Advertisement

OPINIONS

Maximising Your CPF for Home Loans

Here’s a quick run through of how you can make the best use of your CPF savings when purchasing a property.

Redbrick Mortgage Advisory

Edited 28 Dec 2022

Maestro at Redbrick Mortgage Advisory

Are you considering purchasing a new property but have no idea how much Central Provident Fund (CPF) you can use to finance your purchase? Or perhaps you are looking for alternatives to invest your cash and need new financing modes for your mortgage. Well, here’s a quick run through of how you can make the best use of your CPF savings.

Types of Home Loans

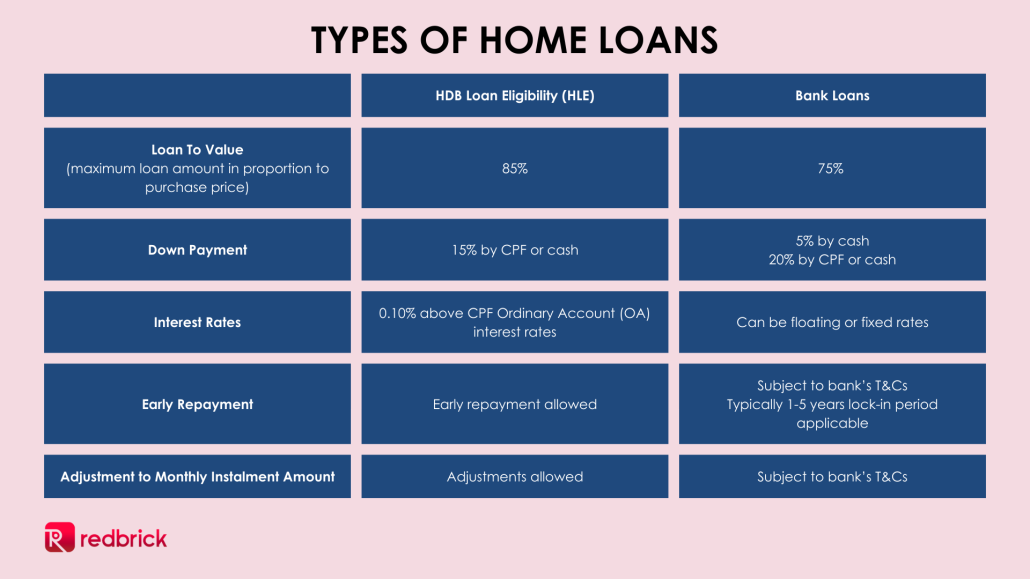

Before delving into the details of using CPF, it is crucial for us to identify the type of home loans you are considering to take up. Housing & Development Board (HDB) loans and bank loans offer different interest rates, as well as loan quantum.

On top of the abovementioned differences between bank and HDB loans, financers also consider your age, current loan commitments, credit repayment history as well as income when determining your final loan quantum. These includes calculations on your Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR).

When can you use CPF to repay your property purchase?

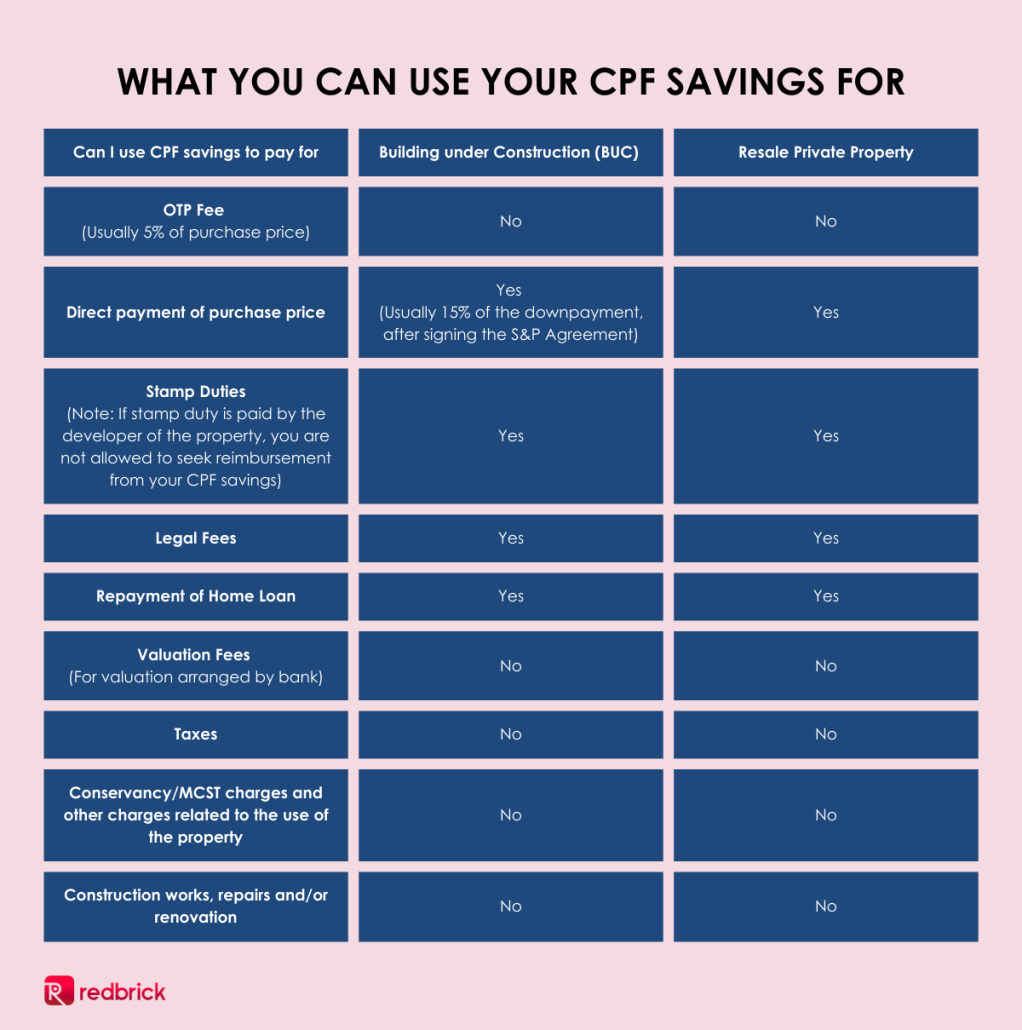

We all know that CPF can be used to purchase HDB or private residential properties for paying down payment and monthly loan repayments. But what you may not know is that your CPF Ordinary Account (OA) savings can also be used to repay your stamp and legal fees, as well as Home Protection Scheme (HPS) premiums for HDB flats. Landed property owners can also use their CPF OA to repay construction loans they have undertaken.

Additional conditions on the use of CPF savings for BUC

- CPF savings cannot be used to pay the construction cost of the house directly. You would have to use your own funds and/or a loan to meet the said payments first and request for reimbursements later.

- Request for reimbursement of CPF savings must be made within six (6) months from the issue of Temporary Occupation Permit (“TOP”). The reimbursement will be in the form of a one-time payment.

Application for the above should only be submitted with the following documents:

- Valuation report of the completed property;

- Breakdown of contractors’ construction costs;

- Original receipts to show evidence of the payments made from your own funds;

- Bank’s Letter of Offer; and

- Grant of written permission from URA for the proposed ‘reconstruction’ or ‘erection’ of the new property.

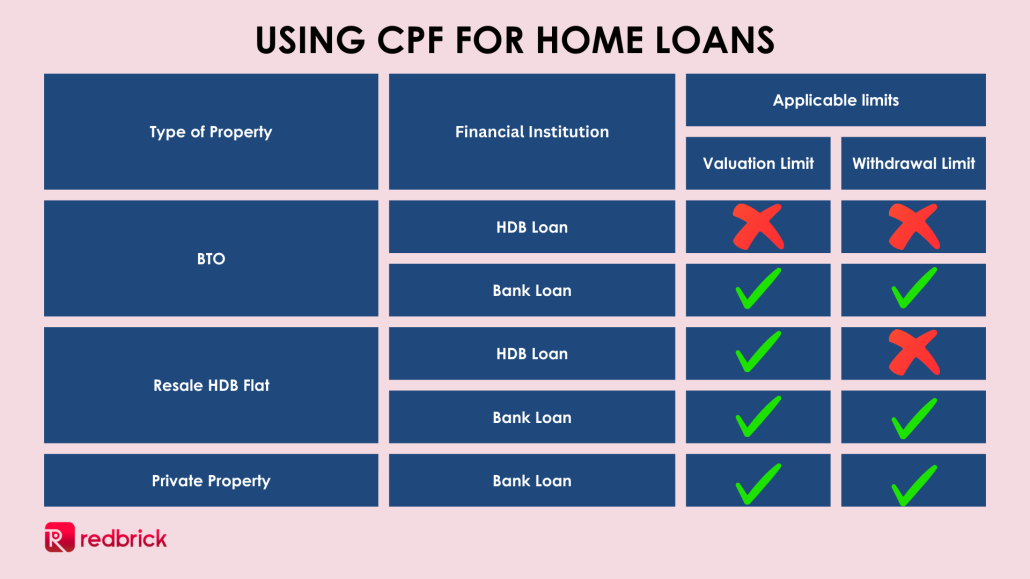

In general, there are 2 types of limits applicable to CPF usage for home loans.

The first is valuation limit, which is the lower of the purchase price or the valuation price of the property at the time of purchase. For example, if the purchase price is $1,000,000 (the amount you are paying) and the market value is at $900,000 (figure given in valuation report), the VL will be $900,000.

Hence, the maximum amount of CPF savings that you can use for the property is $900,000 (this includes the down payment and housing loan repayments).

The second is withdrawal limit, which considers the maximum CPF amount that you can use for your property purchase and is currently capped at 120% of the valuation limit.

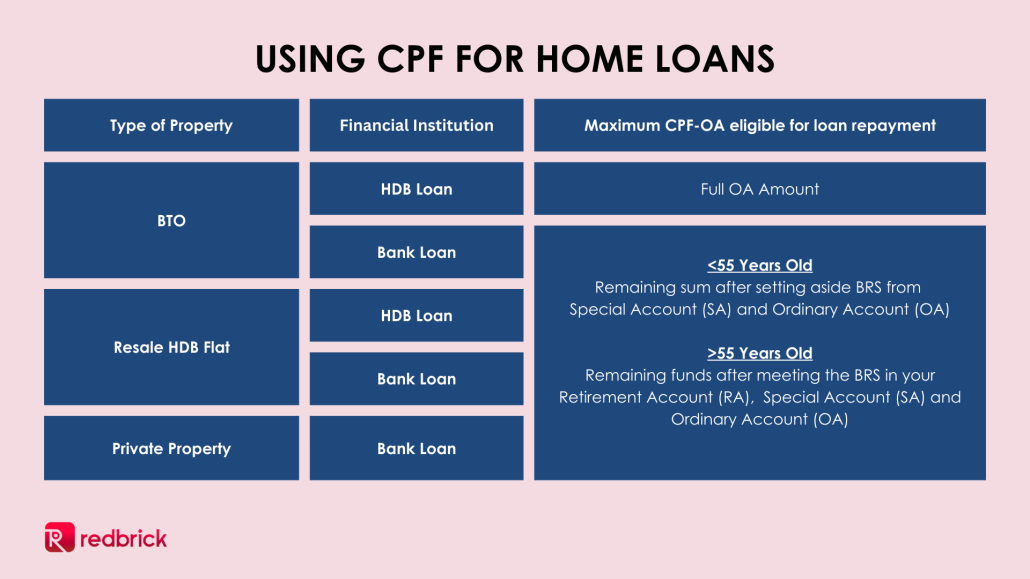

As seen in the table, BRS is an important matric that is used to measure how much you can withdraw from your CPF OA. Since CPF also acts as your nest egg when your Retirement Account is set up once you turn 55 years of age, it is crucial that your CPF meets the minimum requirements of BRS to ensure you have a comfortable retirement.

The BRS for those aged 55 in 2022 is $96,000, which is the minimum sum required to be set aside to their Retirement Accounts for such individuals to enjoy about $850 monthly payouts from 65 years old onwards. Depending on the type of property purchased, the maximum CPF OA funds that can be used in the property would then apply accordingly as per the table.

Source: CPF

Source: CPF

Source: CPF

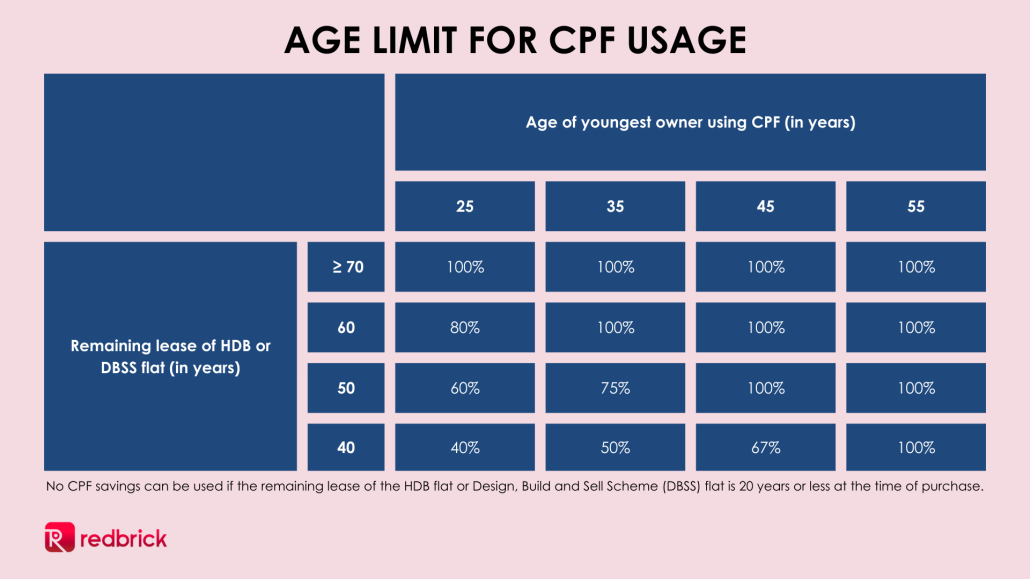

Aside from meeting the BRS requirement, buyers of resale properties should also take note of the remaining lease tenure. If the property’s lease cannot cover the youngest buyer to 95 years old, it will limit the usage of CPF OA for the buyer.

For instance, Mr Tan (aged 35) and Mrs Tan (aged 37) recently purchased a resale HDB flat with 50 years remaining lease. They would only be allowed use 75% of their CPF OA, assuming they have sufficient funds for the BRS.

As a result, younger buyers typically may not purchase older properties with shorter remaining leases due to the lower CPF quantum avail to them for housing usage. This could aid as a property cooling measure, as buyers who are interested in properties in mature estates will need to fork out more cash to purchase the properties.

While the CPF requirements appear to be strict, majority of households are not affected by these requirements. For a couple in their 30s, these restrictions would only apply for their second property, or if they choose to purchase a resale flat with less than 70 years left on the lease. Thus, these rules are critical in ensuring home buyers would have a roof to live under through their golden years, as well as have a property to enjoy potential capital appreciation.

Comments

217

1

ABOUT ME

Redbrick Mortgage Advisory

Edited 28 Dec 2022

Maestro at Redbrick Mortgage Advisory

Largest independent advisory in SG 👨💼👩💼🏢 Provides unbiased advisory for home loans, property financing and refinancing

217

1

Advertisement

No comments yet.

Be the first to share your thoughts!