Advertisement

OPINIONS

Is Your Salary Enough for Singapore’s Cost of Living?

Singapore offers amazing perks, but living here can really stretch your wallet.

This post was originally posted on Planner Bee.

Living in Singapore has its perks: world-class infrastructure, safety, and great food.

However, it also comes with a high cost of living. According to Numbeo’s Cost of Living Index 2025 (as of 16 June 2025), Singapore is the most expensive city to live in Asia and ranks 5th globally.

So, what does “expensive” actually mean? Based on the same report, Singapore’s Cost of Living Index, excluding rent, stands at 79.1. For context, New York City is the benchmark with a score of 100. This means that, on average, Singapore is around 21% cheaper than New York City. That might sound reassuring, but the details tell a different story.

When broken down by category, Singapore scores 67% for rent, 70.8% for groceries, and 53.5% for dining out. Add everything up, and the city’s Cost of Living Plus Rent Index reaches 73.7%. This level of cost still makes budgeting a top concern for many residents, especially for those without dual incomes or supplemental sources of revenue.

Whether you’re living with your parents or paying off a mortgage, it’s natural to ask: Is my salary enough to keep up?

Let’s break it down and see how your income stacks up against the real costs of life in Singapore.

What drives Singapore’s cost of living?

Several key expenses shape the cost of living in Singapore, and most adults can’t avoid them. While everyone’s lifestyle is different, these four big-ticket categories tend to take up the largest chunk of a person’s monthly budget:

Housing

Whether you’re renting a room or paying off a mortgage, accommodation costs are often the biggest expense.

Transport

From daily MRT rides to car ownership, transport choices can make a noticeable difference in overall expenses.

Food and utilities

Groceries, hawker meals, electricity, water, and internet may seem manageable individually, but they add up quickly.

Healthcare

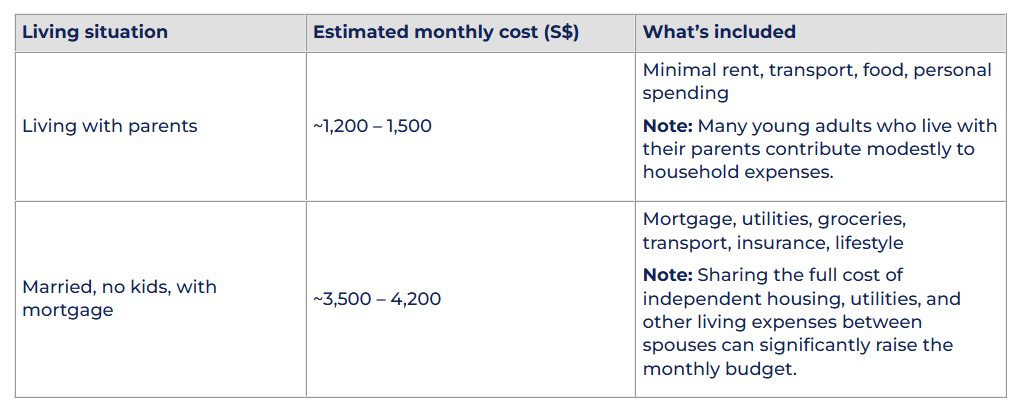

This includes routine medical check-ups, insurance premiums, and occasional or unexpected medical costs. To put things into perspective, here’s a snapshot of what a typical 30-year-old in Singapore might spend each month, based on their living situation:

Whether you’re saving by staying with family or managing your own household, these numbers show how widely costs can vary and why planning ahead is essential.

Breakdown of common cost factors

From housing to transport and everyday expenses, here’s what you can typically expect to spend each month in Singapore. Costs will vary depending on your lifestyle and personal choices.

Accommodation

Housing is usually the biggest expense. Here’s a comparison of what you might pay across different types of accommodation:

Tip: First-time Singaporean buyers can offset costs with CPF Housing Grants (up to S$80,000 for eligible resale HDB flats).

Read more: How To Choose the Perfect HDB Resale Flat in Singapore

Transportation

Getting around in Singapore is convenient, but the cost varies by mode:

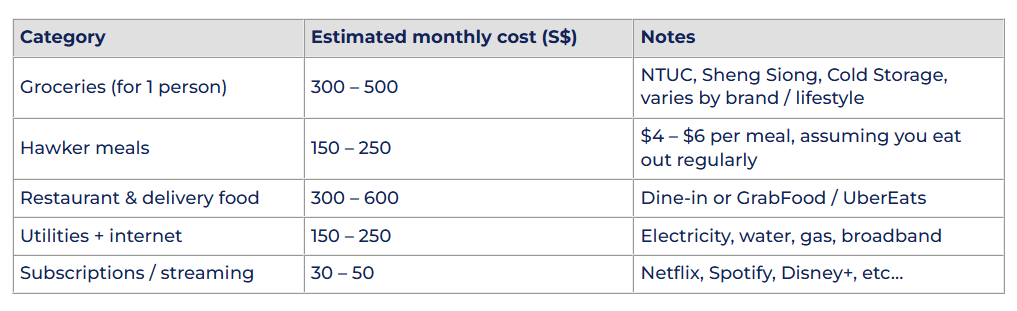

Daily living

Everyday costs depend on your habits and preferences:

Tip: While you’re budgeting for today’s expenses, it’s also wise to prepare for the unexpected. A straightforward digital insurance policy can cushion the blow of surprise medical bills or income disruptions, so you can handle life’s bigger moments without draining your savings.

Read more: Five Cash-Free Insurance Plans You Can Get in Singapore

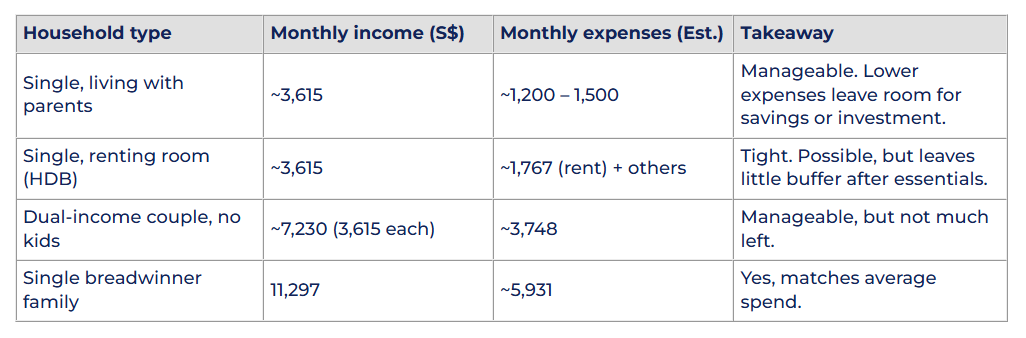

Income reality check: Is salary enough?

Is relying on your salary enough to live comfortably in Singapore? Well, it depends on your income level, lifestyle, and living arrangement.

According to the latest data from the Singapore Department of Statistics, the median monthly household employment income, including employer CPF contributions, rose to S$11,297 in 2024.

That figure may seem reasonable, but context matters. Your cost of living can vary a lot depending on your personal circumstances. Let’s break it down:

Note: Income data is from the Singapore Department of Statistics (2024) and HDB Rental Flat Market (2024). Actual figures may vary depending on lifestyle and location.

Five quick money‑saving moves

Saving more doesn’t always mean big lifestyle changes. Small, consistent tweaks can add up quickly. Here are five simple, practical moves to help you stretch your budget and keep more of your paycheck each month.

1. Rent smarter

Consider co‑living arrangements or renting outside the CBD. Shared flats in suburbs like Woodlands or Jurong can cut your housing bill by 20–30%. These areas also tend to have more spacious units and quieter neighborhoods, which can be a plus if you work from home or value personal space.

2. Transport hacks

Use concession passes for regular MRT or bus travel. If you rely on ride-hailing apps, make the most of promo codes, ride credits, and bank-linked cashback offers. Some platforms offer loyalty rewards that can shave 10–15% off your usual fares.

3. Grocery strategies

Shop at wet markets for fresh produce, buy in bulk at warehouse sales, and opt for store‑brand staples to save up to 25% on your monthly grocery bill. The savings might seem small individually but they really add up over time.

4. Trim your bills

Some providers offer bundle promos. Some offer up to 25% off electricity plans, or 5–8% off when you combine electricity and gas. On an average utility bill of around S$150 a month (with electricity at about S$115, water around S$25, and gas roughly S$10), this could mean monthly savings of S$8 to S$12, or about S$96 to S$144 a year. Bundling telco plans may also give you extra data or small discounts.

5. Earn extra

Pick up a side gig like freelance writing, tutoring, or weekend ride‑sharing. Even an extra S$300 – 500 a month can boost your savings rate and give you more budget breathing room. Many side gigs are now remote-friendly, making it easier to fit them around your schedule.

Managing your finances in Singapore comes down to understanding your expenses and making informed choices. With careful planning and a few smart adjustments, it’s possible to balance your budget, save more, and build a stable financial foundation for the future.

Read more: Time To Start Adulting: A Guide to Cost of Living in Singapore for Fresh Graduates

Comments

141

24

ABOUT ME

Your Personal Mobile Financial Advisor Application Join us at telegram! https://t.me/plannerbee

141

24

Advertisement

No comments yet.

Be the first to share your thoughts!