Advertisement

OPINIONS

Crossing the $100K milestone as an Undergraduate

Crypto changed my life. I was able to achieve financial independence and getting a Full Time job in crypto. Grateful.

Lin Yun Heng

Edited 18 Oct 2021

Senior Analyst at Delphi

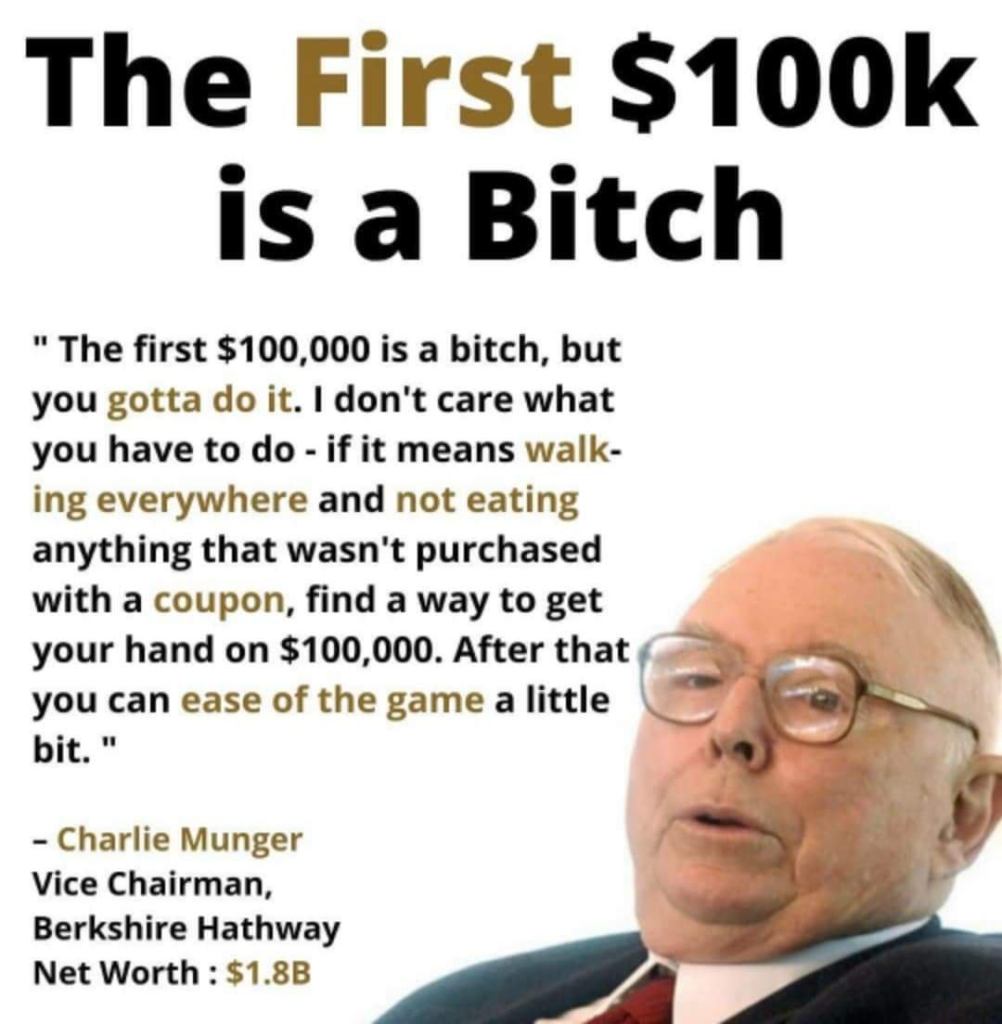

I did it. I broke the $100K psychological barrier net worth figure which was seen as a typical benchmark for individuals under the age of 30. To be honest, nothing much have changed to my lifestyle even as my net worth continues to compound from my investments and yield-generating assets.

I have been wanting to cross the 6-figure portfolio for the longest time, because your compound interest from investing truly becomes extremely significant when your capital is at least 6-figures. 10% of $10,000 is $1000, while 10% of $100,000 is $10,000. You get the point.

So how did I get to this point? No, I did not win a lottery ticket, it was simply prudent investing, and taking profits and letting compound interest do its work. I did not have any magic formula or secret trading techniques. I sticked to what I know and understand, and just executed my game plan.

Started off with the stock market (2018-2020)

I first started investing back in 2018. Back then, I was absorbing everything I could from every investment book I could get my hands on. Over time, I gravitated towards the investing philosophy of Peter Lynch and Philip Fisher (still applies today), and went to seek out outperforming growth stocks with impregnable economic moats.

I focused on building my circle of competence and sticking to stocks which I understood and had huge conviction on. From 2018-2020, I was pretty much compounding my portfolio of stocks on an annualised basis of ~24% APY, not too shabby. I was able to outperform average stock market returns over a period of 3 years using my own knowledge and stock picking, so it was pretty cool thinking back.

Turning Point: August 2020 - Crypto Rabbit Hole

Fast forward to August 2020, I was officially introduced to crypto by a friend from University and dived down the crypto DeFi rabbit hole.

It was at this juncture I was exposed to all the jargons within the crypto space, learnt about the different types of crypto including store-of-value crypto tokens like Bitcoin, utility/smart-contract tokens such as Ethereum, farm tokens such as Autofarm token, stablecoins such as DAI, USDC, UST and many more.

I started my yield farming journey in Binance Smart Chain when it first launched around the end of 2020, tried out AMMs and did LPs, experienced impermanent loss and farmed tons of inflationary tokens and understood yield farming, moved on to other chains and took advantage of the liquidity mining incentive programs like Polygon/Avalanche/Fantom and made significant gains from the farms.

As I became more and more well versed with the world of DeFi, I jumped into high-risk yield farms like MALT, and experimenting with unsustainable yield farms and eventually doing proper due diligence and porting over my knowledge from the stock market over to crypto, which I feel gave me a huge advantage because the crypto world is filled with too many short-term individuals who are basically speculators instead of investors.

Know what you own, and why you own it

This quote by Peter Lynch has always been my investing mantra no matter which asset I was investing in. If I can understand a project deeply (just like how I can understand a company deeply), then I will start to build conviction and allocate capital and let the thesis play itself out.

Innovation S Curve is literally playing out for Crypto/Blockchain

Innovation S Curve is literally playing out for Crypto/Blockchain

The reason why crypto has so much more upside compared to the stock market is because of the market cap. The entire crypto space is currently valued at $2+ Trillion right now. If you compare it to the market cap of Gold ($10 Trillion) or the stock market (~$100 Trillion), crypto is still extremely small and young, which explains why it is so volatile. By the time mass adoption take place (when volatility is more relatable to the stock market), crypto might already be a $10 Trillion industry (perhaps larger).

If you are in crypto now and you have personally tried out Metamask or interacted with smart contracts before, give yourself a pat on the back. You are early.

The next 10 years will be exponential as smart money enters this space and the whole asset class starts to mature and gain traction as a mainstream asset.

How I got to 100K

As mentioned above, as my conviction in the crypto space deepens, I rotated my capital from stocks into crypto completely in March 2021, and it was the best decision I ever made.

If my capital remained in stocks, I would have made roughly +68% Year-To-Date from my stock picks, which is pretty great, but the same capital that got rotated to my crypto portfolio is currently a +700% (7x) Year-To-Date, largely due to the allocation to Fantom (FTM) and AXS. I would have missed out on an opportunity cost of over 600% gains if I left my capital in the stock market.

I also regularly took profits from my crypto every time my capital 2x itself. I’ll pull out the initial capital and let the rest of the profits run. Doing so has allowed me to compound my portfolio over time and prevent myself from losing money.

You get my point here.

Multiple Passive Income Streams

After rotating from stocks to crypto, I started to build up multiple passive income streams within crypto, either through staking, yield farming and most recently, Axie Infinity Scholarships from July 2021 onwards. I also allocated capital into utility-NFTs that generate passive rewards such as MutantCats and Kaiju Kingz.

Mini-Update on Axie Scholarship

Currently, my girlfriend and I have 25 scholars under management and have introduced incentives for scholars to raise revenue and improving the overall average SLP earned per day. Our 25 scholars are averaging ~170 SLP per day with some scholars able to earn more than 200 SLP/day and maintaining 2200+ MMR which is super impressive.

Based on this revenue stream, we are able to generate an average passive income stream of 4100 SGD/month each since the inception of the scholarship business (3 months ago). Being a student, having such a great passive stream is a great boost to overall cashflow and ability to continue re-investing either more scholars to scale up the scholarship or dollar-cost into our high conviction crypto bets.

And 4000 SGD passive income monthly is extremely hard to attain if you do it the traditional way. Assuming you put it in CPF (4%) or get a dividend stocks portfolio with a annualised yield of 5%, that would require 1.2 Million capital at a yield of 4% or $960,000 capital at a yield of 5%respectively to generate that level of passive income. That is the financial freedom figures that most Singapore bloggers I’ve seen hope to attain. If only they knew about Axie Infinity… 👀

Our Axie scholarship capital outlay is no where near that amount mentioned above (its <30K). So the ROI from scholarship is super profitable relative to traditional ways of attaining passive income.

Utility NFTs

Mutant Cat NFT

The recent trend in NFT seems to follow a model pioneered by CyberKongz. In essence, I allocated capital (ETH) into a project called MutantCats which generates 10 FISH tokens every day for staking 1 Mutant Cat.

Meet the Mustachio

Meet the Mustachio

Each FISH token is worth 6 USD at the point of writing, which translates to a neat passive stream of 1800 USD per month. (assuming price stays constant)

Kaiju Kingz NFT

Another NFT project with a similar yield concept is Kaiju Kingz. I am currently co-owning the NFT and to sum it up: Each Kaiju Kingz generate 5 $RWASTE tokens per day with 1 $RWASTE worth 20 USD at the point of writing.

Rarity 629/3333 Genesis Kaiju

Rarity 629/3333 Genesis Kaiju

Holding the genesis Kaiju would translate to 3000 USD per month at the point of writing.

Crypto outperformed Stocks from my own experience investing in both asset classes

Portfolio Return Year-To-Date (15 October 2021)

Portfolio Return Year-To-Date (15 October 2021)

The above is my returns from the start of the year to the point of writing. The lines you see below are the stock market benchmark indexes which is self-explanatory.

Crypto outperformed stocks, and it will continue to do so. I also did an experiment on 3 hypothetical portfolios on the effects crypto can have on potential returns in a stocks portfolio. The returns were not backtested and are reflecting the real-time gains between the different asset class.

It is also another push factor that convinced me to rotate my stocks into crypto instead.

Q4 2021 Game Plan

Honestly, hitting 100K does not change my lifestyle in any way. I am still re-investing my capital back into crypto with all my profits and passive income streams to compound it even further.

I can choose to buy a car now or rent and live in a cozy apartment now that I have a steady stream of profitable passive income. I pretty much have a degree of financial independence with my passive income stream funding my cashflow and allowing me to funnel back into my portfolio, while also providing for my basic daily expenses and seldom splurges, and not having to worry about running out of cash flow.

Q4 will be tough, because I now have a Full-Time role in Delphi Digital as an Analyst while still juggling with my University workload. I will have less time to blog and probably less time to focus on my grades lol.

For Q4, my investing strategy is simple:

- Stick to my convictions (ETH/FTM/LUNA)

- Concentrate my portfolio

- Keep 5%-10% in Stablecoins

- Take profits from the potential crypto bull cycle back into ETH/Stablecoins

- Know what I own and why I own it (Sticking to circle of competence)

- Build up deeper NFT Gaming/DAOs exposure

Now that my portfolio can finally compound exponentially, portfolio concentration will be my strategy going forward and hopefully I can go for the next milestone of a 200K+ portfolio.

Crypto is a crazy place, if Bitcoin were to go towards a similar run-up like Gold did when the ETF first came out, then the upcoming Bitcoin bull-run might be something no one would have predicted.

No one knows though. But long term wise, I am super bullish on this sector and will be contributing to the education of this sector and driving mainstream adoption even further.

Crypto is the next industrial revolution and not many can see it. I am sure people will be flocking to blockchain-based companies in the future instead of traditional sectors. Time will tell eventually. In fact, talents are already moving from the traditional world into the crypto world.

If you think crypto is interesting but you find it hard to learn about them, you can consider joining my telegram group where I share articles, investment opportunities and more research based content on an almost daily basis. You can also ask questions, and take part in polls to see how others think as well!

Join My Tele Channel Here For Blog Updates And More!

For those who are already into Crypto

Want to learn how you can earn high yielding interest rates on your idle crypto assets in a secure, safe and easy manner?

Earn Yields on Those Crypto With These Platforms

You can read up more on my post here to learn more about Celsius and Nexo which give you interest on your crypto assets

Or read up more on Hodlnaut here which is a Singapore-based crypto lending platform with market beating interest rates

What is Bitcoin? Answers here

Or do your due diligence on Bitcoin in my post here where I debunk some of the myths regarding Bitcoin.

What is Ethereum? Simple Guide Here

I did a bite-sized article on Ethereum for you to get a crash-course on what the buzz word is all about here.

Gemini Exchange (My Favourite Crypto Exchange)

Also my crypto exchange of choice Gemini here if you are looking to buy your first crypto!

Too Many Crypto Platforms? Here’s a Crypto One-Stop Solution

If you think there are too many crypto platforms out there, here is a simple solution for you. An all-in-one app for you to earn yield, trade, invest or borrow crypto with high security and assurance. Check out my Matrixport review

What is Decentralised Finance (DeFi)?

Or do you want to learn more about DeFi in a simple to understand manner? Click here to learn more

How to Value Crypto Assets?

Learn more about how you can put a “fair value” on crypto such as Bitcoin, Ethereum and more here

Crypto Referral Links (Click and Sign Up)

Gemini Exchange: Deposits and buy US$100 or more crypto on Gemini and you will earn US$10 in BTC.

Coinhako Exchange: You can create an account by clicking the link and then enter promo code: COINGECKO when doing a buy/sell and enjoy 20% trading fees discount!

Binance Exchange: Create a Binance.com account here and trade the widest range of crypto pairings!

Hodlnaut: Earn US$20 in BTC/ETH/USDT/USDC/DAI for free with your first transfer of US$1000 or more in the corresponding crypto asset of your choice!

Celsius Network: Earn US$40 in BTC for free with your first transfer of US$400 or more in any crypto asset and wait for 1 month!

Matrixport: Get a $1288 free coupon trial to try their product and earn $20 in USDC when you sign up successfully and become a qualified client!

Nexo: Earn US$10 in BTC for free when you transfer US$100 or more in any crypto asset of your choice!

AMEX Credit Card Promo: Earn up to $365 SGD of Bitcoin when you sign-up for an eligible AMEX Credit Card here!

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. In fact, the content is not directed to any investor or potential investor and may not be used to evaluate or make any investment.

Comments

4518

11

ABOUT ME

Lin Yun Heng

Edited 18 Oct 2021

Senior Analyst at Delphi

Crypto Educator

4518

11

Advertisement

No comments yet.

Be the first to share your thoughts!