Advertisement

OPINIONS

Options and Leverage: Should You avoid them?

What are my options if I am looking to take on greater risk in the pursuit for higher returns?

Disclaimer: The information in this article is by no means any form of financial advice and is solely based on my personal opinions and views only. Options are highly risky financial products, and you should always seek help from a trained professional or contact your brokerage before engaging in it. You are warned to only trade with money you are willing to lose as trading is an extremely risky activity. Seedly or I will by no means bear any form of responsibility should you lose money engaging in any form of trading-related activities. I am in no means affiliated, nor recommending the content from the sources of images that are used in the article and the images are used solely for illustration purposes.

In our investment journey, most of us either start off with Robo-advisors, stocks or even cryptocurrency. However, at some point in time, some of us may have came across more complex leveraged products through friends, self-discovery or even through advertisements posted on social media platforms.

Furthermore, we may have heard countless success stories of people making life-changing money or losing their entire life savings in an extremely short period of time through the use of leveraged financial products. With the results of two opposite ends of the spectrum co-existing simultaneously - whereby there are people who have made and lost a lot of money through the use of leveraged products, it naturally makes us ponder as to whether it would be wise for everyone to utilise complex leveraged financial products, or at least know how to use them.

In this article, I discussing mainly on options, as the complex leveraged financial instrument that can potentially magnify our returns with its power of leverage.

Introduction to Options and Leverage

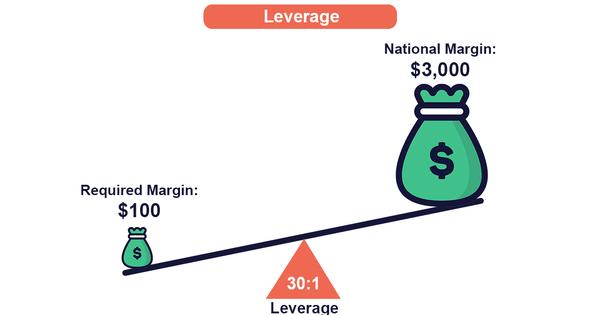

Option contracts are types of derivative contracts based off an underlying security or asset. They give us the right to control 100 shares of an underlying stock at a premium, till the expiration date of the option contract, which is a lot cheaper compared to buying 100 shares of the underlying stock itself. Therefore, option contracts have a leverage factor associated with them that enables us to multiply the power of our capital but there are risks associated as well. An Option contract is essentially an agreement between two parties, the buyer and the seller, to facilitate a potential transaction at a preset price and date. As an investor or trader, we have the ability to decide whether we want to be the buyer or seller of the option contract.

Before starting to trade options, we should be aware that option premiums can fluctuate very rapidly as they are affected by multiple factors such as implied volatility and time decay. Since each contract represents 100 shares of an underlying stock, these contracts can be very costly, especially for rather expensive stocks.

Furthermore, the value of options contracts tend to decrease exponentially due to time decay closer to its expiration date, assuming that stock prices stay the same (Theta decay). This is beneficial for sellers of the options contract, but unfavourable for buyers.

Source: https://www.rosencapital.com/option-time-decay/

These reasons emphasise on the importance of taking calculated and appropriate risk measures before buying or selling any stock option contracts as one wrong move can potentially damage your portfolio rather quickly.

If you are interested in finding more about how option prices are affected, you may refer to the "Greeks":

Source: https://www.tradingcampus.in/option-greeks/

Disclaimer on Options and Leverage

The truth is that trading options is trying to predict future market movements, be it short or long term. It is still a form of gambling since no one can predict the market direction with 100% complete accuracy. Even when macroeconomic conditions may appear bleak or unfavourable, the overall stock market could still be bullish in the short-term due to sudden favourable news releases or even due to mere overly sold conditions.

Potential Options Strategies and Usages

There are are many different ways to utilise options:

For example, proprietary traders may engage in options trading (or other complex leveraged products) to boost returns, while sales and trading analysts and even retail traders may utilise options as a tool to hedge their own portfolios when they foresee or are predicting a drastic change in market direction.

The number of different kinds of option contracts used in each strategy determines the number of legs each options strategy consists of and can cater to a large variety of options trading strategies. It is advisable to practice utilising one-legged options strategies such as covered calls and cash-sercured puts in a demo paper trading account, before moving on to two-legged options strategies such as credit and debit spreads, then to options with a larger number of legs.

Options also enables us to earn profits even in a flat market,minimise the losses of our existing positions in times of a crisis through hedging strategies, and even enable us to collect premiums to withdraw on a regular basis (Click here to learn more!)

Therefore, options have many different usages and knowing how and when to use them appropriately will definitely be favorable to your investment or trading journey.

Avoiding Options Altogether

Nonetheless, at the end of the day, avoiding options altogether may still be a wiser decision for some as well because leveraged products tend to come along with greater risk that not everyone is willing and able to bear. While options may be a useful tool due to its versatility, it is still very risky and not the only option available that will enable us to make significant returns in the long run.

Even though utilising options can magnify our returns greatly if used properly, it is important to be aware that it can also be a double-edged sword that can result in paramount losses quickly. For most passive long-term investors who do not wish to check their portfolios regularly, dollar-cost averaging into company stocks, exchange-traded funds, index funds and robo-advisors' portfolio management funds and holding them long-term is sufficient to generate high returns as well.

Comments

574

5

ABOUT ME

574

5

Advertisement

No comments yet.

Be the first to share your thoughts!