Advertisement

OPINIONS

Lemonade (NYSE: LMND) - The Most Talked About Disruptor in 2020

Insurance is one of the largest markets in the world and it's being disrupted by Lemonade today

Gavin Tan

28 Jan 2021

Founder at sgstockmarketinvestor

This article originated from sgstockmarketinvestor

Join My Telegram Channel Here For More Updates!

Insurance is one of the largest markets in the world, generating over $5 trillion in annual revenue and it's being disrupted by Lemonade today. Month after month, having to pay for insurance leaves a bitter taste in the mouths of most people. Lemonade is trying to transform that lemon into something sweet by simplifying the process.

Lemonade is building an insurance experience that is easy, affordable, and hassle-free by injecting technology and accountability into an industry that often lacks both. Without further delay, let's take a look at the most talked-about disruptor in 2020.

Business Overview

Lemonade is an Insur-Tech company, focused on disrupting the insurance industry by injecting technology and AI. The company uses AI and big data to run its work processes such as allowing customers to purchase insurance or making claims.

On the backend, the company uses AI to manage workflows and predict possible frauds. On the frontend, they utilize AI chatbots to interact with customers, underwrite policies, and pay claims. This allows Lemonade to provide a high-quality user experience at a lower cost than traditional insurers.

Products and Services

As of December 2020, Lemonade sells renters, homeowners, pet welfare insurance. This is a pretty small range of products but in due time, the company will definitely grow its product range to offer wider coverage for new and current users.

How Does Lemonade Work?

Lemonade has a fixed-fee business model based on proportional reinsurance, which is essentially insurance for insurance companies.

Here's how it works: When Lemonade receives premiums from customers, it keeps a flat fee (25%) and pays or "cedes" the remaining 75% to reinsurance companies. In exchange, the reinsurance companies take responsibility for 75% of claims. They also pay Lemonade a commission (25% of 75% = 18.75%) for bringing them business.

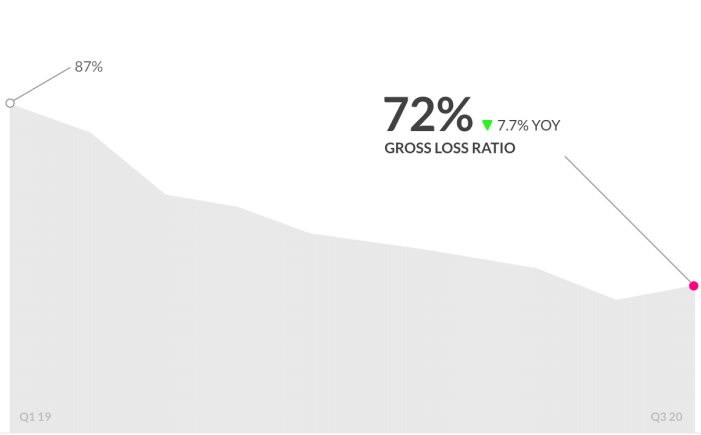

This means, as long as Lemonade keeps its gross loss ratio (how much it pays out in claims, divided by how much it earns in premiums) under 56.25%, Lemonade will keep a minimum of 43.75% of gross earned premiums as operating profit.

Based on Lemonade's Q3 2020 report, they have managed to drop their gross loss ratio substantially and it is now below 75%, standing at 72% for the quarter. They are on track to go well below 56% within the next few quarters.

How Is Lemonade Different From Traditional Insurance Carriers?

By retaining the money that they don't pay out in settlements, traditional insurance firms make money. This means they lose profit every time they pay your demand. This is why it is often so difficult to get your claims paid quickly and in full.

Lemonade, on the other hand, was constructed differently. Lemonade receives nothing by delaying or rejecting claims because they only take a flat fee, unlike any other insurance company. This allows the company to manage and pay as many claims as possible immediately.

What Makes Lemonade Special?

The key reason why the P2P concept of Lemonade works is that it's completely AI-driven. Lemonade does not run or compose policies by agents for any physical entities. Buyers apply, request, and file claims online or via the mobile app instead. This keeps the running costs slim and allows Lemonade to put much of the proceeds into claims and giveback. It also helps to keep rates down, with home insurance beginning at $35 a month and insurance for tenants at $5 a month.

Lemonade's Giveback Feature

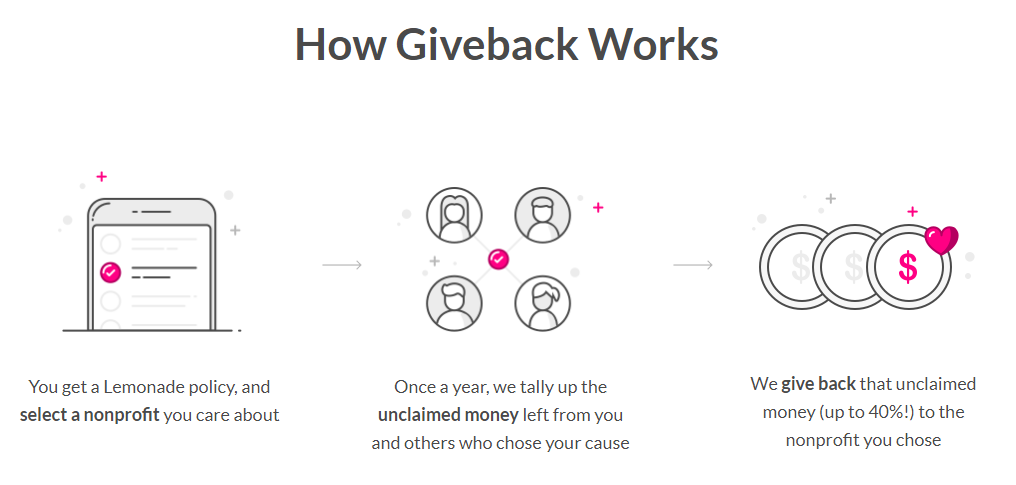

Giveback is a special feature of Lemonade, whereby excess/unclaimed cash is recycled each year towards nonprofit organizations. A simple illustration below explains how Giveback works.

This is a very unique feature and definitely makes Lemonade very different from its competitors. Traditionally, insurance companies will just keep any excess/unclaimed cash as profits. For Lemonade, they simply charge a flat fee, and whatever is left actually belongs to the policyholders. Lemonade will then give back a portion of the excess to nonprofit organizations on behalf of its users.

This way, policyholders who don't make a claim, won't feel like all their premiums are being swallowed away by the insurance company, but rather, are given back to society, towards a nonprofit organization of their choosing.

As we can see from the image above, Lemonade clients enjoy amazing insurance this way, and society gets a little push for the better.

Strong Growth Catalysts

With Lemonade's share price increasing rapidly recently, is there any further upside left? Let's take a look.

Expanding Their Product Offering

Lemonade's management has announced in its shareholder's letter in Q3 2020 that it will start to branch into life insurance. Life insurance is outside of the bounds of 'Property & Casualty’ insurance, yet Lemonade plans to breach this categorical boundary and test a life insurance product sometime in the next 2-3 months. With Lemonade being customer-centric, this means prioritizing product launches based on customer needs, rather than regulatory frameworks.

Lemonade is placing a bet on term life, not because they have high conviction it will be a winner, but because its expected value is high: the ante is modest and the prize is big.

The ante is modest because Lemonade will not be underwriting term life policies themselves, and will be leveraging the technologies, customers, and brands they’ve already paid for

The prize is big because the global term life insurance market stands at about $800 billion this year, and is expected to grow more than 10% CAGR to over $2 trillion by the end of the decade

Expanding into Other Regions

Another huge growth catalyst for Lemonade is to expand into other regions and markets. They currently serve only in the US across several states as well as Germany and the Netherlands. Lemonade expanding into other regions such as Asia and Europe will definitely help grow the business exponentially.

Bonjour la France

On December 8th, Lemonade has finally launched in France. The French offering has been crafted specifically for the French customer, but will also embody what’s loved by Lemonade customers elsewhere: a simple and delightful experience powered by artificial intelligence, instant claims, and the ability to support local and global charities through the company’s annual Giveback.

Final Thoughts

Overall, Lemonade is definitely a company to watch for the next 2 years as they continue to disrupt the insurance industry with all its innovations. As Lemonade continues to grow regionally and through its product offerings, it has the potential to be a 10 bagger or even a 100 bagger thanks to the large Total Addressable Market (TAM).

I've been watching Lemonade for a while now and will be looking to accumulate on dips when I have the cash to deploy. This company is surely one you should not miss out on if you want to invest in new and innovative disruptors.

As always, you can take a look at my portfolio updates to see my current positions! Also, use my referral code for an extended 3 months of premium access to StocksCafe!

If you have not made an account and want to try out Tiger Brokers, feel free to use my referral code (8A8FT4) or sign up through this link so that you can get these rewards!

You can check out my review on them here: Start Saving Up On Commission Costs! Use Tiger Brokers!

Comments

3043

0

ABOUT ME

Gavin Tan

28 Jan 2021

Founder at sgstockmarketinvestor

Hey there, I’m Gavin! I'm the founder and author of sgstockmarketinvestor.com

3043

0

Advertisement

No comments yet.

Be the first to share your thoughts!