Advertisement

OPINIONS

Investing Mistakes I Made So You Don't Have To

The common, not-so-common investing mistakes every beginner should avoid

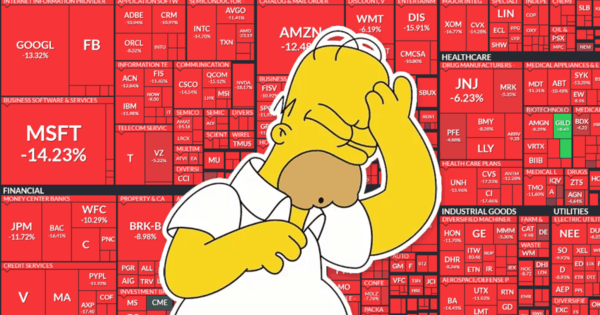

I believe many can relate to that expression of Homer Simpson especially when our investments don't go as planned during periods of uncertainty.

My investment journey is surely a rollercoaster ride that comes with costly mistakes. Investments are never risk-free but understanding the risks involved helps us minimise possible downsides. Here are the investing mistakes that I made that turned into key learning points.

Options and Margin Trading

Image Source: Skalex

I have been liquidated and margin called several times. Certainly not the wisest decision of them all particularly for beginners but this is how I started my investment journey. For someone who is self-taught in investing and has zero business background, it's clear that the focal point at that moment of time is 'getting that bread'. The upsides are limitless with just a small capital so why not? From a beginner's point of view, we are truly blinded by profits and tend to not weigh or consider the risks involved seriously. Not knowing that it's a double-edged sword to the extent that it could wipe away all your invested capital in a flash. It's definitely an overwhelming yet expensive experience for me but it has taught me well.

This is definitely not an optimal way to start off. Avoid options and margin trading at all costs if you're just starting off. It's recommended to gain knowledge of the fundamentals first before investing. It's boring but it'll save you some troubles. In my opinion, mainly tapping on stocks or ETFs for a start and at the very most, acquiring only underlying assets would be ideal as it enables you to cover a vast area of the overall market without exposing yourself to too much risks.

Emotional Investing

Image Source: Capital Investment App

Emotions, something we can't eliminate completely. Allowing room for emotions to dictate decisions is a common mistake made by many investors, breaking away from our own strategy. Typically, poor timing greatly contributes to emotional investing and the primary emotions are commonly expressed as Fear and Greed. It may potentially cause you to make irrational investment decisions that are purely based on emotions which result in these consequences that I experienced first hand.

1. Overtrading

This happens whenever one is in fear or greed, trying to make up for their losses or make even more money. Instinctive reactions don’t always make sound investment decisions. By acting emotionally, you’re more likely to make costly mistakes, like selling low or buying high.

2. Sell Winners, Hold Losers

Selling the ones that are in profits and holding the ones that are in a loss, hoping to at least break even. Holding the ones that are at a loss just because of not wanting to experience the emotional pain of realising a loss on my investments.

3. Speculative Investments

Greed brings the desire to look for other opportunities to gain greater returns, unknowingly exposing ourselves to greater risk. This results in leaning towards speculative investments such as penny stocks and meme stocks.

4. Following the Hype or Invest in Other's Opinions

We tend to be influenced by investments that are massively outperforming for no particular reason which makes you question your investment beliefs and afterwards, make hasty decisions. In short, fear of missing out. This 'chasing' is unsustainable and best to stay away. While experienced traders typically exit trades when they get too crowded, new investors or traders tend to catch a falling knife or be trapped long after smart money has moved out.

Dollar-cost averaging has always been my favourite in eliminating emotions from investing. Alternatively, diversification. It simply helps me establish a long-term mindset where short-term fluctuations don't matter! These has been the two most common strategies to prevent emotional investing. Such methods are the simplest and have been proven successful but yet many are still underestimating the power of it.

In my opinion, the toughest part of investing is indeed long-term holding.

Image Source: Reddit

I crossed upon this illustration on the psychology of a market cycle and I found it relatively interesting! However, this shouldn't be used as a deciding factor for your investments but to a certain extent, it shows how our sentiments can affect our rational decision-making accurately. The psychology of people doesn't change.

Timing the Market

This has been one of the popular mistakes investors make. Everyone wants to get in at the perfect time and at the cheapest price, including myself. Unfortunately, this is almost impossible without luck.

Most attempt to maximise profits by doing so but as a matter of fact, the biggest risk of market timing is typically not being in the market at critical times, resulting in missing exceptional returns which then again leads to emotional investing.

"At one point in time, NIO and Pinterest were trading in 3s and 10s respectively and I was just trading for short-term profits, neglecting all fundamental analysis. And today, it has gone way beyond its previous all-time high."

This made me realise the importance of time in market over timing the market. The stock market is known to be highly driven by sentiments in the short term. Thus, it's best to stay invested despite volatile times. This way, you'll be able to seize as much growth as possible from the market.

Fall in Love into a Stock

I believe we all have that one particular stock that we truly favour the most and we have the tendency of being bias even if it's showing signs of red flag. Never have a personal attachment to the stock or fund you own. As much as conviction is important, adaptability is key in investing as well especially when the fundamentals of a company change negatively. The nature of the stock market is forward-looking and constantly changing. Hence, it's always vital to be open to changes as what works in the past doesn't mean that it will work in the future.

In Conclusion...

These are the common mistakes investors make when they are first exposed to the world of investing. By avoiding such mistakes, you're one step closer to your financial goals. Looking back, I considered such mistakes a blessing in disguise as they nurtured me to become a better investor today. Mistakes don't always come with a price but as long as we learn from them, it's worth it! Most importantly, only invest in companies that you truly understand and that suit your risk appetite and tolerance level to prevent yourself from making hasty decisions in times of uncertainty. If your portfolio lets you sleep well at night, that's when you know it's right for you!

Comments

172

0

ABOUT ME

Forever a student. Enjoys everything stocks and cryptocurrency.

172

0

Advertisement

No comments yet.

Be the first to share your thoughts!