, but for all the sh*t I’ve been through (LUNA in May, FTX in Nov), I think I’ve done decently well).

Many lessons learnt, plenty more to learn still.

I originally had another section to talk about some interesting finds within Messari’s Crypto Theses for 2023. Then I got busy with work and the general holiday season; don’t think that many people read the crypto section anyways (if you do, thank you!).

I’ll slowly read through over the next month and see if there’s any interesting finds. For me, 2023 is for building an even larger crypto position with the spare cash that I have, whether by sniping some undervalued NFTs, or buying majors at distressed prices. Am still bullish overall, but am willing to let macro play itself out. 🥂

===

Life

Check out the full section here: https://joeykoh.substack.com/p/portfolio-review-december-2022

Conclusion

Thank you for reading thus far. There’s not much in terms of content this month, but I’m proud of myself for writing and publishing my investment journal for the 22nd consecutive month (Feb 23 will be my 2nd year running). I’d like to believe that writing this has helped improve my thought process and decision making, while leaving some sort of legacy (of who I once was) for my future children.

The article has always been about writing for me and myself, and I had never expected anybody else to read it (even more so on a monthly basis). I want to take this opportunity and thank each and every one of you who read my article (even if it’s only once), your readership makes me believe that people want to see what I write.

So thank you very much. See you next year!

Cheers & Happy New Year,

Joey

Comments

570

5

ABOUT ME

Crypto and Growth stocks investing with focus on thematic trends Aim: Achieved outsized returns over the long term.

570

5

Advertisement

No comments yet.

Be the first to share your thoughts!