Advertisement

OPINIONS

DeFi: Is Decentralised Finance The Future?

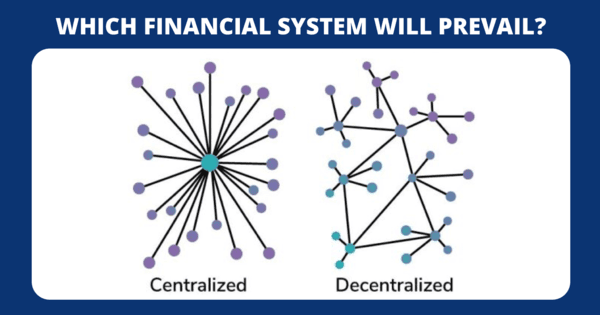

We are shifting from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized tech.

Kenneth Lou

09 Jun 2021

Co-founder at Seedly

With the 2017 wave of Bitcoin and cryptocurrency boom over, we seem to now be heading into a phase where the real applications of decentralised systems are starting to pick up real traction.

What Exactly is DeFi?

Decentralized finance (often called DeFi) has it's roots from the blockchain technology which is currently a booming field. It refers to an umbrella term for a variety of financial applications in cryptocurrency or blockchain geared toward disrupting financial intermediaries.

And it represents a shift from traditional, centralized financial systems (eg banks, payments services providers) to peertopeer finance enabled by decentralized technologies.

Blockchain technology is most simply defined as a decentralized, distributed ledger that records the autheticity, chronology of the ownership and custody of a digital asset.

Cutting Out The Middle Man

The whole premise of Decentralised-anything is the idea of cutting out the middle man. Which is often seen to be inefficient, and resource heavy.

Now there is over $7 billion worth of value locked in Ethereum smart contracts. And decentralized finance has emerged as the most active sector in the blockchain space, with a wide range of use cases for individuals, developers, and institutions.

In this opinion piece, I will share from a few aspects on why I am personally very excited about the future of DeFi and why this could be the next wave vs a modern financial system which has not changed in history.

Some clear use cases of Decentralised Finance

Trends which point to DeFi becoming the answer

Hurdles which DeFi will need to figure out

What Are Some DeFi Use Cases?

Lending platforms (Debt)

These platforms use smart contracts to replace intermediaries such as banks that manage lending in the middle.

Disrupting: Traditional retail and SME banking players who charge high interest rates and provide little service to end-users beyond connecting borrowers to lenders. Also, since 2008 P2P lending companies who still function as centralised platforms and earn a commission of each successful loan quantum.

Fundraising platforms (Equity)

These platforms use smart contracts to replace intermediaries who facilitate equity based investments which today is done very traditionally via physical or digitally signed contracts.

Disrupting: Traditional fund houses, private equity firms and Venture Capital. First experiments were seen in 2017 with a slew of Initial Coin Offerings (ICOs).

Decentralized exchanges (DEXs)

Online exchanges help users exchange currencies for other currencies via buy/sell an trading behaviour. These connect users directly so they can trade cryptocurrencies with one another without trusting an intermediary with their money. No custodians invovled.

Disrupting: All major exchanges worldwide from NASDAQ to NYSE to HKEX to SGX and of course the brokerages who operate in these exchanges and custodian account offerings who charge a fee for holding on the stocks on behalf of investors.

Why DeFi Could Gain Momentum

In the last two centuries, the overall trends point towards a world which is more open and transparent.

With the advent of the internet, and open access to information in our hands, individuals are all able to better undertand the full potential of how it can enable transparency across multiple social movements. In 2020, the Black Lives Matter movement blossomed due to the age of social media and access to information.

The Age of Efficiency & Transparency

Finance is one pillar which has been deeply integrated with our lives, from our paychecks, to our savings to our retirement funds.

I believe that there are many smart people around the world who see the immense total addressable market not only as startups but as huge corporate institutions as well.

Big banks such as DBS, Standard Chartered, JP Morgan have all embarked on their own projects to disrupt themselves, before they get disrupted. Digital banks I believe are just baby steps in this direction.

Hurdles For DeFi To Overcome

The challenges towards a world which is truly transparent and decentralised are not fraught with risks. I would classify the risks into three main buckets.

1) Political & Corporate Risk

With an open and transparent eco-system, it is easy to see why governments and big institutions across the world would have an adverse effect when it comes to such a technology. China has been pretty open about building their own state controlled digital Yuan.

It is inevitable, in my opinion however, that this could just be a matter of time for such a techonology to run its course and become mainstream.

It is the same as how some companies like SPH have never thought newspapers would die and did not see the rise of social & online media.

2) Technological Risk

With any new technology, there are always roadblocks which the brightest brains would need to overcome. This was what 5MB worth of data in 1956 looked like, being loaded on to a IBM truck.

With my own experience, it took me a few hours to make my first bitcoin transfer from Wallet A to Wallet B. And it was due to the transactions are being added to the bitcoin mempool (memory pool) full queue constantly.

But I do believe that humans and engineers are smart enough to one day overcome such problems and bottlenecks sooner than later.

3) Mass Adoption Tipping Point Risk

As with any form of technology, the internet, mobile phones, smartphones and likewise Decentralised technology, it would take some time.

I love this reference of the Gartner hype cycle which often shows where we are at when it comes to adoption of various use cases. As seen with digital cryptocurrencies it could take up to 10 years to be fully adopted.

Comments

758

3

ABOUT ME

Kenneth Lou

09 Jun 2021

Co-founder at Seedly

Helping people make smarter financial decisions one step at a time.

758

3

Advertisement

No comments yet.

Be the first to share your thoughts!