Advertisement

OPINIONS

Millennials’ Guide To Starting Your Investing Journey

Why should I invest? How to start? If you have burning questions related to this, read on 👀👀👀

Lin Yun Heng

24 Dec 2020

Senior Analyst at Delphi

This article originated from my blog: Investing Beanstock

Telegram Channel Here

Without sounding like a broken recorder and advocating people to start investing, I am going to be blunt. Invest or be a work slave.

There are many blogs and self help books out there which teaches people about the importance of investing early, to be frugal while you are young and to keep track of your expenses, put in the extra cash into an index fund so that you can one day escape the rat race and enjoy the fruits of your hard work.

While this concept is known to many, why is it that the majority of people are not practicing it? I attribute it to these few reasons:

Ignorance

Laziness

Complacency

Not looking at the big picture

Personal Finance/Financial Literacy not taught in school

The reason why schools do not teach us how to manage money, and why the majority is not taught how to invest properly is because of one simple reason: The government needs people with “pay check, spend, repeat”mindset, or in other words, workers/employees (the middle class) to help support the economy. If everyone has an investor/entrepreneurial mindset, there will not be enough workers/employees to build companies because everyone wants to be their own boss.

This is the real reason why governments worldwide do not include financial literacy into educational syllabus, because schools produce employees and hardworking workers.

Monkey see, so monkey do?

From young, we are taught by our parents to study hard, get a degree and work at a good company to get high salary for a better life. This norm shaped by our society breeds hardworking workers, and once again not entrepreneurs. By choosing to be a worker, you are putting a limit to your earning potential (be it 3k/month or 10k/month)

Parkinson's Law (The higher your salary, the more you spend)

Even if your starting salary right after graduation is 8k/month, if you never master how to manage your money, you will still remain poor. If your active income is 8k/month and you spend 8k/month on mortgage loans, car downpayment, expensive cuisines and luxury clothings, you still end up with $0 extra cash every month to even build wealth. Likewise, even if you become a executive director earning 1 million every year, if your annual expenses is 1 million, you will still be living pay check after pay check.

So how exactly should you go about building wealth? You need to first understand why compound interest is the most important word you will hear once you talk about wealth building.

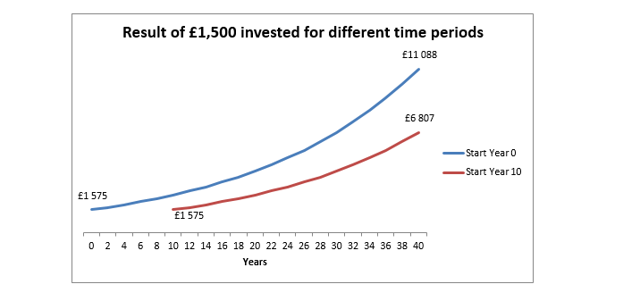

Compound interest is our best friend when it comes to building wealth. It is the archenemy of taxes because taxes is a guranteed form of money outflow from your wealth machine. In order to fully see the effects of compound interest, you need a longer the frame. The longer you let compound interest do its work, the bigger and faster your capital will grow over time.

I’m not going into the details of how long it takes for compound interest to kick off but basically, once you have invested at least 100k into the stock market, your capital should start to skyrocket and compound so quickly that you will reach a million in less than the amount of time you took to reach 100k. (Provided you keep contributing to the investment)

Getting Started on Investing

So how exactly should you go about investing your first penny into the stock market? I will list down the steps you need to take:

Read Books/Youtube videos on investing (Rich Dad Poor Dad + One Up on Wall Street to begin with) *The Swedish Investor makes good summaries on Youtube

Build up a long-term investor mindset and keep track of your expenses

Build up your emergency fund

Put the spare cash aside from emergency fund into an investing “Warchest”

Create a brokerage account (For Sg: Use Tiger Brokers/Saxo/FSMone, For US: Use Firstrade)

Alternatively, you can Dollar Cost Average into a Robo Advisor such as Syfe

Create a portfolio tracker using StocksCafe

Monitor your performance and keep contributingmonthly/quarterly/yearly

Continue to repeat step 1 till step 8 year in year out

Increase the spare cash portion and contribute more into the stock market yearly

Rinse and Repeat until financial freedom

And that’s it! The rest of the nitty gritty details will be _which stocks/ETFs to own, how to diversify etc but for most people, these questions should not even pop up because if you are too lazy to keep track of the market, simply buying the S&P 500 ETF (VOO/SPY) + 1 Robo is more than enough.

“Just because you can trade does not mean you should trade” -Warren Buffett

Ultimately, it is important to come up with a long term and sustainable strategy so that you will stick with it and ultimately reach financial freedom. Also, once you start your investing journey, you will start to look at the world differently because all the short term instant gratifications like getting a luxury car when you can’t afford it will be out of the equation.

You will rather invest that amount, hold on for a few more years before you afford the same car but you have the ability to own it for the long run because you are generating income passively even while you’re asleep!

Retirement planning is a whole different topic for another day but I will leave it at this: Take your annual expenses and multiply it by 25 times, that should be the amount you need invested for you to reach financial freedom.

Dear Millennials still schooling:

For fellow students out there, you have more advantage than a working adult because we do not have liabilities such as mortgage loans, taxes, insurance premiums and credit card debts to deal with so please take advantage of your situation now, drop the shitty excuse of no money and start investing. Even starting with $100 is better than nothing because compounding is really powerful even if you don’t see the effects of it now. If you have the money to eat expensive dinners, go out for suppers, play poker and mahjong, why can’t you fork out $100 each month ($25/week!) to invest? It’s all excuses.

For those who are still ignorant/lazy/complacent or short-sighted (not thinking long term), I wish you all the best and wake up before its too late. The longer you drag, the longer you will suffer from the never ending workload just to chase the monthly paychecks. If you are okay with that life, sure go ahead, as I would rather have my assets pay me while I sleep and no longer dependent on active income to get by life at an earlier age, with a bigger retirement nest egg.

I use StocksCafe to keep track of all my investments (include Robo) + research on stocks. You can also view my portfolio as well as many others so you can compare your own performance with other investors. If you are interested in signing up, you can use my referral link to sign up and access premium features for 1 extra month for new users. (3 months)

TL;DR Syfe Promo Code

For people who are interested to invest into Syfe and wants to open an account, you can use the promo code below as a bonus 🙂

Promo Code: SRPTH8LK3

$10 bonus for the first deposit of $500 (or more)!

$50 bonus for the first deposit of $10,000 (or more)!

$100 bonus for the first deposit to $20,000 (or more)!

Note: Bonus is applicable on the first deposit made only. The bonus will be automatically credited to your portfolio and invested along with your existing investments

Comments

1943

0

ABOUT ME

Lin Yun Heng

24 Dec 2020

Senior Analyst at Delphi

Crypto Educator

1943

0

Advertisement

No comments yet.

Be the first to share your thoughts!