Advertisement

OPINIONS

CapitaLand at a Discount - CLIM, CICT and Cash

KPO believes that CapitaLand is still trading at a discount after they proposed a restructuring.

KPO and CZM

29 Mar 2021

Blogger at KPO and CZM

Hi everyone! We were invited by Kenneth Fong to post some articles/opinions here. Given that this is our first article, we are sharing something more "friendly" as compared to leverage/crypto. lol. If you are more adventurous, do head over to our blog. Appreciate your support!

By now, you should have seen multiple news on the restructuring proposed by CapitaLand. In my opinion, I do think it is a win-win deal. They get to privatized a part of their business at a "cheap" rate (considering the offer is below NAV) while shareholders get to unlock some value and continue to own other parts of their businesses. For those that are not aware, you can take a look at their announcement here.

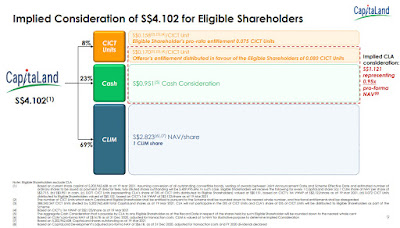

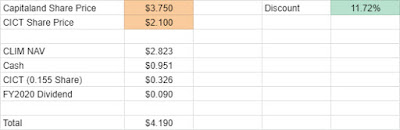

For every CapitaLand share, one will get 1 CLIM share at $2.823 NAV, Cash of $0.951, and 0.155 CICT share. It was stated that "The Cash Consideration will not be reduced by the amount of the FY2020 Final Dividend after the dividend payment is made." Hence, we can also include the 9 cents dividend for FY2020.

They halted for the whole day yesterday and I was surprised when I saw the price of CapitaLand to be trading at a discount compared to what was offered. Using the closing price for the day, it was trading at a 11.72% discount which is quite significant. I was expecting it to be closer to $4 because the CLIM share and cash should be a constant/fix value and the only variable is the share price of CICT.

There are probably a couple of reasons for the discount. The restructuring might not go through and given that CapitaLand has never traded at such a high price, if the deal is called off, the price will surely drop back to low/mid 3+. The market is discounting the value of the CLIM share after all CapitaLand has never traded at NAV so why should CLIM share be valued at NAV too right? Alternatively, there might be shareholders who find the restructuring too complex and are selling it off now without having to deal with the CICT odd lots.

In my opinion, the restructuring will highly likely go through, the decrease in CICT share price is too insignificant to warrant such a discount and likely the market is discounting the CLIM share (too much). Anyway, I believe it should not be trading at a discount because it is no longer considered as a property/developer stock.

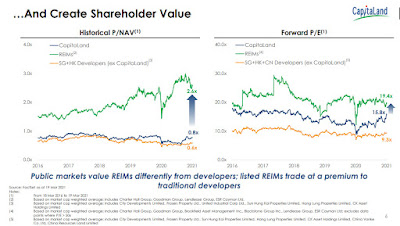

Let's take a look at the other 2 listed REIMs.

Brookfield Asset Management is trading at 2.46 PB.

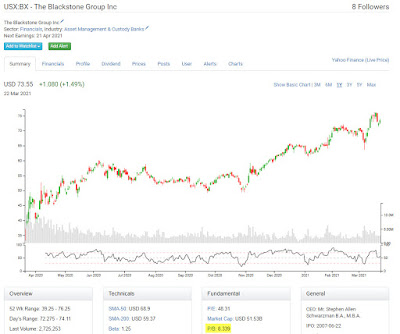

Blackstone Group is trading at 8.34 PB!

In comparison, CapitaLand is trading at just 0.756 PB. Not sure if anyone remembers ARA Asset Management that got delisted back in 2017? That is a REIM and they were not trading at a discount back then.

If you do not want to have any CICT odd lots, these are the magical CapitaLand shares you will need to own.

Alternatively, you can also own the above number of CapitaLand shares to reduce the number of odd lots. I have created a spreadsheet here and you can play with it to see the discount as well as the number of CICT odd lots you might be getting.

Anyway, we bought another 5,000 units at $3.75 earlier today because we believed it is still trading at a discount and also to reduce the number of odd lot we will be getting for CICT. In total, we now own 17,434 shares of CapitaLand. Huat ah!

Original article: https://kpo-and-czm.blogspot.com/2021/03/capitaland-at-a-discount-clim-cict-and-cash.html

Do like any of the following for the latest update/post!

FB Page - KPO and CZM

Twitter - KPO and CZM

Click here to subscribe using email :)

Instagram - KPO_and_CZ

Comments

2511

1

ABOUT ME

KPO and CZM

29 Mar 2021

Blogger at KPO and CZM

A blog on food, travel, money-saving tips and financial freedom 💸

2511

1

Advertisement

No comments yet.

Be the first to share your thoughts!