Advertisement

OPINIONS

Diversification or Diworsification?

Is diversification the holy grail or asinine?

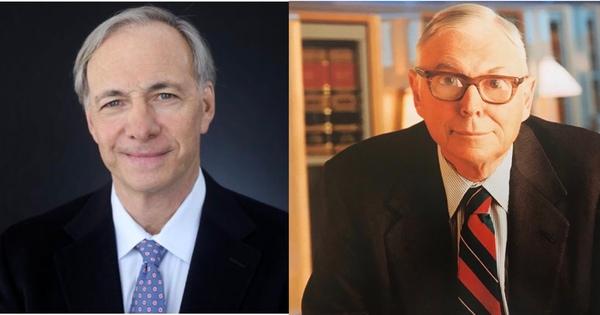

Ray Dalio says diversification is the holy grail of investing and by finding 15 to 20 uncorrelated investment you can achieve the same return with a lower risk. However, Charlie Munger says diversification is asinine and is for ignorant people.

Ray Dalio

https://www.youtube.com/watch?v=Nu4lHaSh7D4

Charlie Munger

https://www.youtube.com/watch?v=_kICKJFhr80

Diversification is a portfolio risk management strategy that involve spreading your money across array of different investment so to reduce the exposure of idiosyncratic risk or company specific risk. The idea is not to put your all eggs in one basket, but some believe that diversification will dilute the returns.

Is diversification for you?

Munger says diversification guarantees ordinary results and Dalio say you can achieve expected returns while reducing your risk. Thus if your expected returns are ordinary, diversification is definitely for you.

Absolute VS Relative Returns

When we compared the return of Munger and Dalio, Munger return is almost 20% p.a., while Dalio is 12% p.a. which is aligned with the S&P500 performance. Dalio created value by providing stability in the portfolio. You will not see the 50% decline in Bridgewater fund which happened to the S&P500. He aimed to smoothen it out and acheive an equal return to the market.

Outside Berkshire, Munger is just Daily Journal and 5 stocks. Comparing the returns of Daily Journal to S&P500, 30x vs 15x, and indeed Munger have underperform the market for a long period of time. Munger also says the whole concept of your investment not departing from the average investment results is insane. What make an great investor is holding a handful of investment over a lifetime and do very well. You must train your mind to find those, if you constantly aiming for an average, you will be average.

What does Risk meant to you?

The benefit of diversification is when you are able to find 15-20 uncorrelated investment with the same returns, the more you added to the portfolio, the lesser the risk. The risk can be reduces from 40% to 11%. The risk is measured by the probability of losing money in a given year. If you are able to do that, then you will have a low volatility with the same return and you invest like Ray Dalio.

However, Charlie Munger has a different defination of risk. Risk is buisness going bankrupt and permanent capital loss. If you buying a one dollar bill at 60 cents, it will be riskier if you buy it at 40 cents, but the expectation of return is greater than the latter, thus low risk and high reward.

it really depends on what is your focus, stock price moving up and down, volatility or buying great buisness at a cheap price while the intrinsic value is higher. Do you want an average relative returns with less volatility or amazing absolute returns, disregarding volatility?

Should we diversify & how?

We are not Charlie Munger. Thus i believe nobody will disagree that putting all your money in a few stocks is probably a bad idea while the degree of diversification is debatable.

How should i diversify if i follow Ray Dalio style?

We can gain diversification through various ETFs. We should also try to avoid False diversification where we purchase various funds which underlying have the similar securities. The ETFs purchase should have low correlation, to reduce portfolio volatility. Purchasing a single broad based ETF like S&P500 will eliminate idiosyncratic risks, but it will not reduce portfolio volatility, but is a great starting point.

If you interested to create an un-correlation portfolio, you may use the free tool via the link below.

https://www.portfoliovisualizer.com/asset-correlations

How should i diversify if i follow Charlie Munger style?

We can adopt the temporal diversification method (diversification overtime). We will have a watchlist of 20 stocks that you would like to invest. If you purchase all 20 stocks at once you are guaranteed to have a average returns. Instead, in year 1, if you found company A, which have a great valuation and you purchase it. In year 2, you will look for another company and over 20 years you will have 20 great buisness in your porfolio. Most common way to valuate a company intrinsic value is through Discount Cashflow (DCF) Model.

Conclusion

Whether is diversification or diworsification the key is YOU. A relative investor or an absolute investor. Ordinary returns of 12% p.a. compounding over 20 years you will be good. Average return of 20% p.a. over 20 years will be excellent, is "god-like" and you are at the super investor level.

Comments

381

2

ABOUT ME

Deal with your problem by being rich

381

2

Advertisement

No comments yet.

Be the first to share your thoughts!