Advertisement

OPINIONS

Comparing Home Valuation Tools: SRX X-Value vs. 4 Alternatives, For Better or For Worse?

Looking to sell your home? Unsure of your home's selling price? We compare the home valuation tools in the market today.

“How high can I sell my home?”

“Can I sell my home for as high as my neighbour… or even higher?”

“Will I have enough to buy my next home?”

“How much will I have to pay monthly for my mortgage?”

You may already be asking these questions as you start planning to sell your current home and buy the next one. Thankfully, there are a number of home valuation tools available online today that can give you the answers you’re looking for. To help you figure out which one you should use, we’ve compared all of them for you.

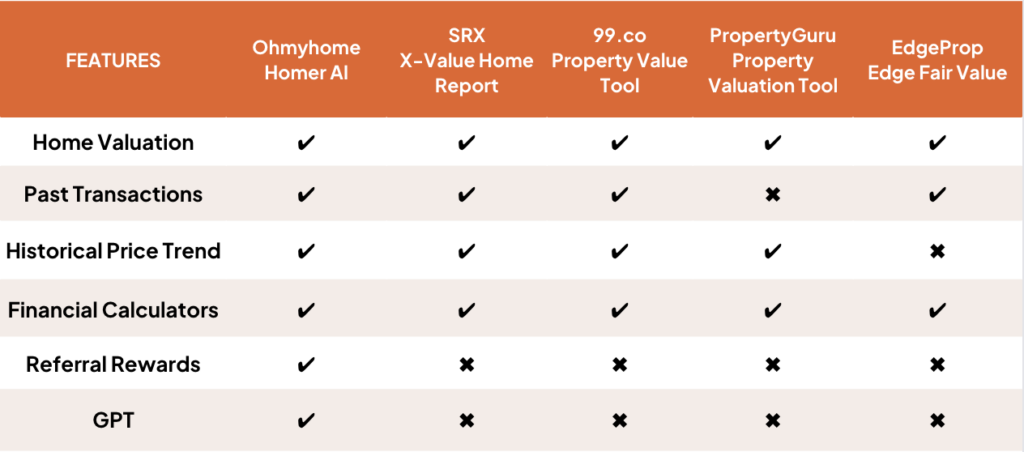

Here’s an overview of the features that each home valuation tool has to offer:

Jump to any of these sections if you want to…

- Find out your home valuation

- Check the past transactions in your area

- Track historical price trends

- Calculate your budget for your next home purchase

- Get a free gift while planning your property journey

- Test a first-of-its-kind GPT made specifically for property

#1. What’s your home worth?

Let’s start with the #1 information you’ll need before selling your home: your home valuation. This is an estimation of how high you can potentially sell your home for based on property attributes such as location and size, as well as the recent property transactions in your area.

Now let’s see what the 5 home valuation tools can give us.

Estimated Home Valuation for Private Properties

What’s the estimated value of a 2-bedroom (1,055 sq ft) apartment at Eden Grove, Serangoon?

SRX$1,380,00099.co$1,380,000PropertyGuru$1,299,129EdgeProp$1,380,000Ohmyhome$1,379,000

As you can see, the estimated home valuation provided by each tool is within the same price range, save for one. PropertyGuru’s estimation is significantly lower than the rest, with about an $80,000 difference.

Estimated Home Valuation for HDB Flats:

What’s the estimated value of a 4-room HDB flat (818 sq ft) in Toa Payoh Central?

SRX – X-Value Home Report$732,00099.co – Property Value Tool$732,000PropertyGuru – Property Valuation Tool$799,634EdgeProp – Edge Fair Value$750,000Ohmyhome – Homer AI$745,000

Based on the most recent transaction of a 4-room flat in the same block, which was sold at $750,000. The closest estimated home value is from EdgeProp’s Edge Fair Value and Ohmyhome’s Homer AI.

Take note that these are specific property examples. As a rule of thumb, your estimated home value should not be significantly lower or higher than the last transacted price in your HDB block, condo development, or surrounding area. Having an experienced and knowledgeable property agent will help you determine the best and fairest selling price for your home.

What we like:

- SRX’s X-Value Home Report also shows how much your home valuation has changed in 10 years and compares it to the transacted prices of properties in your region – be it CCR, RCR, and OCR – and all over Singapore.

Screenshot taken from SRX X-Value.

- PropertyGuru’s Property Valuation Tool will tell you directly if your home valuation is above or below average based on past transactions of similar-sized units in your district over time.

- 99.co’s Property Valuation Tool doesn’t just provide your estimated home value, but also your estimated rental value should you decide to put your home up for rent instead of for sale.

- Upon registering your home with Homer AI by Ohmyhome, all your property details are securely stored within your personalised dashboard. This means that you don’t need to manually input all your home details to check your home valuation – it’s available at all times and is even updated every month. So while you’re planning your home selling journey, you’ll get to access all the information you need about your home anytime, anywhere.

Screenshot taken from Ohmyhome’s Homer AI.

One thing to note: The 5 home valuation tools we’re comparing have different terms for “home valuation”. Before you get confused, here’s a guide:

- SRX calls it “X-value”

- 99.co calls it “Sale value”

- PropertyGuru calls it “Estimated market price”

- EdgeProp calls it “Open market value”

- Ohmyhome calls it “Home e-Valuation”

An important thing to note, though, is that SRX and PropertyGuru can only provide the capital gain or loss of a private property when a caveat is lodged with URA. So this information will not be provided if you own a HDB flat or if a caveat for the sale of properties around you has not been lodged with URA. So you’ll still have to do your own research to ensure the information you receive is accurate.

Now, Ohmyhome’s Homer AI, 99.co’s Property Value Tool, and PropertyGuru’s Property Valuation Tool can also provide the same information. The only difference is you’ll have to manually input the property details necessary for their tool to calculate your estimated gain or loss, which are the date of your property purchase and your purchase price. This is a more accurate way of gauging your returns after selling your home.

Screenshots taken from PropertyGuru’s Property Valuation Tool.

However, Homer AI is able to give a more comprehensive view of your financial health through its Cash Proceeds Calculator which estimates how much you may get to keep after selling your home. You’ll be able to indicate your ideal selling price, outstanding loan payments, and CPF monies utilised for the calculator to crunch the numbers for you. This way, you’ll get a more accurate estimation of your potential returns.

Remember: You shouldn’t rely on assumptions when it comes to your home. So even with all the information you get from these home valuation tools, always speak to a property agent to get their professional advice. With their experience and expertise, they can assist you with proper financial and timeline planning for your property journey.

#2: What did your neighbour sell for?

The home valuation tools we’re comparing in this article use machine learning models that analyse past transaction prices in your area to estimate the value of your home. Not to be “kaypoh”, but that means knowing how much your neighbours have sold their homes for.

However, you will NOT be able to see the transaction history in your area or block with PropertyGuru’s Property Valuation Tool. EdgeProp’s Edge Fair Value does provide you a list of the recently transacted homes in your area, but it is limited as it omits certain transactions “by design”.

What we like:

- Apart from displaying the past transactions in your area in a table, which is how most tools do it, 99.co’s Property Valuation Tool also displays the transacted properties in a map. This additional visual aid gives you a better understanding of its proximity to amenities, which could have influenced the final transacted price.

Screenshot taken from 99.co’s Property Value Tool.

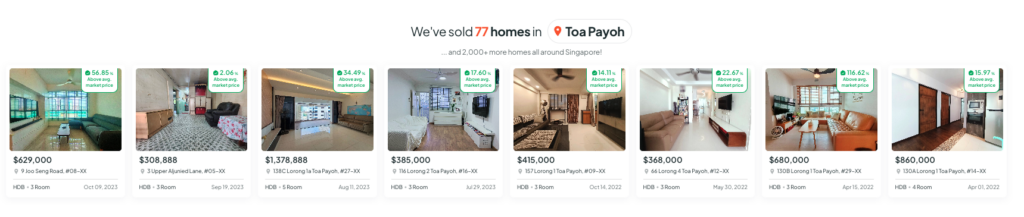

- Ohmyhome’s Homer AI does not just provide you with the transaction history in your area from the past 6 months, but it also presents all the homes sold by their property agents in the same area. So if you’re serious about selling your home, and if you’re on a tight timeline, you can immediately gauge their effectiveness in selling your own home. This should give you more confidence in engaging their agents to also sell your home, or at least meeting up with them for consideration.

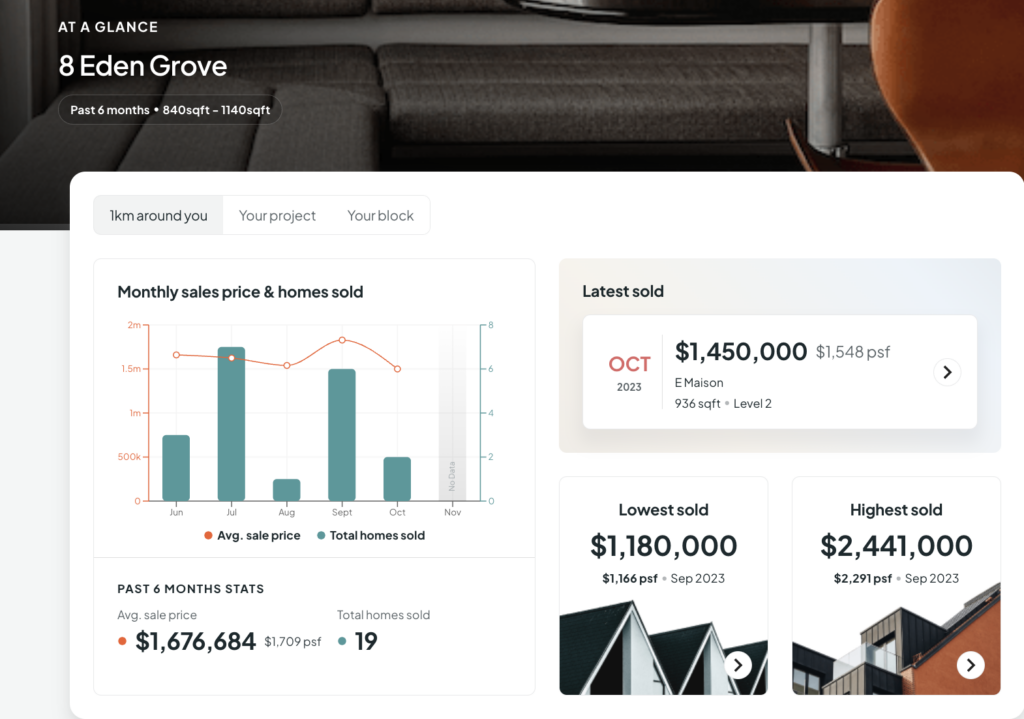

Screenshot taken from Ohmyhome’s Homer AI.

#3: How is the market doing?

Another way for you to set your selling price and ensure your home valuation is true to how the rest of the market is performing, a.k.a by looking at the price trend in previous years.

SRX, 99.co, PropertyGuru, and Ohmyhome provide a table in varying designs that lets you track the price movement in your area or region within a certain period of time. Of course, the amount of data you’ll be able to see depends on when your property was completed and if there have been transactions for your specific HDB block, condo development, area and/or region.

What we like:

- With PropertyGuru, you’ll be able to see when there are or aren’t any transactions for a particular year.

Screenshot taken from PropertyGuru’s Property Valuation Tool.

- With Ohmyhome’s Homer AI, you’ll get to see the average transacted price of properties sold near you and the total number of homes sold every month, from the past 6 months. You’ll also be able to filter this data by properties within 1km of your home, the cluster of blocks near you, and your block, to give you a comprehensive view of the price movement in your specific location.

#4: Can you afford your next home?

As mentioned above, financial planning isn’t to be taken lightly. Fortunately, all 5 home valuation tools provide a comprehensive range of financial calculators that will help you break down your affordability for your next home purchase. It will be based on the following factors:

- Payable Buyer’s Stamp Duty and Additional Buyer’s Stamp Duty

- Number of outstanding home loans

- Total monthly loan repayment

- Monthly fixed income

- Total monthly variable income

- Available cash on hand (from your cash proceeds or personal savings)

It also factors in the type of property you’re looking to buy, if you’re looking to get your 1st or 2nd HDB loan, or a bank loan, your loan tenure, and the interest rate.

The only downside about the financial calculators that SRX, 99.co, PropertyGuru, and EdgeProp provide are they’re all disjointed from their home valuation and market report. This is not to say that it’s less valuable, as homeowners who have no desire to sell their home anytime soon can access just the calculator to check their financial health.

Screenshot taken from Ohmyhome’s Homer AI.

However, when planning to sell your home, it would be more beneficial to have all your property information, including your finances, in one place. In this case, Ohmyhome’s Homer AI stands out as a one-stop platform for all your property information. It organises all the information you’ll need to sell your home and plan your next home purchase in a way that’s easy for you to understand and access at all times. It takes the planning out of your hands and guides you through the step-by-step process of selling and buying, so you have one less thing to worry about.

#5: Referral rewards

One of the best things in life is getting something for free. And when all you have to do is refer someone, that makes it even better. With Ohmyhome, you get a $5 NTUC voucher by referring a friend to get their home valuation through the Homer AI platform. You easily kill two birds with one stone — get all the information you need about your home, and earn while you’re at it too! You can learn more about our Share & Earn programme here.

#6: GPT

Screenshot taken from Ohmyhome’s Homer AI.

A step above these valuation tools and market reports is a digital property expert that knows everything about property just like your typical agent, but without all the sales talk. If you’re tired of being upsold services you’re not interested in but still want to know more about your home, you can do so with HomerGPT, the latest feature from Ohmyhome’s Homer AI platform.

Homer AI is dedicated to providing you with answers to all your property questions, without having to crawl through Google or wondering if your property agent is advising you properly. Not only will you get information that’s generally available, Homer will automatically give you answers suited to the information you’ve saved previously.

This powerful tool doesn’t just help you understand the value of your home, but it also knows what’s happening in the market:

- What’s the valuation of my property?

- Is this a good time to sell?

- Show me the new launches in District 15.

- Can I afford a 3-bedroom unit in this condo?

- What’s the latest property news?

Homer knows who’s selling their homes and at what prices, and guides you with expert precision on the best next step for you, whether that means selling or renting out your home after you’ve bought it. It’s like having a personal property agent in your pocket 24/7.

Which home valuation tool should you use?

The home valuation tool you should use depends on the information you’re looking to get. If you’re only interested in your home valuation, then you should try EdgeProp’s Edge Fair Value. But for a more comprehensive report on how much your home is worth, at what prices other properties near you are selling for, and how much you need for your next home, then you should try Ohmyhome’s Homer AI. As mentioned in this section, the tools that SRX, 99.co, and PropertyGuru provide do not have their financial calculators built into the same page where you get your home valuation. You’ll have to click out of the page and find the exact calculator you’re looking for and piece the data together on your own. With Homer AI, all the information you need to sell and buy a home will be laid out for you step by step. And you can find them in the same place, at all times.

As a rule of thumb, when comparing home valuation tools such as the ones we discussed in this article, you should take note to consider these factors:

- Accuracy. Is your home valuation and financial calculations true to market conditions?

- Transparency. Does the home valuation tool let you know the source for their data and information, and explain their valuation methodology?

- Comprehensiveness. Will you be able to get all the information you need in one place?

- Ease of use. How easy is it to get the answers to your questions?

- Additional benefits. Are there are special perks included with the use of the valuation tool?

Would you rather talk to a property agent instead?

Now, if you’d rather just talk to a property agent instead of planning and researching on your own, which we still advise you to do so you can make the best decision for your home and family, then feel free to drop us a message on WhatsApp.

Empowered by proprietary technology and years of experience under their belt, they will be able to provide strategic advice on your next steps.

Comments

989

0

ABOUT ME

Your one-stop property solution: Buy. Sell. Rent. Renovate. We’ve got you covered.

989

0

Advertisement

No comments yet.

Be the first to share your thoughts!