Advertisement

OPINIONS

Everything You Should Know About Irish Domiciled ETFs

3 reasons to choose Irish Domiciled ETFs over their US counterparts, which brokerage to use and which ETFs to consider.

What are Irish Domiciled ETFs?

The common S&P500 ETFs such as SPY and VOO are domiciled in the United States. Which means they are registered and regulated in the US. These Irish domiciled ETFs are thus registered and regulated in Ireland. This is not to be confused with their place of listing as Irish domiciled ETFs are typically listed on the London Stock Exchange. Meaning that an ETF can be domiciled in one country and listed in another.

Why does the country that an ETF is domiciled in matter?

- Withholding Tax

The short answer is that it matters for tax efficiency. As a non US resident, we are subjected to a withholding tax of 30% when dividends are paid from a stock or ETF domiciled in the US to us. However, due to a tax treaty that exists between the US and Ireland, the withholding tax can be reduced to 15%. Here is how it works.

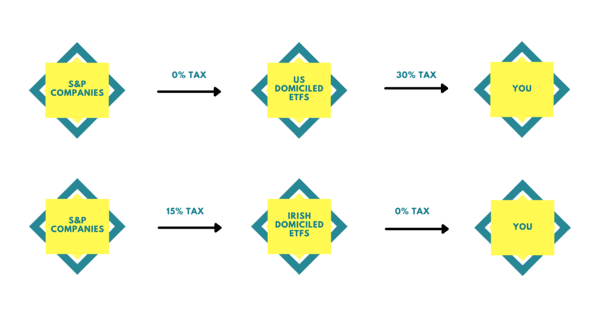

When dividends are paid from the S&P500 companies to a US domiciled ETF such as SPY or VOO, there will be no taxes. However, when the dividends from the ETF is paid out to us, there will be a tax of 30%. As for Irish Domiciled ETFs, the US-Ireland tax treaty will reduce the withholding tax to 15% when the S&P500 companies pay the dividends to the Irish Domiciled ETFs. As Ireland does not have a withholding tax for foreigners, we will not be taxed when we receive the dividends from these ETFs. This means our effective tax rate will be reduced from 30% to 15% simply by purchasing Irish Domiciled ETFs instead.

- Estate Tax

While we are on the topic of taxes, another tax that the US levies is the estate tax, which is basically a tax on all of your assets located in the US when you pass on. This includes property, shares of US companies and cash (even cash in US brokers such as IBKR!). As you would have guessed, because Irish domiciled ETFs are not regulated in the US, they are exempted from the US estate taxes. For a rough idea of how much estate taxes can add up to, here are the estate tax rates from the IRS.

If you have 1 million in assets in the US, the estate tax will amount to a WHOPPING $345,800! Thus, Irish domiciled ETFs is one way to minimise the impact of the US estate taxes.

Now, you may be wondering why I am taking this into consideration at such a young age. This is because I intend to continue dollar cost averaging into ETFs tracking the S&P500 and hold for a long long time (basically my whole life). This means if anything were to happen to me (touch wood), I may not have time to make arrangements. The last thing I would want is my dependents having the shock of their lives when the IRAS sends them a bill for hundreds of thousands of dollars. Life always seems to throw a curve ball when we least expect it, so it is good to plan for the unexpected.

- Accumulating ETFs

Accumulating ETFs are ETFs that automatically reinvest the dividends. The typical US listed ETFs are distributing, meaning they pay the dividends out to shareholders and it seems like there are no accumulating ETFs in the US. I am guessing this is due to withholding taxes and perhaps other reasons. On the other hand, there are many accumulating Irish domiciled ETF options.

As someone who wants to maximise the compounding of my investments, accumulating ETFs are a fuss-free and cost effective solution. Instead of having dividends paid out to me and having to reinvest manually through a broker which will incur additional commission fees, accumulating ETFs will help me do this automatically and save on fees as well. Furthermore, as the dividends I receive are not much, I may not be able to buy complete shares of ETFs. With accumulating ETFs, I do not have to worry about buying complete shares as the dividends are all reinvested, no matter how little.

The two screenshots above compare an accumulating ETF (CSPX) with a distributing one (VUSD). Both track the same index (S&P500) and have the same expense ratio (0.07%). As you can see, the dividends that are automatically reinvested show up in higher capital gains (more than 15% in the last 5 years).

Tradeoffs of Irish domiciled ETFs

Firstly, Irish Domiciled ETFs will have lower trading volumes and thus have a higher bid-ask spread than their US counterparts. This can be considered a hidden fee of sorts.

Secondly, the commissions for LSE will be higher than that of the US markets.

However, considering the lower withholding taxes, exemption from the astronomical estate taxes and accumulating option, Irish domiciled ETFs will still be more cost effective in the long run, maximising our returns.

Which brokerage to use?

If you are convinced about the benefits of buying Irish Domiciled ETFs instead of the US domiciled ones, you will need to choose a broker to get started. When I was first doing my research, I shortlisted SAXO markets and Interactive Brokers (IBKR) based on these criteria:

- competitive trading commission fees

- zero or low management fees (ideally zero of course)

- trustworthiness

Here is a comparison and my final verdict:

Previously when IBKR charged USD$10 monthly minimum fees for accounts with total asset value less than $100,000, SAXO markets was more cost effective for investors with assets less than $100,000 and IBKR was the cheaper option for those with assets more than $100,000. Since then, IBKR has removed their inactivity fees. This makes them the best brokerage to purchase Irish Domiciled ETFs in my opinion. The only downside is that IBKR's interface can be slightly hard to navigate initially and takes some getting used to.

ETF Comparison

To conclude this rather long article, here is a comparison between some of the common Irish Domiciled ETFs and how I go about picking the ones that suit my portfolio and personal preferences.

First, let us start with the ETFs that track the S&P500.

Personally, I look out for a combination of low fees and accumulating type. This is because I do not require the dividend pay outs at the moment and wish to reinvest everything in order to maximise compounding. This leaves CSPX and VUAA, both of which are accumulating and have extremely low fees of 0.07%.

The main differences would be the share price and volatility. CSPX is currently priced at USD$456.42 while VUAA is priced at USD$82.20. Thus, if you are DCA-ing less than USD$460 (SGD$621) a month, VUAA would be the obvious choice.

The tradeoff would be that trading volume of VUAA is much lower than that of CSPX, meaning that VUAA will have higher bid-ask spreads. However, as mentioned previously, these fees should not a cause for concern in the long run.

In the end, I decided to go with CSPX by DCA-ing every 2-3 months instead of monthly so that I will be injecting a larger capital each time. I do so to keep trading commissions low. Else, just buy VUAA and don't worry about the spread.

The next group of ETFs track world indices.

As mentioned above, I favour the accumulating options. Thus, my choice was between VWRA, ISAC and SWRD.

I chose VWRA because compared to the other two, it gives me slightly more diversification away from the US market and greater exposure to emerging markets such as China. This suits my portfolio considering I already buy CSPX.

While there may be a myriad of ETFs to choose from, my advice would be not overthink it. No point wrecking your brains over which ETF to choose because any of these are excellent options to form the core of your portfolio. As usual, the most important thing is to pick an ETF, start dollar cost averaging and stay the course.

For more resources and opinions related to investing and personal finance, click here to join my telegram chat!

Comments

30729

11

ABOUT ME

My name is CTKS and I love talking about everything Economics and Finance relate. As a firm believer learning occurs both ways, I frequently answer questions here and at the same time, learn from everyone as well. If you'd like to read more of my articles or sharings, head over to my website or join my telegram!

30729

11

Advertisement

No comments yet.

Be the first to share your thoughts!